Last week I was in Amsterdam for the second annual conference hosted by the The Bitcoin Foundation. As a strategist and advocate for ever-better payment solutions, I was very curious to learn how the Bitcoin protocol and its emerging enablers can address some of the most intractable challenges facing payments.

For the most part, payments work fine today. Yet at the upper and lower ends of the spectrum there are challenges – complex, cross-border transactions between businesses are slow, expensive and unpredictable; cross-border remittances remain largely cash, dependent on literally hundreds of money transmitters and their respective agent networks; and low value day-to-day transactions in the developing world where financial inclusion is a priority are still not adequately served. Microtransactions on the web are another ideal use case, as existing payment systems are not cost-effective for very small value transactions. It is at these extremes that bitcoin has the most potential.

I came away from the conference impressed by the power of the blockchain and the fervor of its advocates: it is the future of payments. It represents brand-new, global infrastructure that is resilient and adaptable. But it’s going to take awhile.

A few general observations:

The bitcoin community is an uneasy confederation of idealists, libertarians, cryptography/mathematic wizards, savvy tech investors and the entrepreneurs they bet on. I was struck by the genuine openness – I had engaging conversations with people from all backgrounds and perspectives and they were patient with my questions and generous with their expertise, although somewhat curious about me, a middle-aged female representative of the payments status quo.

The Bitcoin Foundation has limited resources and faces significant demands in terms of professionalizing its lobbying efforts – despite distractions large and small, internal and external. Governance challenges, International expansion, and balancing membership priorities as the challenges of maturing stretch the binds of mutual bitcoin enthusiasm. It’s definitely experiencing an intense growing phase.

The protocol itself is open source code supported by a few paid developers employed by the foundation and a team of volunteers. The well-funded companies that have emerged in the space are starting to take a role in funding developers to maintain and enhance the protocol through an internship program the Foundation is starting. Yet, there is clear tension between caring for and expanding the core protocol and developing proprietary services that enable access to it. Mike Hearn previewed a native bitcoin Kickstarter-like crowdfunding application called Lighthouse at the conference with the hope that once it is launched it will facilitate funding of key decentralized capabilities that the whole ecosystem can benefit from.

The thing that surprised me most about the conference was the profound lack of knowledge about payments within the bitcoin community. I am not judging, just surprised – we at Glenbrook know full well how arcane the world of payments can be, even to those of us that live and breath it daily. On the one hand, lack of payments knowledge was one of PayPal’s key success factors but if one intends to disrupt an industry, it may be useful to understand its economics, the motivations of participants in the value chain in order to determine those that are the most likely partners vs. the most highly motivated enemies, and the varying requirements of specific payment domains, in order to find out where the bitcoin capabilities make the most sense. I sense that regulatory and public perception battles take primacy for now, and exploration of the payments industry will follow in time.

Comsumerization and Expanding Merchant Acceptance

The biggest announcement at the conference was the unveiling of the eagerly anticipated solution from Circle Financial, led by Jeremy Allaire. Circle aims to de-mystify bitcoin and make it accessible for the average consumer (your mom). It is offering free transactions, telephone support, and fully insured deposits – the goal is to build a new consumer financial brand that utilizes bitcoin, but is surely prepared to incorporate future math-based currencies, whether bitcoin 2.0 or a successor. The company anticipates that the majority of its users will be International, rather than US based. There was widespread coverage in the press, but if you want to see the demo for yourself, there is a video here.

This comes just days after the announcement that BitPay, the rapidly growing merchant processor, raised an additional $30 million in funding and is processing $1 million per day in payments for 30,000+ merchants.

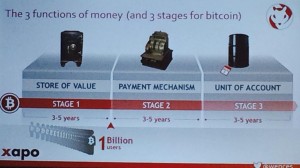

Xapo bitcoin vault and wallet founder Wences Cesares gave an impassioned presentation on the allure and promise of bitcoin, without mentioning his company or what it does. Here is one of his slides depicting stages of bitcoin adoption:

The other big venture-backed player in the space, Coinbase, has over 1.2 million users and at times has experienced 30% growth per week. I hadn’t realized that over 5000 developers are using (or intending to use) Coinbase APIs to buy/sell bitcoin, outsource compliance, etc..

Mechanics: Evolution of the Digital Currency Infrastructure

The most interesting sessions I attended were in the technical track. I couldn’t always follow the nuances of the conversation but I was struck by the openness and mutual respect between the panelists on stage and the audience. There was considerable discussion about scalability of the blockchain infrastructure and the trade-offs between faster transactions and preventing double spending via the mining process.

The notion of Bitcoin 2.0 was explored often, although there appears to be little consensus what it really means; competing protocols have existed for awhile (Ripple), others are emerging (Mastercoin), and entirely separate protocols with their own blockchains and currencies are under development (Ethereum).

Here are a few of the interrelated concepts that I find intriguing (with the caveat that my understanding of these concepts is evolving and I may be confused – so I welcome clarification!):

Colored coins

Bitcoin enables peer-to-peer movement of funds, denominated in bitcoin whether mined or purchased on an exchange. Colored coins enable tagging a bitcoin (or fraction of a bitcoin) with additional data that links it to another kind of asset – stock in a company, commodities, or other tangible assets such as houses or cars. It is an open standard protocol layered on top of the bitcoin protocol.

Using this notion, one could potentially sell shares in a company and store the record of share ownership in the blockchain. (As an aside, Patrick Byrne, the CEO of Overstock.com claimed in his keynote that he’d like to do an Overstock IPO on the blockchain – a similar public claim is what led his company to accepting bitcoin for payments).

