Innovations and industry disruptors consistently emerge in the payments domain. As they arise, businesses often scrutinize these trends, evaluating their significance, the appropriate allocation of time and resources, and strategies to integrate emerging technologies.

In this piece, I will dive into Generative Artificial Intelligence (GenAI): defining GenAI relative to Traditional AI, highlighting GenAI payments use cases such as fraud prevention, consumer insights, in-store payments, and improved chatbots, and sharing steps that your company can take to assess your GenAI strategy.

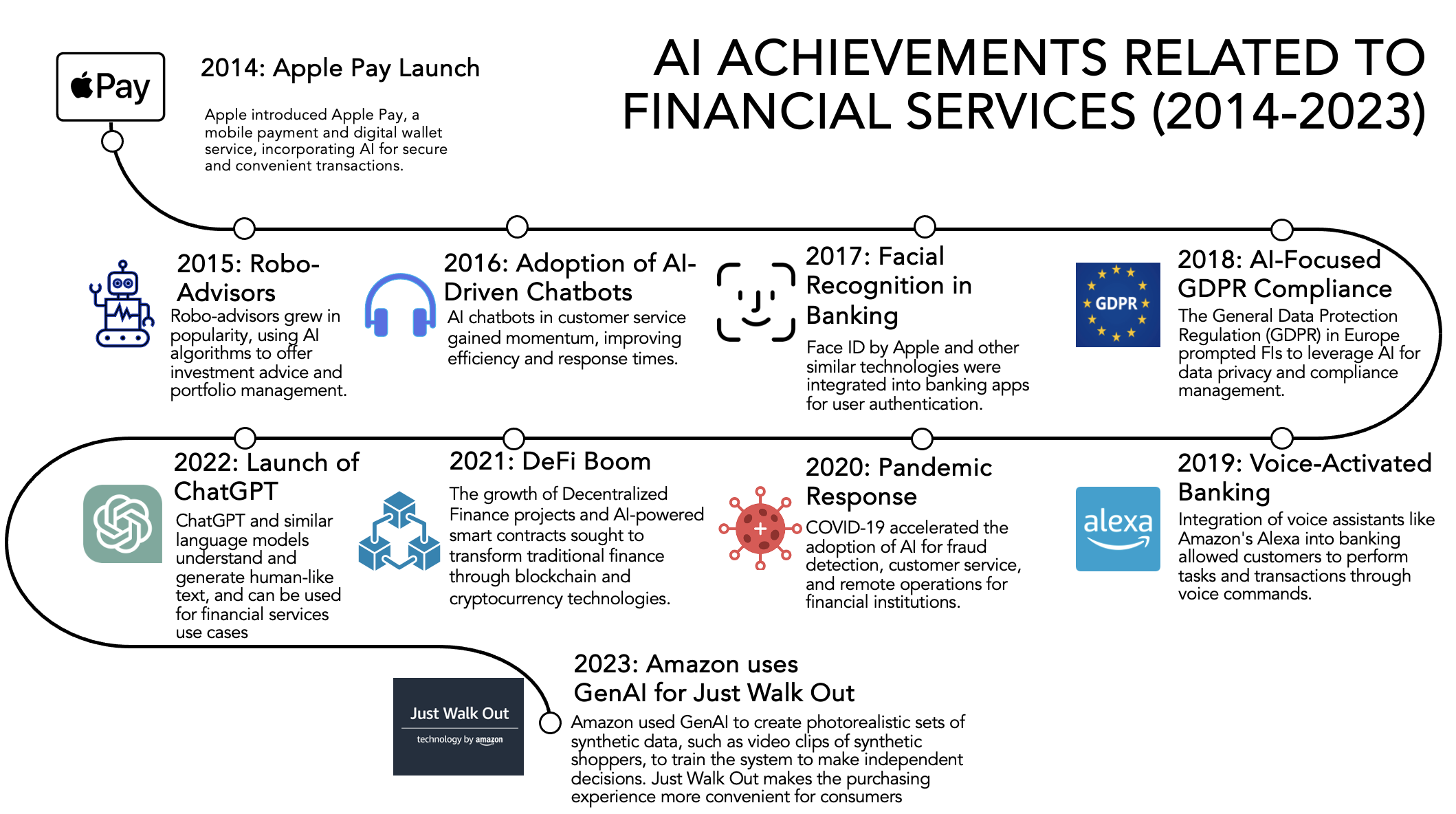

A Brief History on AI, and the Impact of AI in Financial Services in the 21st Century

AI’s roots trace back to the mid-20th century. Despite early challenges, such as limited computing power and high costs, AI gained momentum with the 1956 Dartmouth Summer Research Project on AI. Progress in the 1950s-70s coincided with cheaper and more powerful computers, and successes like Newell and Simon’s General Problem Solver promoted government funding for AI research. While the 1980s offered breakthroughs in deep learning and expert systems via Japan’s Fifth Generation Computer Project (FGCP), most project goals were not met. AI lost funding during the late 1980s and early 1990s, but the FGCP might have inspired a new generation of engineers. The late 1990s and 2000s saw impressive AI feats, demonstrated by Deep Blue’s victory over chess champion Gary Kasparov1.

