In Kavita Jiandani’s post Assessing a Merchant’s Payments Operations, she introduced Glenbrook’s methodology for our in-depth assessment of a merchant’s payments operations. In her introductory piece, Kavita highlights the major Key Assessment Areas we evaluate during each engagement.

In this Payments Views entry, I continue with a focus on one of the Key Assessment Areas: Reporting and Analytics.

The ability to monitor performance and identify operational anomalies is essential. Measuring trends of the key performance indicators (KPIs) of a merchant’s payment operation is just one benefit of a comprehensive reporting and analytics platform. Besides dashboard and report-based monitoring, the ability to perform ad-hoc analyses assists with troubleshooting operational issues and supports response to inbound questions from other teams within the organization.

Critical attributes of a successful reporting and analytics system include:

Access to Data

Before a merchant can start thinking about building dashboards and standard reports, a critical, and not always easy, first step is to ensure they have access to the necessary data. When Glenbrook starts a merchant assessment, we ask the merchant to provide us with a variety of data points to help shape the engagement’s focus. How long it takes us to receive that information, and the data quality underlying it, is often the first indicator of how well the merchant is managing its data resources. The longer it takes, the more work we need to do.

Data Storage

Most sophisticated merchants ingest payments data from all relevant sources: acquirers, gateways, PSPs, fraud solutions, and more, and store it in an internal data warehouse. Ideally, this data is normalized to other business data in order to simplify analyses across multiple data sets. Payment providers may not provide the exact data needed by default. It is important that the merchant work with its data partners to make sure the needed data is provided. Due to the increasingly low cost of data storage, we recommend erring on the side of storing too much data, rather than too little.

A Centralized “Single Source of Truth”

The data warehouse serves as the “single source of truth” to ensure the organization operates using a comprehensive view of its payment operations. In parallel, the warehouse also includes data from all business lines, a not always simple task for large organizations with multiple LOBs grown organically or via acquisition. Global operation further complicates the task. Decentralized, siloed data storage and management makes measuring and managing Key Performance Indicators much more difficult.

Alternatives to On-site Storage

Building and maintaining an internal payments data warehouse may be considered too long-term a project for an organization. An alternative is to work with a third-party provider that ingests all of your payments data directly from each of your provider’s feeds. This approach can remove the complexity of data warehouse implementation and management. The in-house team is freed up to focus on dashboard and report development.

If you decide to use one of these third-party data storage providers, make sure your contract states that you own all of the data and have full rights to migrate it to another party or into your in-sourced data warehouse should the need arise.

Key Motivators for Managing Payments Data

The dashboards and reports designed to monitor KPIs must support the following goals:

Maximize Revenue

First and foremost, merchants want to make sales. In this category, we want to monitor authorization rates and identify reasons for declined payments, as declined payments represent lost sales and increased customer churn.

Granularity matters. Merchants may need to examine and segment approval rates by tender type, business line, card brand, card type, issuer, geography, acquirer, and across other factors. Sophisticated merchants able to analyze these factors may then optimize routing decisions across multiple acquirers in order to maximize revenue.

