Introduction

For those of us who follow the payments industry, it has been difficult in the past few years to avoid the hype around payments orchestration. The ubiquity of the term begs the question: what exactly does payments orchestration mean? We see the term used to describe providers serving FIs that will “orchestrate” – i.e., optimize – routing for fast payments, and providers offering risk orchestration have emerged in the fraud space. However, orchestration is most frequently used in conjunction with merchant payments acceptance, whereby Orchestration Platforms tout the myriad benefits they bring to merchants, including improved authorization rates, lower overhead costs, and greater speed to market.

In this post, we will objectively review the topic of payments orchestration for merchants, avoiding marketing jargon and spin, to decipher what is being offered, in what forms, and by which types of providers. Later this week, we’ll explore the benefits of orchestration, whether 3rd party Orchestration Platform solutions are the right choice for all merchants, and the characteristics that promote good fit.

Merchant Payments Orchestration Defined

Before we define payments orchestration, it’s helpful to first look more broadly at the concept of orchestration. The dictionary definition of the verb orchestrate is “to arrange or combine so as to achieve a desired or maximum effect.” [1] In systems administration, “orchestration is the automated configuring, coordinating, and managing of computer systems and software.” [2] Hence, the concept clearly includes the utilization of multiple component parts in a combined and choreographed fashion that, through their combination, gives the user a superior outcome.

As applied to payments, there are many different descriptions and definitions that have been postulated, and indeed, many solution providers promoting their orchestration credentials. However, we seek here to offer a definition focusing on pure-play Payments Orchestration Platforms and contrasting that definition with other payments service solutions.

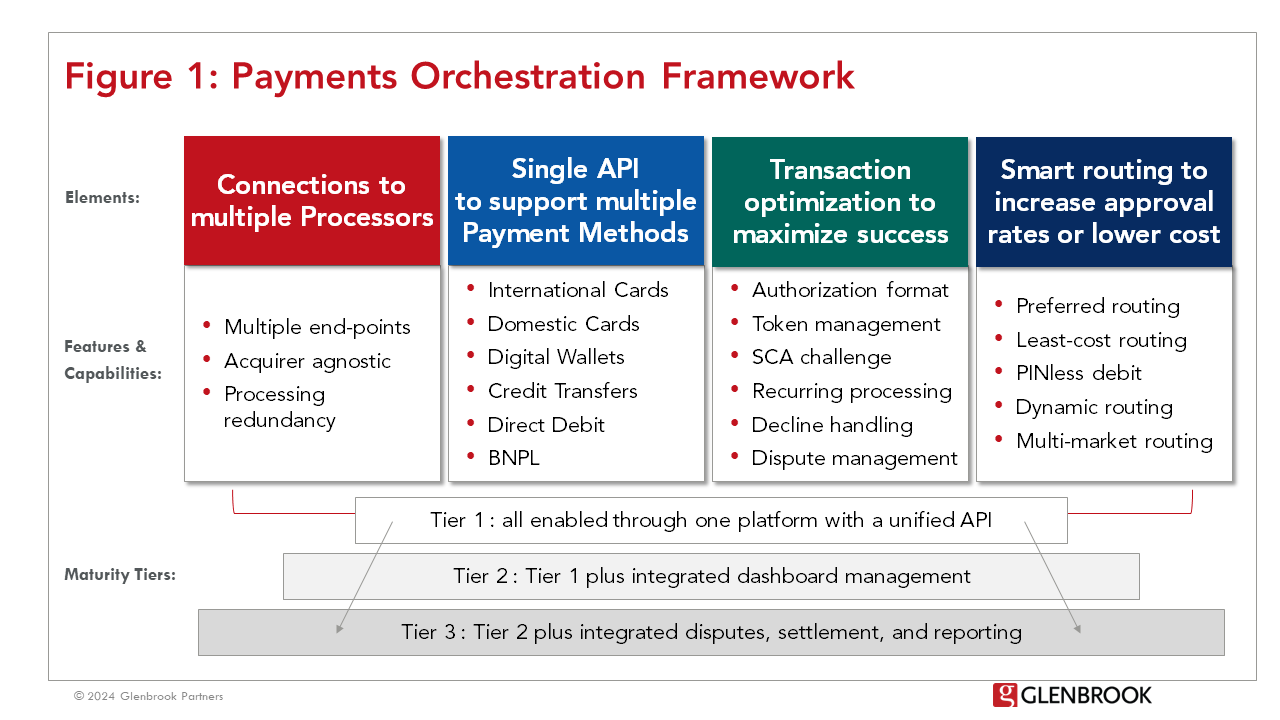

Cutting to the chase, we believe that a full Payments Orchestration Platform solution can be characterized as including the following four elements with the first element being primus inter pares (first among equals):

1. Connections to multiple processors or acquirers within a given geographic market giving a merchant the ability to swap out one processor for another, providing greater operational processing resiliency

2. A single integration point through which merchants can access relevant geographies, payment methods, and related services

3. Transaction optimization solutions to maximize the authorization success of individual transactions; including tokenization capabilities, decline management, and step-up authorization rules

4. Smart routing capabilities that can dynamically vary the flow of payments across different networks, regions, or acquirers to lower costs or increase performance.

