Situation

A global marketplace operated an end-to-end e-commerce fraud prevention process using a combination of third-party vendor and internally-developed technologies. Manual review rates were approximately 30bps, of which 75% were ultimately ‘released’ as good transactions. The marketplace believed that there were opportunities to decrease the volume of manual reviews by enhancing and tuning their automated fraud screen system. In addition, the marketplace’s business, product offering and global reach had evolved significantly since the implementation of its original fraud tools, technologies, and practices. As a result, the company believed that they could greatly benefit by re-assessing their end-to-end fraud toolset and operations. Glenbrook was asked to support a Request for Proposal (RFP) process to evaluate potential new fraud prevention service providers, by defining the business requirements, drafting and distributing the RFP document, managing the vendor interaction throughout the process, and evaluating the responses submitted.

Approach

Glenbrook used its tested RFP management approach to lead this engagement. Key steps included:

Step 1 – Requirements Gathering

Through a series of stakeholder interviews and workshops, we identified key functional and operational requirements to be included in the RFP. Key stakeholders took part in a requirements evaluation process, which involved leaders from payments, fraud, finance, technology, and treasury operations.

Step 2 – RFP Development

We developed an RFP, iterating with the marketplace to ensure they were satisfied. We also worked with the client to define a response scorecard that we used together later to evaluate and score RFP responses.

Step 3 – RFP Distribution & Management

We identified appropriate potential partners and managed distribution and execution of NDAs on behalf of the client. Throughout the process, we managed all communication and logistics with the candidates, and continually updated the client on the status of the RFP process.

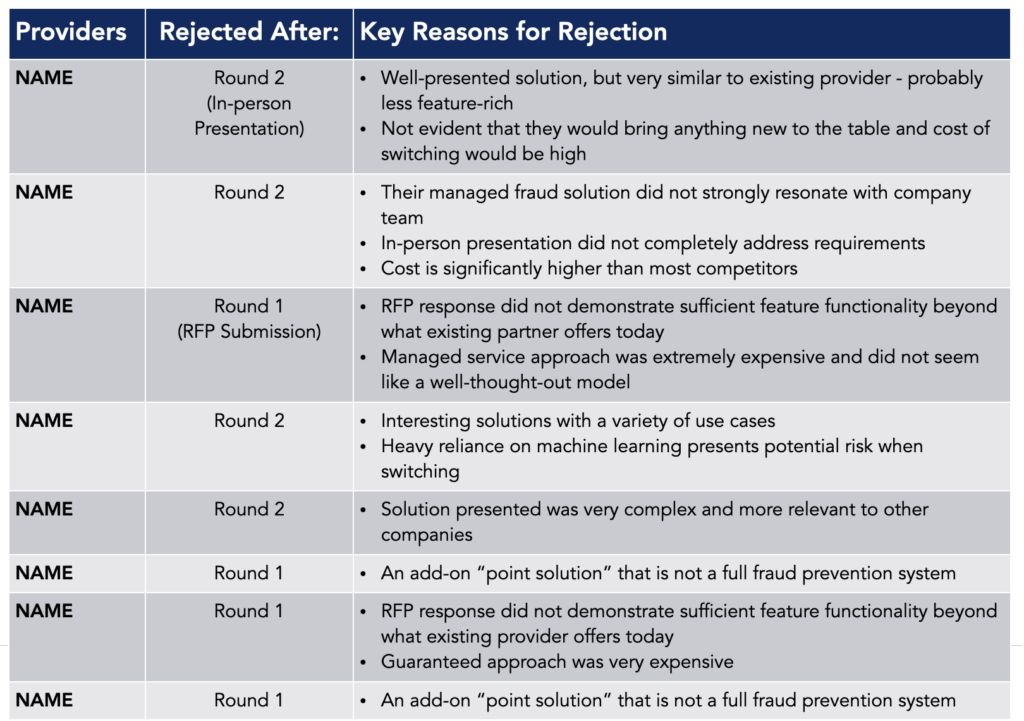

Step 4 – RFP Evaluation & Recommendation

Once we had the RFP responses, we reviewed them carefully to ensure they address what the client requested. We scored each response against our collaborative response scorecard, weighed any other factors as they arose, and ultimately provided our insights and recommendations. At the appropriate time, we notified all RFP respondents of their status on behalf of the client. Finally, we provided the client with a summary of the final evaluation process as an artifact for the organization.

Impact

Five providers were asked to present to the client. After a detailed analysis of all bidders, Glenbrook and the client collaboratively concluded that an enhanced implementation of the client’s existing partner would sufficiently meet the company’s current and future fraud prevention needs. Glenbrook also recommended that the company evaluate services offered by another bidder for non-transaction fraud mitigation use cases, such as account takeover and buyer/seller fraud. The client ultimately was able to enhance overall fraud operating metrics through the recommendations that were provided through the engagement.