A country’s economy is made up of multiple generations. And while we in the payments industry have been watching (and are fascinated by) the financial behavior of the Millennials (e.g. excessive student debt, delayed home buying, preference for digital, etc.), hot on their heels is Generation Z.

Currently characterized as self-aware, persistent, realistic, innovative and self-reliant, these ~4 to 19 year-olds have experienced a digitally-integrated (sometimes digital-first) life. And now, they are entering an age where their financial lives are starting to take off. (See appendix for more details on Generation Z characteristics).

As a Millennial (‘Generation Me’), I’m deeply curious about what this means for my industry (I mean, the payments industry 😉 ). More specifically, how will Gen Z impact the U.S. economy, how will Gen Z impact payments organizations, and how will Gen Z affect payments-related products?

How will Gen Z impact the U.S. economy?

Gen Z will impact PCE spending mix

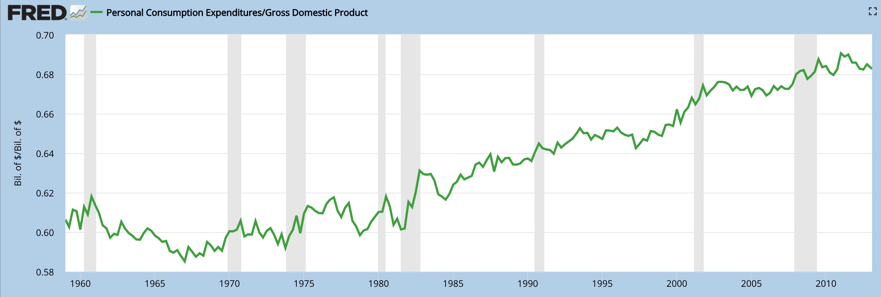

Like most developed countries, personal consumption expenditure (PCE) makes up a significant portion of the U.S. GDP (Chart 1). In Q3 2017, PCE accounted for 68.8% of GDP in the U.S.

Chart 1: Personal Consumption Expenditure as a Percent of GDP in the U.S.

Source: St. Louis Fed

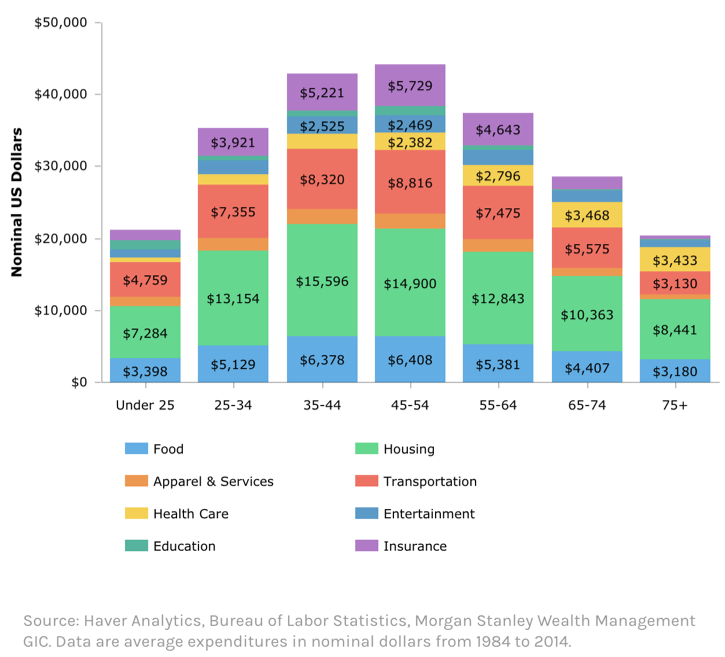

While Gen Z makes up only ~20% of the U.S. population, they are likely to impact the spending mix by categories such as Healthcare, Education, etc. (Chart 2). For example, given their willingness to explore non-traditional post-high school pathways, we are likely to see a decline in Education spending, particularly in the Under 25 category. Moreover, their tendency to save rather than spend may drive down consumption categories that could be considered ‘luxuries’ (e.g. Apparel and Entertainment). Perhaps this will be reflected in earlier and greater investments in Housing and Insurance?

