In this episode, we explore the intersection of three significant payment trends: helping small businesses modernize their payment acceptance options, embedded finance, and the consumer lending phenomenon known as Buy Now, Pay Later. We look at the potential market – asking ourselves if there is demand from small businesses and consumers. Then we unpack the opportunity using our BNPL “flywheel” to examine the critical success factors for any BNPL solution.

Yvette Bohanan and Debbie Bartoo are joined by Bobby Tzekin, Founder and CEO of Wisetack (and Glenbrook Payments Boot Camp alumnus) to examine how technology, consumer and small business demand, and banking are opening up a very large market in the BNPL space – one that has a lot of potential and a lot of nuance.

Yvette Bohanan:

Welcome to Payments on Fire, a podcast from Glenbrook Partners about the payments industry, how it works, and trends in its evolution.

Hello, I’m Yvette Bohanan, a partner at Glenbrook and your host for Payments on Fire. In this episode, we’re exploring consumer financing and the buy now, pay later phenomenon. Some of the most stressful situations in our lives involve the intersection of a big purchase. Some of those moments where we have unexpected events, unexpected healthcare bills maybe for people or even pets come to mind, emergency home repairs, even a planned home repair that can come with its own set of surprises. All of these things can fall into the buy now, pay later category. It’s not just for your splurge purchases or treats.

So we know this, and we know that there are businesses out there that are trying to help their customers when they have those unexpected situations, and the options for offering ways to pay can dwindle as the cost and the size of the service provider is smaller and the cost goes up. Large big-box retailers have often used private label cards that they can easily offer these days, but think about an independent owner of a small company who maybe doesn’t have all those resources available to them. So, in this episode, we’re taking a closer look at situations like these and how technology, consumer and small business demand, and banking are opening up a very large market, one that has a lot of potential and a lot of nuance. Joining me for this episode is my Glenbrook colleague, Debbie Bartoo. Debbie, I am so glad to have you joining me for this conversation, and welcome to your first episode as a co-host of Payments on Fire.

Debbie Bartoo:

Thanks, Yvette. It’s great to be here, especially talking about this important topic today.

Yvette Bohanan:

I am so glad you’re with me. You have done a lot of interesting work with financial institutions, both banks and credit unions in your career, and you’ve helped teams work on innovation, strategy, and launches at scale. As a leader on our Education Team, you have recorded some on-demand modules in the last year for buy now, pay later. So all of that makes you a perfect co-host for this episode.

Debbie Bartoo:

Yes, Yvette. I’m looking forward to this conversation. We’re actually exploring here the intersection of three big trends in payments and really helping small businesses modernize their payment acceptance options, thinking about embedded finance, and then buy now, pay later, BNPL as we call it, with consumer lending.

Yvette Bohanan:

Exactly, and consumer lending has and still is very much in the realm of banking, right? Card products, private label, like I was mentioning. Lots of products out there, and then we have APIs, and modern tech stacks, and cloud computing. All of that’s been squarely in the tech domain, and helping small businesses modernize for decades has been a bit of a desert landscape.

Debbie Bartoo:

Yes, and there’s actually over 31 million small businesses in the US compared to 20,000 or so large businesses, so you can imagine the diversity of needs here. When we discuss BNPL, we tend to fixate though on large businesses selling to consumers, an alternative to private label, but small businesses don’t have the know-how or the ability to offer private label cards, let alone an alternative to it. So it’s these intersections and gaps that really make this an interesting space for innovation in the payments industry.

Yvette Bohanan:

It’s the intersections and the gaps that we’re going to be talking about today and how things are starting to come together to solve for this. So, without further ado, we’re going to be covering a lot of ground with our guest today, Bobby Tzekin, founder and Chief Executive Officer of Wisetack. Bobby, welcome to Payments on Fire.

Bobby Tzekin:

Thank you for having me, and it’s great to cross paths again, Yvette.

Yvette Bohanan:

Oh, yes, it’s delightful, and so here we are. You have been in payments for a while. Our paths have crossed in prior lives, and I’d love to start by just asking what we often ask of our guests. Can you share a little bit of your background so people understand and get a sense of how you found your way to founding Wisetack? Why are you doing what you’re doing now, and how did you get here?

Bobby Tzekin:

Sure. I’ll give you the short version of the full story.

