By: Justin Pituch and Drew Edmond

Time to Read: 7 minutes

If you read Apple’s Q3 earnings report, you may have noticed that the company’s Services business has grown to $19 billion in quarterly revenue. That’s a staggering number, and it represents a complex recurring billing operation. With 860 million paid subscriptions, Apple’s payments team has to manage changing consumer payment credentials, monitor gateway performance, and research shifting consumer payment preferences. These activities all serve to lower one crucial number for recurring billers: Involuntary Churn. As recurring revenue becomes more and more important to growing businesses, payments teams should make sure they’re aware of the leading tactics to manage this number.

So what is Involuntary Churn?

If you’re not already familiar with involuntary churn, you can think of it like this: In any recurring business model some customers will leave every term, whether that’s monthly, annually, or some other period of time. Folks in the recurring billing world call it ‘Churn’. Some customers will leave because they mean to; maybe the service you offer has become too expensive for them, or they no longer need it. That’s called Voluntary Chun. But other customers experience a service interruption “accidentally” when their payment fails: their card credentials are out of date, their checking account has insufficient funds, or there’s an error that prevents their payment from being processed. Merchants might give these customers a grace period while new credentials are collected or the merchant is able to ultimately process the payment. But sometimes the payment is never completed successfully . That’s Involuntary Churn.

Involuntary Churn can be a big problem for merchants. Recurly reports that Involuntary Churn affects 1.39% of subscribers on average. Although that might not seem like a huge number, it can have a meaningful impact on your bottom line; it can also be significantly higher for certain industries. Take Apple, for example. With up to $19 billion in recurring revenue each quarter, if we assume an evenly applied Involuntary Churn rate of 1.39% (illustration only), that would give us $264 million in Involuntary Churn. So what can your payments team do to limit their levels of Involuntary Churn?

Fighting Churn requires keeping track of Churn-related data

Think about your organization’s objectives. Where do you need to get Involuntary Churn-related data from? In many cases, you’ll probably have to coordinate across multiple groups within your company. Depending on who tracks key metrics in your organization, you may want to involve members of your Payments, Analytics, or Product teams. Metrics to track include Involuntary Churn by customer cohort or by marketing funnel. Your Payments team can also track Involuntary Churn by BIN or by acquirer. We recommend looking at this information before you start to make changes to address Involuntary Churn so you can measure the effectiveness of the different methods you put in place to combat Churn.

