Since my April 2018 post, there’s been a lot of activity in the “land of weed.”

Multiple countries and U.S. states have moved toward legalization. Major non-cannabis industries are investing heavily in cannabis related products and cannabis-based companies. With U.S. Attorney Jeff Sessions out, his strict stance against marijuana perhaps no longer holding, many are suggesting that now just might be the right time to legalize marijuana at the federal level.

Let’s review the action of late and see where that leaves us in terms of legal marijuana payment services for businesses and consumers.

Legalization Activity in U.S.

Just this month, as Americans took to the polls, two additional states – Utah and Missouri – voted to legalize medical marijuana. A third, Michigan, passed a bill to legalize recreational marijuana, the first Midwest state to do so. North Dakota’s ballot to legalize recreational use did not pass, even though medical marijuana is legal in the state for qualifying conditions.

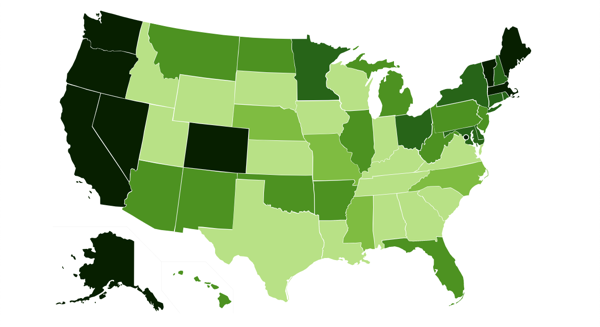

That puts the total at 33 states, the District of Columbia, and Puerto Rico with laws legalizing medicinal marijuana. Ten states and the District of Columbia have legalized recreational marijuana. With 17 states left to go for medicinal use, many say it is only a matter of time before federal legislation allows such usage.1

In a recent poll by the Pew Research Center, 62% of Americans, including 74% of millennials, said they supported legalizing marijuana. Gallup has seen dramatic increases in support across demographic, geographic, and political groups. In general, when asked the question: Do you think the use of marijuana should be made legal, or not?, 66% of Americans support legalizing marijuana in October 2018, compared to 12% in 1970 and about a third of the population in 2000.2

click on map to view DISA’s interactive map of state-by-state marijuana regulation

Legalization Activity Around the World

Our neighbors to the north legalized marijuana at the federal level in October of this year. Canada is the first G7 country do so. Other countries have changed their laws, too. In fact, there are about 30 countries that have legalized marijuana in the last decade either broadly to allow both medicinal and recreational use or medicinal and/or scientific usage. Countries from every corner of the globe have embraced legalizing marijuana including Australia, Chile, Denmark, Germany, Israel, Malta, Mexico, Poland, Peru, Switzerland, Uruguay, and Zimbabwe.

Will Canada’s progress influence the U.S.? Unlikely to influence federal statutes, but you can guarantee that those payments providers serving the Canadian market will have a head start over their U.S.-only competitors. Understanding the risk and behaviors of participants in this growing space will be a core competence.

Non-Marijuana Industries are Jumping In

Major beverage companies have announced significant marijuana-related deals this past year as they search for new sources of growth. These investments align nicely with the legalization progress being made in the U.S. and Canada.

For some perspective, consider these moves:

- Constellation Brands, a U.S.-based adult beverage company and the maker of Corona, has taken an additional $3.8 billion stake in Canadian cannabis company Canopy Growth, positioning it to acquire the company. Constellation’s CEO was quoted as saying: “Over the past year, we’ve come to better understand the cannabis market and the tremendous growth opportunity it presents…”

- Molson Coors Canada announced a joint venture with the Hydropothecary Corporation, a Canadian medical cannabis company, to develop a line of non-alcoholic, cannabis-infused beverages.

- In collaboration with AbsoluteXtracts, a cannabis grower specializing in extracts, Heineken launched a “weed-infused” sparkling water line called Hi-Fi Hops, currently being sold to consumers in California.