Manage Costs

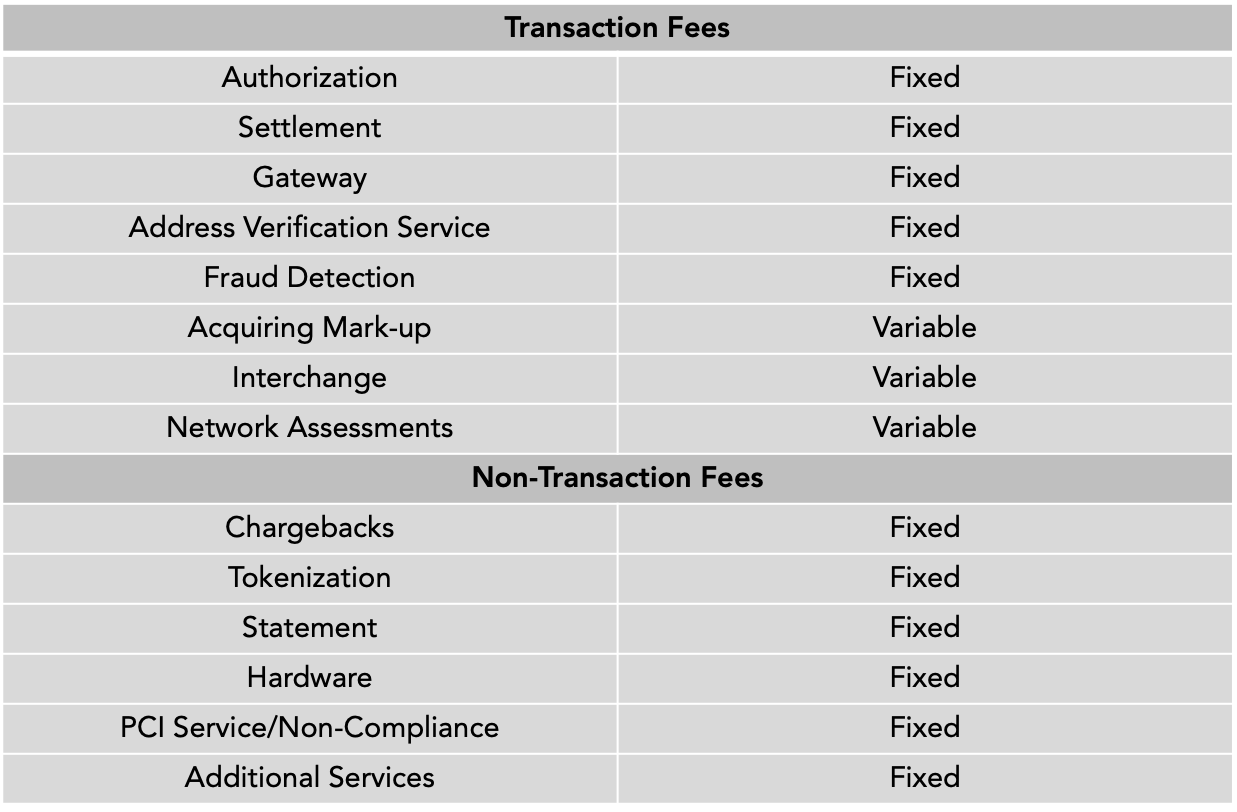

At some point in the evolution of a merchant from start-up to established business, they will take a look at the costs of payment acceptance to identify ways to reduce them. Depending on the structure of their merchant agreement, merchants have multiple costs to track. There may be fixed and variable costs for each transaction, such as gateway fees, interchange, network assessments, and processing fees. There are also non-transaction fees such as tokenization costs, chargeback fees, or hardware fees.

Such cost tracking is a core outcome of a strong reporting and analytics capability. The merchant’s dashboard should provide a top level of view of these costs, having parsed provider statements, with the ability to drill down in order to track and analyze individual cost components. In order to make informed decisions about payment costs, merchants should measure all-in transaction costs across all tender types in order to build a baseline understanding of their true cost of payment acceptance.

For example, consider the costs associated with interchange downgrades. Some acquirers can help with this, but many currently monitor these additional costs on a quarterly basis. For high-volume merchants, we recommend interchange be monitored daily to determine whether estimated interchange costs match the actual settled interchange fees. Bugs and procedural errors by the merchant or the acquirer can lead to unnecessary interchange downgrades and their higher costs. Quarterly monitoring is inadequate.

Minimize Risk

Risk management and fraud prevention metrics deserve their own focus, but for the sake of high-level payment operations, merchants need to keep an eye on their chargeback ratio. At the very least, merchants want to stay out of the card network monitoring programs for merchants with high chargeback ratios. It becomes rather expensive and reveals the existence of serious operational issues. Getting to the root causes and addressing what led to the error is paramount. Strong reporting and anomaly analyses alert the organization to the existence of such problems.

Ensure Data Integrity

Measuring and managing payment operations relies on accurate data. Critical business decisions rely on it; incorrect data can lead to poor decision making and negative outcomes for customers and for the organization. Where possible, organizations should log internal transaction data in order to compare and reconcile it against authorization and settlement data received from their provider. Exceptions generated from this reconciliation process will identify issues that may exist at the merchant or its upstream provider. Dealing with incorrect data from providers can be time-consuming and costly. If necessary, implement terms in your provider’s service level agreements to monitor report accuracy, with financial remedies that cover the cost of these mistakes, including the opportunity cost of employee time spent on troubleshooting and remediation rather than their existing priorities.

Manage Platform Performance

It is critical to monitor platform health and to have clear operational processes when performance falls below expectations. Merchants should monitor metrics such as platform availability (uptime), latency (transaction speed), and throughput (transactions or files per second). Contract terms should accurately describe these KPIs and what remedies are available should the provider fail to meet them.

Dashboards and Reports

Dashboards provide an opportunity to monitor and push alerts in real-time to relevant stakeholders, while pre-developed reports streamline the communication of key metrics to various audiences within the organization.

When developing dashboards and reports for managing payments, we recommend adhering to the following principles:

Actionable

Dashboards should be designed with the ability to highlight potential issues without complex manipulation of data. Focus on key metrics across granular dimensions that may expose underlying issues not evident from a high-level view. For example, a chart that shows decline rates on Visa cards may not expose declined transactions on Visa debit cards issued by Bank of America, specifically for transactions between $25 and $50. Dig deep.

Accessible

Data accessibility provides opportunities for all members of the payments organization, and those outside of payments, to become involved in identifying and troubleshooting issues as they arise. Our experience is that spreadsheets, overburdened by data volume, make it difficult for stakeholders to find the data they need. We recommend using a business intelligence tool (e.g. Tableau and its competitors) to make data manipulation more accessible to non-analysts.

Automated

Dashboards and reports should be rendered automatically for Key Performance Indicators. Manual report generation is time consuming and inefficient.

Thresholds and Alerts

Rather than relying on a human being to check every dashboard and report manually on a daily basis, alerts should be automatically delivered to relevant stakeholders when key metrics associated with a particular dashboard or report pass pre-determined thresholds. For instance, if Mastercard transaction approval rates fall below 88% for over 1 hour, an email is sent to the payments operations and engineering teams or on-call points of contact. The appropriate remediation steps should also be in place and followed to limit the impact of the anomaly. It is important to develop benchmarks for each KPI in order to understand when metrics begin to fall outside of an expected pattern.

Frequency

For each dashboard, report, and/or KPI, determine its measurement frequency. Some metrics may benefit from real-time monitoring, while others can be reviewed quarterly.

Troubleshooting and Operational Processes

Alerts should be paired with an operational process that identifies both the root cause and the sequence of steps necessary to restore or improve the KPI. Depending on the severity of the issue, this process may include multiple stakeholders from different teams within the organization. Development of these procedures is essential.

At Glenbrook, we work closely with our clients to develop strategies across all performancd areas to streamline management of their payments operation. Please reach out if you would like to discuss how your organization could benefit from Glenbrook’s Merchant Payments Assessment.