Merchants must determine the appropriate type and degree of interventions

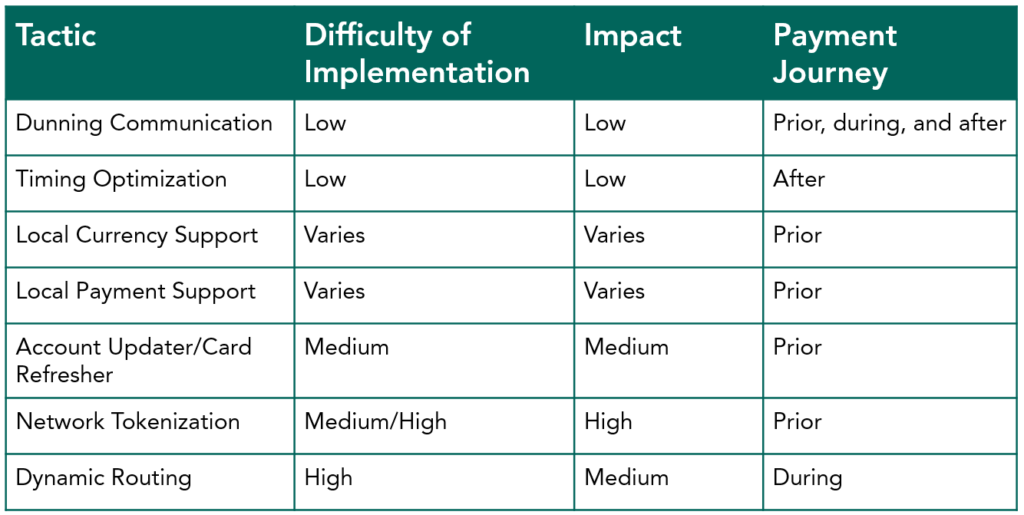

There are a variety of tactics organizations can employ in order to bring Involuntary Churn down, with varying degrees of sophistication. At one end of the spectrum, you can implement changes that require no disruption to your existing payments set up. On the other end, sophisticated tactics may require significant changes to your payments platform. As you might expect, the harder-to-implement solutions generally yield the highest impact in terms of Churn reduction. Involuntary Churn mitigation tactics may be employed prior to the transaction to reduce the risk of initial failure, during the transaction to try again using different information or transaction paths, or after the transaction.

Dunning Communication

Dunning communication refers to the communication sent from the merchant to the customer. If a merchant checks an expiration date on the customer’s stored card and realizes that the card will expire prior to the next billing cycle, it is prudent to notify the customer that they should update their credentials. Communication can happen through any available medium: in-app and via email are most common. Communication during a failed transaction and following the transaction may result in updated credentials and a successful transaction.

Timing Optimization

Success of a transaction can differ depending on the country (due to differences in payroll) as well as banks (due to differences in settlement timing). Merchants can use third party tools or develop their own machine learning to identify the right timing for each card BIN.

Local Payment Methods and Local Currency

Churn is especially complicated for international merchants. Churn rates in Brazil might be quite high, while they might be lower in Japan. We’ve found that it often isn’t helpful to try to manage these local Churn rates against a US benchmark. Rather, merchants find it more useful to recognize that a high Churn rate in Latin America might not be “bad” and that a low Churn rate in East Asia could actually still have room for improvement. Once you figure out an appropriate benchmark for each region or market in which you operate, there are ways to optimize accordingly. Key ways to do this include adding local payment methods or local currency support.

Account Updater and Card Refresher

Account Updater is a Visa product that can be used by a merchant to ensure their card credentials are up to date. Implementations are batch or real-time. With a batch file, the merchant sends a file to their acquirer indicating which cards they want checked, and the acquirer either provides those details back, or updates the cards in their token vault. With real-time Account Updater, card numbers can be updated during the transaction. Card Refresher is the American Express version of this product.

Network Tokenization

The benefit of Network Tokens is that it should reduce the need for Account Updater and Card Refresher, because the token and card credential are linked and automatically updated by the Issuer. Ultimately, Issuers should also approve Network Tokens at a higher rate because they are more secure.

Dynamic Routing

Dynamic Routing allows merchants to optimize their approval rate by identifying which acquirers have higher approval rates across card BINs. This can also be used immediately following a failure to retry an attempt on another acquirer, in the hopes that the change will make the transaction successful. It may take a significant amount of development effort to make this tactic a reality, but some third parties are or have developed this capability.

Conclusion: With the right data and the right tools, you can lower Churn

Involuntary Churn is a serious issue, especially as companies are increasingly adopting subscription models. The more recurring payments you process, the more Involuntary Churn becomes a problem for your organization. A first step is understanding the problem through data, which might require assembling a cross-functional task force from different parts of your organization. Once you have a clear Involuntary Churn prognosis, you can decide which methods to implement or expand to address the issue. This is the start of a cycle of tracking data and testing methods that will help you reduce Churn. But remember, it’s not a problem that anyone will be able to completely solve. Reduction, not elimination, is the name of the game.

It’s an exciting time to be thinking about this particular payments problem; new tools like network tokenization will help payments teams even more effectively reduce Churn in the future. If you have questions about how to pin down your Churn data or implement Churn reduction tactics, we’re here to help.

Read Next – Involutary Churn: Measured and Managed

About the Authors. Justin Pituch‘s work has included research on BNPL, open banking, and faster payments. Justin has led work in the competitive intelligence, investor research, and education spaces. Drew Edmond has years of experience managing global payments operations in marketplace and financial services environments. He brings a keen interest in identifying and executing optimal payments strategies for businesses throughout the payments value chain.