Payments Risk Management

Fraud schemes exploit weak controls.

Every participant in the payments system has risk exposure and risk management responsibilities. Payment risk comes in many forms, each requiring specific controls and compliance.

Business risk: automation, people, and vendors

Settlement risk: timing, credit, and currency

Legal risk: regulatory, rules, and contract

We can help you understand which risks are relevant to you and what controls you should have in place to help mitigate those risks.

Strong risk management requires constant vigilance.

Risk management and fraud mitigation require cross-functional planning and execution. Let us help.

Payments Consulting

We apply decades of experience and rigorous, tested methodologies to help address your payments risks and assess the strength of your controls.

Recent engagements include:

- We worked with an ecommerce merchant to identify and mitigate the cause of a persistent uptick in fraud that had placed them on a network dispute management program.

- We used our Payments Risk Management (PRM) Maturity Model and Risk Taxonomy to help a global merchant develop a comprehensive control plan to increase lead generation and manage payment risks in the short and long term.

- We conducted consumer research in Ghana, Uganda, and India to understand end user experiences with fraud in real-time payments.

Payments Boot CampTM workshops

Our education capabilities can bring your team quickly and thoroughly up to speed on latest developments and next steps related to digital currencies, answering questions like

- What are incumbents doing to “get in the game”?

- How are new entrants defining economic models?

- What regulations are in place or approaching and how will they impact digital currencies?

- What use cases will digital currencies most likely impact in the near and long term?

The GlenbrookTM Team’s Risk Frameworks

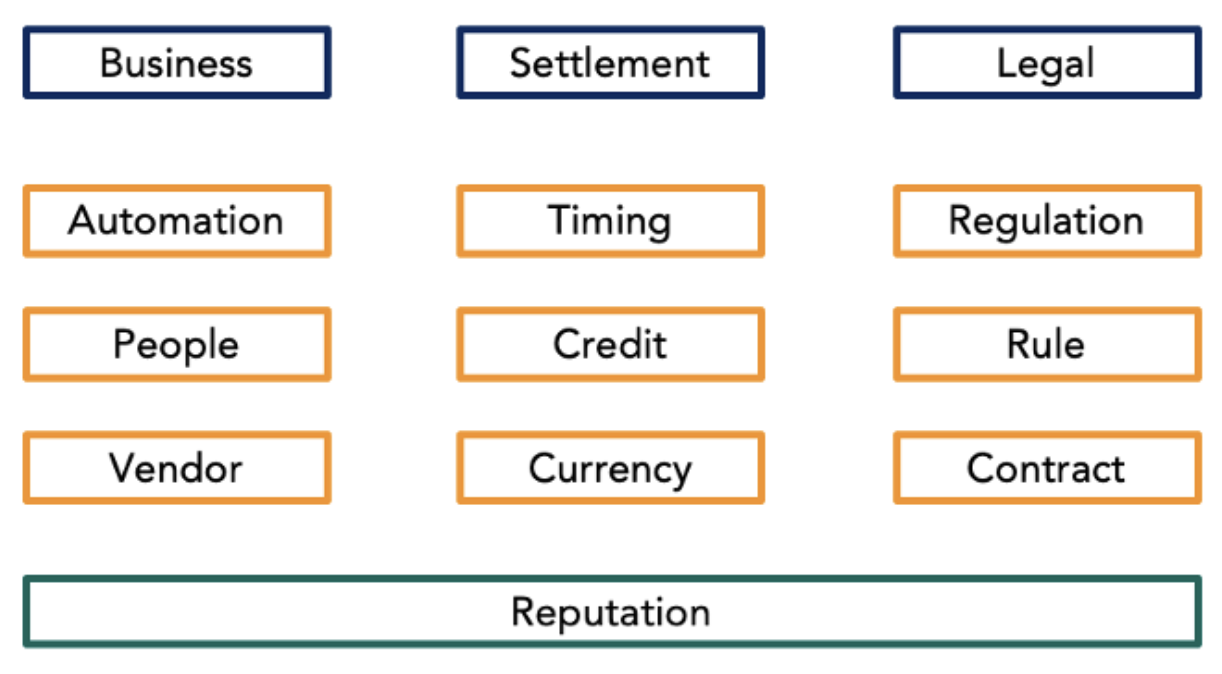

We use a simple framework that we call our Payments Risk Taxonomy, to identify a client’s specific risks. All payment risks can be mapped to one of the categories in the taxonomy.

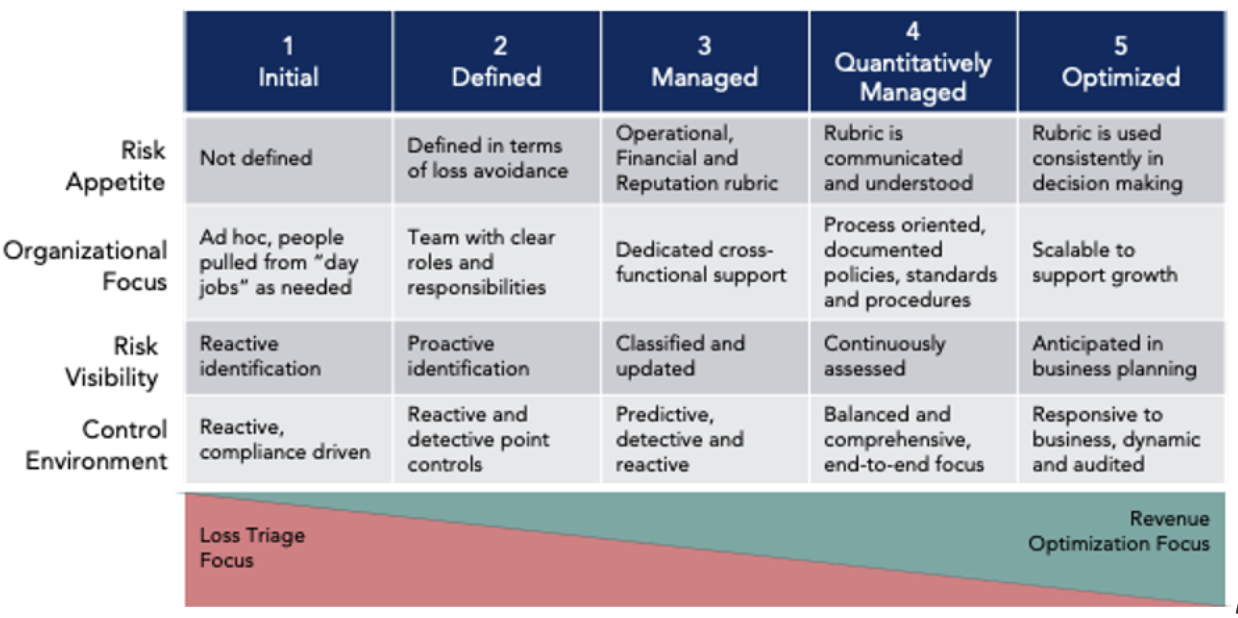

A company’s ability to manage payment risks can be measured using a simple PRM maturity model. When assessing a client’s controls, we use our PRM maturity model. The model is similar to Enterprise Risk Management (ERM) and Information Technology and Cybersecurity maturity models.

Recent Engagements

Launch, improve & grow your payments business