Get smart about payments - register for the March 10-12 Payments Boot Camp! Save 10% through February 10.

A leading payments industry news source for more than 17 years. Glenbrook curates the news and keeps you abreast of the important daily headlines in payments.

Search Payments News

November 22, 2019

September 4, 2019

On the web

Barclays’ Former CEO Says Banks Should Beware the Story of Uber

Quartz

“In late 2015, Antony Jenkins said the banking industry was approaching its “ Uber moment .” The former Barclays CEO predicted that major, established lenders could be forced to cut as much as half their workforces and bank branches in the coming decade. He said that a group of new banks would become well known brands. Nearly four years later and his predictions seem broadly accurate. In the UK, the number of bank branches has dwindled to fewer than 8,000, compared with nearly 18,000 some 30 years ago.”

Chime Now Has 5 Million Customers and Introduces Overdraft Alternative

TechCrunch

“Challenger bank Chime has reached 5 million customers in the U.S. The San Francisco-based startup is creating an FDIC-insured mobile bank without any physical branch. The company also promises less fees. Back in March, Chime said it had 3 million customers when it announced its $200 million Series D round . So that’s 2 million additional customers in roughly 5 months. Chime says that it is the fastest growing challenger bank in the world. In other words, the company is throwing shade at European challenger banks, such as Monzo and N26, that have been doing really well too. N26 just entered the U.S. market.”

September 3, 2019

On the web

Bunq Simplifies Group Payment Tracking and Adds Analytics

TechCrunch

“European challenger bank Bunq is announcing a handful of updates today. You now get a better overview of your account with more insights on how you spend money. If you’re going on vacation with someone else, you can now choose to automatically add transactions to a Slice Group. There are also improvements to VAT management for business users. Slice Groups are shared accounts for owners of the Bunq Travel Card . You can create a group with multiple Bunq users and then add expenses to the group. You can’t add money to a Slice Group directly. It is essentially a group accounting feature that lets you keep track of who paid for what, who has a positive balance and who has a negative balance.”

August 22, 2019

On the web

N26 Launches Shared Spaces and Is Now Fully Available in the U.S.

TechCrunch

August 15, 2019

On the web

N26 Sets Sights on Future IPO

FinTech Futures

“Co-founder and chief executive, Valentin Stalf, has told the Financial Times that the fintech – which has amassed 3.5 million clients since its 2015 launch – plans to eventually apply for an IPO, as part of its aim of building a global brand. “We want to provide the app that you turn to every day to deal with your financial issues,” he says. “Our goal is ultimately to do for finance what Spotify did for music and Uber did for mobility.””

August 1, 2019

On the web

Revolut Launches Stock Trading in Limited Release

TechCrunch

“Fintech startup Revolut is launching its stock trading feature today. It’s a Robinhood-like feature that lets you buy and sell shares without any commission. For now, the feature is limited to some Revolut customers with a Metal card. While Robinhood has completely changed the stock trading retail market in the U.S., buying shares hasn’t changed much in Europe. Revolut wants to make it easier to invest on the stock market. After topping up your Revolut account, you can buy and hold shares directly from the Revolut app. For now, the feature is limited to 300 U.S.-listed stocks on NASDAQ and NYSE. The company says that it plans to expand to U.K. and European stocks as well as Exchange Traded Funds.”

July 23, 2019

On the web

Robo Adviser Betterment Pitches for Client Cash by Offering Traditional Banking

Wall Street Journal (paywall)

“Betterment LLC, an early provider of digital-investing services, is trying its hand at traditional banking. To vie for customer cash and expand beyond its robo-advising roots, the firm is introducing new banking products at a time when anxiety over slowing economic growth has led some investors to reduce market exposure and stockpile cash. Betterment is offering a 2.69% promotional annual rate on cash in savings accounts—one of the highest around—in hopes of standing out in a field where banks have paid peanuts on client cash for years. The aim is to woo new customers while retaining its core investing clients looking to pull money from investment portfolios.”

July 11, 2019

On the web

N26 Launches Its Challenger Bank in the US

TechCrunch

“European fintech startup N26 is now accepting customers in the U.S. The company is launching a bank account with a debit card that should provide a better experience compared to traditional retail banks. If you’re familiar with N26, the product that is going live today won’t surprise you much. Customers in the U.S. can download a mobile app and create a bank account from their phone in just a few minutes. It’s a true bank account with ACH payments, routing and account numbers.”

July 10, 2019

On the wires

Neo Receives Approval From the Bank of Spain to Launch a Corporate Multi-currency Account

Neo will allow the account holder to receive, store and pay in around 30 currencies. The Neo account will include an IBAN in the client’s name, and will be fully programmable in order to offer extended automation capabilities to clients. It will rely on a proprietary Core Banking System developed by Neo Fintech Lab in the UK.