Yvette Bohanan:

Okay.

Bobby Tzekin:

My career has been very organic in the sense that very little of it was planned for more than a year in advance. Actually, I grew up in Bulgaria and hadn’t even heard of the internet until I moved to the US for college.

Yvette Bohanan:

I’m going to date you a little bit. What year is this that we’re talking about?

Bobby Tzekin:

I moved in 1996.

Yvette Bohanan:

Wow. Okay.

Bobby Tzekin:

The internet was very much in existence, just not in Bulgaria.

Yvette Bohanan:

Okay.

Bobby Tzekin:

I was a strategy consultant for a couple of years out of college, and then very quickly, through a couple of twists, ended up at PayPal when it was much smaller than it is today. It was a general business role at the time, and as the company was growing really quickly, I ended up in a product function having not known what product management was at the time, and I stayed at PayPal for seven years. Post-PayPal, I ended up leading product teams at three other fintechs. All of which were in the Series B stage when I joined, and we worked together at one of those at Yapstone. Those fintechs were doing card processing as well as online lending. That’s leading up to Wisetack is at the intersection of payments and lending. We are a payment option that results in an installment payment plan for the consumer. In a way, I’ve been thinking how everything I’ve done for a really long time leads to what we’ve done with the company and similarly for the rest of our senior team where most of the folks on our senior team have a lot of experience with that fintech, various aspects of the fintech landscape that we have brought in to build what we are doing.

Yvette Bohanan:

We’re going to get to this. We’re going to get to all of this, but you guys, you’re using an embedded finance no-code, low-code solution approach to the market that we’re going to be talking about. I was on your website, and you actually have pictures of projects and stories about people that have used Wisetack to pay. Some of them are like before and after pictures of home remodeling projects or like, “Wow, this really helped me out in this emergency situation,” and I just found that really interesting. Most embedded software companies out there are not posting stories on their website of real-life customer stories of what’s been going on, how this product has been used. Most of the time, the consumers don’t even know the company exists, right, or they know it’s a name, but it’s this nebulous thing, and they don’t quite understand how it’s helping them, but somehow it’s important. Right? Why did you decide to do that? I’m just really curious. Why did you decide to put those stories on the website?

Bobby Tzekin:

There are a couple of reasons. The biggest one is that we are incredibly customer-focused. We have five values. One of them is customers first. From the very beginning, we were doing things like overstaffing customer service as a function so that when people call… and we wouldn’t hide the phone number. We wanted to get the calls. We wanted to get the feedback. We wanted to know if something’s not working. So we’ve always been very focused on talking to customers, hearing from them. The more in touch we are with customers, I find the better we’re able to serve them. Actually, we recently won an award for excellence in customer service. We have a really high net promoter score of 80, and all of that, including posting the customer pictures on the site is part of just keeping in mind what we’re doing and the fact that the company exists to be a benefit to customers. Otherwise, we’re not going to have a very successful company.

That’s enabled by the fact that we do have a customer relationship. So, even though we are embedded fintech, we’re embedded in the sense that that is a distribution channel, that is how we meet the needs, that is how we have a better product, but we still have the customer relationships. Merchants and consumers know they’re working with Wisetack. So the reputation we’ve built for customer service is becoming an asset because now the providers that we’re going to work with and integrate, they know that we bring this reputation for excellence and customer service, and it benefits our business and obviously, benefits customers in terms of what they get.

Yvette Bohanan:

That’s fascinating to me because a lot of companies that I speak with, they’re in this either/or situation like, “We’re embedded,” or, “We’re customer-facing,” and what you’re saying is you’re both.

Bobby Tzekin:

We are definitely both, and both are really important to what we do.

Yvette Bohanan:

Okay. So we could do a whole podcast just on that. We’re going to take a bigger view of this whole topic for a second here today.

Debbie Bartoo:

Well, let’s talk some more about consumers. There’s a lot of nuance for payments, and particularly in this area, it feels like it’s boiling over with nuance. What’s your thesis about consumers? For example, why aren’t cards enough today? From your perspective, what has traditional consumer lending with the banks and the common providers, really, what have they gotten right, and what have they gotten wrong?

