Get smart about payments - register for the March 10-12 Payments Boot Camp! Save 10% through February 10.

A leading payments industry news source for more than 17 years. Glenbrook curates the news and keeps you abreast of the important daily headlines in payments.

Search Payments News

July 19, 2019

On the wires

SecurCapital Acquires Breakout Capital Finance’s Lending Business

prnewswire

“SecurCapital Corp, an expanding supply chain and financial services provider headquartered in California, today announced the acquisition of the lending business of Breakout Capital Finance, a leading fintech company and nationwide small business lender. SecurCapital is also providing additional equity capital to drive growth in Breakout Capital Finance’s two primary lending products: its highly regarded and innovative term-loan product and its FactorAdvantage lending solution for small businesses that utilize factoring to finance their business. The acquired lending business assets will be operated by a subsidiary of SecurCapital that will conduct business as Breakout Capital.”

July 1, 2019

On the web

Flux, the Digital Receipts and Rewards Platform, Adds Support for Online Takeout Marketplace Just Eat

TechCrunch

“Flux , the London fintech that offers a platform for banks and merchants to power digital receipts and rewards, has unveiled its first partnership with an online-only merchant. The London-based company has managed to sign up Just Eat, the online marketplace for takeout food and delivery. As of today, Just Eat’s U.K. customers will be able to receive digital itemised receipts directly in their Flux-supported banking app immediately after placing an order. At launch, this will include challenger banks Starling and Monzo , with the service rolled out across Flux’s other existing bank partner, Barclays launchpad , later this year.”

June 19, 2019

On the web

Fintech Startup Tally Raises $50 Million to Automate People’s Finances

Fortune

“Tally, a San Francisco-based financial technology startup, has raised $50 million in new venture capital funding. Founded in 2015, Tally aims to automate the financial services of consumers at low cost. The company’s first product, released last year, offered an automatic credit card debt payment service. In March, the firm added an automatic savings account service .”

Token Raises $16.5M in Funding

FinSMEs

“Token , a San Francisco, CA- and London, UK-based open banking platform, raised $16.5m in funding. Backers included Opera Tech Ventures, the venture arm of BNP Paribas, Octopus Ventures and EQT Ventures. The company intends to use the funds to expand adoption of its open banking platform and accelerate new ways of innovating payments with digital money and ID solutions.”

June 13, 2019

On the web

N26 Shares Some Metrics

TechCrunch

“Fintech startup N26 just issued an update on its main metrics. The bank now has 3.5 million customers across 24 European markets. The company is about to expand to new countries, such as the U.S. and Brazil but it sounds like the company is not ready just yet. In addition to the Eurozone, N26 is currently available in the U.K., Denmark, Norway, Poland, Sweden, Liechtenstein and Iceland. If you look at past milestones, N26 announced reaching 2 million customers back in November 2018 , 2.5 million customers in February 2019 . So growth is still accelerating when it comes to user registrations.”

Curve, the All-your-cards-in-one Banking App, Introduces 1% Instant Cashback With Curve Cash

TechCrunch

“Curve , the London fintech that now describes itself an “over-the-top banking platform,” is unveiling a re-vamped cashback feature in a bid to draw in more customers for the premium versions of its Curve card. The company lets you consolidate all of your bank cards into a single Curve card and app to make it easier to manage your spending and access other benefits. With the new Curve Cash programme, customers get 1% instant cashback on top of any existing rewards cards that they have plugged into the app, potentially earning customers double rewards on purchases.”

Trustly and PayWithMyBank Agree Merger

Finextra Research

“Swedish fintech Trustly is merging with Silicon Valley-based PayWithMyBank to create a transatlantic payment network for consumers to pay for online shopping direct from their bank accounts rather than with cards. Together, Trustly and PayWithMyBank will enable merchants with a global footprint to accept online banking payments from European and US consumers.”

June 12, 2019

On the web

Uber Is Pivoting to Fintech, Something Asian Startups Have Been Doing for Years

Quartz

“Uber is looking to hire dozens of staff in New York, drawing from the city’s pool of engineers with experience in financial services, according to CNBC , citing unidentified sources. The team could, over time, expand to more than 100 workers and may focus on payments (reducing transaction costs) and providing financial services for drivers and contractors. Even more radically, the company is debating the feasibility of launching bank accounts, according to the report. Uber already operates the Uber Cash app and launched a branded credit card a few years ago.”

June 10, 2019

On the web

Uber Said to Be Expanding Into Fintech, Boosting NYC Hiring

Yahoo! Finance

“Uber ( UBER ) may be looking to branch out into the financial technology (fintech) industry, which includes a hiring push in New York City and may eventually include banking, CNBC reported on Monday. The ride-sharing giant, fresh off of its IPO , is looking to hire a team focused on the creation of new financial products, according to the report. The team will be based in the Big Apple, where Uber already maintains a large presence, and could ultimately exceed over 100 employees.”

