The Income Domain consists of payments to individuals for salary, benefits, rebates, and expense reimbursements. In the U.S., these payments are made primarily via direct deposit through NACHA’s ACH system, and to a lesser extent, paper checks and payroll cards.

The COVID-19 pandemic has led to widespread business shutdown, and as a result, caused mass unemployment and loss of income for millions of individuals. The government responded with roughly $2 trillion in economic stimulus, outlined in The Coronavirus Aid, Relief, and Economic Security (CARES) Act. The CARES Act consists of one-time payments to individuals, unemployment benefits, and Paycheck Protection Program (PPP) loans for businesses.

This final installment in our COVID-19 Impact series explores the challenges and opportunities confronting government and financial services firms in the context of the CARES Act and subsequent programs.

“There were 6.6 billion payments made on the ACH Network during [Q2 2020], reflecting a 7.9% increase over the same period in 2019. The value of those payments was $14.7 trillion. Direct Deposit payments rose 17%, due in part to federal and state assistance payments made to Americans in need.” – NACHA, July 16, 2020

Glenbrook Observations

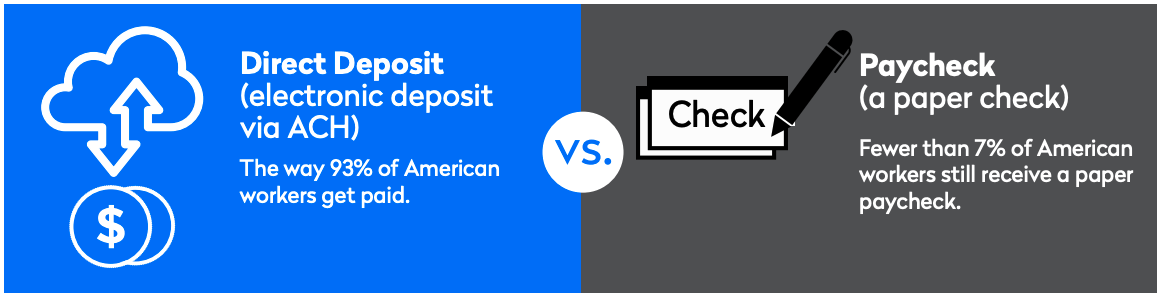

When the government announced plans in March to release the first tranche of stimulus payments, the most (or least) surprising element to many payments professionals was the reliance on paper checks as a disbursement method for those whose bank account credentials were not on file with the IRS.

Source: NACHA infographic

The current centralized hub of account credentials that the IRS used to disburse stimulus payments is based on individuals who have filed tax returns electronically and provided their bank account credentials to receive tax refunds via direct deposit (ACH). According to NACHA, “more than 80% of people who received a stimulus payment did so by Direct Deposit.”

However, there was also a portion of the population excluded from the IRS’ pseudo-directory: non-filers and those without traditional bank accounts. The government’s initial solution was to reach these individuals via paper checks, which take months to arrive.

Non-filers were directed to enter their name, address, date of birth, Social Security Number, and bank account information on the IRS portal to enroll for stimulus payments by check. This approach is particularly susceptible to fraudulent interceptions. There was no good way to verify these individuals and authenticate that the bank account belonged to them. The Federal Trade Commission “reported that it had gotten four times as many complaints about identity fraud in the first few weeks of April as it had received in the previous three months combined.”

A directory could help mitigate issues related to fraud and enable more payments to be made electronically. Other countries employ centralized or federated directories, or have a national ID system that tracks individuals’ identity and status (e.g., dead or alive). The U.S. does not have an easy way to identify and validate individuals’ identities or their bank account credentials. Nor is this information maintained or updated routinely (e.g., there have been reports of $1.4B in stimulus aid sent to deceased individuals).

While this is not a new phenomenon, the Treasury Green Book is, in part, supposed to maintain updated bank records. Early Warning Services’ Zelle network is the closest example of a consumer directory, however, there would still be data sharing required, technical challenges, and, of course, it is most useful to banked individuals.

In the absence of a directory, and to reach the long tail of individuals that would otherwise have to rely on check payments, we observe a host of industry developments that have helped Americans gain access to funds in a timely and digitized manner. For example, prepaid cards became the better alternative to paper checks, and several non-traditional financial services companies stepped in to help.

Short-term Impact

Prepaid accounts saw a resurgence in popularity, and several notable fintech players from P2P mobile wallets to neobanks found ways to help consumers receive funds.

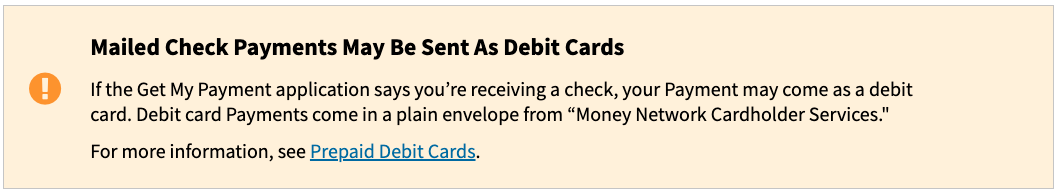

Per the Electronic Funds Transfer Act (EFTA) Regulation E, government agencies cannot require consumers to create accounts at a particular financial institution as a condition to receive government funds. However, the CFPB issued an interpretive rule stating that pandemic relief payments are not considered government benefits under Regulation E.

