Since the media latched onto Bitcoin as good fodder for the 24 hours news cycle, the hard focus has been on Bitcoin, its merits, and shortcomings, as a currency, commodity, and as next generation payment rails.

My thinking on its currency and commodity aspects is straightforward. If you don’t understand Bitcoin, don’t buy it, caveat emptor. And volatility is a feature of thinly traded anythings so price stability at this early stage is just not going to happen. Amidst all of that, Bitcoin’s USD value has found what looks to be a solid floor at the $600 level, despite the Mt.Gox meltdown and occasionally grumpy news from global regulators.

You have to admit, Bitcoin is resilient if nothing else, and that indicates that the math-based currency model is here to stay.

But let’s take another step back. Let’s say that Bitcoin doesn’t survive because of functional shortcomings. Putting aside money supply and central authority arguments, Bitcoin falls short in the areas of speed, programmability, and power consumption.

Speed. It takes about ten minutes for a transaction to be written to one block in the blockchain. You want more speed. While even an hour is plenty fast for most ecommerce transactions of physical goods, it’s not too good for POS transactions. Risk arbitrage can span the time gap but that adds cost.

Programmability. Bitcoin has a built in scripting language that is used to manage the security and currency handling aspects of each transaction. It can even be used to manage multiparty transactions, simple escrow-based transactions for use with a third party mediator, and some simple “smart contracts.” For more sophisticated application such as complex contracts, autonomous agents, and blockchain-mediated relationships, Bitcoin’s scripting language runs out of gas.

Power Consumption. Many of us are aware of the energy density required to operate Internet data centers run by the likes of Google, Facebook, Apple, and countless others. Computers, disk drives, and networking gear, never mind the air handling systems needed to keep them all cool, consume plenty of power. That’s why major Internet providers install solar and wind power, locate in cool climates, and near cheap sources of electricity. Mining Bitcoin is a particularly power intensive activity. Computational efficiency has increased with the latest Bitcoin mining gear, based on application-specific integrated circuits (ASICs) that do one thing (run the SHA-256 hashing algorithm) very, very quickly. But even with that, given the scale of the Bitcoin network (bitnet), it now consumes half as much energy as is used by all of Cyprus. Energy intensity only goes up with Bitcoin’s value as the reward increases in value and the hashing rate increases.

A currency with a carbon footprint larger than a country seems like a backward step.

These are just a few candidate reasons for Bitcoin obsolescence. Regulatory compliance concerns could pressure change as well.

Conditional Money, Global Asset Register

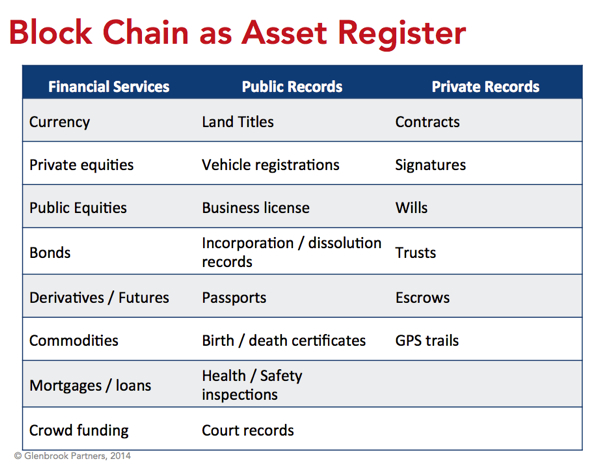

Thinking beyond Bitcoin’s currency and commodity attributes, the blockchain may be used as an asset register, a public record of ownership. That is a compelling notion. Dozens of ideas (see figure below) suggest the power of this model.

Imagine using the blockchain to manage a car loan and transfer of ownership. If the borrower does not stay current with his payments, scripting in the block chain can remotely shut down the car’s Bitcoin-enabled computer (OnStar to off switch). Once all payments are made, ownership of the vehicle can be automatically transferred to the borrower, recorded in the blockchain. The transaction, and trust, is managed by algorithm.

Such flexibility could produce substantial changes in how we transact, track ownership, create business entities, and manage trust. It may not be that Bitcoin as it’s currently designed will get us there. We may need a Ripple from Ripple Labs or another “alt coin” model that addresses these and other shortcomings. Just as HTTP rides over TCP/IP, we may need another more sophisticated layer to ride above Bitcoin 1.0. That’s what the Ethereum platform promises to do as a “next-generation smart contract and decentralized application platform.”

So, don’t get too attached to how Bitcoin looks today. It or its immediate successor is going to change. Moving to another math-based currency may be in your future because we are only at the end of the beginning of the math-based currency journey. This will take time. While Bitcoin and its competitors may run on the Internet, they also handle money and value. Whenever the Internet and money meet, the machinery of change downshifts to a more sedate pace, far slower than the next smartphone app release cycle or social network update.

If you’re in the Bay Area March 26 or think you can make it to Mountain View, come join us for the Bitcoin: Basics and Beyond one day Insight workshop. Details are here. We will discuss these issues and much more. Hope you can make it.

This Payments Views post was written by Glenbrook’s George Peabody.