Side chains

New blockchains, purpose built distributed public ledgers that are tied to bitcoin are referred to as ‘side chains.’ This concept is not unlike how fiat currencies used to be linked to gold – no new bitcoin are created, thus leveraging the scarcity of bitcoin. Bitcoins are transferred from the main blockchain to the side chain, and back again. Side chains could specialize and compete on features that are optimized for specific use cases.

To use a current payments world analogy, imagine separate tracking of agreements, contracts, and assets, but using the bitcoin blockchain as the system of record. Sort of like using Salesforce to track prospects and sales and SAP to record the financial transactions associated with those sales. This concept is particularly interesting to me as a means to address the acute interoperability challenges we face in B2B payments – can we tie invoice creation, delivery, approval and payment that occurs today in various accounting and ERP systems together using side chains rather than forcing individual companies to adopt new systems and procedures?

This notion could be extended (really extended!) to include the notion of running an entire national economy on a side chain. (Intrigued? Learn more here.)

Machine to machine transactions

Building on the concept of side chains, a separate ledger could be optimized for very fast processing of very small transactions and used to facilitate metered usage of digital assets. This is the reduce email spam and get rid of ad-based content delivery use case. This feels inevitable to me and I welcome it wholeheartedly, sooner rather than later.

Hierarchical addresses

One of the challenges when thinking about business to business payments is the need for confidentiality – corporate buyers don’t want their purchasing behavior or customer orders broadcast for all to see in a public ledger.

The notion of hierarchical deterministic (HD) wallets that enable one address to generate fresh addresses, in a tree-like manner. Some can remain private, others can be shared but all are tied to one root address. They aren’t entirely private (you can trace back to the root) but they are more adaptable than creating many new unrelated addresses. Another approach uses stealth addresses, that prevent tracing back to the root. Yet these tools that may help businesses mask their transactions are the very same tools that the privacy-seeking elements of the bitcoin community hope will retain true anonymity. This makes for some curious alliances.

[On a side note, this weeka long-awaited ZeroCash paper was released at the IEEE Security and Privacy Conference in San Jose. This is a bitcoin-based protocol with extremely advanced anonymity features – observers in the blockchain can tell that transactions are occurring, but cannot link transactions together or tell how many coins were sent in any individual transaction.]

It wasn’t entirely clear to me (and may not be clear to anyone) which of these capabilities will be incorporated into the core bitcoin protocol, which will remain separate protocols that will continue to exist in parallel, and which will be developed and refined in parallel and, if successful, adopted by the core protocol. I suppose there is the chance that one of these alternative protocols will supersede the bitcoin protocol – but with all of the momentum behind the core protocol that isn’t likely to happen anytime soon.

Start Up Competition

There was a very entertaining start up contest on the last afternoon, with eight hopeful entrepreneurs pitching a panel of seasoned investors. The contestants ranged from remarkably naïve to humbly brilliant. My two favorites came away with the prizes:

Coinprism – This effort includes a wallet for colored coins and a supporting Open Assets protocol. Users can store their bitcoins alongside various other coins that represent non-bitcoin assets in one wallet. Coinprism also enables users to create their own colored coin and issue their own assets.

Reality Keys – This solution enables conditional transactions dependent upon by factual information that can be verified at a specified time in the future. It relies on a public database called Freebase that offers APIs on literally millions of topics (sporting event outcomes, etc.), databases of currency exchange rates, and specific activity on the bitcoin blockchain. You set up the condition, Reality Keys issues two keys, one for a YES outcome, one for a NO outcome. When the date you specify comes up, they check against the data source API, and publish the result, then deliver the private key for the winning outcome to the appropriate party. It’s free, unless you need a person at Reality Keys to do research on a specific outcome.

And I have to give special credit to Qllector. The presenter had a bad cold, readily admitted to not having much business acumen, but had genuine passion for monetizing digital representation of artwork, because (in the words of the presenter): “Artists create emotional value, out of thin air. Their landlords still want to get paid in a more traditional currency.”

Some of the best quotes from Bitcoin2014:

Wences Cesares, CEO of Xapo, characterized the “immense gravitational pull” of bitcoin @wences

“The people you’re up against all have senators on speed dial.” – Patrick Byrne, CEO Overstock, @OverstockCEO

“To scale to a factor of a million, we’ll need a hard fork.” Gavin Andresen, Chief Scientist, Bitcoin Foundation @gavinandresen

“I want the ecosystem to develop. I don’t want the AOL of money, I want the Internet of money.” – Sean Neville, Co-Founder and CTO of Circle @psneville

“We know machines are going to pay each other, and that the existing banking infrastructure can’t support [microtransactions.]” – Nick Shalek, Ribbit Capital, @nshalek [I think it was Nick that said this on the one of the investor panels, but If I have misattributed it let me know!]

Commenting on an improving regulatory environment “Developers don’t worry about going to jail anymore” – Mike Hearn, bitcoin developer +MikeHearn

All of the keynote and break out sessions were recorded and video will be available on YouTube here (for now there are just highlight reels for each day of the conference). I encourage you to check it out.

As I indicated earlier, it may take some time, but the world of payments will face dramatic changes as bitcoin and its developing ecosystem mature. It’s by far the most exciting thing I’ve encountered in my career, but it is going to take a long time. That’s okay, I’m patient (and have no interest in retiring anytime soon).

If you are interested in learning more about bitcoin, consider attending our one-day Bitcoin: Basics and Beyond workshop in NYC on June 25. And if you are confortable with your bitcoin knowledge, but want to learn more about payments, consider one of the upcoming Glenbrook Payments Boot Camps. Either course can be delivered privately at your office, for teams large or small.

This post was written by Glenbrook’s Erin McCune, she’s on Twitter @erinmccune.