Of course, these four elements are ideally supported by integrated reconciliation, reporting and management through a single dashboard providing operational efficiency for the merchant.

Merchant Payments Orchestration: How did we get here?

Why is this our definition? To explain, it’s helpful to look back at the evolution of the payments ecosystem and some of the participants within it to illustrate the capabilities that relate to modern-day payments orchestration. The modern Orchestration Platform can be seen as the market evolution of two payments lineages: the gateway, and the modern, full-stack payments service provider (PSP).

Following the early days of e-commerce, we saw gateways (like Cybersource) emerge – and exist today — as a single integration point for merchants to connect with a range of acquirers (typically a single acquirer in a given geography). The benefit to merchants being that it allows, for example, airlines to more easily reach acquirers all over the world as they expand their e-commerce activities into new geographic markets. This single integration point provides clear operational and technical efficiency benefits to those merchants.

Fast forward to the last 10-15 years and we start to see a number of global PSPs (like Adyen, Stripe, and Checkout). Not only do these providers offer merchants local acquiring capabilities around the globe through white-labeled solutions or their own acquiring licenses, but also connections to a long list of alternative (non-card) payment methods that are highly prominent to consumers in specific local markets – all through a single platform integration. Beyond streamlined access to card acquiring and payment acceptance, this cohort of PSPs are also providing merchants intelligent solutions to improve authorization success rates (like smart retries) or reduce transaction costs (like PINless debit card routing in the US) to optimize performance.

Gateways and global PSPs provide many features and capabilities commonly considered as part of the payments orchestration puzzle. However, a critical distinction between pure orchestration providers and other payment services is their ability to dynamically route transactions between different acquirers in a given market. This capability provides processing redundancy and differentiates pure Orchestration Platforms (like Spreedly, Gr4vy) from PSPs (like Adyen, Stripe, Checkout, which reside in the flow of funds).

We can continue to compare PSPs and Orchestration Platforms through the merchant lens and objective of achieving the best performance at every step of the payments value chain. The PSP value proposition is that, in aggregate, it can bring the best end-to-end solution package to the merchant.

In contrast, the value proposition of the Orchestration Platform is to bring the best 3rd party point solutions together seamlessly with the accompanying routing and optimization logic, enabling a merchant to compare the performance of one PSP or acquirer with another.

Hence, of the four elements of our payments orchestration framework, it is the connections to multiple processors which is key to our definition of a payments Orchestration Platform.

Variations between Orchestration Platform providers

You may ask then; how do Orchestration Platforms vary? Undoubtedly, they offer differing flavors and combinations of solutions across the orchestration elements. From our vantage point, we don’t currently see a single provider offering all of the capabilities across all of the elements in the framework (and certainly not within transaction optimization), at least not to a strong level of maturity. There are also varying degrees to which a merchant can manage and control all the individual aspects through a single integrated dashboard (as illustrated in the Payments Orchestration Framework in Figure 1).

Another key dimension that differentiates Orchestration Platform providers is their approach to the business logic that underpins their smart routing capabilities. We can envision this as a spectrum with, at one end, a simple user interface that enables merchants to define and set their own routing rules, and at the other end, inbuilt intelligence to autonomously define routing logic. In reality, Orchestration Platforms will fall somewhere along that spectrum offering merchants varying degrees of support in setting and refining the routing logic including combinations of: pre-existing rule sets that can be customized, industry-benchmark data to inform processor selection, or preferred processor recommendations to build into routing logic.

As we conclude the first part of our Payments Orchestration series, we have lifted the hood on orchestration, shed a light on the components of Orchestration Platform engines, how they differ, and how they compare with other payment solutions. Later this week, we will continue to ‘demystify payments orchestration’ as we explore the key benefits and level of fit with differing types of merchants.

[1] Merriam-Webster dictionary definition of the verb to orchestrate https://www.merriam-webster.com/dictionary/orchestrate

[2] Erl, Thomas (2005). Service-Oriented Architecture: Concepts, Technology & Design. Prentice Hall. ISBN 0-13-185858-0.