Situation

This subscription merchant sells software to students, educators, and businesses to enhance virtual communication. The client was experiencing an increased rate of lost subscribers due to failed payments, at around 12% on a monthly basis. The client engaged Glenbrook to better understand what tactics they could use to reduce the number of failed payments and to develop more sophisticated KPIs and dashboards to monitor the effect of involuntary churn tactics.

Approach

Glenbrook’s approach to this engagement was built on a foundation of deep expertise in the payments industry and a proven track record of assisting both domestic and global merchant clients in addressing strategic and operational challenges. One of the primary objectives of this project was to enhance authorization rates and mitigate the impact of involuntary churn.

Conduct Payments Environment Assessment

Glenbrook conducted our payments environment assessment, which begins with an iterative Data Request process to gather essential information about the client’s customer, business, and payments data. This includes examining factors such as authorization rates, decline reason codes, involuntary churn metrics, chargeback rates, payment methods, authentication processes, and more. The assessment also includes interviews with key stakeholders which provide valuable perspectives into the payments environment, internal processes, and the customer experience.

The assessment seeks to answer critical questions about payment processing, renewals, customer communication, retry logic, and more. Understanding the client’s practices and challenges in these areas is essential to formulating an effective involuntary churn strategy.

Develop Involuntary Churn Strategy

Following the comprehensive assessment, Glenbrook analyzed the gathered data and stakeholder insights to develop a tailored strategy for the client. This strategy provided a roadmap for addressing involuntary churn, highlighted likely root causes, and proposed methods to tackle these issues. It outlined short, medium, and long-term strategies, with an emphasis on their potential impact on the business. Our recommendations were focused on changes that could be made to the customer experience within the product, specific payments strategies, as well as improvements to the data monitoring capabilities of the client. Additionally, the recommendations provided benchmarks to illustrate how the client compared to industry peers. Glenbrook facilitated a workshop with the client team to discuss and finalize the strategy.

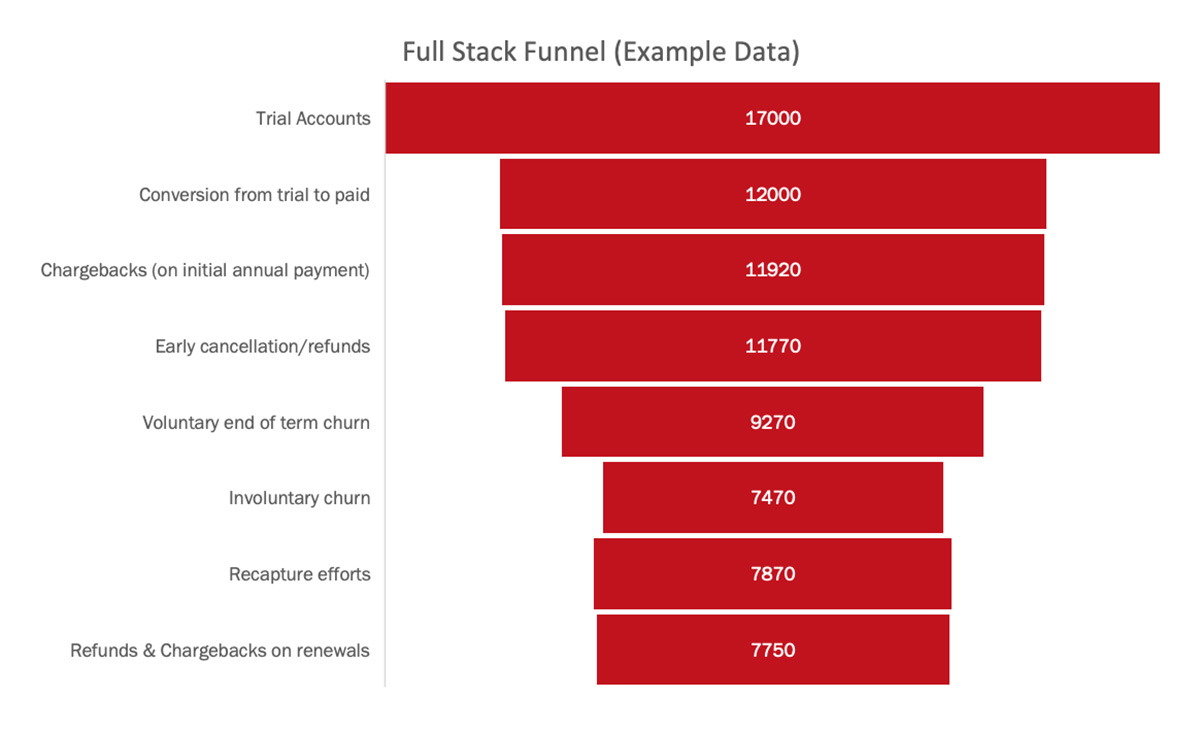

Monitor throughput through the customer lifecycle

Impact

Glenbrook’s approach combined industry expertise, data-driven analysis, and collaboration with key stakeholders to develop a holistic strategy aimed at optimizing authorization rates and reducing involuntary churn. This strategic roadmap will position the client for sustained growth and improved customer retention in the payments landscape.