Download the PDF of our Regulatory Analysis of KYC for Covid-19 in Emerging Markets or read the web version.

Among today’s most pressing questions for emerging market governments is how to get assistance funds into the hands of those who need it given the COVID-19 crisis. This need is especially acute in emerging markets that lack broad government-issued, national IDs.

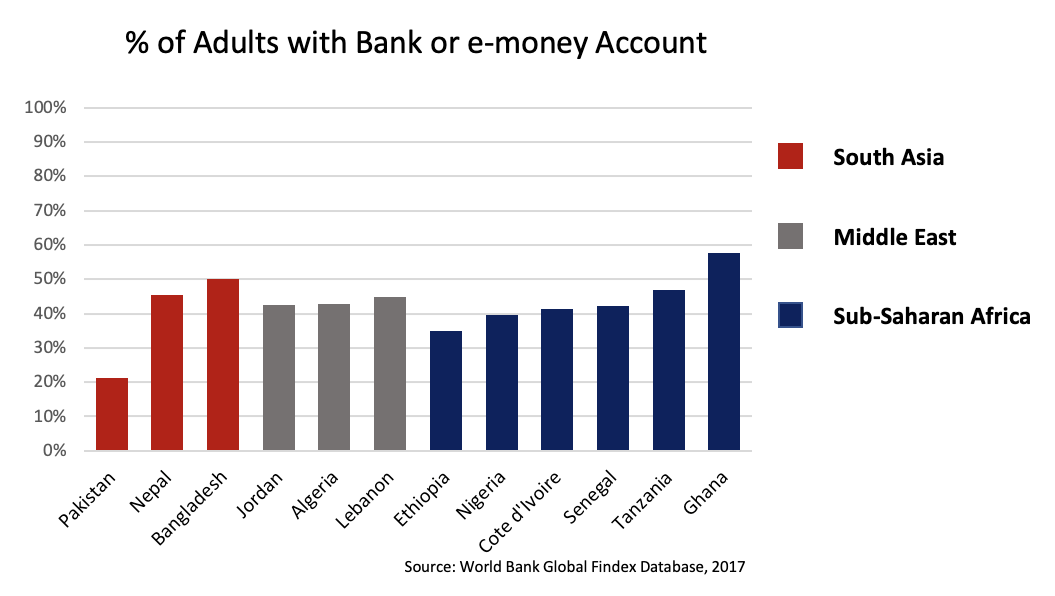

While the development of government-to-person (G2P) programs is essential to reduce COVID-19’s humanitarian impact, major questions remain about how residents will receive and cash-out these funds. In too many markets, account penetration remains stubbornly low. New cash-based programs require developing distribution pathways, which saps valuable time during a crisis. Additionally, they are difficult to oversee, presenting an opportunity for intermediaries to siphon off funds.

Governments need to swiftly onboard the population to new accounts in order to reach vulnerable residents. This imperative can run in opposition to Know Your Customer (KYC) requirements designed to protect the country’s financial system from risk including money laundering and terrorist financing.

The Impact of Know Your Customer Requirements

KYC procedures include identifying an individual via self-reported information, verifying the individual based on public databases, and monitoring those individuals to ensure that their financial activities stay compliant with domestic and international law.

Today, regulators within government ministries and Central Banks are grappling with whether their KYC provisions are appropriate during a crisis. Regulators have established two primary methods to ease the onboarding bottleneck before this crisis began:

- Tiered KYC. This approach minimizes the identification requirements needed for account opening through limits on the amount of funds an account may hold or transact in a given period. As account activity levels increase, further identification steps are required.

- eKYC. Banks and e-money providers verify customer-provided identity information against resident databases and other sources in order to allow remote account opening and onboarding

Some markets have seen significant progress in the deployment of these basic accounts. In Peru, account ownership rose from 29% to 43% in the three years after launching its basic account. In India, the number of basic accounts grew 300% between 2015 to 2019, reaching 380M accounts.

