Payments Risk Management

Fraud schemes exploit weak controls.

Business risk: automation, people, and vendors

Settlement risk: timing, credit, and currency

Legal risk: regulatory, rules, and contract

Strong risk management requires constant vigilance.

Risk management and fraud mitigation require cross-functional planning and execution. Let us help.

Payments Consulting

Recent engagements include:

- We worked with an ecommerce merchant to identify and mitigate the cause of a persistent uptick in fraud that had placed them on a network dispute management program.

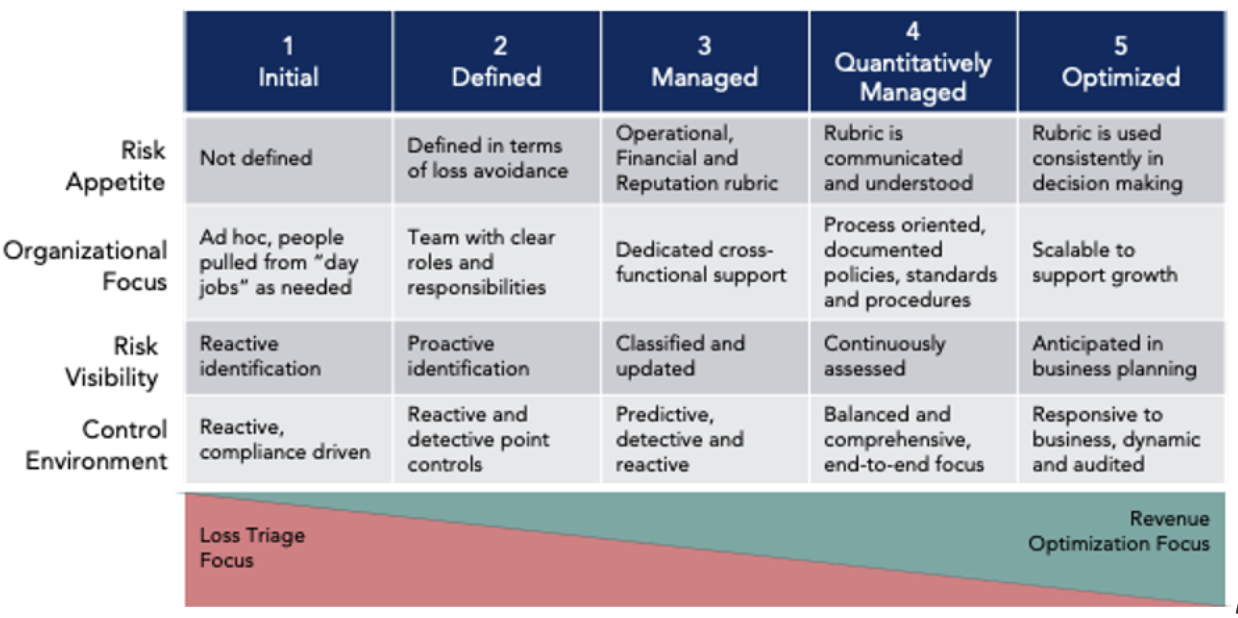

- We used our Payments Risk Management (PRM) Maturity Model and Risk Taxonomy to help a global merchant develop a comprehensive control plan to increase lead generation and manage payment risks in the short and long term.

- We conducted consumer research in Ghana, Uganda, and India to understand end user experiences with fraud in real-time payments.

Payments Boot CampTM workshops

The payments industry is evolving at an unprecedented pace. With new technologies, regulations, and products, successfully managing risk in this innovative era is challenging. Whether you are implementing new forms of payment, making decisions about vendors and technology, or creating new payments products, our education programs can introduce you to risk fundamentals and provide you with the key concepts required to make sense of a rapidly changing landscape.

The GlenbrookTM Team’s Risk Frameworks

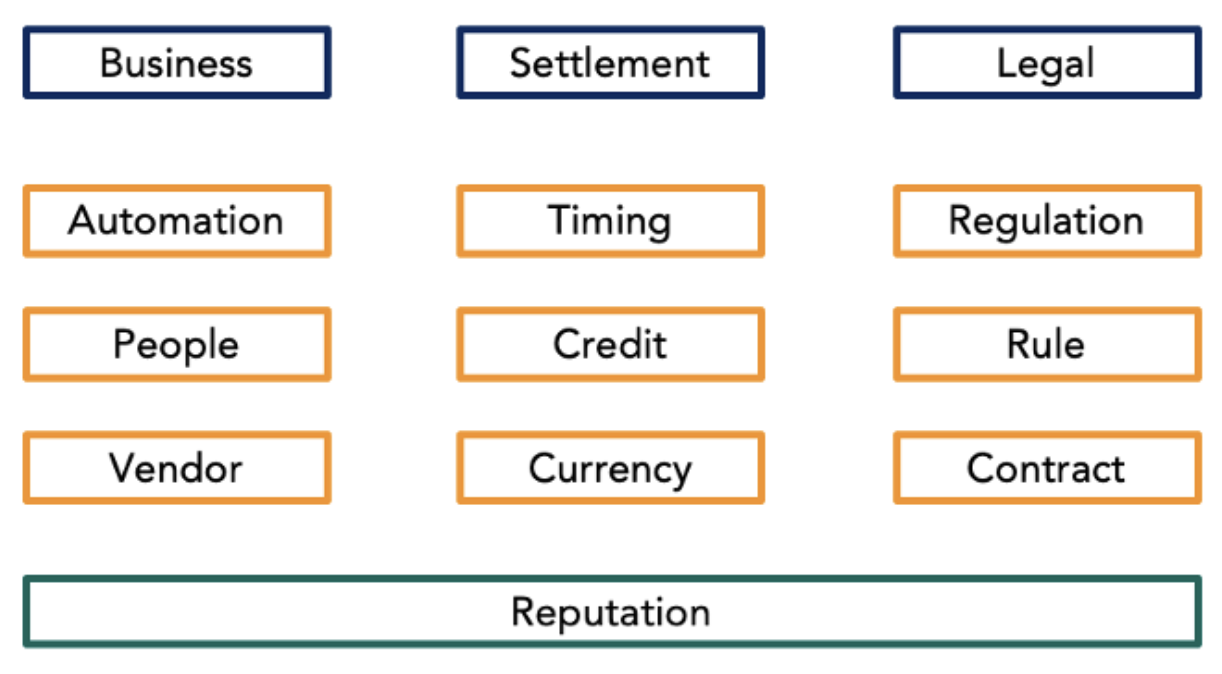

We use a simple framework that we call our Payments Risk Taxonomy, to identify a client’s specific risks. All payment risks can be mapped to one of the categories in the taxonomy.

A company’s ability to manage payment risks can be measured using a simple PRM maturity model. When assessing a client’s controls, we use our PRM maturity model. The model is similar to Enterprise Risk Management (ERM) and Information Technology and Cybersecurity maturity models.

Recent Engagements

Launch, improve & grow your payments business