Hosted as part of the Mobile Payment Conference (August 24-26) this inaugural conference brought together fintech influencers, payments experts, and providers to address issues facing financial services companies serving the Cannabis and CBD industry.

Setting the Stage

I was honored to kick off the workshop with an overview of the cannabis payments market. I stressed two realities:

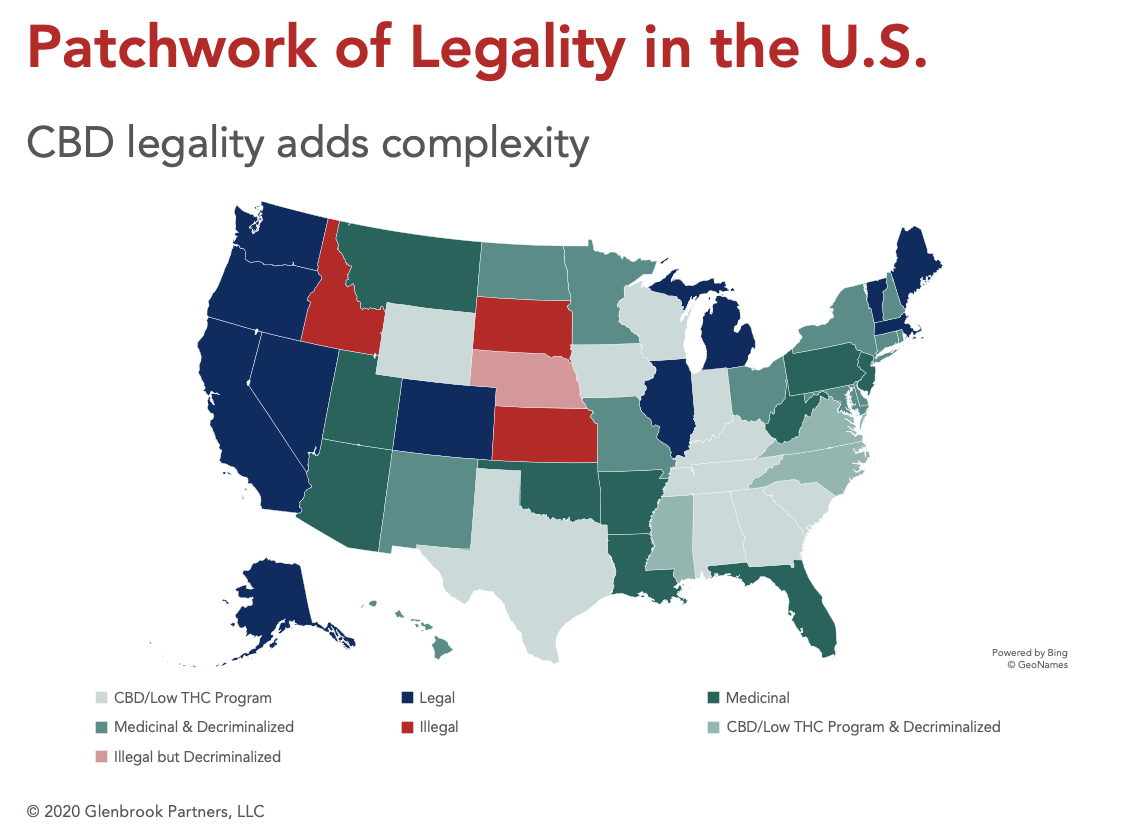

- The dichotomy between federal and state regulations

- The differing treatment applied to Cannabis and CBD

These issues drive the heavy regulatory burden on financial services providers and a complex map of legality state-to-state.

Federal regulations determine the legal status of cannabis. To the Feds, it’s illegal. That status automatically eliminate any nationally chartered bank from serving Cannabis Related Businesses (CRBs).

Many states have enacted legislation to legalize cannabis, some for medicinal purposes, others for both medicinal and recreational use. Federal law allows states to license growers and sellers of CBD (2018 Farm Bill) but strict compliance programs are required.

These complexities keep many state-based financial institutions on the sidelines, even when they have CRB clients that want the safety and soundness of a business banking relationship.

Despite these constraints, according to New Frontier Data, the cannabis and CBD market reached $13.60B in 2019 and is expected to reach $30B by 2025. When hemp-based products are included, other forecasts estimate a market of $40B.

