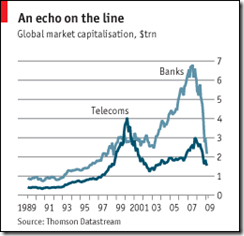

The Economist observes that the downfall of the telecom industry (1997-2003) offers foreboding lessons for today’s bankers.

Just like banks, telecoms had imperial bosses, kamikaze deals and incomprehensible jargon—if collateralised-debt obligations troubled you, try gigabit Ethernet routers. In telecoms leading firms were reduced to indebted objects of ridicule. The consequences were bankruptcies, huge job losses, fraud, trashed reputations and, eventually, a clean-up.

By these standards, banks remain in a fantasy world. They are largely still run by the same people, they have a piecemeal approach to cutting leverage, and their goal, beyond firefighting, is to tinker with their portfolios, removing areas of egregious excess. If the telecoms industry is anything to go by, this gradualism will fail.

Read more:

Lessons from the telecoms bubble (1)

Crash course: What can banks learn from the clean-up after the telecoms crash of 1997-2003?

Lessons from the telecoms bubble (2)

Adulation: Tips on taking charge of a basket case in a broken industry, from KPN’s boss

Feb 26th 2009

From The Economist print edition