In our previous post on involuntary churn, The Payments Playbook for Challenging Churn, we explored the challenges faced by business in managing recurring billing operations. The post explored various tactics to manage and reduce involuntary churn, such as dunning communication, payment timing optimization, local payment methods, account updater, network tokenization, and dynamic routing. In this post we will explore in more detail the importance of tracking churn-related data.

While reducing involuntary churn is an evergreen issue for subscription merchants, coming out of the summer of 2023, the macroeconomic environment has made retaining subscribers even more paramount for subscription merchants. As consumers and businesses tighten their belts, bank accounts hold less money, credit limits are more often met, and fraud activity may increase, we will see higher declines coming from issuing banks.

In order to successfully mitigate the number of subscribers lost to involuntary churn, it is critical to develop the right set of Key Performance Indicators (KPIs), filters, and dashboards that enable actionable analysis to improve. Here are some important analyses that you should be aware of and measuring regularly to understand your involuntary churn environment:

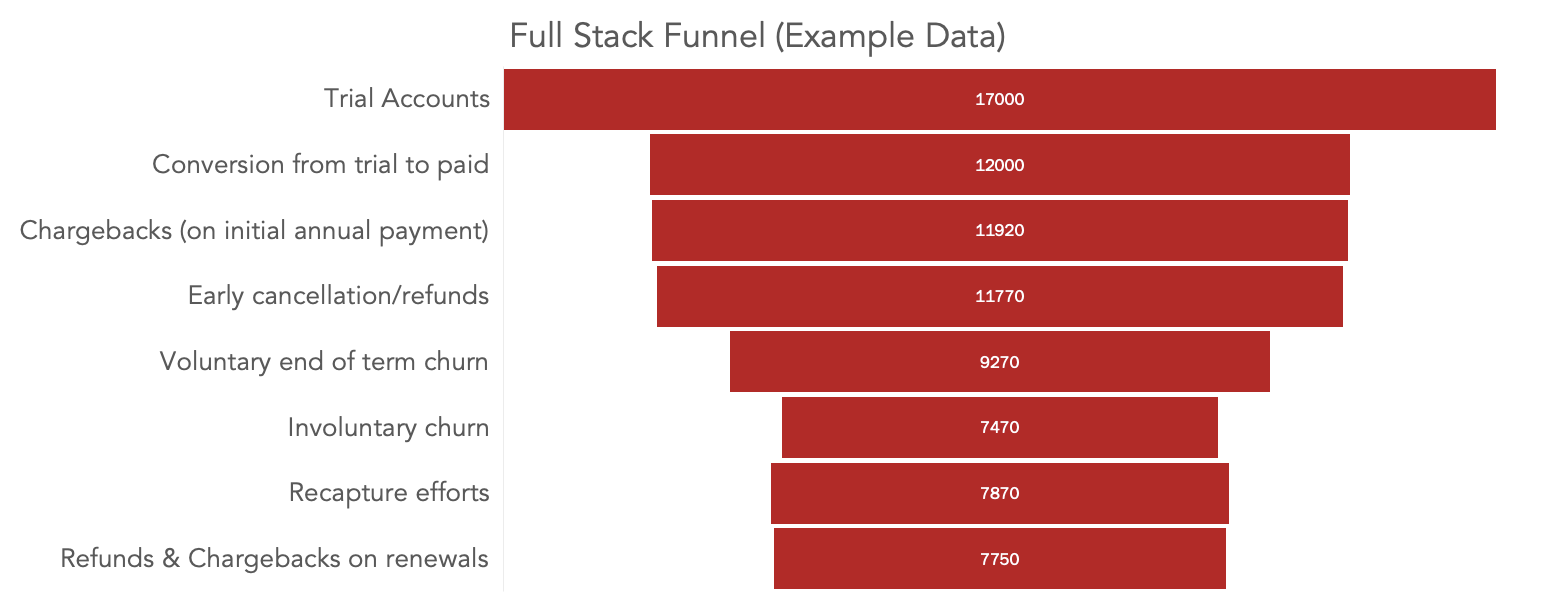

Measure Throughput Through the Entire Customer Lifecycle

It is essential to measure the entire customer lifecycle to understand where there may be customer leakage and tradeoffs (e.g., involuntary churn is going down, but chargebacks are going up).

