Recap

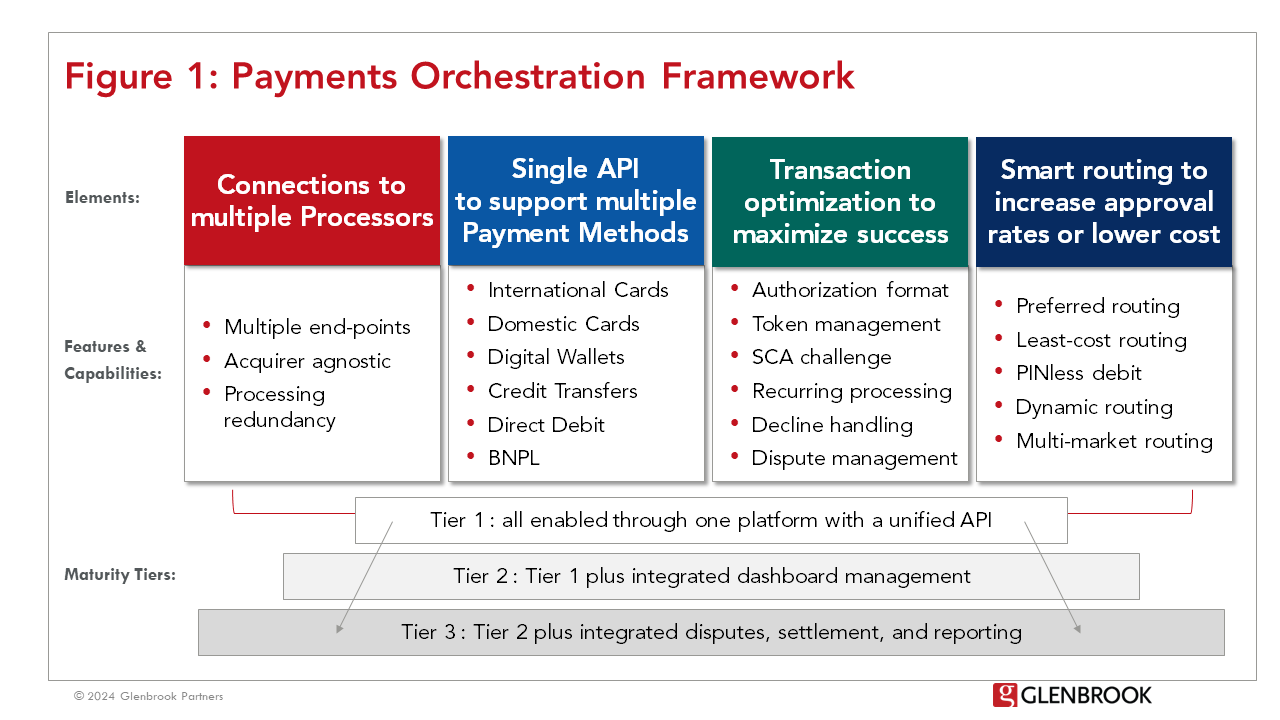

Earlier this week, we started to unpack one of the buzziest terms in payments: orchestration. As we define it, Orchestration Platforms facilitate a merchant’s multi-acquirer setup, in addition to providing services across the areas of transaction optimization, smart routing, and connections to multiple providers (acquirers, non-card payment methods, and related services such as risk solutions) through a single integration.

It is important to note that these benefits and features are not unique to Orchestration Platform providers. Indeed, many of them are enabled by gateways and global PSPs. Furthermore, orchestration is not an activity that requires a 3rd party provider; many sophisticated enterprise merchants have technical and operational teams working on payments and have been doing their own orchestration in-house for years.

Though the individual functions they provide may not be unique, Orchestration Platforms are unique in their ability to provide all of these offerings in a streamlined manner. Here at Glenbrook, we like to draw a distinction between what we’ve been calling “little-o” orchestration (the activities), versus “capital-O” Orchestration (meaning the providers and service offerings that encompass the defined elements). Now that we have our definitions in place, we will examine the benefits of Orchestration Platforms and which types of merchants may benefit from their use.

What are the key benefits of Orchestration?

The most straightforward way to explore the benefits of orchestration, in its broadest sense, is through the individual elements of the four pillars in its framework.

1. The ability to route payments between multiple processors in the same domestic market – while remaining out of PCI scope – offers the merchant optionality, processor performance benchmarking, and redundancy that prevents business interruptions caused by outages.

2. Access to multiple providers and payment types through a single API integration point reduces the effort to add new payment methods or even geographies – thus reducing the resources, cost, and time to bring new features to market.

3. Transaction optimization (for example, BIN-level performance decisions for routing between different acquirers or using PAN instead of Network Tokens) helps merchants maximize their revenue. It also creates a stronger end-user experience for their customers by reducing the number of declined and failed payments.