In the 21st century, AI has continued to thrive, driven by “big data” and computing advances, reshaping various industries. In the financial sector, AI has revolutionized payments, enhancing fraud detection, elevating customer service, and personalizing user experiences. Since 2014, we have seen consistent AI-focused product launches and improvements.

The impact of AI in today’s world is significant.

- The overall AI market is worth about $200B and expected to reach $1.8T by 20302

- 85% of IT executives in banking have a “clear strategy” for adopting AI in the development of new products and services3

- AI was mentioned nearly 200 times during the most recent earnings calls by Meta, Microsoft, and Alphabet4

Generative AI: How it differs from Traditional AI

While there are multiple subsets of AI, a common taxonomy is to distinguish traditional AI and generative AI. Traditional AI is designed to follow predefined rules and patterns, while GenAI can learn from large datasets of existing content, then use this knowledge to create new content that resembles the examples they were trained on. Inputs and outputs to these models can include text, images, videos, sounds, and other types of data.

Driven by its ability to generate creative solutions and drive efficiency in financial processes, GenAI is poised to have a strong impact on both the world and payments:

- The GenAI market is worth roughly $40B and projected to hit $900B by 20305

- 67% of IT leaders surveyed have prioritized GenAI for their businesses in the next 18 months6

GenAI in Payments: Use Cases

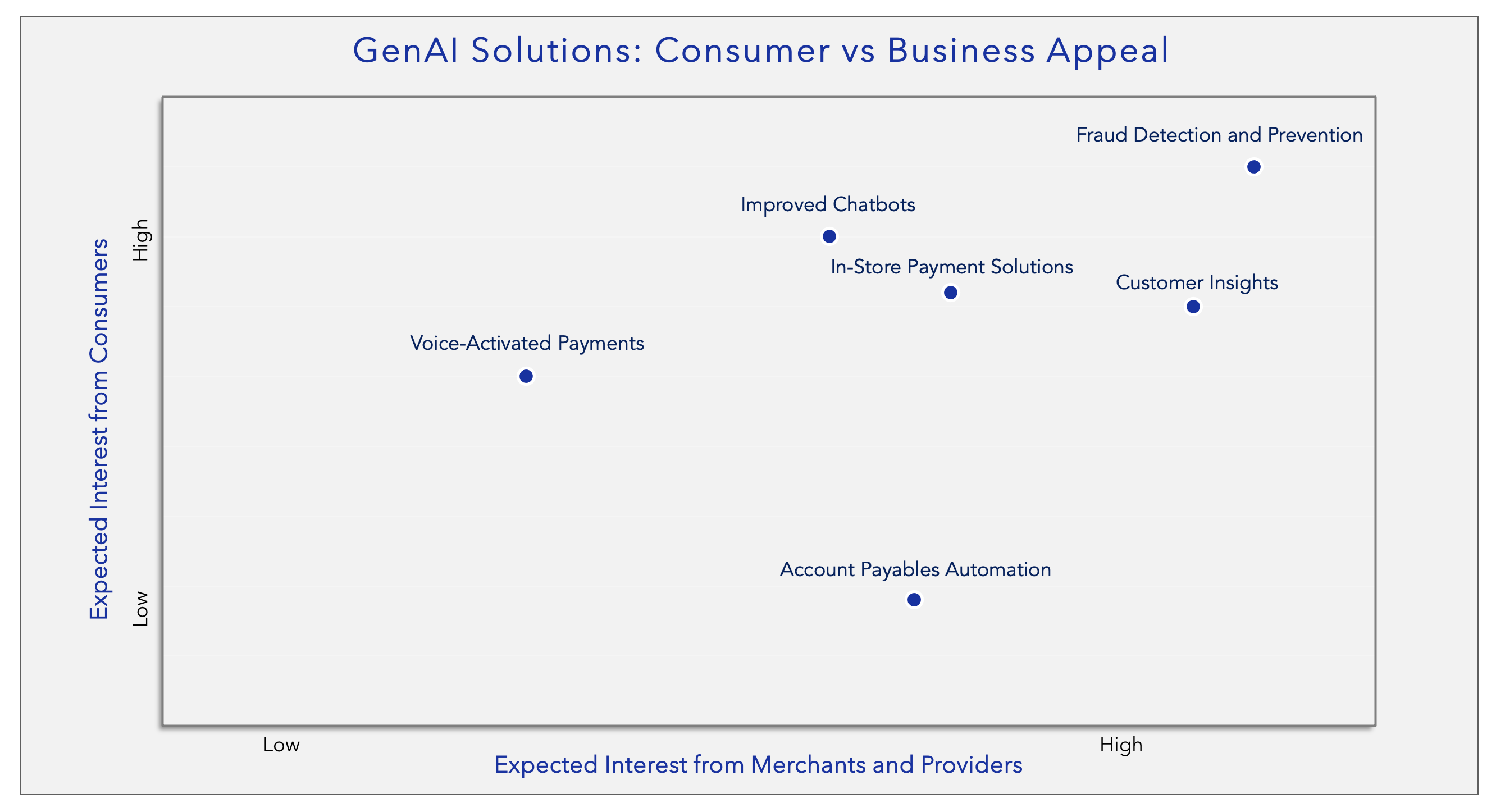

There are several GenAI use cases; the below graph illustrates six that we have explored in more depth at Glenbrook. I will elaborate on the four that I expect will have high early appeal from both Consumers and Merchants/Providers:

- Fraud Detection and Prevention: While AI has already been effective in helping companies reduce payments fraud, GenAI models can further the battle against fraud in a few ways. Traditional rule-based systems may struggle to detect new, previously unseen fraud patterns.

- Key GenAI capabilities: anomaly detection and data generation

- GenAI models, such as variational autoencoders (VAEs) and generative adversarial networks (GANs), can learn normal patterns of transactions and generate data that conforms to those patterns. This allows them to identify anomalies and deviations from the norm, which are often indicative of fraudulent activity.

- Consumer Insights: GenAI can extract and analyze financial data, consumer feedback, and trends, to offer insights to business leaders.

- Key GenAI capabilities: customer insights analysis and scenario creation

