Now that the recent fever of Bitcoin speculation that swept up both a worried global constituency and a hype-hungry media has subsided, it’s time for Glenbrook to examine the Bitcoin ecosystem in particular and math-based currencies in general. While there is still no end of open questions, certainties have emerged as well. This Payments View post addresses a few of them. It is also the first of a series by Glenbrook on Bitcoin’s role in value transfer. While the Bitcoin currency has strong commodity-like characteristics—gold does come to mind—it is the potential of Bitcoin in value transfer of all kinds and payments in particular that has caught our imagination.

We’re not alone. Scores if not hundreds of Bitcoin start-ups are seeking funds from the smallest of angels as well as the VC archangels on Sand Hill Road, NYC, Boston, and almost everywhere else.

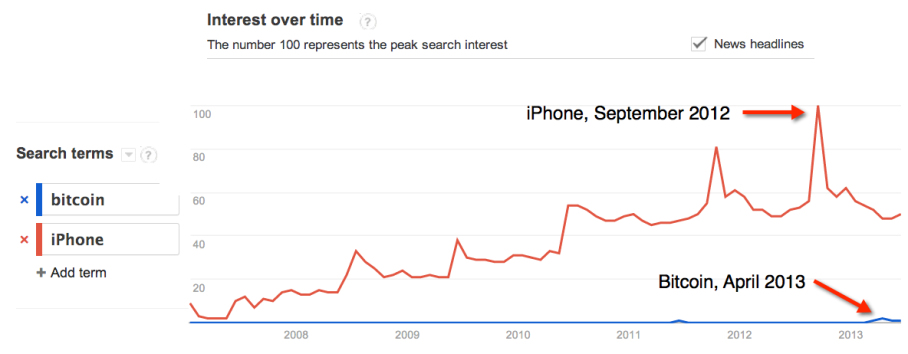

Now that Bitcoin has survived at least two major crashes and the accompanying media hype cycle has subsided (see the Google Trends chart below), it’s time to get real on the topic. Let’s begin with a few things we know.

In Bitcoin, Some Trust

Bitcoin is a resilient currency because of the trust a broad set of users have in it and that’s despite recent history that’s tested that faith.

Bitcoin’s been through several wild rides, not the least of which took place in April. That ride was fueled by a number of factors, including:

- The media hype cycle (see the previous chart). While non-state, fiat currencies deserve thoughtful examination by economists and regulators, there was a lot of hype. But not even close to iPhone levels. (Just to keep this in perspective, check this version of the chart).

- Well founded concerns for currency value and availability in places like Cyprus and Argentina

- The organic spread of interest in Bitcoin as investment and currency

- Manipulation of exchanges. A look at the chart of Bitcoin value and volume (below) is revealing. Immediately after btc peaked at $230 on April 9, a precipitous drop began, fueled by DDoS attacks on dominant exchange Mt. Gox. Panicked Bitcoin holders fled, driving the price down by 70% in a week. And then btc trading volume spiked once more.

Since the April ride, the dollar value of btc has fluctuated between $100 and $150, settling down in this week’s range at just over $120. Homeland Security’s investigation of Mr. Gox as an unlicensed money transmitter didn’t affect price at all. Indeed, it’s risen since then.

It’s this price stability that is significant. It’s proof that there are some (unknown number of) hundreds of thousands who believe in Bitcoin.

In Dollar Terms, Not a Big Deal. Yet.

Bitcoin is proof we love shiny new things, excitement, and a bit of mystery. But the numbers tell a modest little story about an experimental new currency that’s getting some traction. A little perspective is in order:

At the current range of value of $125 / btc and 11.249 million btc mined, the total dollar value of all that btc is just over$1.4B. Not bad at all for an experiment but, for example, Bitcoin’s “market cap” is less than half the annual sales of California grocery chain Raley’s, which occupies the number 100 spot on the NRF’s 2012 Top 100 Retailer list.

In other words, we’re not talking Big Money here. Yet. It’s the “yet,” of course, that’s gotten our attention.

It’s Still Amateur Hour

While angels, archangels, some nefarious types, and just plain miners evaluate their options, entrepreneurs by the hundreds have been brainstorming new ways to make money in Bitcoin. As a programmable platform, it has endless potential (more on that topic later).

But simple development of the transactional infrastructure around the Bitcoin core has been a first order of business because a functional Bitcoin ecosystem requires currency exchanges, trading platforms, wallets for individual uses, and vaults, among others. Exchanges and wallets, in particular, have been the focus of early entrepreneurial effort and the results have been, from a security point of view, mixed.

Multiple exchanges have been hacked via the standard toolkit of social engineering, phishing for malware delivery, and other tricks. Some of these breaches were childishly simple. While actually doing something with stolen btc appears to be quite difficult, it’s hard to be confident in such weak operations.

Of more concern is the market concentration of exchange functions in Mt. Gox. With some 70% of the overall volume, over reliance on its services cannot be healthy.

Given the panic sown by the DDoS attacks against Mt. Gox, Bitcoin needs more redundancy at exchange points and better run exchanges at that. To that, the FinCEN’s classification of miners selling bitcoin for profit and exchanges as money transmitters could be a very healthy stimulant to professionalizing the ecosystem. Acquisition of money transmittal licenses is a fiscally non-trivial activity, requiring $1 million and more in legal fees, licenses, and effort to cover the US. If investment follows talent and has an ounce of prudence, then stronger operators should emerge, fuelled by smarter money, to create more reliable, secure services for the Bitcoin community.

Bitcoin Will Be Hard to Kill

Internet history demonstrates that once a new capability is introduced that gains user traction it is hard to dislodge. This is particularly true for services that operate at multiple levels. Bitcoin operates as a P2P network that has its own API. Bitcoins can be programmed via its transaction scripting language, a powerful way to define novel, flexible transactions. Its JSON-RPC APIs expose services valuable to client-facing wallet and other user applications.

Open source, decentralized tools have legs. The star-stable Internet is growing another leg. Whether or not it becomes the native means for programming money on the Internet won’t be decided for years. Even if governments regulate it into the shadows, Bitcoin will be very hard to kill.

Glenbrook has assembled a practice around math-based currencies for two constituencies: first, for members of today’s payments industry trying to discern opportunity in the Bitcoin ecosystem and for Bitcoin entrepreneurs confronted by the incumbent payment industry’s rules and complexities. We’re looking forward to exploring the potential of what looks certain to become a permanent component of internet infrastructure. Let us know what you think!

[Editor’s Note: Follow Bitcoin news on our PaymentsNews.com daily news blog!]