Bobby Tzekin:

So card providers have gotten a lot right, which is why there are so many credit cards in the US, and they’re incredibly convenient. I think the things that don’t work as well with cards are connected. One is everyone knows these days, it’s very expensive to borrow on a credit card. So if I revolve, and I don’t pay off my bill, everyone knows it’s expensive. Actually, most people don’t know exactly how expensive. The other issue, it’s not really customer-friendly in the sense that I’m not sure how much I’m paying, I’m not sure how much the total finance charges will be. I usually don’t know what my interest rate is. So the convenience, the ease of paying is fantastic, but it is very expensive, and a big part of it is due to the negative selection that exists in cards which is… My credit cards were opened more than 10 years ago. So, back then, I applied, I was considered qualified, and I’ve had this open line of credit.

That’s the case for a lot of credit cards, and so what ends up happening is people will mostly keep borrowing on that credit card, keep it as a last resort until something happens that really makes them have to rely on that revolving line of credit, which means when most balances really get added to the open line is at the worst possible time for the consumer, which means the lender is bearing higher risk when those balances are being added. So they have to charge more, and because they charge more, it’s a reinforcing loop. That then drives more of that behavior. Then, I’ll wait until the last moment to use that credit.

With where the industry is going, where you’re seeing these installment payment options, that negative selection doesn’t exist because usually, the consumer is applying for one purchase for a closed-end loan for a limited amount of time, and it could be three months. It could be 12 months. But at that particular time, the lender would know exactly what is the consumer’s credit worthiness at that time and the exposure is capped. So that keeps costs really low in this new alternative model, whereas costs are built to be high in the credit card world.

On top of that, you think about the fact that credit card rails were established more than 60 years ago, and much of the limitations that we have right now, what’s available when I am doing that credit card transaction, which isn’t much. I swiped a piece of plastic, and then I’ll get the statement later at the end of the month. But these days, we all have smartphones, so the products that we make available, while you’re considering the purchase on your phone, you can review exactly how much your monthly payment will be, exactly how much you would pay in finance charges if they apply. So there’s a lot more information. It’s a lot more transparent. It’s more user-friendly. The risk is better managed. So it’s just the products available today can do more versus what was possible with credit cards. I think that’s the biggest difference.

Yvette Bohanan:

Let’s flip it around to the other side of the transaction here and talk about businesses for a second. Businesses go to market globally, right, these days faster than ever, and they all start by accepting cards. We’ve seen some progress for businesses that are small businesses, sole-proprietorships able to take cards now, but a lot of times, it’s not enough. Right? So there’s this diverse long tail of businesses out there, right? You look at all of these graphs, and it’s like most of the business transactions are being done. It’s the 80-20 rule. It’s the Pareto. Then, you have this long tail, and it’s super nuanced. There’s all of these different categories of providers out there in business, and cards don’t reach all of them for all of the needs that they have. When you’re thinking about buy now, pay later in this context of that long tail and where you’re serving not just consumers, but businesses, what nuances… We always wave our hand and say, “There’s all this nuance in this space. Plumbers are different than this, and this is different than that.” What have you picked up on since you’ve started into this journey, and how nuanced is nuanced from your perspective?

Bobby Tzekin:

There’s a lot, and you’re right, they’re very diverse. One thing they all have in common or most of them, I believe, is that in terms of what they need from a product, including a financial product, they’re like consumers in that they just need it to be super simple and easy. If I’m running a small business, I’m just incredibly busy. There are so many things I have to deal with on the business side, personal side. They’re so busy that the typical business-focused product that requires a salesperson to explain complicated pricing and to train my employees, those are much harder to make work both from a cost perspective because I have to… As a provider to these small businesses, I just expend a lot more cost to onboard them and also, just the time investment from the business.

So what we’ve done, which was exciting to see it working, is we applied this model where it’s mostly self-serve for the business, we meet them where they are, which is they keep using the software they’ve been using, we’re integrated in there, and the business can just get going the same as any of us would with any other consumer software product. It’s designed to be self-serve, incredibly simple. We don’t have to explain complicated concepts. That’s one thing, I believe, is key to serving that segment well because it manages the cost, and it actually gives them what they want, which is very quickly meet their needs.