Source: IRS “Get My Payment” page

Shortly after this announcement, both Walmart and 7-Eleven announced solutions for customers to receive stimulus payments via, respectively, the MoneyCard and Trans@act prepaid programs. MetaBank and Fiserv also “won U.S. Treasury contracts to issue Visa Inc. prepaid cards loaded with stimulus payments.” As of May, roughly 4 million Americans were eligible to receive their stimulus payments via prepaid card.

Additionally, we saw a host of non-bank alternatives launch efforts to provide customers with an option to receive their stimulus payments. Square’s Cash App has allowed users to sign up for direct deposit using the app since 2018, but amid the pandemic the company rolled out steps for consumers to apply for a Cash Card and submit their information to the IRS to receive stimulus payments.

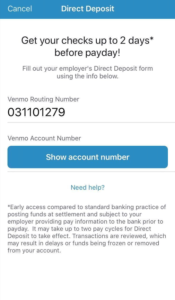

Similarly, as of April this year, Venmo began to roll out direct deposit via the app to a subset of users who could then direct stimulus payments to their Venmo balance, so long as they were approved for or had applied for the Venmo debit card.

Neobanks Chime and Current emerged as champions of their customers. Both companies offered partial or full advances on stimulus payments. In doing so, they also avoided major service outages and funds transfer issues that plagued many other FIs on April 15th, as consumers flooded online channels to check for their stimulus payments.

Ultimately, these measures became necessary as the industry realized the shortcomings in the government’s stimulus fund distribution plan. Chime reportedly offered early access to stimulus payments to approximately 100,000 of its customers. Current indicated it credited approximately 10,000 of its customer accounts as of early April.

We believe we will see more public and private sector collaboration to distribute funds, especially to those who cannot receive direct deposit based on current IRS parameters. We have seen evidence of both regulatory bodies and technology companies stepping in to identify alternative disbursement mechanisms, particularly to reach the unbanked and underbanked.

Longer Term Impact

Income is generally a predictable and somewhat stable source of funds. That comfortable assumption has been shattered. Current unemployment claims are seeing the “17th straight week in which initial claims totaled at least 1 million,” and overall claims have risen by 51 million since late March. While some consumer payment activity has been restored, the impact of such high unemployment rates will be profound.

We anticipate a subsequent round of stimulus payments, but with a greater incentive to digitize those payments – disbursement options will likely improve, with continued reliance on alternative solutions. Furthermore, we expect to see more aggressive communication and education efforts to raise consumer awareness of fraudulent attacks and scams.

There will likely be continued interest in non-traditional/digital financial services providers, especially among the financially excluded and vulnerable gig economy workers.

Additionally, we expect to see more attention focused on faster delivery of payments, in the nearer term via push-to-card, Same-Day ACH, and the The Clearing House’s Real Time Payments (RTP) network. In the longer term, the upcoming FedNow service, based on the Federal Reserve’s role as the fiscal agent for the U.S. Treasury, may become an option.

For example, payroll provider, Paychex, recently announced that it launched payroll disbursement using the RTP network.

Implications

- Expect more focused interest in faster payments for the payroll use case, driven both by pandemic concerns and the secular trend toward faster payroll delivery for hourly workers.

- Expect increased usage of non-traditional, alternative financial products. These may come from digital financial services such as mobile wallet providers like CashApp and Venmo, neobanks like Chime and Current, and from the “earned wage access/on-demand pay” providers like DailyPay, Even, PayActiv, and Branch.

Recommendations

Financial Institutions

- Add Faster. Consider the benefits of accelerating faster payments deployment to expand treasury management offerings for companies with demanding payroll requirements and other use cases.

- Let Fintech Help. Typically equipped with modern technology, a focus on niche use cases, and strong user experience, a fintech provider may offer products and services unavailable from the incumbent provider.

Networks

- Networks are natural directory providers. Apply learnings from other countries, or even NACHA’s own Phixius B2B directory scheme, to expand upon the directory capabilities we already have. Zelle is a start. How can the industry make it more usable for emergency/crisis situations? Is it possible to incorporate Zelle for the next round of stimulus payments?

Regulators/Government

- Faster Onboarding. Apply lessons learned from financial inclusion efforts in emerging markets to encourage financial institutions and fintechs to offer basic or limited-use accounts, requiring minimal KYC, given the inherently low-risk nature of G2C/G2P payments. (Read Glenbrook’s Regulatory Analysis of KYC for Covid-19 in Emerging Markets.)

- Encourage Collaboration. Regulators could push to improve industry collaboration to improve payment system interoperability through directory interoperability, shared best practices in risk mitigation, etc.

This series examines these impacts, and others, in more detail through Glenbrook’s Domains of Payments framework.

Please return to the series landing page, to the Payments Views website, or sign up here to be alerted when the next installment is published.

[Domains]