Despite decades of payment industry efforts, businesses have remained stubbornly dependent on checks. Back office processes (and personnel) can be remarkably change resistant despite being mired in paper, regardless of the size of the business.

At Glenbrook we believe the Covid-19 pandemic is a watershed moment for B2B payments.

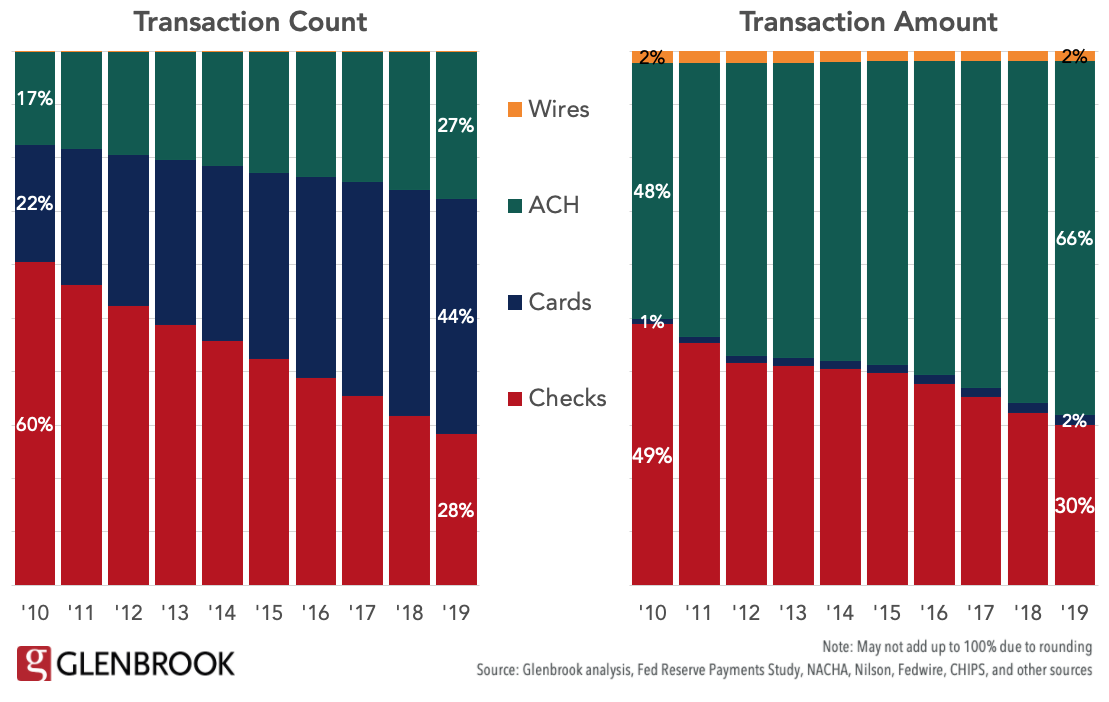

B2B supplier payments – invoiced, accounts payable transactions – have steadily migrated toward digital methods but checks still represent 30% of the total value and 29% of B2B transactions (Figure 1).

Figure 1: U.S. B2B Supplier Payment Mix – Excludes T&E, intracompany transfers, and investment/M&A transactions

Enterprises have made more progress in digitizing payments than smaller businesses. Yet they are often frustrated when paying the ‘long tail’ of their non-strategic, typically smaller suppliers.

Glenbrook estimates that SMBs generate nearly two-thirds of B2B check payments. Reasons for check’s resilience include:

- Smaller companies may not be offered ACH origination as a default feature of their banking accounts.

- Many rely on online bill pay to make payments to their vendors. Ironically, many of those ‘electronic’ transactions result in paper checks. If the SMB buyer is paying an invoice from a company that is not a major biller via online banking bill pay then a check will be cut on the back end and mailed to the biller.

Anecdotally, we understand that 80% of the checks generated by online banking bill pay are payments to SMBs!

Short-term Impact

The sudden COVID-driven shift to remote work exposes how reliant businesses are on paper-based manual processes for invoicing and payment. Businesses experienced multiple impacts from this paper dependency:

- Suppliers with accounts receivable/billing departments reliant on USPS invoice delivery may not have had sufficient staff available to prepare invoices. Their outsourced print and mail provider or lockbox may have had disrupted service due to virus-driven staff reductions.

- Buyers similarly may not have had sufficient accounts payable staff on hand to receive and process incoming invoices. Not all invoices are directed to accounts payable departments so many may have stacked up, waiting for office managers, department heads, and line of staff buyers to return to work.

Even those businesses that have digitized have struggled with a range of issues:

- Back office employees lack the capability to securely access the enterprise financial software they use to perform their primary duties.