Where they’re different? There are, again, many aspects. One that we see that’s very clear is one delineation in terms of the types of owners of these small businesses. One can be the craftsman. So I’m really into the work. If I’m the craftsman, I want the independence of running my own business. I want to do an amazing job. I love tinkering with the things that I work on, whether it’s plumbing, or electrical, or whatever it is, but I’m not really out there trying to grow the business much. I just want a stable independent living where I do a great job.

The other one would be a more growth-oriented business where even though maybe the type of business is not as scalable as a technology startup, they still… If they are running a home services business, they want to add employees. They want to add more trucks to their operation. So they think more like a business. They’re getting growth capital. They’re training their employees. They’re adding processes. So we see a lot of that as well, and that’s one very clear distinction. There’s many others. Some of them can be, “Do I work in the field? Am I in someone’s home repairing things?” We work with dentist offices as well. So that’s a very different setting than the trades. Hopefully, that helps give you a bit of lay of the land, but yeah, there’s a lot of difference there. They’re very diverse.

Debbie Bartoo:

I was going to say, and then we have the banks, too. These businesses and consumers are their customers, but have they really been missing an opportunity here? From your vantage point, how big is this missed opportunity for them?

Bobby Tzekin:

Banks are paying a lot of attention to what’s happening with installment payments, and what we’re seeing is some of the largest US banks are developing strategies around how to play in that space. They’re seeing what’s happening with e-commerce and how, essentially, every online retailer these days have… that they have a pay overtime option, and so there’s a realization, “Oh, credit preferences are changing. Consumers are opting for something different.” Given that for a bank, the most frequent way to interact with their consumer in terms of credit is their credit card, they understand that method is actually losing market share. I think in terms of usage, it’s still growing, but the new options are growing faster, and so banks… What we’re seeing is they’re very forward-looking in terms of understanding things are changing. We ourselves have built our platform so that now that we have a network of merchants and consumers, we can onboard a bank onto that network, and it can be a part of them being able to participate in this new way for consumers to use credit.

Yvette Bohanan:

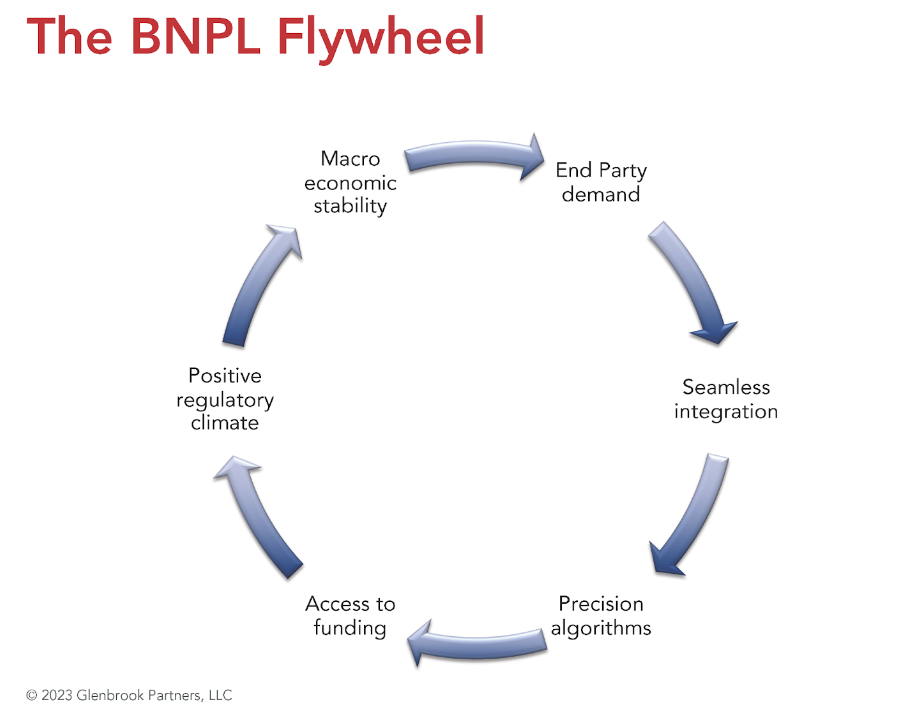

This is really interesting. So when we talk in our workshops about buy now, pay later, I think it is a hot topic. Everyone has been wanting to talk about buy now, pay later for the last couple years. We knew it would probably be big when it started to get some traction. Of course, you were at PayPal. They bought Bill Me Later. So this, to us, is the beginning of the digital era of lending, consumer lending, right? We have a flywheel effect that we’ve observed. So first is you just have to have demand, right, because that’s the classic chicken and egg problem. You have to have people offering it, and you have to have people that want to use it. So we’ve established that here, and it’s a big enough opportunity that even the banks are starting to go, “Hey, wait. We need to do something,” but there’s other things you have to have.

