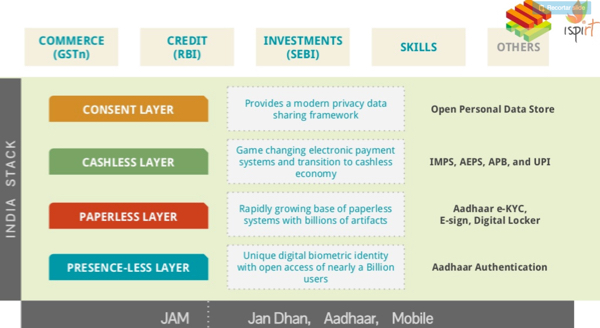

There is a growing curiosity about India’s payments systems. These systems, and their role in the “India stack”, have been the subject of many articles speculating their importance in shaping India’s future.

Despite this attention, there is still considerable confusion about what these initiatives are, and how they interact with each other. This led me to write this piece, a simple explanation of the basic pieces of India’s digital payment infrastructure. A follow-on piece will analyze the Government of India’s unique approach in developing this payments infrastructure, focusing on the recent demonetization of major currency bills in the country.

India Stack [Source: ispirit]

Aadhaar – National Identity Platform

There are a multiple key initiatives that combine to make India a leader in payments. First is Aadhaar, India’s 12-digit national identity number with biometric information. A lot of countries today have national IDs with biometric information but what makes Aadhaar unique is its federated architecture. The Aadhaar database can be queried by any entity that needs to verify an Aadhaar number and biometric information against the information available in the database through the Aadhaar Auth API. No personal or biometric information is shared with the parties; the query will only respond with a “Yes” if there’s a match between the information sent and the central Aadhaar database. This feature has enormous potential to drive “presence-less” and “paper-less” authentication of transactions in multiple industries particularly in banking and payments, across public and private sectors.

Aadhaar is like a new fuel that is accelerating the usability and performance of India’s payment systems.

Building the Cashless Layer of India Stack

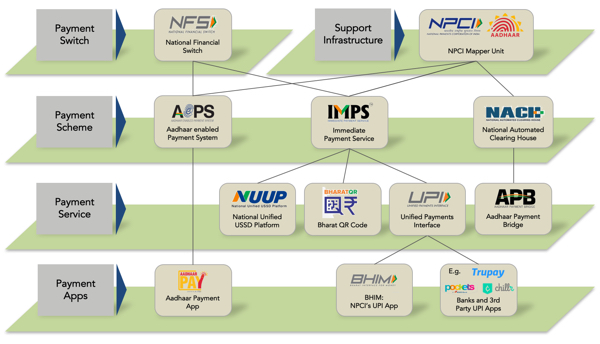

India has developed a set of highly advanced retail payment systems over the past decade, all under the auspices of the National Payments Corporation of India (NPCI), the umbrella organization promoted by the Reserve Bank of India and major banks. NPCI is responsible for building and managing these payment systems and is the most important player in the ecosystem.

Today, NPCI is managing four important payment schemes:

- National Financial Switch (NFS) – the largest network of ATMs in India, which also functions as the switch for many other payment schemes including IMPS.

- Immediate Payments Service (IMPS) – an interoperable push payment scheme that allows banks and wallet providers across India to transfer funds in real-time 24×7. An immediate funds transfer system, IMPS transactions can be carried out using ATM, mobile, and web interfaces. IMPS is an important payment system as it is used as a foundation for building several other payments services including Unified Payments Interface (UPI), and the recently launched interoperable Bharat QR Code.

- Unified Payments Interface (UPI) – an interoperable mobile push payment service that works real-time, 24×7 across banks in India. UPI is built on the IMPS platform, and comes with some really interesting features:- Payees can send ‘request to pay’ notifications to payers- Customers can link ‘virtual payment addresses’ (e.g. payshiv@abcbank) to their bank account that they can get paid without having to disclose their account number.These features are expected to make digital payments seamless and increase small-value merchant transactions. UPI is made available via a set of APIs, which banks and Fintech companies can use to build mobile applications. NPCI also built its own UPI App called BHIM (Bharat Interface for Money) which participating banks can use. The standardized APIs allow customers to make UPI transactions from their bank account using any UPI-based app. This is quite remarkable: you can use “Bank A’s” app to access your account at “Bank B”!

- Aadhaar based payment systems – the NPCI, working with the Unique Identification Authority of India (UIDAI), created the Aadhaar Payments Bridge (APB) to channel Government to Person (G2P) payments directly into beneficiaries’ bank accounts using the Aadhaar number as the payment address. APB uses National Automated Clearing House (NACH) to affect the fund transfer. There’s no need to know the beneficiaries’ account number. Additionally, the Aadhaar-enabled Payment System (AePS) allows customers to use their biometric information to authenticate and perform cash-in and cash-out transactions at any bank agent who has a biometrically-enabled POS device. These schemes require customers to link their bank account to their Aadhaar number. The “Bank’s Issuer Identification# to Aadhaar#” mapping information is held in a Mapper Unit managed by NPCI. The NPCI Mapper Unit is also the engine that allows customers to use their Aadhaar number as the payment address (instead of account numbers) while making IMPS or UPI transactions. Recently, Aadhaar Payment App was launched using AePS which allows consumers to pay merchants by entering their Aadhaar# and authenticating with their biometric information. Merchants have to download the App and connect their smart phone to a biometric reader.

The impact of these initiatives increases as the number of Indians with a mobile phone and bank account continues to grow swiftly, and the benefits will percolate to the “bottom of the pyramid”.

You’ll be surprised to know that a smart phone is not mandatory to enjoy many of the above-mentioned services. NPCI’s National Unified USSD Platform (NUUP) allows any feature phone user to dial *99# regardless of their mobile carrier or bank to make IMPS enabled transactions.

India’s Payment Systems and Services

These payment systems and services are not standalone setups but rather layers of infrastructure laid one over the other. NFS is used to provide IMPS. UPI is built over IMPS. When layered with Aadhaar (using the Mapper Unit), Aadhaar based payment systems are created. The use of layers in an infrastructure stack—as opposed to a value chain based approach—is what makes India’s payment ecosystem quite incredible!

There are other, less tangible but all-important ingredients that have contributed to the India stack’s success. The first is strong government commitment to the program. The second is the trust that the government enjoys among its citizens. Indian citizens are quite willing to share their biometric information with the government, a situation hard to imagine in most developed countries. Last, the government has endorsed and evangelized this payments infrastructure and continues to play a very important role in fostering quick, widespread adoption and usage.

Do you have more questions about India’s systems? Let me know. I’ll follow up this post with one addressing the Indian government’s unique approach of supporting the country’s payment infrastructure.