Download a PDF version of this document here. Read our introductory discussion here.

Regulatory Background

The Financial Action Task Force (FATF) sets global standards for combating money laundering (ML) and the financing of terrorism (TF) and proliferation. While its recommendations are not binding, they are broadly accepted by regulators as guidelines for national rules. FATF and FATF-Style Regional Bodies evaluate the adoption of FATF’s recommendations via Mutual Evaluation Reports (MERs).

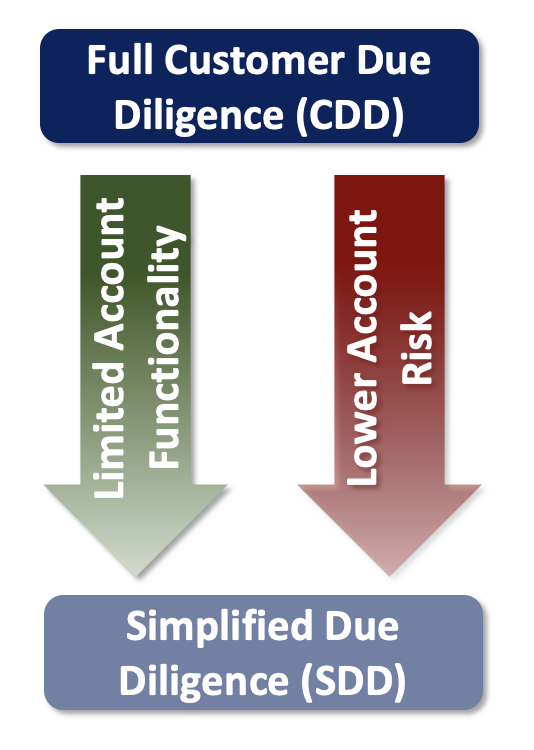

Since the issuing of the 2012 FATF Recommendations, FATF has encouraged financial regulators to implement risk-based approaches in the adoption of its recommendations. This includes permitting simplified forms of customer due diligence (CDD) requirements for account opening where the risks are low. Regulators, especially in lower income countries, may allow simplified due diligence (SDD) processes to improve access to financial services for customers who present low risk of money laundering or terrorist financing but may lack the typical formal identification documentation required under national “know your customer” (KYC) rules.

The FATF report on financial inclusion contains recommendations on risk-adjusted customer due diligence and provides high-level guidance where these more lenient KYC requirements may operate.

“FATF recognizes that there are circumstances where the risk of money laundering or terrorist financing is lower (e.g., certain customers such as government administrations or enterprises, transactions or products such as life insurance policies within limited annual premiums, see below). In such circumstances it may be reasonable for a country to allow its financial institutions/DNFBPs to apply simplified CDD measures when identifying and verifying the identity of the customer. Such simplified measures are allowed based on a risk analysis conducted either at the country or the financial institutions’ level.” (paragraph 82, emphasis added)

FATF has clarified that guidance in interpretive notes 1 and 10 to the 2012 recommendations by delineating options for these simplified measures and clarifying that SDD is to be used in “strictly limited and justified circumstances; and it relates to a particular type of financial institution or activity.”

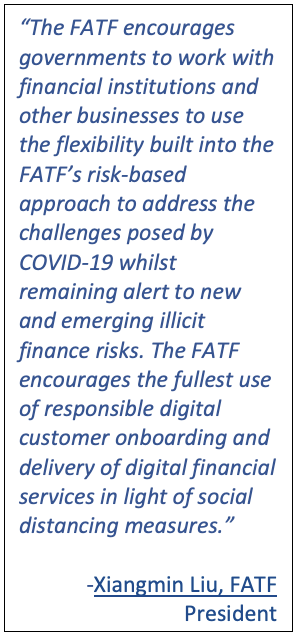

Additionally, FATF published Guidance on Digital ID in March 2020 that focused on account opening, with particular focus on doing so remotely. These recommendations have increased salience given global physical distancing guidelines now in force in many jurisdictions to avoid the spread of COVID-19.

While some jurisdictions have had live implementations of tiered KYC and eKYC (see definition here) for more than a decade, FATF has not proscribed nor endorsed any particular approach, offering case studies in its 2017 Financial Inclusion paper as being “presented for information only.”

Further analysis of recent public-facing mutual evaluation reports (MERS) and follow up reports of Mexico, India and Peru, three countries with SDD implementations, found no remedial actions required by the jurisdiction regarding compliance of these low tier accounts, perhaps signaling a growing acceptance of their utility and role.