- By extracting key information from financial documents, GenAI can provide business leaders with insights for more efficient decision making. Models can analyze customer transaction data to generate insights about spending habits, consumer interests, and payment preferences. This information can be used for more targeted marketing and personalized offers. Further, models can generate diverse scenarios to simulate market conditions and economic indicators, helping businesses evaluate risks and opportunities.

- In-Store Payment Solutions: GenAI, combined with other technologies, can revolutionize in-store payment convenience. Amazon’s Just Walk Out technology is an example of this last use case. Just Walk Out utilizes computer vision, object recognition, advanced sensors, deep machine learning models, and GenAI (specifically GANs) to work together seamlessly.

- Key GenAI capability: synthetic data generation

- GenAI can create photorealistic sets of synthetic data, including video clips of synthetic shoppers performing activities. This synthetic data helps train the system to make accurate decisions in real-life scenarios.

- Improved Chatbots: Compared to traditional AI, GenAI-powered chatbots can hold more engaging and articulate conversations to improve customer satisfaction. GenAI chatbots can also guide users who wish to perform transactions and provide payments-related customer support.

- Key GenAI capabilities: enhanced natural language understanding, context awareness, and personalization

- Strong GenAI models excel at understanding and generating natural language text. They can engage in dynamic, human-like conversations, and handle complex customer requests related to transactions. GenAI chatbots can also personalize responses based on a user’s transaction history, preferences, and previous interactions.

While GenAI has plenty of exciting current and future use cases, it is important to be aware of the risks and challenges, including criminal enablement, deepfakes, data privacy, and accuracy. I’ll be addressing these risks in part 2 of this GenAI series. Until then, here are some ideas about what your business can do now to prepare for GenAI:

- Determine internal use cases

- Ask your vendors about what they’re doing related to GenAI

- Find your internal champions: data scientists, product managers, fraud analysts, and engineering professionals

- Lay the groundwork for in-house capabilities

- Speak to your legal, compliance, and privacy stakeholders about their concerns

- Keep an eye on the regulatory framework

What use cases is your business thinking about?

- Harvard University

- Grand View Research

- The Economist Intelligence Unit

- Meta, Microsoft, and Alphabet Earnings Call Transcripts

- Bloomberg Intelligence

- Salesforce