There’s study after study that talks about seamless integration. You have to also have a really good understanding of underwriting, even if it’s just that one purchase. I want to talk to you a little bit about that, access to funding. Funding so you can fund, right, as a provider, and a pretty good macroeconomic environment and regulatory environment goes hand in glove with that. So can we go through each of these aspects and just talk a little bit about… Pick it apart a little bit. What are we seeing right now with the flywheel? Because everyone’s big question is, “What’s going to happen with buy now, pay later?” Right? Is it going to continue to be big? Is it going away? We’ve had some recent news, a firm pulling out of somewhere. I think Australia, right, Debbie? Is that-

Debbie Bartoo:

That’s right.

Yvette Bohanan:

Yeah, and so that gives everybody pause. The CFPB has made some comments here. So there’s a lot going on in the space. So you were talking about the importance of making it easy, and the term “no-code, low-code” gets thrown around a lot right now. What does that really mean? Like you said, you’re letting people use the software that they’ve been using. You’re not going in and having a huge install cycle to do something, but it almost sounds too good to be true. So what’s happening here? How do you get seamless integration to work? Is low-code, no-code the way of the future as I said?

Bobby Tzekin:

That’s one way to offer what I think is the general recipe to be successful, especially with small businesses which, to me, is better, faster, cheaper. If you can do that, then you are offering a better product, and the way we accomplish that, our strategy has been to embed, and so we would integrate with software providers that small businesses are already using, which then means I as a business, I keep using the software I’ve been using. Usually, that software has become my operating system for my business, and we’re integrated in there as a payments provider. The parallel that we all have seen get very well-developed is card processing. There are a number of card processing providers. They’re great at integrating seamlessly. Once they’re integrated, it just takes me a few clicks, and I am set up.

We have the same approach, so the approach isn’t new for financial products. It is new for the types of financial products that we offer. Well, what we offer, we find, is very differentiated. So we’re able to reach businesses and their customers who otherwise wouldn’t have had access to these options. The good news is the channel that we work with and the companies that we embed in are growing massively themselves. In fact, they weren’t even around 15 years ago. The whole landscape of software as a service, that term became a thing in the last decade. So, 15 years ago, we couldn’t have done this business because it is a huge tidal wave that is sweeping over everything. So we think this particular strategy that we have, there’s quite a bit of room to run, and it allows us to meet a new need in the market that’s pretty recent, and it allows us to offer that better, faster, cheaper.

Yvette Bohanan:

When you talked with investors about starting the company and you told them this was your approach to the market, well, of course, that’s how you go to market these days, fast, all that stuff, or was it more skeptical because of the… I don’t want to say you’re in a niche because it’s a really big niche in a weird way, but what was the reaction from your investment community?

Bobby Tzekin:

There were both types of responses sometimes from the same people, and it makes sense in that it is obvious that there’s something there. On the other hand, it’s maybe more complicated than another business model, and so folks would usually see both of the promise, and they would see a bunch of risks, and it just depends on what their experience had been and where they’d come from, but we definitely had a number of folks in Greylock funded our series seed. They very much saw us as not a business where you have to wonder, “Should this exist?” but more of, “How big? How fast?” as in, “Clearly, this should exist,” and the question is, “How big will it be, and how fast will it get there?” I’m happy to say that we’re right. We have had very clear product market fit from the very beginning, and then there were folks who had skepticism because with everything, there’s a number of risks. When they were focused on those, they would get more focused on the areas that there was uncertainty.

Yvette Bohanan:

Did you have any entrepreneurial blindness? You’re so focused on doing this distribution model that you woke up one day, and you were like, “It’s working, but oh my gosh, I completely missed that this could happen.” Was there some set of surprises in the model that really showed up?

Bobby Tzekin:

The most shocking surprise was that there were no big surprises.