Conference Conversations

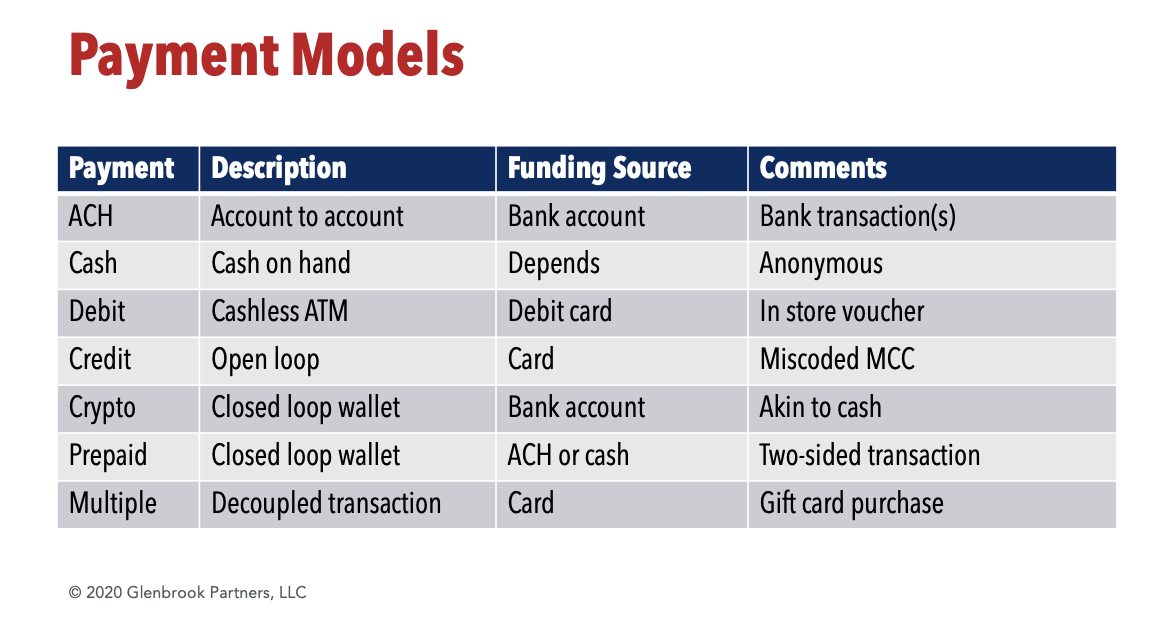

Much of the conversation was, of course, around retail payments and the not-always straightforward options in the market. Quite frankly, some solutions are designed to work around card network business rules. Because of federal regulations, American Express, Discover, Mastercard or Visa do not support cannabis transactions. None have created a valid MCC (merchant category code) for CRBs.

To get around those rules, some payment service providers (PSP) miscode customer receipts using a store name different than the one purchased from. Other solutions are just a poor user experience, requiring a “decoupled” or “multi-step” process to enable a transaction. Your receipt might show you bought a stored value prepaid card at the dispensary rather than the Trainwreck or Blue Dream buds you walked out with.

Talk about operating in the gray zone.

Other PSPs do it right. They rely on ACH or bank-based transactions that draw from the consumer’s checking or savings account. This approach is legal for the consumer and requires a bank partner that can navigate the compliance complexities. State chartered banks are typical partners for PSPs.

Session Highlights

The Understanding Sponsorship and Keys to Success session, moderated by Travis Dulaney from PayFi, addressed the dispensary, state bank and provider perspectives.

A highlight was the nuanced discussion of the risks dispensaries face. It’s not simply fraud. A big risk is not receiving the money earned from prior transactions when and if their PSP suddenly drops them. Concerns include:

- What if my provider drops me?

- Will I get paid for previously settled transactions?

- How can I be certain this won’t happen?

This is a rampant problem. Despite PSPs wanting to provide merchant services to CRBs, the sponsoring settlement bank, the PSP’s upstream partner, will often shut down the PSP due to their own compliance concerns.

There were two sessions focused solely on compliance risk.

- One, led by Gerard Olson of LegitScript, identified the various regulations applied to the industry. Beyond financial services regulations, agricultural and producer regs apply.

- Andre Herrera, the compliance officer from Hypur, focused on the immense compliance burden financial services companies face when providing to hemp and cannabis related businesses. The complexity is daunting. It’s no wonder that so many banks, credit unions, and traditional payments companies avoid this growing and still untapped market.

Cash: Still the King of Cannabis Payments

Cash is still king. Approximately 70% of all transactions (B2B and C2B) are conducted in cash. The panel on cash handling at the POS delved into best practices, offering attendees practical advice on how to use the venerable payment method.

Partners Matter

The final keynote was by Chris Rentner, CEO and co-founder of Spence, a digital payment platform that recently announced its partnership with Chicago-based Burling Bank. Spence is an early entry into the burgeoning Chicago market, now that Illinois is implementing full legalization.

I was struck by two important points:

- First is Spence’s choice of and reliance on a bank that has deep expertise in risk management practices and that knows how to navigate the legislative chasm between federal and state regulations.

- Second is Spence’s hard focus on the end user experience with its clear communications around the use of ACH (customers bank account), straightforward FAQs on their website, and a consumer-friendly downloadable app to smooth the checkout flow.

This just seems to be the “right way” to enter the market and represents how payments providers should enter today, while preparing for a future fully legal status and the access to card payments that will allow.

The opportunity in Cannabis and CBD payments is immense. The companies that invest in compliance, legitimate payment types, and simple end user experiences will be the early winners and poised to grow as legalization expands.