3 Biggest Fintech Trends Shaping Latin America

Crowdfund Insider

“Latin America is one of the fastest-growing regions in the world for mobile usage. In fact, the region ranks third for smartphone adoption globally, behind North America and Europe In 2017, the percentage of the Latin American population with smartphones hit 61% , and LAVCA predicts it will reach 76% by 2025. In Brazil, for example, there are almost as many smartphones as there are people. There are approximately 198 million smartphones in use in Brazil, while the current population is just over 200 million.”

Fintech Platform Synapse Raises $33M to Build ‘the AWS of Banking’

TechCrunch

“Synapse, which operated under the radar prior to (that) Series A deal, is focused on democratizing financial services. Its approach to doing that is a platform-based one that makes it easy for banks and other financial companies to work with developers. The current system for working with financial institutions is frankly a mess; it involves myriad different standards, interfaces, code bases and other compatibility issues that cause confusion and consume time. Through developer- and bank-facing APIs, Synapse aims to make it easier for companies to connect with banks, and, in turn, for banks to automate and extend their back-end operations.”

June 7, 2019

Top Post

The Fintech Bubble Floats Toward a $64 Billion Pin

Bloomberg

“The cuddly mask slips sometimes, though. Trendy U.S. online payments company Stripe, worth some $22.5 billion according to private-market valuations, is joining Amazon.com Inc. and Apple Inc. in warning about the impact of EU rules aimed at getting customers to double-check payments going out from their accounts. The campaign reveals a lot about the state of fintech.”

June 6, 2019

On the web

How Wealthfront Is Strengthening Its Banking Arsenal

Financial Planning

“Wealthfront may be one step closer to becoming a super robo . The Palo Alto, California-based digital firm is teaming up with the banking and financial services company Green Dot to offer clients a Visa debit card and the ability to direct deposit paychecks from employers, Green Dot CEO Steve Streit said in a May earnings call . Streit cited the successful launch of the Wealthfront cash account in February that attracted $1 billion in deposits in just a few months. The robo advisor recently upped the annual percentage yield to 2.51% one of the highest rates in the industry.”

Bunq Launches Travel Card to Make Foreign Exchange Fees Disappear

TechCrunch

“Fintech startup Bunq provides full-fledged bank accounts. But if you’re happy with your existing bank, the company is launching a new free tier so that you can cut down on banking fees. The Bunq Travel Card is a Mastercard without any foreign exchange fee. The company uses the standard Mastercard exchange rate but doesn’t add any markup fee — N26 also uses Mastercard’s exchange rate. Most traditional banks charge you 2 or 3 percent for foreign transactions. When you get a card, you can then top up your account in the Bunq app. You can also send and request money with other Bunq users. But it isn’t a full bank account.”

June 5, 2019

Top Post

We Are “Very Close” to Peak Fintech, With More Than 10,000 Startups Jumping Into the Boom

Quartz

“Financial technology startups are booming . How long will it last? Many venture capitalists are still convinced that the financial sector, despite the vast moat of regulation surrounding it, is due for the kind of disruption that has swept through things like retail and television , according to Curve’s Shachar Bialick. The founder and CEO of Curve, an app that lets customers to link all their credit and debit cards to just one card, says there are more than 10,000 fintech startups around the world, and even he can’t keep track of them all. Some, or even most, aren’t going to make it.”

June 3, 2019

On the web

NAB Backs Online Portal to Boost Bank-fintech Collaboration

Computerworld

“NAB, Israel’s Bank Leumi and Canada’s CIBC have launched an online portal intended to facilitate collaboration with fintechs. The site solicits pitches from fintechs to address a range of challenges facing the trio of banks. A representative of a fintech can select which problems they think they can address, choose which bank they want to pitch to, enter details about their business, and then submit their idea.”

May 30, 2019

On the web

A Silicon Valley Fintech Is Looking to Supercharge Access to Financial Data for UK Startups

Quartz

“Plaid isn’t just a pattern used by Scottish clans that goes back 3,000 or so years. It’s also the name of a technology company that has been building data links between US banks and financial upstarts since 2012. Now the San Francisco-based company is rolling out its services in the UK, Europe’s hub for fintech startups. Most consumers don’t realize they’re using Plaid’s technology, which is aimed at software developers. It provides a kind of connective tissue between financial companies, linking firms like PayPal-owned payment service Venmo with consumer bank accounts, and says its software is integrated with more than 15,000 US banks.”

Online Lender SoFi Has Quietly Raised $500 Million in Funding, Led by Qatar

TechCrunch

“According to SoFi’s release about funding, its pre-money valuation is $4.3 billion, the same valuation it was assigned at the time of that Silver Lake-led round two years ago. Seemingly, that owes to competitive pressure in the space, including a flood of non-bank lending companies that includes Lending Club and Prosper for consumer loans, OnDeck for small and mid-size business loans, StreetShares for veteran-owned businesses and CommonBond and SoFi for student loans. That’s saying nothing of newer online lenders like Affirm, the Silicon Valley startup that’s led by serial entrepreneur Max Levchin and is aggressively chasing millennial shoppers who need loans, or can be easily persuaded to take one, in any case.”