4. Finally, smart routing can be deployed in various ways to service the merchant’s key outcomes, whether it is maximizing auth rates or (in the example of PINless debit routing in the U.S.) optimizing costs.

The true benefit of Orchestration, however, is more than the sum of its parts. The promise of Orchestration is that the four functional pillars of the framework work not only alongside but also to amplify one another, thus enabling a merchant to employ best-of-breed point solutions at every step across the payments value chain – optimized at the transaction level – without adding the technical or operational complexity of supporting numerous integrations.

An Orchestration Platform’s ability to streamline integrations has downstream impacts on the technical, product, and operational functions in the payments organization. From a technical perspective, Orchestration Platforms dramatically reduce the engineering effort required for payments, freeing up valuable technical resources for other initiatives. Rather than building and maintaining a whole host of individual connections to different providers, the merchant will build a connection to the Orchestration Platform. The single integration also makes the process of opening up new markets and introducing new payment types simpler, as the technical integration (to the Orchestration Platform) has already been completed.

Orchestration Platforms hold the promise of collapsing the tradeoffs between payments product, engineering, and operations teams, by making it easy to add payment methods or open new markets without fighting for space on the technical roadmap – often against other initiatives with more measurable contributions to the bottom line – and increased complexity.

Cue Ina Garten: “How easy is that?”

Streamlining is also a major benefit for merchants’ payments operations teams, to whom the burdens of provider relationship management and transaction optimization typically fall. Orchestration Platforms promise payments operations teams the ability to compare performance and adjust routing logic across providers, with the insights to help them make the smartest decisions. There is not yet an Orchestration Platform provider in the market that has fully realized the vision of serving as a one-stop, “command center” for all payments operations, including full reporting, reconciliation, and operational capabilities (e.g., chargeback management) across all providers. However, the benefit of a single, global view of all payments performance – that doesn’t require a data engineer to build and maintain – should not be understated. Furthermore, gone are the days when a payments operations team would need engineers to build a full integration to test performance of a new provider. So long as the connection is supported by the Orchestration Platform, payments operations teams can easily route volume over a new acquiring connection to test performance – on their own traffic – with only a contract, without any development required.

Which types of merchants is Orchestration right for?

While the activities involved in orchestration – optimization, smart routing, and streamlining complex operations – are valuable to most merchants, not every merchant will need to employ the services of a third party Orchestration Platform.

