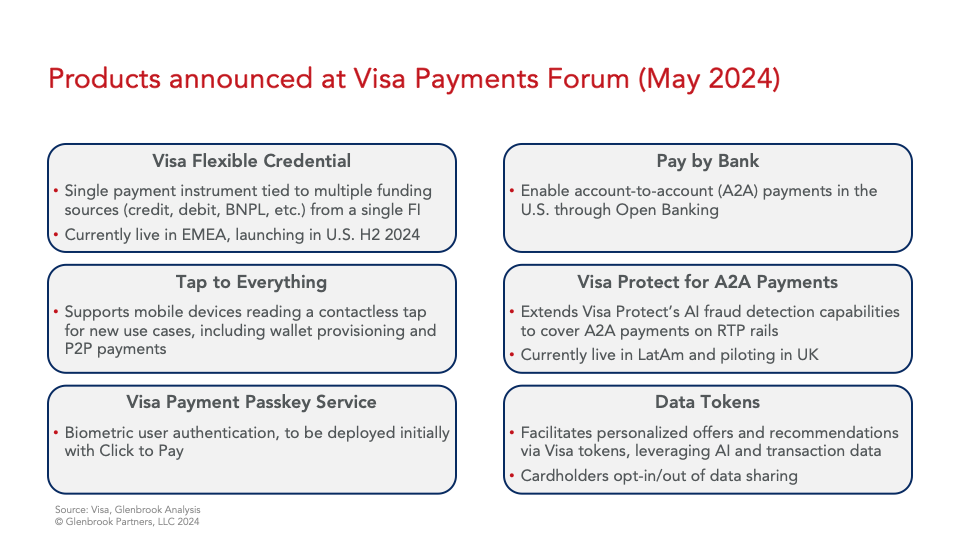

Earlier this month, Visa announced a suite of products at their annual Payments Forum that center around enabling customized cardholder experiences, additional security for CNP transactions, and services to support banks – beyond just in their role as card issuers.

While each of these products have driven a good deal of discussion around our fully-remote office’s proverbial water cooler, I’m going to focus on unpacking the Visa Flexible Credential today.

Visa Flexible Credential

Visa Flexible Credential is one of the flashier new products that Visa unveiled at their Payments Forum. The Flexible Credential (VFC in Visa’s terminology) is a single payment credential that can be tied to multiple funding sources from a given financial institution: credit line, checking account, prepaid balance, installment payments, and reward points. Effectively, VFC separates the spending instrument (the card) from the funding sources made available by the issuing bank, and allows the cardholder to control the funding source for each transaction through an app and through simple usage rules.

One way to think of this is a single-bank wallet, where all the payment accounts that a user holds at a particular bank are accessible from this single instrument. This use case may not immediately land with consumers in the U.S. market, where cardholders tend to hold cards from several different issuers (for example, American Express has a very strong share of credit, but a very slight position in debit). However, this use case may be more intuitive for cardholders in markets where they are more likely to get their credit and debit cards from a single issuer – and a boon for those issuers, as customers would have to engage more deeply with the issuer’s app to manage the funding sources used for different transactions, as well as keeping their cards top-of-wallet. It will be interesting to see whether VFC will be able to compete effectively in the U.S. against Apple Wallet and Google Wallet, which offer more complete solutions for customers that hold cards from multiple issuers.

It’s worth mentioning that the universal card category is not new to the card industry. Fintechs have been developing products that link multiple accounts to a single card for over a decade now, supporting different levels of dynamic switching (think Wallaby, Coin, and the Protean Echo). However, these products were never blessed – much less promoted – by the major card networks, and ultimately failed. On the network side, Mastercard offers the Mastercard Multi Card that combines three cards into one (corporate card, purchasing card, and fleet card) to business clients.

While Visa’s “One Card to Rule Them All” positioning (or tagline) is not new, VFC itself (which has been around in the Visa rule set since March 2020) was initially designed to serve a different purpose: supporting BNPL financing plans offered by Visa issuers. This history reinforces Visa’s decision to pilot VFC outside of the U.S., and explains why Affirm is an early launch partner – it’s the original use case.