- Many back offices with on premise software were unreachable to home-bound employees.

- Many mobile and tablet versions of corporate treasury solutions have disproportionately focused on management reporting and approvals (for positive pay, dual control of large value transactions) rather than day to day accounts payable and accounts receivable processing.

- Large enterprises often rely on business process outsourcing to handle large scale manual work. Their outsource vendors are likely to have experienced COVID-based staffing disruptions and there are likely to be ongoing challenges as the pandemic ebbs and flows across geographies.

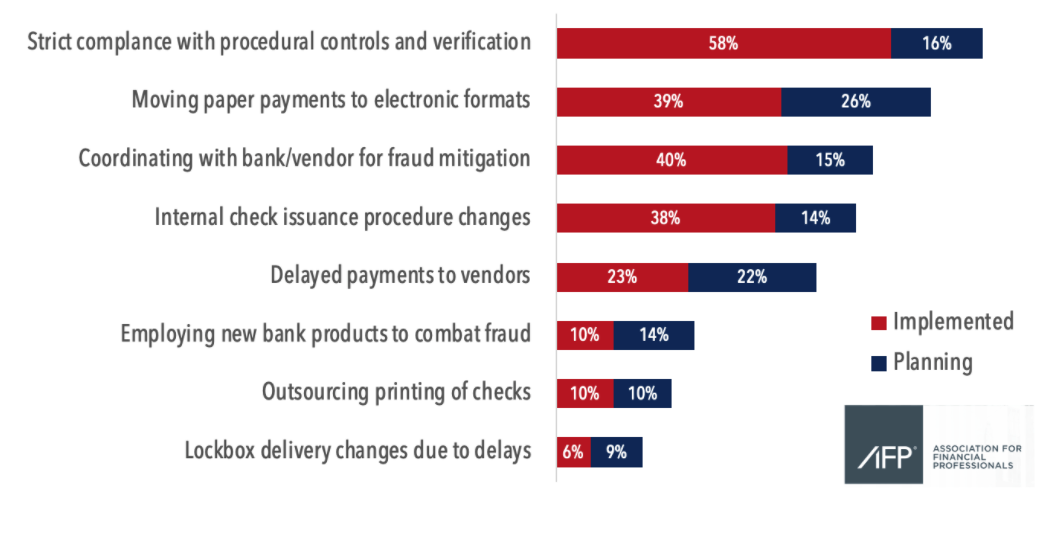

An April 2020 Association for Financial Professionals survey found that 65% of businesses have already started (39%) or are making plans (26%) to move check payments to electronic formats. AFP found that “Thirty-eight percent of organizations have implemented changes in their internal check issuance procedures and another fourteen percent are working on making similar changes. Many financial professionals have challenges with check printing processes, as well as the requirement of wet signatures for checks above a certain threshold.”

Not surprisingly, the move to remote work has also intensified focus on process controls and fraud mitigation.

Figure 2: Payments Related Actions as a Result of the Covid-19 Pandemic

Source: 2020 AFP Survey: Impact of the COVID-19 Pandemic; the survey was conducted April 1-10, 2020 and received 465 responses. Note that AFP members tend to be mid-market and enterprise sized businesses.

Source: 2020 AFP Survey: Impact of the COVID-19 Pandemic; the survey was conducted April 1-10, 2020 and received 465 responses. Note that AFP members tend to be mid-market and enterprise sized businesses.