July 9, 2019

On the web

India’s NiYO ‘neo-bank’ Raises $35M to Help Blue-collar Workers Access Financial Services

TechCrunch

“NiYo Solutions, a Bangalore-based ‘neo-bank’ that helps salaried employees and blue-collar workers access company benefits and other financial services, has raised $35 million in a new funding round to expand its business in the nation and explore international markets for some of its products.”

July 1, 2019

On the web

Singapore to Issue Digital Bank Licenses | ZDNet

ZDNet

“Singapore has announced plans to issue up to five digital bank licenses as part of efforts to add market diversity and boost the banking system in the country, as it looks to become a digital economy. The move also is part of a market liberalisation journey spanning two decades and an extension of an existing internet banking framework that has allowed local banks to establish digital bank subsidiaries.”

June 25, 2019

On the web

Monzo, the UK Challenger Bank, Raises £113M Series F Led by YC’s Continuity Fund at a £2B Post-money Valuation

TechCrunch

“Monzo , the fast-growing U.K.-based challenger bank with more than two million account holders, has raised £113 million (~$144m) in additional funding. Confirming TechCrunch’s scoop in April, the Series F round is led by Y Combinator’s “Continuity” growth fund, and gives the company a new £2 billion (~$2.5b) post-money valuation. That’s double the £1 billion valuation it garnered in October last year.”

June 14, 2019

On the web

Monzo Launches Its ‘bank of the Future’ in the US

The Verge

“As Monzo doesn’t have its own US banking license, the features will be a little different. “The main thing that will be removed is lending,” says Blomfield. “We’re not a bank [in the US], so we won’t be lending customers money.” The majority of existing Monzo features will be available in the US, including things like notifications for payments and tap-to-pay (contactless) payments. “

June 6, 2019

On the wires

Airfox Announces Digital Challenger Bank for Emerging Markets

“Airfox today announced banQi , its free and flexible digital challenger bank designed specifically for the Brazilian market and its 50 million people who are not served by traditional banking establishments. Developed by Airfox with strategic partner Via Varejo , a leading Brazilian retailer, the banQi platform evolved from the Airfox digital wallet that launched in Brazil in 2018 — continuing an evolution that is emblematic of the Boston fintech startup’s rapid growth.”

May 30, 2019

On the web

New Startup-Focused Bank Gets More Than $100 Million From Investors

Wall Street Journal (paywall)

“A group of investors has bet more than $100 million on a new digital bank that is looking to tap into the growth of technology startups and the venture-capital firms that fund them. New York-based Grasshopper Bancorp Inc. opened for business in May with plans to challenge Silicon Valley Bank as a go-to financier for startups. It recently raised $116 million from investors including T. Rowe Price TROW 0.26% Group Inc. funds, Patriot Financial Partners LP, Endeavour Capital Advisors Inc. and FJ Capital Management LLC, the company said. Hamilton Lane Inc., HLNE 1.20% the alternative investment manager, also invested on behalf of the New York State Common Retirement Fund.”

May 21, 2019

On the web

Kard Is a Challenger Bank for Teens

TechCrunch

May 16, 2019

On the web

YouTrip, a Challenger Bank in Southeast Asia, Raises $25.5M for Expansion

TechCrunch

“Singapore-based startup YouTrip thinks consumers of Southeast Asia deserve a taste of the challenger bank revolution happening in the U.S. and Europe, and it has raised $25.5 million in new funding to bring its app-and-debit-card service to more parts in the region. Challenger banks have sprung up in Europe in recent years. Unicorns Monzo, Revolut and N26 are among those that offer their customers a debit card linked to an app and various levels of banking services, including savings and overdrafts. Brex — another billion-dollar-valued startup — is bringing that approach across the pond to the U.S. market.”

May 13, 2019

On the web

Two New Next-gen Banks to Open in the US

FinTech Futures

“Two new banks are coming to the US: Piermont Bank in New York and Nexos National Bank, based in Stamford, Connecticut. “We appreciate, respect and honour family legacy” Piermont Bank is a “new generation” of commercial banking with a focus on helping clients build and grow business. The Piermont Bank’s team says that it aims to support privately-owned business, especially multi-generation family-owned enterprises….Nexos National Bank, however, would be the first nationally chartered bank to open in Connecticut since the 2008 financial crisis. The bank was founded by Gordon Baird, CEO and has Kathleen Romagnano as president and COO. It would serve individual customers and small- and medium-size businesses throughout Fairfield and Westchester counties, with brick-and-mortar branches and online offerings.”

April 2, 2019

On the web

German Fintech Company Builder Finleap Acquires SME Banking Provider Penta

TechCrunch

“Just since months after raising $7 million in Series A funding , German SME banking provider Penta has been acquired by Finleap. Terms of the deal remain undisclosed, although I understand that the acquisition sees Finleap and Penta’s co-founders becoming the challenger bank’s sole owners, with all other shareholders exiting.”

