Over the past several years, I have focused my time and energy on projects aimed at increasing financial inclusion in developing countries to help alleviate poverty. I feel fortunate to work in this arena; I find it both rewarding and interesting.

Recently, as part of a project, I interviewed a number of people working on financial inclusion efforts in their home country. Time and time again, interviewees cited, and you could feel, their passion on the subject. They want to improve access to financial services within their country, believing that increasing financial access would have a profound positive impact on their friends, peers and country wo(men).

Humbled by the responses, I started to reflect on how those in similar circumstances have fared in my own backyard, the United States. Here’s what I found:

Poor, Wanting and Without in the U.S.

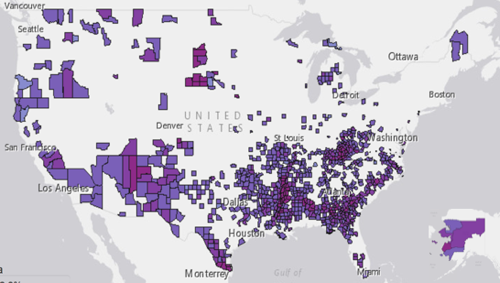

According to the United States Census Bureau, the official poverty rate in 2015 was 13.5%. (Poverty thresholds are variable and determined by the number of persons in a household. A single person under 65 years of age was considered living in poverty if he/she made less than $12,331/year). Though poverty averages continue to decline in the US (thanks to a number of robust efforts by the government, NGOs, and the private sector), a significant number of counties still experience poverty rates of 20%+ (see map below).

Fortunately, there are effective mitigations that can decrease poverty rates. Perhaps the most fundamental are programs to improve access to financial services. A number of studies have shown that such access helps to alleviate poverty. For example, a 2015 study by the Asian Development Bank, ‘Financial Inclusion, Poverty, and Income Inequality in Developing Asia’ discovered that ‘financial inclusion significantly reduces poverty; and there is also evidence that it lowers income inequality.’

A recent Science Magazine paper by Suri and Jack representing MIT and Georgetown University, respectively, titled ‘The Long-run Poverty and Gender Impacts of Mobile Money’’, makes the case that “mobile money (or digital financial services) has increased the efficiency of the allocation of consumption over time while allowing a more efficient allocation of labor, resulting in a meaningful reduction of poverty in Kenya”.

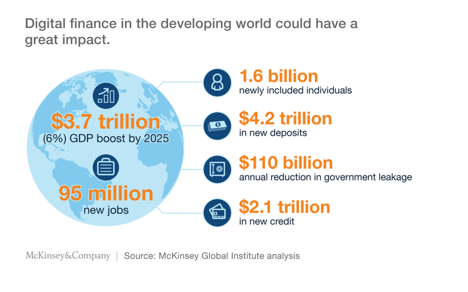

The McKinsey Global Institute outlined the impact digital finance could have in the developing world, illustrated by the following diagram:

Comparing Access Rates to Financial Services

So how is the US doing at providing access to formal financial services? According to the Federal Deposit Insurance Corporation (FDIC), in 2015 7% of households in the US were ‘unbanked’, meaning the household has no account at insured financial institution. An additional 9.9% of households were considered ‘underbanked’, meaning the household has an account at insured institution but also obtains financial services and products outside of the banking system.

How does this compare to other G20 countries? The Global Findex reports that in 2014, 93.58% of the US ages 15+ had access to a financial account compared to 99.10% of Canadians, 98.76% of Germans and 96.58% of French (The Global Findex database provides in-depth data on how individuals save, borrow, make payments, and manage risks.)

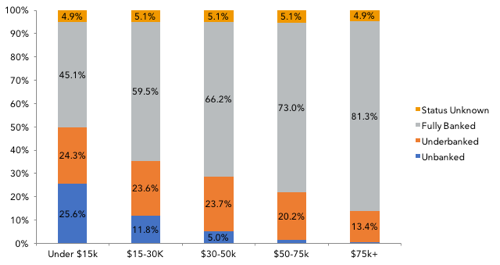

However, as you may have guessed, in the U.S. the percentage of unbanked and underbanked households increases substantially as income decreases. Nearly 50% of households who earn less than $15K/year are unbanked or underbanked (see graph below).

Furthermore, age, education level and minority status are correlated to financial access:

- Unbanked rates are higher for younger consumers (13.1% of 15-24 year olds and 10.6% of 25-34 year olds are unbanked compared to 3.1% of 65+).

- Unbanked rates are higher for those with less education (23.2% of those with no high school diploma and 9.7% of those with a high school diploma but no college are unbanked compared to 1.1% of those with a college degree).

- Unbanked rates are higher for Blacks and Hispanics (18.2% of Blacks and 16.2% of Hispanics are unbanked compared to 3.1% for Whites, 4.0% for Asians and 11.1% for Other).

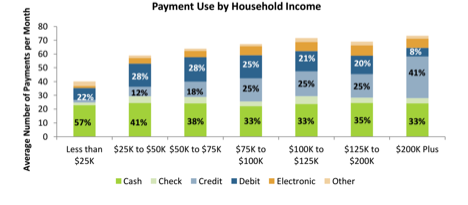

Low income consumers continue to primarily use cash: 57% of transactions, by count, for household’s earning less than $25K per year were conducted in cash, compared to 33% for households earning $75K+ per year (see graph below)

Making It Better

So how do we improve access to financial services in the US, particularly for those who live in poverty?

Digitizing payments systems and account access is commonly cited as a catalyst leveraged by other countries working to increase financial inclusion. For example, a report titled, ‘The Opportunities of Digitizing Payments: How digitization of payments, transfers, and remittances contributes to the G20 goals of broad-based economic growth, financial inclusion, and women’s economic empowerment’ by the Gates Foundation, the Better than Cash Alliance, and the World Bank Development Research Group supports and builds on this claim. The report points out that “digitizing helps overcome the costs and physical barriers that have beset otherwise valuable financial inclusion efforts” and that “digital platforms offer the opportunity to rapidly scale up access to financial services.”

The US arguably has strong digital payment platforms, systems that typically require a digital mechanism to access. And the unbanked appear to have access via mobile devices. According to the FDIC, in 2015, almost 70% of unbanked consumers have access to a mobile device and over two in five have access to a smartphone.

How do we take advantage of this opportunity?

We should promote programs, organizations and policies that recognize, and are already seizing upon, digital as a means to improve financial inclusion and upward mobility, such as the Center for Financial Services Innovation which works to lead “a network of committed financial services innovators to build better consumer products and services” or the Financial Solutions Lab which is a “program that seeks to identify, test and bring to scale promising innovations that help Americans increase savings, improve credit, and build assets.” (listen to Glenbrook’s podcast), or the Consumer Financial Protection Bureau which created “Your Money, Your Goals”, a tool for organizations to help the underserved build financial skills and knowhow.

We should also continue to look to other countries like Canada who have strong rates of financial inclusion across wage brackets for best practices and lessons learned. For example, the Canadian government coordinated with local provinces to integrate financial education into the school curricula to improve financial literacy.

And, finally, we should maintain the awareness that poverty and financial exclusion remain critical issues in the US have profound negative and confounding impacts on those living in poverty as well as those of us who don’t.

These are our neighbors – and this is our country. When those around us need help and providing that help benefits us all, we should do more. Like what, you ask? I welcome your ideas and comments.