SDD Regulatory Responses to COVID-19

We are witnessing expansive action from financial regulators and central banks to shore up financial markets and manage currency risks. Some have gone further, broadening their SDD usage to encourage account opening for their unbanked populations:

- The Bank of Ghana expanded its tiered KYC to allow residents to reuse their SIM card registration to open the lowest tier of e-money accounts. The Bank has eliminated fees on e-money transactions up to GH₵100 (~US$17), not including cash-out. Transaction and maximum account balance limits have been raised across the board, with those for Minimum KYC accounts increased by 50%. Specifically, the maximum balance limit for a Minimum KYC account increased to GH₵2,000 (~US$348) from GH₵1,000 (~US$174).

- The Central Bank of Kenya increased or eliminated e-money transaction ceilings. E-money transactions under Ksh.1000 (~US$10) are now required to be free, and the daily transaction limit more than doubled to Ksh.300,000 (~US$2,800) from Ksh.140,000 (~US$1,300). Total monthly transaction limits have also been eliminated.

- The Central Bank of Pakistan transformed the eligibility review process for the government’s social relief program, Ehsaas Emergency Cash, from an in-person process to a remote process, allowing residents to send an SMS to Ehsaas to confirm available social benefit funds. Individuals can collect cash from biometrically enabled branchless banking operations and biometrically enabled ATMs. All cash transfers will be made after biometric verification of each beneficiary through the National Database and Registration Authority of Pakistan (NADRA). The program is expected to reach 12 million beneficiaries.

- Central Bank of West African States (BCEAO) created remote onboarding for a basic account (via USSD text messaging or voice) or a standard e-money account (via voice or smartphone). The BCEAO has enabled a deferred KYC requirement, creating a three-month window for in-person verifications after the end of the COVID-19 crisis.

Mexico, a Market Leader in Tiered KYC/ SDD

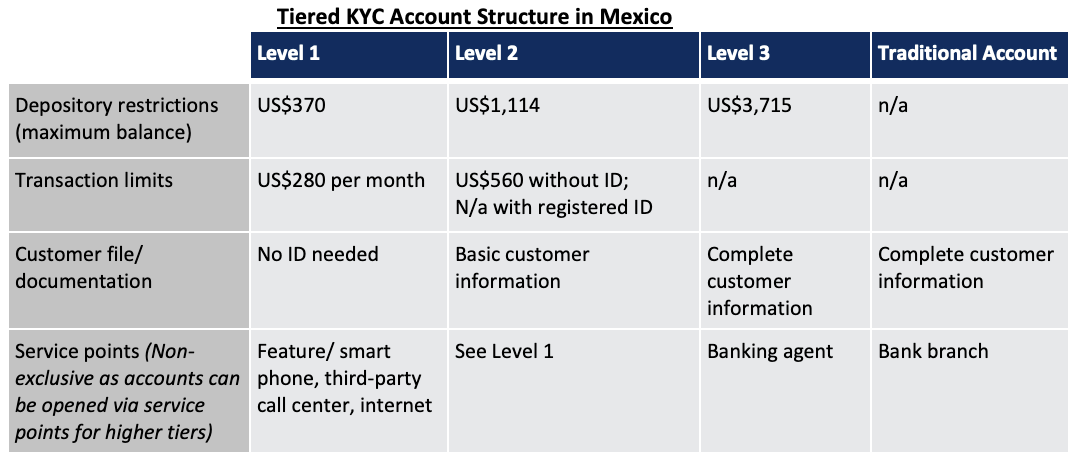

Mexico was an early, if not the earliest, implementor of tiered KYC. The country now has a robust four-tiered KYC system with requirements that increase progressively based on the account functionality. Highlights of Mexico’s implementation include:

- Level 1 accounts can be opened without any ID, and both level 1 and level 2 accounts can be opened remotely.

- Maximum balance restrictions are kept intentionally low to minimize risk at about 40% and 125% of the average monthly domestic income

- Within two years of launch, 4.5 million level 1 and 2.1 million level 2 accounts were opened, increasing the total number of accounts in Mexico by nearly 10%.

- While anonymous accounts were initially mentioned within the remediation actions in the 2012 follow-up to the MER, those concerns seem to have been alleviated by the 2018 MER. Although the accounts continued to gain popularity during that period, FATF concluded in 2018 that the level 1 accounts do “not seem to be a major deficiency.”

- Additionally, Mexico has been working on additional layers of verification for remote accounts since 2017, though nothing has been published.

If you are seeing any adjustments to KYC requirements due to COVID or are interested in learning more about innovative approaches to KYC, please contact Glenbrook Partners. We look forward to speaking with you.