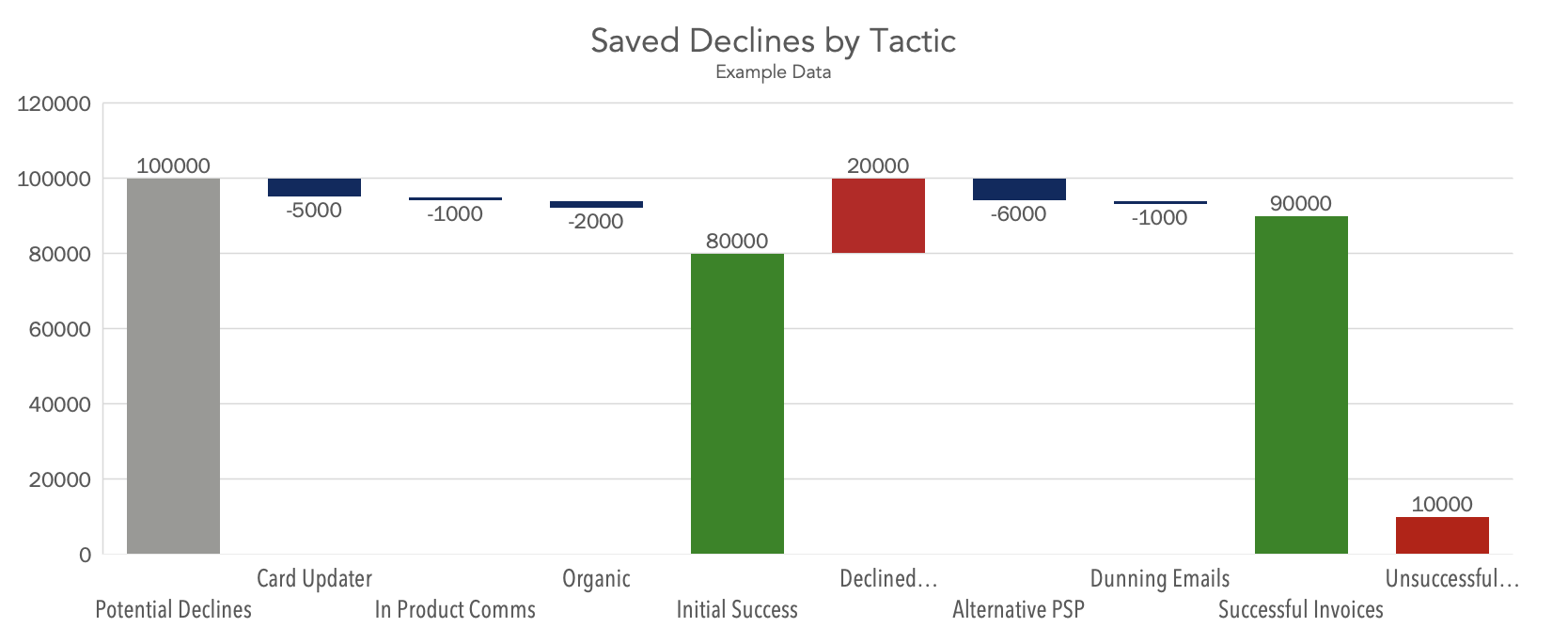

Monitor Recapture and Prevention Effectiveness

To understand the overall effectiveness of your involuntary churn strategy, your dashboards should have the ability to measure the effectiveness of each individual tactic. How many declines did you prevent using Account Updater? How many recaptured payments did your third-party recapture vendor provide?

Measure Refund and Chargeback Rates for Retried and Non-retried Transactions

While improving the number of successful transactions is a positive outcome for any involuntary churn strategy, it is important to be mindful of any related increases in refunds and chargebacks that occur as a result. Customers may have initially churned involuntarily, but once they see a successful transaction, they may be interested in churning voluntarily. If you see a rise in chargebacks specifically, it may warrant a review of the cancellation process to ensure customers that want to cancel are able to without too much friction.

To effectively combat involuntary churn, it is imperative to adopt a data-driven approach. This involves implementing the right KPIs, filters, and dashboards that empower actionable insights. By regularly measuring and analyzing key metrics throughout the entire customer lifecycle, businesses can pinpoint areas of concern and identify opportunities for improvement.

Monitoring recapture and prevention effectiveness, tracking refund and chargeback rates, and understanding the intricate relationship between successful transactions and customer behavior are essential steps in crafting a robust strategy. As we move forward, staying vigilant and adaptive in our approach to involuntary churn will be vital for businesses seeking to thrive in this evolving subscription landscape. Contact Glenbrook at info@glenbrook.com if you could use support in developing a data-driven approach to mitigating involuntary churn.