Yvette Bohanan:

How pleasant.

Bobby Tzekin:

Well, I didn’t expect that. As always, you create a business plan, and then obviously, I expected that within the first year or two, we would just throw it out the window and have to do something different, but the plan, when we made it made sense, and it turned out every single big assumption in the business plan has played out as planned or better, and so everything worked. There were a number of leaps that were all logical and made sense, and everything worked pretty much exactly as planned in terms of, “Well, here’s who we’re going to integrate with. Here’s how we’re going to serve customers. Here’s what our differentiation will be,” and it worked.

Yvette Bohanan:

You’re serving a lot of customers though because you’ve made that conscious decision to connect with the end consumer which if you would’ve gone down another path in terms of distribution, you wouldn’t have made that connection necessarily. Then, you have the business owner who just wants it better. We’d just say better, faster, cheaper like, “Just make it work, and then get out of my way, and just make sure the payments show up where they need to show up.”

Bobby Tzekin:

Yeah.

Yvette Bohanan:

So you’re doing a lot of support. That must have given some people some pause because that’s a big commitment right there for a startup.

Bobby Tzekin:

Well, yeah, there are a lot of moving pieces, but the good news is it actually gets easier with scale because by now, we’ve oiled all the processes. We have plenty of data to show that it works for customers. It works in terms of the numbers for the business. So this is a great place to be where we said, “Okay. This is complicated, but I think it will work.” Now, it is working, so we just want to scale it and grow it, but all the foundational pieces have been proven.

Yvette Bohanan:

So the seamlessness of seamless integrations, but you got to keep everybody connected in other ways. Interesting.

Debbie Bartoo:

A lot of attention has really been given to buy now, pay later and having precision algorithms using machine learning or even more contemporary data sources to make smarter decisions on who to approve for these purchases. There’s definitely been a lot of debate over whether or not these new algorithms are really much better or if the nature of buy now, pay later just makes it easier to decide because maybe it’s just a single transaction. So, from your vantage point, is it that the buy now, pay later solutions have some secret sauce, or are they simply advantaged by the nature of the transaction?

One of the things, while we’re definitely seeing a lack of reporting to the credit bureaus potentially allowing people to really overextend themselves, and this really creates a lack of visibility for the buy now, pay later providers who do not see how much is actually outstanding, how much outstanding buy now, pay later debt they have actually racked up, so from your perspective, where do you think the industry should be headed in terms of really working with the credit bureaus?

Bobby Tzekin:

Yeah. Let me take the two separately. So the first part around risk management, and is it that the transactions have, just by nature, an advantage, or is it that the BNPL providers are much better? I think it is both as I mentioned because it is closed-end credit for a very specific transaction. Inherently, there’s a better ability to manage risk. They’re better than open-ended credit. I also think in recent years, there have been a lot of new data sources that you can use to better understand risk when you’re managing financial transactions, and the new providers, being newer with more modern technology and just faster moving, they’re better able to use these new data sources. They’re better able to test what works and what doesn’t, and I think the two feed on each other, and so it ends up being a substantial advantage over what legacy providers are doing. I don’t think it’s one or the other. It is both and having both.

When it comes to credit bureaus, that’s a big topic. I do think at some point, the new BNPL providers will end up working with the credit bureaus in reporting. That’s my opinion. I think there are several aspects to credit bureau reporting. One is when a financial provider is reporting, it lets their customers build their credit by having on-time repayments, and that’s the carrot. There’s also the stick where if people aren’t paying back on time, it will negatively impact their credit history. The thing about credit reporting is there’s a first-mover disadvantage as in if I’m in a field of providers, and I’m the first to report to credit bureaus, everybody sees my data, they get the benefit out of seeing how that’s doing, but I don’t get the benefit of others reporting. So I think there will need to be a coordinated move for most of these providers to move.

However, inherently, there’s probably a little bit less of a business need on their side because there’s a lot of repeatability, especially in e-commerce, BNPL. There’s a lot of repeat transactions that each provider is seeing. So, in a way, they’ve built their own ecosystem where if I’m using a particular BNPL repeatedly, if I’m not paying back, then I can’t keep using that provider. So there’s a benefit to the consumer paying back, and because of the repeat nature of these transactions, that provider already has a view of how different consumers are doing. Then, overall, those transactions for e-commerce where most of the adoption has been, they’re very small in dollar value. $100 or $200 is pretty typical. So, in terms of the total amount of obligations that are taken on, it’s not that much, and they’re very short in terms of how long they’re outstanding. So it’s probably less of a currently huge impact to the consumer credit industry. It’s more of a business decision by these providers.