March 14, 2019

Top Post

Challenging the Challenger Banks

Glenbrook Partners

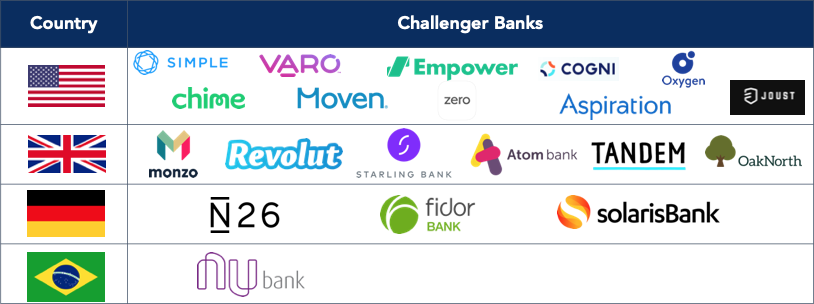

“Fintech start-ups have begun a phenomenon some call the “unbundling of financial services” through stand-alone products such as unsecured consumer loans, credit cards, checking and savings accounts, or personal financial management tools. A cohort of entities known as “challenger banks” or “neo-banks” have also entered the market in an attempt to take on digital banking itself with user-friendly product bundles that include checking, savings, debit, and money management tools.”

“

March 8, 2019

On the web

Nigeria’s Paylater Lending App Is Converting to a Full-service Digital Bank

Quartz Africa

“Paylater is looking to deploy new products while transitioning to a digital bank. Since launching in 2016, the Paylater mobile app was downloaded by over 1 million users and disbursed loans of over 13 billion naira ($36 million). But now, the company is looking to get into the unbanked population of Nigeria and provide banking services for them. The startup will be announcing a name change to fit its new business in the first week in April.”

February 27, 2019

On the web

Challenger bank N26 plans to expand to Brazil

TechCrunch

“N26 has already announced that its next market would be the U.S. at some point during the first half of 2019. Brazil should launch after that. Right now, N26 is available in 24 European countries, including all of the Eurozone, the U.K., Denmark, Norway, Poland, and Sweden, Liechtenstein and Iceland.”

February 5, 2019

On the web

Meridian Set to Launch Its New Digital Bank Called Modusbank

Betakit (Canada)

“Meridian has been given the green-light by the Office of the Superintendent of Financial Institutions to move ahead with its new digital bank, Motusbank. The digital bank, set to open this spring, and will allow Canadians to access their bank accounts, investments, and mortgages online, while offering digital customer service from real people. Through Meridian, members will also receive access to one of Canada’s largest no-fee ATM networks.”

January 11, 2019

On the web

OCC fights for US fintech charter in court

FinTech Futures

December 13, 2018

On the web

U.K. Fintech Revolut Gets European Banking License Via Lithuania

Bloomberg

“Revolut, the London-based financial technology startup, has obtained a European banking license as Brexit looms, with plans to launch checking and savings accounts as well as retail and business lending. The Bank of Lithuania, the eastern European country’s central bank, granted Revolut the regulatory approval that gives it permission to operate throughout the European Union.”

October 12, 2018

On the web

Tandem’s new credit card targets people who have non-existent credit histories

TechCrunch

“The challenger bank founded by Ricky Knox has launched its second credit card today, this time targeting people in the U.K. who have yet to build up a credit history at all. Credit cards are already one of the most effective ways of improving your credit score (presuming you are approved for one and always repay on time, of course) and it seems that Tandem wants a piece of that action.”

September 7, 2018

On the web

OPEN BANKING AND THE POST-CARD WORLD

https://internationalbanker.com/technology/open-banking-and-the-post-card-world/

“Open Banking will be the biggest change to financial services since the introduction of electronic payments. However, to date Open Banking has fallen short of the expectations set throughout Europe. Why? Consumers aren’t aware of the initiative—92 percent of them are not, according to Which?—let alone educated on the opportunities that it presents. Without consumer demand, there is little immediate pressure on incumbent banks to accelerate Open Banking activities.”

August 10, 2018

On the web

Neat is a challenger bank for early-stage startups and SMEs

TechCrunch

“With the growth in cross-border payment services and ‘challenger’ bank cards for consumers, you’d be forgiven for wondering where the options are for small business — where cash is particularly precious. They do exist. One of the newer options is Neat, which is nested in Hong Kong but open for business worldwide.”

August 3, 2018

On the web

Starling Bank Unveils Banking-as-a-Platform APIs

BankingTech

“These businesses can pick and choose individual components and features, as they use Starling’s banking licence – which means they do not need to be regulated themselves. Raisin UK is Starling’s first business client for this offer, an online savings marketplace that allows customers to pick savings deals on the market to meet their individual needs. Through Starling’s API, Raisin UK will be able to open accounts for each customer, collect their deposits and place them at their network of partner banks that participate in its marketplace.”