Cash Flow Concerns

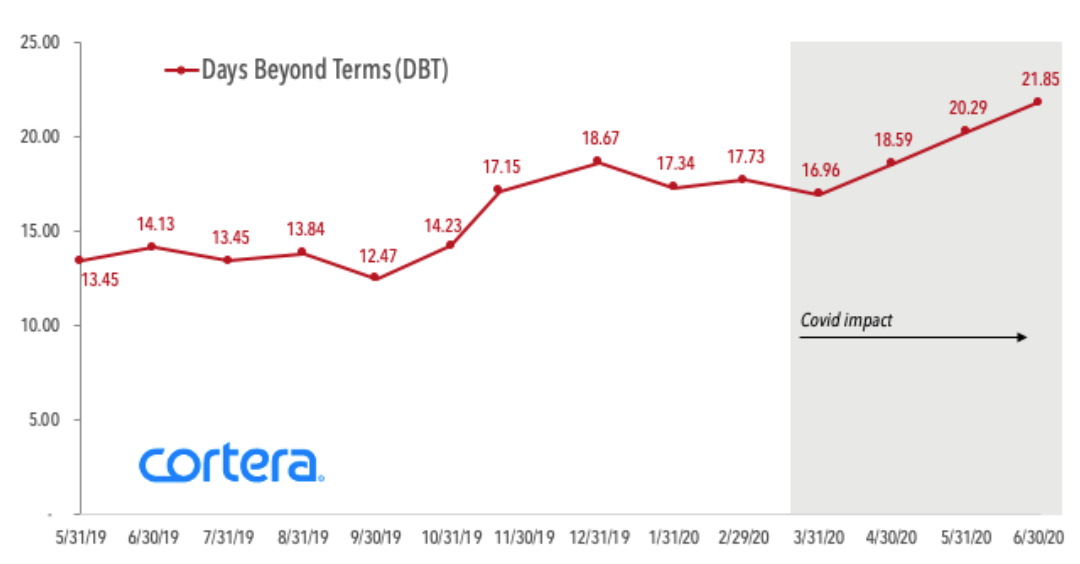

The broader impact of the pandemic on the economy and resulting uncertainty creates intense cash flow pressure. Buyers are extending terms and paying later than usual (Figure 2). Suppliers must carefully consider (and reconsider) the financial health of buyer customers to avoid the risk of not being paid at all. Newer businesses that have only operated during the decade-long expansion are facing reduced sales and late payments for the first time – often without the experience, procedures, reporting, and cash management tools necessary to manage through the crisis.

Figure 3: U.S. Businesses are Paying Later

Source: Cortera COVID-19 Economic Impact Tracker (CEIT)

Uncertainty underscores business reliance on reliable, timely transaction information to project cash flow, predict creditworthiness, and manage collections. Manual processes introduce keying errors and are inherently inefficient. As a result businesses suffer doubly – as a result of disruption of manual processes and as a result of impaired decision making due to incomplete or delayed data.

Longer Term Impact

The pandemic has brought C-suite attention to back office “business continuity” challenges. For years accounts payable and accounts receivable teams have struggled to garner IT attention and obtain funding for process improvement and the implementation of new financial solutions. As a result of the COVID-19 crisis digitization will finally occur.

The acceleration of financial digitization efforts will impact not only businesses as buyers and suppliers, but also their banks, enterprise solution providers, and the enablers each relies on.

The ripple effect extends beyond payment. Electronic invoicing and delivery of remittance data (the explanation of what a business payment is for) will both benefit.

Industry Readiness

Increasing demand for digital business processes could not come at a better time. Over the last few years the payments industry has intensified its focus on business transactions. There is increased focus on interoperability between buyer and supplier-centric solutions to exchange invoices and effect payment.

New real-time payment systems offered by TCH and being planned for by the Federal Reserve are ideal for business transactions, not because of speed but because of data handling (more on that below).

Meanwhile, both Visa and Mastercard acknowledge that cards are appropriate for only a modest number of B2B supplier transactions. They have redoubled efforts to support a wide range of business payment methods and address associated remittance delivery challenges. Both networks have intensified partnerships with enterprise solution providers to address the needs of buyers and suppliers. Competition between the networks to address B2B payments will benefit banks as well as their business customers.

Implications

Machine Learning/AI Impact

The increase in digital transactions will boost the utility of artificial intelligence (AI) and machine learning (ML). Benefits of this technology include:

- More sophisticated translation of data from one format to another

- Better matching of invoices to purchase orders and matching of remittance information to associated payments

- More accurate application of incoming cash to open invoices in accounts payable

- Improved cash flow forecasting

- More effective risk management tools.

This will increase straight through processing rates and better decision making to better manage through future business cycles. As smaller businesses adopt digital tools they, too, will have access to robust tools and efficiency.

Focus on Directory Services

Electronification of business transactions will intensify focus on directory services. Everything necessary to pay by check is provided on the supplier invoice. Shifting from check to electronic payment requires additional information – either RTN and account number for ACH/wire/real time or 16 digit PAN for cards. Yet businesses have concerns about sharing sensitive payment credentials (suppliers/accounts receivable) and storing it (buyers/accounts payable). Directory capabilities offered by NACHA Phixius, Mastercard Track, PaymentWorks could address this concern, but none have meaningful traction thus far. In the meantime, the consumer-oriented Zelle P2P solution has the potential to serve many SMBs.

There is also a need for registries to facilitate exchange of electronic invoices. The Minneapolis Federal Reserve sponsored Business Payments Coalition has made great strides toward an e-Invoicing Framework for the United States and a similar approach may be useful for remittance data exchange.