Issuer Rewards

Visa is positioning VFC as a consumer product – and it is. Visa’s own blog gives an example where a customer avoids abandoning a transaction due to insufficient funds in their debit balance by switching in the moment to credit or loyalty points as a funding source. We can also imagine the use case where VFC behaves as a credit card at all POS locations, but a debit card at an ATM.

The most interesting use case (to us points enthusiasts) is one that allows cardholders to define logic for the card to maximize points, rewards, or other benefits depending on the MCC or dollar value of the purchase. Terry Angelos (Visa’s former SVP and Global Head of Fintech) lays out a great example of how a cardholder can optimize the benefits of several Visa cards within the Chase Bank portfolio:

- Fuel Tap = Shell rewards debit card

- Grocery Tap = Amazon Prime for 5% back

- United Airlines Tap = Mileage Plus Credit Card

- Restaurant Tap = Sapphire Reserve

However, there is one points-earning payment instrument that is noticeably absent (again, to us points enthusiasts) from this list: Amex. There is no indication that VFC will support payment products from different issuers, much less different networks, which raises a question about how much cardholders can benefit from using a VFC, as opposed to ApplePay or Google Wallet.

On the other hand, there is a clear winner in this example: Chase. In fact, it’s easy to see why VFC is great for issuers – particularly the largest ones that offer a robust portfolio of Visa payment products. All issuers can benefit from locking in their top-of-wallet positioning, and shifting the primary point of customer engagement away from ApplePay (or Google Wallet) to their own mobile banking apps. However, for issuers like Chase that offer a wide selection of Visa products, VFC incentivizes cardholders to open up separate card accounts for their different use cases, deepening their relationship (and tie-in) with the issuer. In the world of open banking, any additional stickiness is a good thing.

But What About Merchants?

The merchant side is where the benefits of VFC become less apparent, outside of the opportunity to reduce the number of sales lost to insufficient funds (which should not be discounted!) One big unknown is around interchange treatment – that is to say, whether VFC in the U.S. will have its own interchange category, or if transactions will be charged the interchange matching the funding source. As it is currently deployed in Australia, VFC has the highest possible interchange rate in Australia, equivalent to the “Super Premium Business” rate. This is (again) great for issuers; for merchants, not so much.

Another question raised by the U.S. rollout is how regulators will view VFC in light of the Durbin Amendment, which calls out techniques to help issuers earn credit card interchange on transactions funded by existing funds in a bank account as circumvention. (I should point out here that the Durbin Amendment also prohibits circumventing the Durbin Amendment.)

The mechanics of VFC’s single credential also raise a number of questions for merchants’ payment operations. Today, merchants gain information about their customers and their payment credentials through the Bank Identification Number (BIN). For example, the type of card being used for a transaction (debit, credit, or prepaid). This information may be used for routing decisions in a multi-PSP or multi-network (e.g., PINless debit) environment. Some businesses do not allow prepaid transactions (e.g., certain recurring subscription merchants), and need to provide details to the cardholder when this information is entered into the order field. And, for those merchants that employ surcharges, they need to know whether the card is acting as a credit or debit card (as surcharges are not permitted on debit cards).

In a world where a single credential can be tied to multiple funding sources, there are many open questions that arise as a result of this launch:

- How will merchants be able to use Visa BIN data going forward, if the same indicators no longer indicate card type, or if this card type can change from transaction to transaction?

- Will merchants receive information back about the underlying funding source in an authorization response?

- How will this work for recurring transactions, if at all? Will all future recurring transactions be expected to be charged using the original funding source? (For example, if the initial transaction is funded by a prepaid or debit card, is there a mechanism to switch easily to credit as a funding source?)

- Will consumers be able to set up a fallback funding source option for certain transactions? (Back to the recurring example above: can the cardholder set up credit funding as a fallback option if my prepaid or debit card balance is insufficient to cover my subscription payment?)

- Will there be any changes to decline reason codes, or will issuers map decline reason codes to the funding source indicated by the consumer?

- Will this follow the Apple Card model where a new card number is generated for each transaction (and thus perhaps solve some BIN questions)?

Having invested so much into BIN-level optimization, it will be interesting to see how VFC impacts merchants, PSPs, and Orchestration platforms’ optimization strategies.

We’ll be watching closely as Visa’s new capabilities roll out, to see how they are implemented (and received by the market) in practice. If you’re interested in exploring how these can affect your business, we’re always here to talk.