Merchant Payments Strategy

We work with merchants to develop a tailored payments strategy that supports organizational objectives while considering each client’s unique characteristics. We leverage our deep understanding of payments to identify and address major strategic topics that merchants need help with, and to apply best practices for improvement.

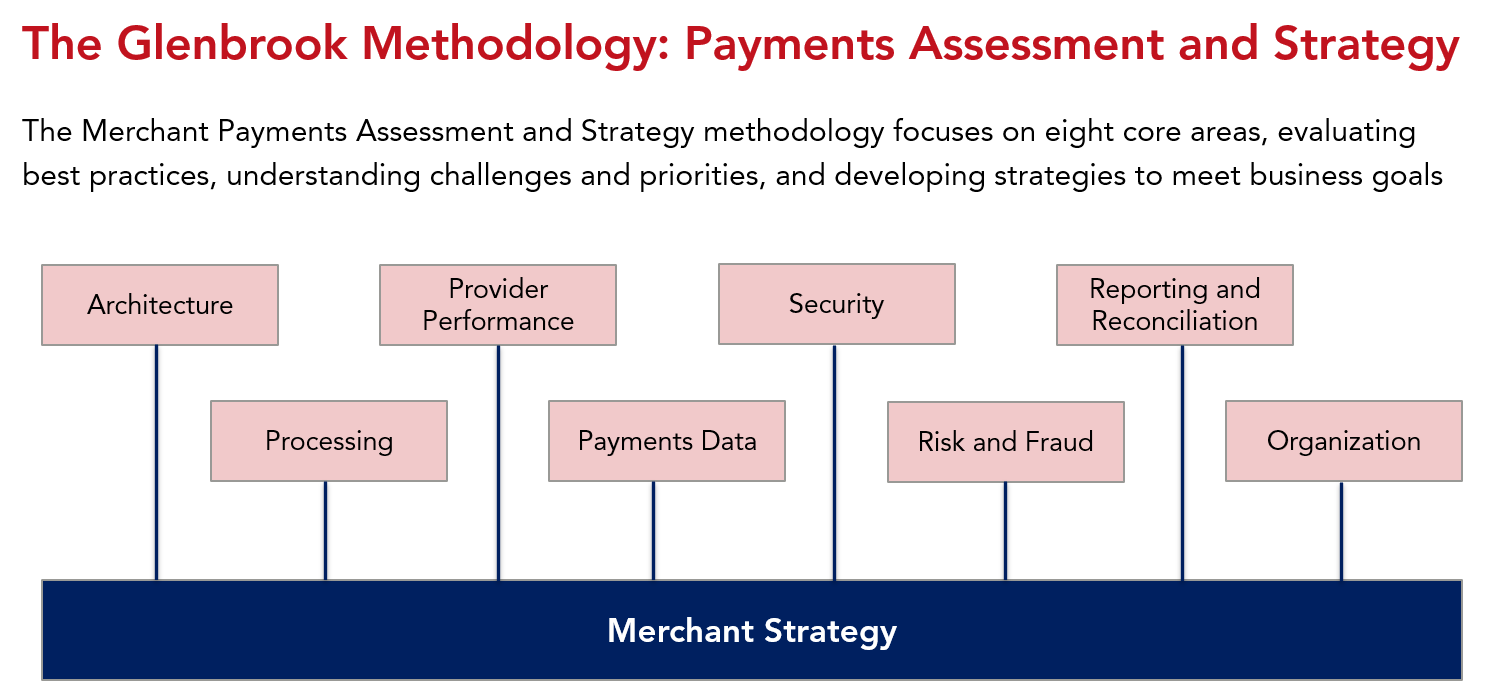

Payments Assessment & Strategy

Step 1 – Discovery

We review your payments data, provider contracts, provider invoices, procedural documents, and management reports to make preliminary observations. In parallel, we meet with key stakeholders who are directly or adjacently involved with payments to understand processes, challenges, determine what is working well, and to investigate questions generated by our documentation review.

Step 2 – Assessment

Following documentation review and stakeholder interviews, we develop an assessment of functional areas across the organization, including architecture, payment processing, team structure, payment provider performance, risk and fraud, security, accounting and reconciliation, and payments data management. This assessment highlights areas of opportunity for improvement as well as areas that are performing to expectations. In anticipation of the recommendations that follow in Step 3, we will outline any major considerations that apply to strategic options the organization faces. Insights into internal performance are augmented with industry research and our expertise.

Step 3 – Strategy Recommendations

Based on the outcome of the assessment, we develop a blueprint for supporting the organizational objectives identified during Discovery, complemented by industry and GlenbrookTM consulting team best practices.

RFP Management

Our approach includes:

Step 1 – Requirements Gathering

What is your current environment and the most important priorities you need to address? We’ll identify any unique processing requirements that must be included in the solution.

Step 2 – RFP Development

We’ll develop an acquirer RFP, iterating with you to ensure you’re satisfied. We’ll also work with you to define a response scorecard that we’ll use together later to evaluate and score RFP responses.

Step 3 – RFP Distribution & Management

Which merchant acquirers are the best potential partners for you? We’ll locate appropriate acquirers and manage distribution and execution of NDAs on your behalf. Acquirers often have additional requests for information, and we’ll manage that influx by setting a timetable for submission and organizing the process so it’s as painless as possible. We’ll continually update you on the status of the RFP process.

Step 4 – RFP Evaluation & Recommendation

Once we have the RFP responses, we review them carefully to ensure they address what you’ve requested. We then score each response against our collaborative response scorecard, weigh any other factors as they may arise, and make our recommendations. This discussion also includes acquirer contract “best practices” recommendations for use in further negotiations.

At the appropriate time, we’ll notify all RFP respondents of their status on your behalf. Finally, we’ll provide you with a summary of the final evaluation process as an artifact for your organization, to document how you chose your partner(s).

Read a Testimonial

“ALDI utilized Glenbrook partners in 2015-2016 on various electronic projects. From the first phone call with Allen it was clear that this team knows everything there is to know about payments. Throughout the engagement, Glenbrook was thoughtful, backed up recommendations with industry best practice and knowledge, and most importantly kept our well-being at the forefront of very conversation! Involving Glenbrook for our electronic payments projects over the last year was a game changer. We would not be where we are at in the projects without the hard work and dedication of George and Bryan. They never missed a deadline and worked hard on our behalf to create a high quality RFP that produced valuable insights, and in the end, saved us a lot of money! I would highly recommend Glenbrook’s services to anyone looking for a valued partner in the payments spsace. We also attended one of their Payments Boot Camps which was invaluable in learning more about a very complex industry. All products and services we have received from Glenbrook have exceeded expectations. ”

Greg Strom | Director of National IT, ALDI

Recent Engagements

Contact Us

Contact us to discuss a Merchant Payments Strategy engagement for your company.

Launch, improve & grow your payments business