- Reports in CNBC, Bloomberg, and other news outlets suggest both Coca-Cola and Pepsi are looking into cannabis-related opportunities to develop “functional wellness” and “sports recovery drinks” to capitalize on the current interest in CBD or cannabidiol, a compound from the cannabis plant that is known to have medicinal uses, such as anti-inflammatory, anti-nausea, and anti-seizure properties.

U.S. Attorney General Sessions is Out

No surprise, Jeff Sessions is out. If he can no longer stand in the way of the Cole Memo, does that mean the pressure is off or will his replacement echo the Sessions stance?

As a reminder, marijuana remains on the federal Controlled Substance List, up there with heroin and LSD. Punitive fines and jail sentences apply, including to those that provide financial services or payments acceptance to any business dealing in these molecules.

The Cole Memo was issued by the previous Attorney General to reduce legal uncertainties for the growing list of states that had legalized marijuana and therefore had conflicts with the federal statute. In essence, “if you follow these guidelines”, stated the Cole Memo, “we won’t come after you.”

When Sessions came into office, he immediately rescinded the Cole Memo.

Since then, there have been several bills submitted by both Democrats and Republicans in both the House and Senate to:

- Simply allow states full rein to legalize and monitor marijuana, or

- Decriminalize marijuana, or

- Increase the number of licenses granted to cannabis businesses

There are significant implications for the financial services industry

As I wrote in my April 2018 post, the current legal logjam severely constrains the provision of banking services to growers, dispensaries, labs, and sellers. Only a handful of institutions support this growing industry in an otherwise compliant manner that meets BSA, FinCEN and other federal and state requirements.

Partner Colorado Credit Union’s division called Safe Harbor Private Banking is a leading example. In the meanwhile, employees, contractors, suppliers, service providers like lawyers and accountants, and even tax authorities are all getting paid in cash because the majority of the approximately 25,000 cannabis-based businesses are unbanked.

Open loop card network rules by policy comply with federal statutes in the U.S., so cannabis related transactions are prohibited on the Visa and Mastercard networks. Discover and American Express, on the other hand, are banks and are directly regulated as such.

This has major implications for consumer-based purchases of either medicinal or recreational marijuana. Today, most payments are made in cash. But there are a few instances where a bank-issued credit or debit card is in play. How is that happening given the network rules? Well, through “creative” solutions that are, I fear, not sustainable.

Consider this (ugly, real life) scenario:

The customer makes a transaction at a dispensary in Nevada. It starts with the customer handing over their Mastercard-branded credit card. The clerk swipes it, hands it back, and then picks up another card and swipes that one to complete the sale. When asked, the clerk replies “this makes it easier.” At home part of the mystery is resolved when the sales receipt and statement both show the transaction is run as a gift card purchase with an additional $3 processing fee. Clearly, games are being played to obfuscate the merchant category and funding mechanism.

That transaction tells us an awful lot about what is wrong with payments in the cannabis industry. Two separate transactions occurred, increasing the cost to process a transaction and decreasing the transparency of the transaction – to the bank, to the card network, and to the end user.

Cannabis is a Legitimate Industry

Given that an overwhelming majority of states are legalizing marijuana in one form or another, marijuana sales are projected to grow 15% a year. Forecasts call for the creation of a $25B industry by 20253. The lack of a viable financial system no longer makes sense on multiple levels. The government is losing out on billions of dollars in tax revenue, cash is catnip for criminals, and the inconsistencies in legality creates room for non-compliant “creative” solutions.

The time is now for the federal government to ease restrictions on the financial services industry so that we may legitimately and transparently serve this important and burgeoning industry for businesses and for consumers alike.

- https://disa.com/map-of-marijuana-legality-by-state

- https://news.gallup.com/poll/243908/two-three-americans-support-legalizing-marijuana.aspx

- https://newfrontierdata.com/marijuana-insights/cannabis-potential-5-billion-economic-impact-onto-north-american-tribal-communities/