Bilateral Adoption Claims Another Victim

Word came earlier this week that Square had sunset its consumer-facing app, Square Wallet. The app had pioneered one of the great parlor tricks in payments, enabling a merchant using the Square Register POS app to recognize the presence of a Square Wallet consumer in its store and allow that consumer to pay for goods with his name and face as represented on the Square POS system.

In spite of this bit of mobile magic, it appears that the Wallet failed to gain traction with consumers. A deal struck with Starbucks in 2012, designed at least in part to drive consumer uptake, failed to capture the consumer’s imagination in a venue already well served by Starbucks’ own, compelling mobile app. The combination of that failure and a perhaps too aggressively priced acquiring contact, may mark the Square-Starbucks deal as one of the great smoking craters in the annals of payments.

In thinking about this outcome, it struck me that the stark contrast of the rampant success of the Square Register and the dismal failure of Square Wallet perfectly illustrates a phenomenon we often discuss at Glenbrook – the challenge of bilateral adoption versus the power of unilateral adoption, in those rare instances where it can be found in payments.

Some years ago, long before the payments business became a darling of the investment community, a venture capitalist described the bilateral (or multilateral) challenge to me in graphic terms: “I hate your business,” he opined. Foolishly, I asked him to elaborate: “It’s hard enough for a startup to find one customer who wants to buy its untested new product; in your stupid business, they have to find two.” Of course, he was referring to the need for any payment product to meet the needs of both a sender of payment (say a buyer) and those of a receiver (say a supplier or retailer). In fact, successful payment systems usually manage to become attractive to a large number of players in each group, but it doesn’t happen that often.

“I hate your business,” he opined. Foolishly, I asked him to elaborate: “It’s hard enough for a startup to find one customer who wants to buy its untested new product; in your stupid business, they have to find two.”

Square, in its original incarnation, had navigated deftly around this Himalayan obstacle. Square recognized that the advent of the smartphone and a reliable wireless network provided the core infrastructure required for a cost effective mobile payment card terminal (though the development of a low power, audio-based magnetic stripe reader was an important and impressive bit of engineering). Then, leveraging the master merchant technique popularized years before by PayPal, Square enabled a new class of small merchants to accept cards in the offline world. Because Square’s solution could process all the payment cards already prevalent (no, saturated) across the US market, the company went on a growth tear that at last report is processing payments at an annual rate of over $20 billion.

The cards were already there in large numbers; once Square provided its dongle (and some decals with the right networks logos), the force of unilateral adoption took over as consumers discovered new places to use their cards. The technical innovation was accompanied by a strong marketing program and a highly transparent and understandable pricing structure that were key drivers of merchant adoption.

The cards were already there in large numbers; once Square provided its dongle (and some decals with the right networks logos), the force of unilateral adoption took over as consumers discovered new places to use their cards. The technical innovation was accompanied by a strong marketing program and a highly transparent and understandable pricing structure that were key drivers of merchant adoption.

On the other hand, the story of Square Wallet is a tale of bilateral adoption, and ends less happily. While the Square Register app (increasingly run on tablets rather than smartphones) was prepared to detect and interact with the Wallet, Square had never before asked the consumer to explicitly adopt or even recognize its product (the Square merchant could simply advertise that she accepted the existing credit and debit cards). But to use the Square Wallet, the consumer needed to download a new app to his increasingly crowded smartphone, provision it with a card account, and most critically, seek out merchants able to process the magical new cardless transaction. The familiar benefits of geolocating participating merchants and receiving unspecified value via offers were also in play, but apparently the package proved insufficiently compelling to the consumer. It’s likely that in many markets there simply weren’t enough Square merchants to make it worthwhile for the consumer to embrace the Wallet app.

As we have seen with other innovations around user experience (contactless RFID cards, PayPal ‘Empty Hands’ at Home Depot), eliminating the card swipe at POS is likely not the kind of value proposition capable of moving consumer behavior in meaningful numbers. For the moment, the merchant value proposition of taking payment through a mobile device trumps the consumer benefit of making payments with a smartphone (as I’ve often said, my credit card was already pretty mobile).

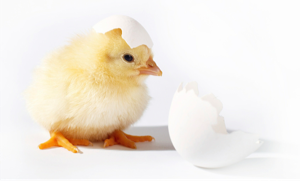

So, welcome, Square, to what we affectionately call the “poultry problem” in payments. As that venture investor had noted so long ago, in the networked world of payments, it’s not the chicken OR the egg; it’s the chicken AND the egg. Mobility has been harnessed well in bringing lots of chickens (merchants) into the payments kitchen, but work remains to be done on how to bring those eggs to the table.

We still have enormous respect for Square’s accomplishments and the creativity of its team. We commend them for having attempted the big play with their Wallet and look forward to their next attempt at a consumer-side app with Square Order, which will be focused on the important task of reducing line waits in venues like quick service restaurants. That’s a narrower market than Square Wallet sought to address, but perhaps can provide a more tangible benefit to the consumer.

This post was written by Glenbrook’s Bryan Derman.