Amid increased government ownership of Citibank, persistent rumors that BofA is next, and announcement of the Obama administration’s budget, there has been increasingly loud debate over bank nationalization.

The media pundits and blogosphere are a cry with claims of pending socialism and the “Europeanizaton of America” – which, while provocative, aren’t necessarily true.

Here’s a definition of nationalization and a brief summary of the arguments for and against.

What is Nationalization?

Nationalization means different things to different people (and in different eras). There is a whole spectrum of actions labeled “nationalization” and not everyone debating the topic is using the same definition.

At one end of the spectrum you have the economic and political philosophies of Lenin, Hugo Chavez, and Francois Mitterrand. Under this theory the government controls the major industries that drive a national economy, believing that centralized control is more effective than private ownership. History demonstrates that this methodology has lackluster results.

At the other end of the nationalization spectrum is significant government investment in private companies to shore them up in uncertain times, in exchange for an ownership stake. This is somewhat like the original TARP plan where the Treasury invested in insurance giant AIG and most of the large banks, with the important exception that the government has not taken explicit control. Although, even if government does not have voting rights, it does exert considerable influence over the future of these companies.

Somewhere in the middle you have a scenario where the government stages a temporary takeover of specific companies in response to a crisis. Sweden did this in 1990s (see link below for further information) with reasonable success and that precedent is widely cited today as an example of what the US government should do to stem the current crisis. In this scenario the stockholders would lose what is left of their investment.

Source: Nick Anderson, Houston Chronicle

Keep in mind that as the debate continues, the U.S. actually took control of – nationalized – IndyMac last year and Continental bank back in the 1980s. And the FDIC is currently taking over troubled banks at a rate of 1-2 a week.

Arguments in Favor

A surprisingly broad constituency has come out in favor of nationalization. As one would expect, liberal economists are in favor. But even Alan Greenspan and Republican Senator Lindsay Graham are supportive.

Essentially the argument in favor of nationalization claims that only the government has the means to address our broken financial infrastructure, the backbone of the economy, and that the pending economic recovery is dependent upon fixing banking and credit, therefore we must act swiftly.

Lindsey Graham (on ABC Feb 22nd) said he wouldn’t take the idea off the table.

Alan Greenspan (in an interview with the Financial Times): ”It may be necessary to temporarily nationalise some banks in order to facilitate a swift and orderly restructuring,” he said. “I understand that once in a hundred years this is what you do.”

Barry Ritholtz, chief executive and director of equity research at Fusion IQ and author of the (highly recommended) economics blog The Big Picture asks “OK, so how do we move beyond the N word?” and suggests “Instead, why don’t we call it by a more accurate, precise, and less scary name: FDIC mandated, pre-packaged Chapter 11, government funded reorganization. That is an accurate description of what occurred with Washington Mutual (WAMU) now part of JPM Chase, and Wachovia, now part of Wells Fargo. The Feds step in, seamlessly transfer control of the assets to a new owner, while simultaneously wiping out the debt, the shareholders, and giving a huge haircut to the bondholders.”

David Reilly (Bloomberg) added the following perspective: “The nationalization debate is a smoke screen. We’ve already nationalized the big banks. Let’s just accept it and move on”.

Adam Posen, an economist in Washington and a prominent voice for nationalization testified before congress on February 26th that US banks are already in a dangerous public-private hybrid state:

The guarantees that the US government has already extended to the banks in the last year, and the insufficient (though large) capital injections without government control or adequate conditionality also already given under TARP, closely mimic those given by the Japanese government in the mid-1990s to keep their major banks open without having to recognize specific failures and losses. The result then, and the emerging result now, is that the banks’ top management simply burns through that cash, socializing the losses for the taxpayer, grabbing any rare gains for management payouts or shareholder dividends, and ending up still undercapitalized. Pretending that distressed assets are worth more than they actually are today for regulatory purposes persuades no one besides the regulators, and just gives the banks more taxpayer money to spend down, and more time to impose a credit crunch.

Nouriel Roubini (in a WSJ interview) says that bank nationalization “is something the partisans would have regarded as anathema a few weeks ago. But when I and others put it in the context of the Swedish approach [of the 1990s] — i.e. you take banks over, you clean them up, and you sell them in rapid order to the private sector — it’s clear that it’s temporary. No one’s in favor of a permanent government takeover of the financial system.” … “we started with banks that were too big to fail, but what has happened, in the process, is that these banks have become even-bigger-to-fail. J.P. Morgan took over Bear Stearns and WaMu. BofA took over Countrywide and then Merrill. Wells Fargo took over Wachovia. It doesn’t work! You can’t take two zombie banks, put them together, and make a strong bank. It’s like having two drunks trying to keep each other standing.”

