I am in London this morning, where I had an opportunity to present a vision for the future of business payments at Experian‘s Payments Strategy Conference 2013. Acknowledging that it is always dangerous to make predictions, this is what I envision for the future of B2B payments:

Interoperability — I expect the future of business payments will be dominated by an ecosystem of interoperable solutions, across ERP and accounting platforms, supplier networks, and payment schemes, so that data flows freely between counterparties and their preferred vendors.

Track and Trace — As a result of that interoperability there will be transparency so that suppliers understand when they will be paid, and can plan accordingly. From our B2B payments work here at Glenbrook, we’ve heard time and time again that predictability is more important than speed.

Rational Transaction Pricing — And finally, in the future, B2B transaction pricing will be determined not by the payment method (wire, bank transfer, check, card) but by a combination of factors including: urgency, finality, transaction value, and the manner in which remittance data is delivered (PDF, via a web portal, or in a system-digestible format).

That sounds good doesn’t it? Interoperability, predictability and value based pricing, what’s not to like?

How on earth do we get there? I have six suggestions for you:

1. Shift focus to match changing business demographics

As an industry, we need to re-align our focus to match the changing nature of business. Manufacturing is no longer the powerful economic force that it once was – at least in developed markets. Distribution is growing and increasingly relying on the Internet, replacing costly sales teams, and creating opportunities for electronification. Services are booming and companies in the service sector often sell to both consumers and other businesses. They are far more likely to have embraced card payments. Recurring transactions are evolving as an important, underserved need of services businesses.

An important related trend is the movement from a traditional employee model to using more contractors, individuals acting as businesses, particularly as economic recovery continues to be weak and businesses are reluctant to take on full time employees.

The consequence of trend is that businesses must deal with more unknown counterparties. Counterparties are more likely to be small businesses or even individuals and these smaller, growing businesses are often less well served by banks because their needs fall between retail and enterprise platforms.

2. Mimic consumer technology

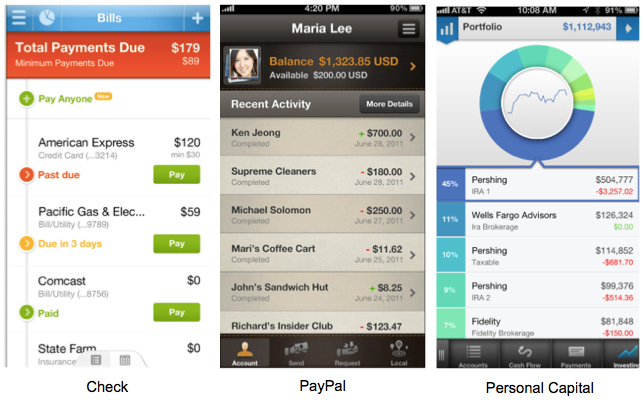

Successful enterprise solutions will mimic consumer technology. They will endeavor to make solutions easy to use, provide customization and immediacy, and mask complexity. Consumerization creates a sense that things “just work.”

As you develop next generation tools for your business customers, look toward examples such as these:

And not this:

3. Embrace technology to mask complexity

While it is important to make things look good and be easy to use, even more important is technology that overcomes the inherent complexity of overlapping solutions in the B2B ecosystem. APIs make it much, much easier for various cloud-based solutions to develop interfaces. And as more and more enterprise solutions move to the cloud, and businesses of all sizes gradually adopt them, this becomes a key driver of interoperability.

So you, Buyer, use your system, and as a Supplier, I’ll use mine but eventually they will talk to each other, so neither of us winds up hand-keying invoice and payment information into our accounting software. Back office bliss.

4. Resist network fantasies

But in order to achieve interoperability we, as an industry, are going to have to give up our network fantasies. What’s a network fantasy, you may ask? Solutions have to work for BOTH buyers and suppliers in order to achieve critical mass. The network effect is very, very powerful, but it is also very hard to achieve. [More on network fantasies here.] Beyond the card networks and PayPal very few payments network fantasies have been realized.

Glenbrook estimates that no more than 5% of B2B spend is through B2B networks. If B2B networks that currently compete with one another for scale would play nice with one another, and be interoperable, then perhaps the pie would grow larger.

eInvoicing is on the rise. Largely through mandates – Mexico recently made an announcement, Brazil has established requirements, Northern Europeans have been at this for awhile, and leaders in the space. How can we leverage the movement toward delivery of eInvoices to drive electronic payment? Is there an opportunity to facilitate broader participation and interoperability as a result of eInvoicing mandates? Can we utilize these platforms to pass the critical remittance info (“What’s this payment for?”) from buyer to supplier?

5. Recognize that there are many ways to pay and be paid

Let’s ponder for a moment the variety of methods that businesses use today to make payments (figure below, via gtnews and AFP). What’s striking here is the persistence of checks – they are listed twice (cut by you, cut by your bank)!

Providers that hope to capture 100% of a company’s payment flows, whether making payments via AP or receiving payments via AR, are setting themselves (and their investors) up for disappointment.

6. Choose a sustainable business model

One reason that payment solutions or schemes aren’t gaining traction with business buyers and suppliers is that they may not have a sustainable business model. Adoption is predicated on the fact that the person, or company, paying the provider is doing so gladly for benefits received. Consider two examples:

- The payer may not be aware they are paying: the FX that businesses pay for their nuisance cross-border transactions because they are so focused on fees, not spreads.

- If payer is begrudgingly paying: suppliers accepting purchase cards for invoiced transactions that have historically been paid via check or ACH.

In neither of these cases is the entity paying for the payment solution delighted. Delighted customers are dependable customers, delighted customers migrate transactions to your solution, delighted customers happily accept your payment method and encourage their customers to use it, too.

Very recently Ariba announced that it is going to partner with Discover to offer a payment solution [more here]. We have many, many open questions – but what we do know is that this is potentially a large-scale experiment with value based B2B transaction pricing.

I’m eager to hear whether your vision for the future of business payments resembles mine — reach out if you’d like to discuss.