Chart 2: Spending Levels in Nominal Dollars by Age Group (1984-2013)

Source: Morgan Stanley

Gen Z will impact PCE spending totals

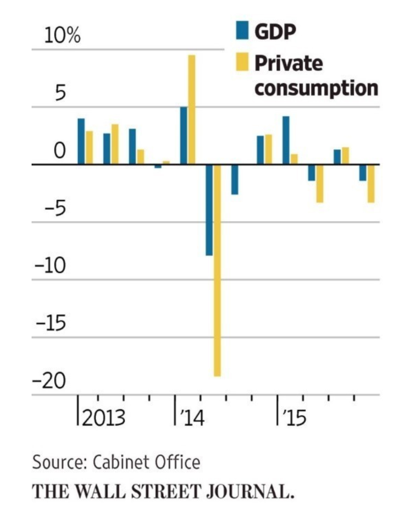

Could Gen Z have an impact on total PCE? Possibly, given their tendency to save in parallel with a decline in population growth overall, some .7% last year. If the economy moves into a strong recession, as some expect, during their formative adolescence, we may see Gen Z double down on their reluctance to spend. As Japan illustrates, since the 1990’s a lack of consumer spending can have a long-term, economy-wide impact on GDP. As the World Economic Forum explains, ‘Japan’s economy stagnated in the 1990s after its stock market and property bubbles burst… Wages stagnated and consumers reined in spending. Once deflation set in consumers started to expect prices to fall and they delayed spending for as long as possible in order to save money. That perpetuated the problem and continued the cycle.’ And as you can see from the Chart 3 below, the impact on PCE in Japan correlated to the GDP growth.

Chart 3: Quarterly GDP and Private Consumption in Japan 2013-2015

How will Gen Z impact payments organizations?

Payments organizations will have to alter messaging and invest in digital channels to attract Gen Z

Gen Z’ers are likely to be attracted to financial services providers that offer a strong, mission-based approach for delivering services. For example, Gen Z’ers could be drawn to companies like Aspiration, that uses the tagline ‘do well, do good’ and offers 10% of profits to charities. Credit unions, like BECU, that focus on ‘putting people first’ may also be well-positioned to serve Gen Z. We could see Gen Z’ers rebel more strongly than prior generations against organizations that are negligent with our personal data (Equifax) or behave badly (Wells Fargo).

Gen Z’s preferences for mobile and digital will likely promote the trend toward branchless banking that is already taking place. Financial services providers will have to alter their messaging and models of delivery in order to win the business—or, more likely, partnership—of Gen Z consumers. Could this change the landscape of, and relationships between, payments providers as we understand them today? Likely.

How will Gen Z affect payment-related products?

Gen Z customers could be attracted to alternative loan products

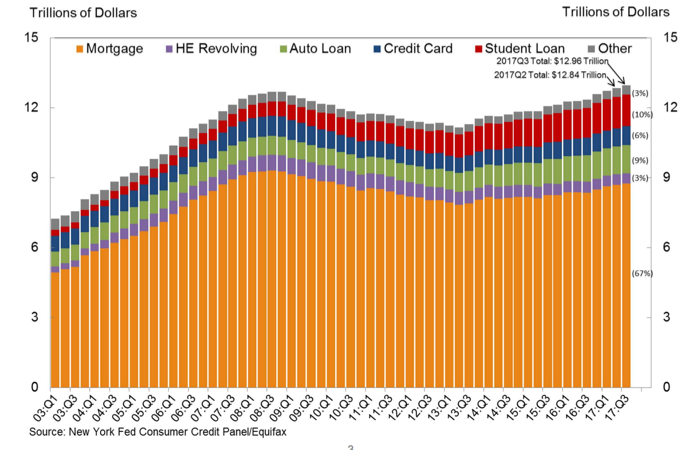

Given Gen Z’s savings tendencies, we could see a lack of growth, or even a decrease, in outstanding credit card debt (Chart 4). Gen Z consumers are likely to shift towards alternative credit approaches, like installment loans, that provide predictable pay-back models (think Affirm, ‘pay over time, on your terms’). Could we see a decline in what is the most profitable payments product? Credit card companies may need to further diversify their credit products to stay attractive to Gen Z. American Express’ ‘Pay It Plan It’ program is a great example. Users are allowed to:

- pay off specific purchases before their credit payment is due (thus removing it from the potential revolving line), or

- transition specific purchases into an installment loan

Chart 4: Total U.S. Debt Balance and its Composition

Source: NY Fed’s Quarterly Report on Household Debt and Credit

Savvy payments-integrated savings models are likely to be well-received by Gen Z

As Gen Z is self-reliant, savings-oriented and digital, savvy savings products integrated into payments products may continue to gain traction. For example, Gen Z’ers are likely to find products like Acorns attractive, which allows consumers to round up purchases to the nearest dollar and pulls that money into a savings/investment account.