“The weight of the historical evidence,” as a Brookings Institution report put it “is on the side of the proponents of tough action.”

In today’s NYTimes David Lionhardt summarizes the rationale for nationalizing banks:

Instead, the federal government would declare a bank insolvent, wipe out its existing shareholders, fire its top executives and inject enough money to keep it functioning. The government could then siphon off the worst assets into a so-called bad bank — pooling them with toxic assets from other nationalized banks — and resell the bank’s healthy parts to private investors. Once the crisis lifts, some of the toxic assets may even have value.

source:

Arguments Against

Federal Reserve Chairman Ben Bernanke is adamantly against, as Bloomberg reports: while the U.S. government may take “substantial” stakes in Citigroup Inc. and other banks, it doesn’t plan a full- scale nationalization that wipes out stockholders. Nationalization is when the government “seizes” a company, “zeroes out the shareholders and begins to manage and run the bank, and we don’t plan anything like that,” Bernanke told lawmakers in Washington [on February 25th]. President Obama and Treasury Secretary Tim Geithner continue to voice their opposition to ban nationalization at every possible opportunity.

Bill Gross, investment manager at PIMCO, observes “The U.S. isn’t Sweden, and not just because our blondes aren’t au naturel,” he writes. “Their successful approach revolved around a handful of banks but we have 7,500, as well as many S.&L.s and credit unions, which would have to be flushed into government hands.”

Across the board there is a lack of confidence in government’s ability to manage, let alone repair, the troubled banks. These are enormous conglomerates. Presumably executive pay would be capped, so how would the government attract the necessary talent?

Tyler Cowen (in an article in today’s NYTimes) describes the risk of contagion: “The most obvious problem with nationalization is the risk of contagion. If the government wipes out equity holders at some banks, why would investors want to put money into healthier but still marginal institutions? A small number of planned nationalizations could thus lead to a much larger number of undesired nationalizations.”

William Issac (former head of the FDIC, oversaw the nationalized Continental) observes that there must be an exit strategy, a reasonable expectation that the banks can be re-privatized. “Today, who has the wherewithal, legal authority, and desire to purchase our largest banks? No one comes to mind, particularly if we rule out foreign groups, which I suspect would not pass muster due to national security concerns about ceding that much power over our economy to foreign powers.”

Conclusion

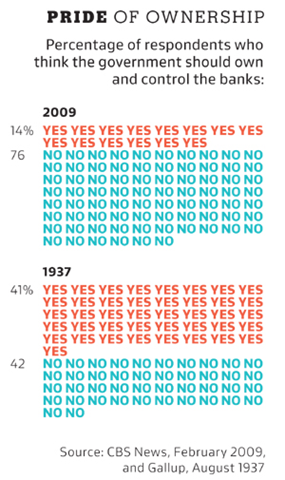

Popular opinion is not in favor of nationalization, as this graph from the New York Times comparing support for government ownership of banks in 2009 vs. 1937 demonstrates:

Source: NYTimes

Source: NYTimes

But until a coherent plan is in place (and clearly communicated!) for addressing the bad assets – the root cause of the problem – the spirited debate will continue. And continued debate only exacerbates the problem, as The Economist notes:

The uncertainty over nationalisation is costly and self-defeating. Several big banks have seen their borrowing costs rise as bondholders fear that they, too, will suffer in any government restructuring. Weaker share prices and dearer credit will worsen the economy, further weaken banks’ loan books and increase the need for yet more public capital.

Meanwhile, Citigroup CEO Vikram Pandit hopes to be reassuring: “Of course, the government holds a significant amount of common stock investment in us, but our commitment we have had to every shareholder, which is to provide an exceptional return as we get through this cycle, remains unchanged. And in many ways for those people who have a concern about nationalization, this announcement should put those concerns to rest.”

Further Reading

In addition to the links throughout this post, these may be of interest:

- An ever-growing list of those in favor, and against, temporary bank nationalization

- The Economist: “In Knots Over Nationalisation”

- Marketplace Radio (audio and transcript) “Nationalization Fears are Mounting”

- Collection of recent VIDEO commentary

- Krugman vs. Issac on PBS’s Newshour (VIDEO)

- The Swedish Precedent

- BCA Research “US Authorities: Trying to Avoid Bank Nationalization”