April 30, 2019

On the web

Machine Learning and Data Are Powering Monzo’s Fintech Disruption

The Drum

“App-only fintech startup Monzo is scaling up its machine learning capabilities and plugging employees into the rich stream of data generated by 1.7m global users as it forges ahead of the high-street banks in the digital space. Neal Lathia, data scientist and machine learning lead at the UK-based bank, told The Drum how his team is delivering “incremental gains” in the app, in customer and the product using smarter automation since he took the role on one year ago.”

March 26, 2019

On the web

JPMorgan’s Clampdown on Data Puts Silicon Valley Apps on Alert

American Banker

“Long-simmering tensions between the financial industry and Silicon Valley startups are erupting behind-the-scenes into a battle over the reams of valuable data held inside Americans’ bank accounts. In recent months, major banks including JPMorgan Chase and Capital One have led the industry into a fresh campaign to control how outsiders tap into sensitive customer information. The lenders say their highest priority is protecting consumers.”

March 14, 2019

Top Post

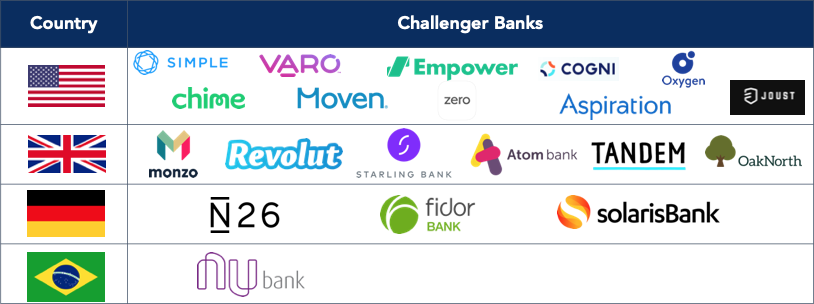

Challenging the Challenger Banks

Glenbrook Partners

“Fintech start-ups have begun a phenomenon some call the “unbundling of financial services” through stand-alone products such as unsecured consumer loans, credit cards, checking and savings accounts, or personal financial management tools. A cohort of entities known as “challenger banks” or “neo-banks” have also entered the market in an attempt to take on digital banking itself with user-friendly product bundles that include checking, savings, debit, and money management tools.”

“

January 30, 2019

On the web

Amex blocks Curve as the fintech startup vows to fight “anti-competitive” decision

TechCrunch

“Well, that was short-lived: Just 36 hours after Curve, the London fintech that lets you consolidate all of your bank cards into a single Curve card, re-instated support for Amex, the feature has once again been unceremoniously blocked by American Express. This time, however, the context feels very different from 2016 when the startup was barely off the ground, with Curve telling customers in an email this morning that it intends to “fight Amex’s decision with our full might”.”

December 18, 2018

On the web

How a Chinese anti-virus software maker builds a fintech firm to wrestle with giants

TechCrunch

“360 Finance, an online consumer loan platform that spun off from China’s anti-virus service giant 360 Group, has joined a raft of Chinese fintech companies to go public in the U.S. over the last two years.”

November 9, 2018

On the web

Mash and Nets Partner For Pay Later Solution Across Nordics

Banking Tech

“Mash and Nets have teamed up to provide a “pay later” solution to merchants across the Nordics. As the name suggests, this will offer consumers an option to pay later for purchases while “enabling merchants to increase their average basket size, growing their business”. At the time of purchase a user can select the Mash option from a Nets enabled terminal for instant on-boarding and credit approval. Within 14 days, the consumers will receive an invoice to pay the balance in full or choose to convert the payment into a monthly instalment plan.”

November 7, 2018

On the web

Consumer Expectations, Open APIs and the Evolution of Bill Pay

Banking Journal

“The evolution of financial services over the last decade has been dictated by fintech companies with a tight focus on experience. The resulting landscape of thousands of easy-to-use options for payments, savings and planning has fundamentally changed how account holders view the relationships they have with their financial institutions.“

March 21, 2018

On the web

How digital banks are raising the bar for customer experience

Tearsheet

“Digital-only challenger banks have changed customer expectations, including customer service and how customers want to use financial products. Big banks are taking notice, with companies developing sub-brands to hook younger, digital-savvy customers or others — the most recent of which is rumored to be the Royal Bank of Scotland.”

March 13, 2018

On the web

Ride hailing app Grab launches financial services unit

Finextra

“South East Asian ride-hailing firm Grab has moved deeper into financial services with the launch of a dedicated unit and the introduction of micro-loans and insurance products. Grab Financial will encompass all of Grab’s fintech offerings, including payments services, rewards and loyalty services, agent network services and now also financial services.”