Looking Ahead

Generation Z, is likely to change the face of our economy and the payments industry dramatically in the coming years. What changes do you expect they will bring? How can payments organizations better prepare?

We look forward to your comments.

Get to Know Gen Z Better

Defining Generation Z

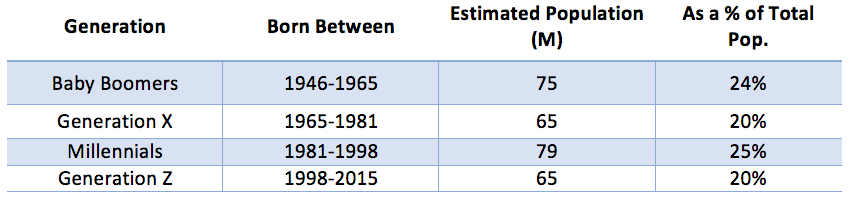

Generation Z is a common term used to refer to the generation following Millennials. Born between 1998 and 2010-15 (somewhat ambiguous start and end dates still), the oldest Gen Z’er will turn 20 this year and is largely being raised by Generation X parents. Generation Z accounts for approximately 20% of the U.S. population, or about 65 million people, with an estimated $44 billion in annual economic impact (see Table 1 for generational comparisons). Recognizing that most are still under 18 years old, their economic impact is relatively substantial and will increase significantly in the coming years.

Table 1: Generation categories

Sources: Knoema, Pew Research, Vision Critical

What are Generation Z’s characteristics and preferences?

Generation Z members are self-aware, persistent, realistic, innovative and self-reliant.

Generation Z as consumers

Gen Z’ers were born in the wake of the great recessions during which their parents were likely financially impacted. As a result, research has found that Gen Z’ers are much more spend conscious than their Millennial counterparts and are less likely to be influenced by deals (e.g. coupons, discounts, etc). In fact, 57% said they would prefer to save money than immediately spend it.

Additionally, Gen Z’ers emphasis on the real rather than the ideal and their genuine focus on human rights and social activism is reflected in their spending and interaction with companies. As a Forbes article recently explained, ‘What does it take to reach Generation Z? It’s pretty simple, actually: Don’t make it look like an advertisement!’.

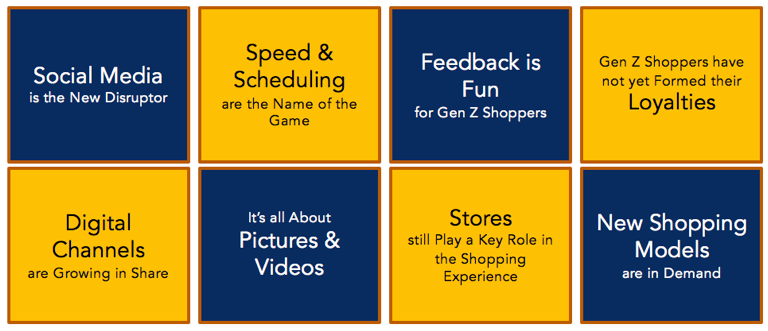

Finally, Gen Z’ers have only experienced a digitally-integrated life. This, of course, has impacted how they interact with and perceive companies. Accenture distilled the Gen Z approach in the following table:

Source: Accenture Driving Future of Payments Report

Generation Z’s perspective on education and their future

Generation Z has seen their parents and Millennial counterparts burdened by extensive student loan debt (outstanding student debt stood at $1.36 trillion as of September, 2017). That, in conjunction with their heavy exposure to a rapidly evolving and digital environment, have researchers predicting that more Gen Z’ers will go straight into the workface or pursue alternative higher education models than previous generations that opted for traditional higher education. Research also shows that Generation Z, with their tendency toward self-reliance, favors entrepreneurship. In fact, 62% reported that they are interested in starting their own business rather than working for an established business.