To mitigate the risk these accounts represent, regulators have imposed limits on both functionality and absolute values—often only allowing for prepaid or savings products and capping the account, transaction size, and velocity limits at low-levels.

Some Major Barriers to New Accounts

In addressing the question of how to drive rapid digital onboarding, regulators in emerging markets are presented with three primary challenges:

Populations Without Mobile Phones

These individuals are among the world’s most vulnerable and disproportionately are women. This population will unfortunately require some kind of in-person intervention, whether it is providing digital access to users or, less optimally, direct cash disbursements. Largely, ministries should avoid in-person cash-based programs due to COVID-19 transmission risks as well as the inability to track cash flows. Malawi successfully led a similar engagement in 2013, providing 23,000 phones to families receiving social disbursement with preloaded digital accounts.

Populations Without a National ID

The lack of ID affects 640M adults globally, a problem most pronounced in Africa, the Middle East and South Asia. In markets with exceptionally low ID penetration, some 70-90% of adults lack an ID (Source: ID4D World Bank).

Several markets allow basic account registration without an ID. Mexico is the market leader in this approach. The low-tier account, launched in 2009, can be opened remotely via a basic feature phone or smart phone. Low limits reduce overall risk with account balances limited to $370 and with transaction velocity held to $280/month. To register, individuals just provide basic demographic information (i.e. name, DOB, etc.).

In lieu of an ID, other markets (e.g. Pakistan, Ghana, Sri Lanka) have re-used the SIM registration required by mobile network operators to open an e-money account, as SIM cards are verified prior to activation using a range of identification techniques. The ready availability of affordable mobile phones in these regions have pushed mobile penetration rates to 70-80% for the Middle East and South Asia, with Sub-Saharan nations lagging at approximately 50% of the population (Source: GSMA), and catalyzed significant growth of e-money providers.

Populations Without Reliable Mobile Data Services

In many emerging markets data services are only available in urban centers. Rural users are confined to 2G networks and the simple interface supported by basic, feature phones. This, in turn, limits the complexity of the enrollment forms that can be completed. ID cards cannot be scanned for verification; data entry must be manual instead.

Peru has solved this problem domestically having established a process for opening a BiM account. Customers just need to enter a small number of fields along with their national ID number. Accounts are opened within a couple of minutes. Similar accounts are restrictions are in play to limit risk, with total account balance set to $600 and a transaction velocity of $290/month.

To shorten the length of time required to open an account, other markets have opted for immediate opening with a deferred KYC requirement. India accomplished this by created a lower tier of their no-cost accounts, Pradhan Mantri Jan Dhan Yojana (Jan Dhan). These “Small Accounts” have the same balance and transaction limits as traditional Jan Dhan accounts, however they can be opened without a national ID number. The accounts remain valid for one year and can be extended for another year with proof of an application for an official ID.

Potential Regulatory Responses

There are a range of potential responses that regulators could take in the short-term to alleviate the impact of some of these barriers. The pandemic presents regulators an urgent opportunity drive substantial changes to encourage onboarding. These include:

- Further leveraging mobile networks to drive the expansion of e-money services

- Utilizing existing KYC tiers to open more low-functionality accounts

- Ease requirements to open new accounts, allowing alternative forms of ID

- Designation for low-KYC merchant account onboarding

- Leveraging alternative networks with existing customer bases (e.g. micro-finance lenders) to drive account onboarding

COVID-19 is testing institutional financial inclusion goals, eliminating the livelihoods of billions, and driving people away from their traditional cash-based financial access points. While some governments have tools at their disposal to rapidly digitize their residents, others will need to identify and quickly implement solutions that best fit their population and local financial service providers.

We’d love to hear from you if you know of other regulatory innovations to speed financial account onboarding of vulnerable populations. Please leave a comment, reach out to one of the Glenbrook team members, or set up a meeting via our contact form.