Yvette Bohanan:

The coordinated effort. So we all know in payments, the coordinators of coordinated efforts are often the regulators, and we have some really interesting macroeconomics going on right now. Right? We have a lot happening in payments, and we have a lot happening in commerce, and we have a lot happening with inflation and interest rates. When you look at this in total right now, higher interest rates, certain sections of the job market still being impacted, whether they’re tech layoffs, or coming out of COVID, or this, and that, and the other, we’re starting to get news stories of people using buy now, pay later for groceries, which sends alarm bells off even though a lot of people use their credit cards to pay for milk in that it’s more of the reward-savvy than the necessity kind of situation. So that’s giving regulators some pause, too.

Where do you see it headed? Are you saying that there’s a regulation coming that’s going to get everyone to start using credit bureaus, that’s going to sort of ring-fence some of these offerings? Do you see it being… If the purchase transaction is this much or lower, there’s one set of regs if it’s this much or higher? What does your crystal ball look like here, and how do you see that affecting the industry at large for this buy now, pay later sub-segment of payments? It’s a big question, I know, but you get up and eat this stuff for breakfast, so I got to ask.

Bobby Tzekin:

There are a lot of regulations around consumer lending, and maybe where part of the news has been is that, and maybe we should have started there. When we say buy now, pay later, oftentimes, people are referring to the pay-in-four, so to speak, which is, “I’ll make four payments every two weeks to pay off the transaction.” According to my understanding, that currently is not considered a loan because it’s very short-term and no interest has been charged. So some of the regulations may not apply to those types of transactions. However, there are other types of transactions that often get labeled BNPL that very much are a consumer loan, and all the regulations apply to them. Actually, all of what Wisetack does is in that second bucket. So everything we do is a consumer loan that is regulated as a consumer loan, and that’s very well established and understood.

Maybe there’s a case to say that for those pay-in-four transactions, there will be some changes. I don’t think it will be a massive shift, and it may be as simple as clarifying that here’s the cases in which those transactions apply. Already existing consumer lending regulations will apply to those transactions as well, and that’d be a very simple way to go about it. I don’t think it changes much around the adoption or usage because it’s likely fairly straightforward to add some changes to these products that would easily meet the requirements. So I think, possibly, there’s going to be some changes there, but it wouldn’t shift adoption, and you’re already seeing even when the CFPB was spending more time looking at these pay-in-four options, the letter they published was very balanced, and they said that they understand that these products are meeting a need that wasn’t met before, and they’re doing a lot of good. So there was an understanding that the reason why these products are getting popular is because consumers want to use them, and there’s a benefit. So I doubt that anything would happen to change that. Maybe some streamlining,

Yvette Bohanan:

That’s a good way to put it. I would largely agree with that, actually, but Debbie, what do you think?

Debbie Bartoo:

I agree, and really thinking about another question here. Regulation tends to cut both ways, especially for startups in the regulated space, and with buy now, pay later, are there certain things that maybe from a regulation standpoint had helped with the consumer lending business right now, or maybe there are some that just seem out of date, and maybe it’s time to take a look and update them? Thoughts?

Bobby Tzekin:

That also could be a very long answer. The short version-

Yvette Bohanan:

Yeah.

Bobby Tzekin:

The short version is probably the part that feels out of date is that many of the regulations have incrementally, and there are federal level, and then there’s a lot of state level regulations that are not always in tune. So probably the biggest thing that could help is to do a streamlining and reconciliation, but the regulations are there for a reason, which is consumer protection. So it makes sense that they’re there. It would make it easier for everyone to follow and comply with them if there was some clarification on where some of these are in conflict or at least not perfectly in tune. So then, my answer would be for us running a business in this space, it just takes analysis oftentimes to understand exactly what applies where, and that part can be better where we can take all of the intent of everything that was put in place over time and just streamline what the requirements are and how they apply in different cases. That’s probably the biggest gap.