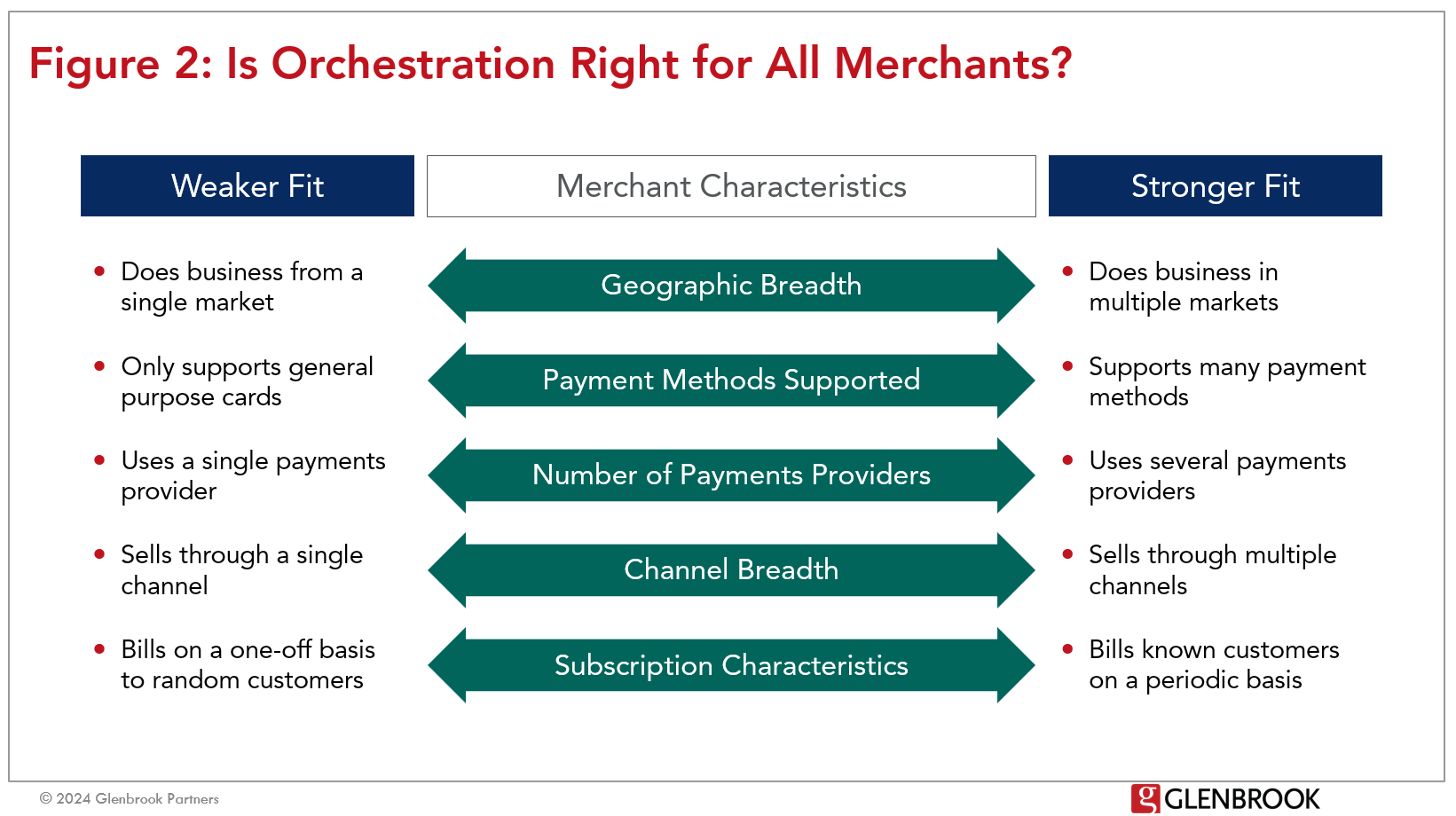

In our view, there are a number of dimensions (as illustrated in Figure 2) through which to look at merchants’ payments activities to help inform whether orchestration is likely to be a strong fit. Those dimensions typically speak to the level of complexity of a merchant’s current or planned payment activities; the more complex the merchant’s setup, the greater likelihood that they will derive value from orchestration.

The key lens through which to consider the need for a third party Orchestration Platform is the size and maturity of a merchant’s existing payments operations, and the level of resource assigned to support those operations. For smaller merchants, the simplicity of a full-stack solution offered by a single PSP may outweigh incremental benefits of an Orchestration layer. However, once a merchant “graduates” to a level of maturity where a multi-processor environment is required (or desired), third party Orchestration becomes a real consideration.

In our view, two types of merchants can benefit from 3rd party Orchestration Platforms: mid-market merchants whose growth has outpaced the size and sophistication of their current operational capabilities; and enterprise merchants with complex payments operations that can benefit from the efficiencies an Orchestration Platform can provide.

Mid-market merchants have generally been considered a “sweet spot” for Orchestration Platforms, which can add functionality the current organization lacks. Moving from a single PSP to an environment that balances multiple PSPs is a jump for any payments team; an Orchestration Platform can help to automate and support routing and optimization decisions. Essentially, third party Orchestration can allow a small payments organization to behave and make decisions like a sophisticated payments operations team, without requiring the time and resources to build one from the ground up.

At the other end of the spectrum, larger enterprise merchants with existing multi-processor models may have already built the orchestration tools and capabilities in-house, with teams of payments experts optimizing the routing and transaction processing. In these cases, an Orchestration Platform does not add new capabilities (as it would for a mid-market merchant); its main benefit is enabling these sophisticated teams to optimize their resources. For enterprise merchants with complex payments environments, Orchestration Platforms offer a way to reduce the cost and resources required for the ongoing building, maintaining, and updating of their numerous connections and in-house payments capabilities.

The jury is out as to whether enterprise merchants will want to relinquish the control of payments orchestration to a third party, or go through the upheaval (and cost) of rewiring their fully functioning and optimized payments stacks. Anecdotally, we are seeing serious consideration of Orchestration Platforms among larger merchants whose payments requirements have become increasingly more complex and whose in-house payments expertise is resource constrained. Among this segment, the efficiencies offered by a third party Orchestration Platform are attractive, particularly if a merchant can retain appropriate control of the business logic underpinning the smart routing capabilities. For merchants that are hesitant to relinquish any control of their payments operations, an Orchestration Platform that takes the approach of reporting insights, but letting the merchant control their own routing decisions may be a better fit than one with a more “black box” approach that makes routing decisions on the merchant’s behalf.

A final consideration is a merchant’s roadmap for geographic expansion. As merchants look to expand their geographic footprint, an Orchestration Platform can help to open new markets without requiring additional integration work or resources. This can accelerate the time to enter any market, but also can enable merchants to enter longer-tail geographies where it may be difficult to build a business case with sufficient ROI to justify the necessary development resources.

Conclusion

This was a lot to unpack, and we still have more to come in our next orchestration week in the Spring. Until then, if you are a merchant wanting to dig in more deeply, please reach out. And if you are a gateway, PSP, or Orchestration Platform, we would love to hear from you too.