Faster Payments Systems Offer Flexibility and Data

New Faster Payments infrastructure (like TCH RTP and the forthcoming FedNow) are well positioned to replace checks for B2B transactions, especially since they can support delivery of payment related data. These modern systems feature “request to pay” (RfP) functionality which enables a supplier to generate a simple invoice and send it to the buyer. These solutions address both invoice delivery and electronic payment. They have the added supplier benefit of easier payment posting since the payment is logically tied to the RfP invoice.

For less complex relationships involving SMBs, where the invoices themselves aren’t particularly complex (not a lot of line items) and each invoice is paid individually, this function probably provides adequate information for the receiver of funds to understand what is being paid for.

More complex B2B counterparty relationships will require far more robust data capabilities. The ISO 20022 message standard includes a remittance message that can either be delivered with the payment (for example embedded in an ACH CTX) or delivered separately via one of the increasingly interoperable business solutions serving buyers, suppliers, or both.

ACH Powers On

Meanwhile, old-fashioned ACH can also play an important role in replacing checks. Business use of ACH has steadily climbed (refer to Figure 1 above) and is likely to accelerate, particularly if banks proactively offer debit-blocked accounts. This approach should ease concerns of customers that have been reluctant to transition from checks through education that the sharing of the RTN and account number of the credit only account on their invoices carries little risk. This can help counter business anxiety about sharing account information (nevermind that it’s printed in the MICR line at the bottom of every check) and has the added benefit of facilitating buyer/accounts payable enrollment of suppliers for electronic payment.

Historically, third party origination of ACH transactions has been tightly controlled due to fraud concerns (banks and NACHA want to reduce the opportunity for bad actors to debit consumers and businesses) but there may be an opportunity to facilitate credit-only ACH origination on behalf of business buyers.

Recommendations

Financial Institutions

Digitization of business banking has lagged behind retail banking and banks of all sizes must turn their attention to solutions that enable businesses to transact electronically. Short term solutions include:

- Enabling SMBs to deposit checks without visiting the branch or ATM by increasing or removing altogether limits on remote deposit capture (manage risk by managing funds availability on the back end instead).

- Banks should also explore redundancy of their lockbox services, potentially utilizing operations in different geographic locations, even from the same vendor, to ensure continuity.

- Banks should simultaneously enhance their receivables solutions to help businesses transition customers to electronic payment via ACH or card, or new real time RfP. This will likely require heavy lifting from core processors such as Fiserv, FIS, and Jack Henry but also partnerships with the invoicing and payment solution providers that businesses rely on. Visa and Mastercard’s recent focus on business payments and ‘network of network’ B2B strategies will also help.

For Buyers/Accounts Payable and Their Providers

- Businesses that still rely on paper checks to pay suppliers should work with their banks and providers such as Deluxe to explore alternatives to maintaining check stock on site and shift toward outsourced check printing.

- Procurement and B2B networks such as SAP/Ariba and Bottomline have deep expertise and increasing strategic focus on electronic payment.

- Electronic invoice workflow and payment solutions geared toward mid-market and SMBs such as Mineral Tree and Bill.com can help smaller businesses transition to digital accounts payable.

Enterprises that have struggled to digitize invoicing and payments with their long-tail counterparties can look forward to fewer incoming paper invoices and greater ACH acceptance as a result of pandemic-related digitization by their suppliers.

For Suppliers/Accounts Receivable and Their Providers

Suppliers of all sizes will be motivated to adapt electronic invoicing rather than rely on printing and mailing invoices to customers.

- Large businesses that receive large volume check payment via wholesale lockboxes will seek redundancy and simultaneously encourage electronic payments from their buyers. They should seek vendors with strong bill presentment and payment expertise such as Billtrust and Transactis.

- Small and mid-sized businesses that have historically relied disproportionately on receiving checks may look to their ERP/accounting system providers for solutions. Intuit/Quickbooks, Netsuite and Xero should all benefit but may need to augment their payment capabilities, integrations with fintechs and banks, and reconciliation capabilities to support new real time transactions, ISO formatted messages, and bank/bank processor APIs.

- Providers that have long served SMBs such as Square, PayPal, and Freshbooks enable invoiced transactions and the associated payment. A myriad of industry-specific ISVs (increasingly payment-enabled by Stripe) are also well positioned to help.

For Providers that Serve Businesses of All Sizes

Be prepared to scale! This is a once in a lifetime opportunity to take advantage of a step change in business process automation. But, as we warned biller-centric providers in Glenbrook’s Bill Pay COVID-19 piece, demand will intensify, and many new customers will be late-adopters without digital experience. This will stress provider implementation resources and may result in delayed revenue.

This series examines these impacts, and others, in more detail through Glenbrook’s Domains of Payments framework.

Please return to the series landing page, to the Payments Views website, or sign up here to be alerted when the next installment is published.

[Domains]