Entertainment

The entertainment industry is made up of multiple, distinct sub-markets. One way to break it down is to consider the content or activity type, for example:

Digital content, inclusive of video streaming and downloads, news access and subscriptions, audio content purchases (i.e., books, stories, music, podcasts), and video games (i.e., game purchases, in-game purchases)

Events , inclusive of events ticketing to sports games , concerts, etc .

Online gaming and betting, inclusive of sports betting, casino games, and other wager-based betting experiences

Another way to consider the market is by the key players, like Consumers, Content Creators, Distributors/Platforms, and Advertisers. In either instance, if you are an organization working within one of these markets, you offer end users access to fun and leisure, and end users have high expectations for related experiences – including payments. As a result, you must take a more systematic and intentional approach to your payments strategy.

Glenbrook supports entertainment companies to address the following common questions

How should our payments strategy support our growth strategy?

How should we support tokenization, if at all?

What fraud vectors should we be most concerned about and how do we best mitigate those?

What is the optimal team configuration to support our payments strategy?

What is the optimal architecture to support our objectives?

Are we using the right payments partners?

What orchestration approaches are most meaningful to us?

Are we exposed to churn risk? If so, how do we best manage it?

Our Clients

Gaming Companies

Event Ticket Marketplaces

Newspapers

Digital Music & Audiobook Services

Video Streaming Services

Other Entertainment Companies

Entertainment Case Studies

Resources

Articles

Glenbrook shares our perspectives on activities in the industry.

Podcasts

Glenbrook speaks with industry leaders to share a variety of perspectives on the latest payments trends and activities.

Episode 268 – Rethinking Payment Optimization Through the Merchant of Record Model, with Rehman Baig, FlexFactor

In this episode, Rehman Baig, Chief Product Officer at FlexFactor joins Drew to talk about how FlexFactor is rethinking payments optimization through a Merchant of Record model. For most people in the industry, “Merchant of Record” is usually associated with global tax compliance and marketplaces, not optimization. But FlexFactor is using it to directly address failed payments and auth rate challenges in a way that merchants simply can’t do on their own.

Episode 267 – Fanning the Flames: Agentic Commerce

Russ Jones and Drew Edmond spent some time at the Glenbrook water cooler this week to consider the rapidly emerging topic of agentic commerce and agentic payments. Tune in as they explore different industry perspectives in order to understand the implications of this new technology in the payments ecosystem.

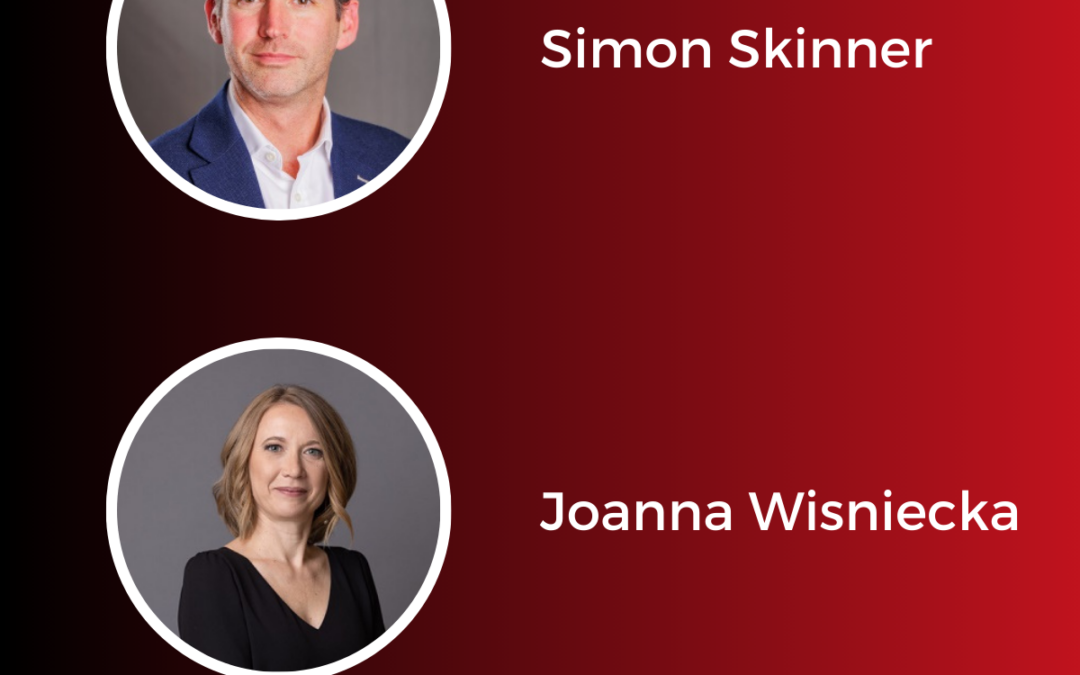

Episode 266 – Innovating Inclusive Financial Systems on the African Continent, with Sabine Mensah, AfricaNenda

In this episode, Joanna Wisniecka welcomes Sabine Mensah, Deputy CEO of AfricaNenda, a leader in financial inclusion, to explore Africa’s dynamic path towards inclusive instant payment systems and the need for continued innovation and collaboration to enable access to financial services for all Africans on the continent by 2030.

News

Glenbrook objectively curates the news to keep you abreast of important daily headlines in payments.

Cash App Enables Over A Million Sellers to Accept Contactless Payments Using Only an iPhone

"Cash App announced the launch of Tap to Pay on iPhone for Cash App Business sellers, allowing them to accept contactless payments – including credit and debit cards, Apple Pay, and other digital wallets – directly on their iPhone using the Cash App iOS app, with no...

Payments Vision Delivery Committee Update [UK]

"The National Payments Vision set out the government’s ambitions for a world-leading payments ecosystem which drives innovation, supports competition and ensures security, in line with the Growth Mission. It established the Payments Vision Delivery Committee to...

Shopify Has Quietly Set Boundaries for ‘Buy-For-Me’ AI Bots on Merchant Sites

"Shopify is drawing a line in the sand on agentic AI — a type of bot that autonomously completes tasks on its own, without human inputs — with new language across merchant websites that appears aimed at blocking agentic AI systems. Shopify now includes a warning in...

Ready to see how Glenbrook can support your entertainment company to be as efficient and effective as possible?