Yvette Bohanan:

I mean, that’s true in a lot of things right now in payments, right? I think that the stuff that we’re talking about here, you have the speed. I don’t want to say ease because that underestimates the amount of work that you or anyone has to go and put in to go to market, but this sort of… Everything is a service environment, and low to no code, and techs, full stack implementation that you can leverage now. There are a lot more opportunities to get into the lending space than there have been in the past, and it used to truly be just the realm of the banks, right? Now, there’s sponsorships, and there’s this, and there’s that, but you can do this any number of ways when it comes to lending.

I think that and the fact that there is a lot of flexibility in the model and a lot of speed to market being enabled through the tech, the regulations just haven’t caught up, and they are absolutely different by state, and so many other things that… Our driver’s licenses are different by state, right? Come on, you move across the country, and here you are pulling out that book again that you thought you would never have to look at after you were 16. They haven’t reconciled that. They haven’t reconciled money services businesses. There’s been some attempts to make the application process better and harmonized, if you will.

Bobby Tzekin:

It creates a barrier to entry in the space. The complexity creates a barrier to entry, which now that we’re in the space and we have a differentiated product helps us in a way because we’re…

Yvette Bohanan:

Yeah. You might be okay with that barrier being a little-

Bobby Tzekin:

Yeah.

Yvette Bohanan:

Yeah.

Bobby Tzekin:

Currently, it works in our favor. It is a daunting task to consider starting a business in the space because you’re early in the life of the company. One of the substantial line items were the legal costs of ensuring that we’re doing everything the right way.

Yvette Bohanan:

Mm-hmm, mm-hmm. Super important, but very expensive, and then keeping up with it. Once you’re there, just keeping up with it because it is a dynamic space, and this too will change state by state as different regulators come in and decide different things based on what they think is best for their state and their population, so it’s going to be interesting. You’re on an interesting rollercoaster ride here, Bobby. This is cool.

Bobby Tzekin:

The good news is it’s being driven by consumer preference, and it is pulled by the market need in which case, and it feels like many of the products out there are doing a better job at saving costs for consumers and just enabling maybe folks who wouldn’t have had access to similar products. So that’s a good reason to be, I think, playing catch-up from a regulatory perspective.

Yvette Bohanan:

It’s good. In your case, it’s good for small business, too. I mean, I know you like that barrier to entry, but you’re probably going to have competition, and it’s probably benefiting the businesses that there is that competition once it enters in.

Bobby Tzekin:

Yeah. Overall, yeah, I think we are lowering the costs to using these products both for businesses and for consumers. Yeah, more competition over time would mean those costs will keep coming down. Very similar to card processing, what we saw. I remember 20 years ago, it was way more expensive to process cards. These days, everyone knows roughly what the cost is, and it’s come down. I think the same thing will happen for other financial products including the BNPL type flavors.

Yvette Bohanan:

It’s a cycle. Debbie, it is that special time where we’re going to have to wrap up. Thank you so much for being here, Bobby. It’s always a pleasure to catch up with you, and we wish you the very best with Wisetack and the whole team there.

Bobby Tzekin:

Thanks so much for having me. Really enjoyed it.

Yvette Bohanan:

Debbie, congratulations. You made it through your first Payments on Fire Podcast. I hope to have you back co-hosting again sometime soon.

Debbie Bartoo:

Absolutely, Yvette. Thank you.

Yvette Bohanan:

To all of our listeners who made it to the end of the podcast and feel like this just wasn’t enough, and you want to hear more about embedded commerce, buy now, pay later, the business-to-business domain, the business-to-consumer domain, these are all topics we discuss in our on-demand learning modules, on our website, and in our workshops, so please check them out. Until next time. Thanks for tuning in. Keep up the good work. Bye for now.

If you enjoy Payments on Fire, someone else might, too, so please feel free to share this podcast on your favorite social media outlet. Payments on Fire is a production of Glenbrook Partners. Glenbrook is a leading global consulting and education firm to the payments industry. Learn more and connect with us by visiting our website at glenbrook.com. All opinions expressed on our podcast are those of our hosts and guests. While companies featured or mentioned on our show may be clients of Glenbrook, Glenbrook receives no compensation for podcasts. No mention of any company or specific offering should be construed as an endorsement of that company’s products or services.