Time to Read: 8 minutes

Highlights:

- ACH, though a 50-year old payment system in the U.S., continues to grow

- The ACH ecosystem is evolving to meet modern-day needs:

- Nacha, the rule-making body, plans to implement a series of enhancements that address shortcomings in ACH usability

- Dynamic payment service providers (PSPs) and fintech infrastructure players are innovating on top of this legacy system to provide cost savings and benefits, such as safety and security, to businesses and consumers alike

The ACH Ecosystem Expands

Electronic payments saw accelerated usage due to the COVID-19 pandemic and ACH was no exception. 2020 ACH transaction volumes increased 8.2% over the previous year, continuing a 10-year growth trend.

Some of this growth was due to the unique circumstances caused by the pandemic. However, as economic recovery continues, will the ACH system continue its steady pace of growth? Will consumers increasingly prefer having a “pay with my bank account” option as an alternative to card payments?

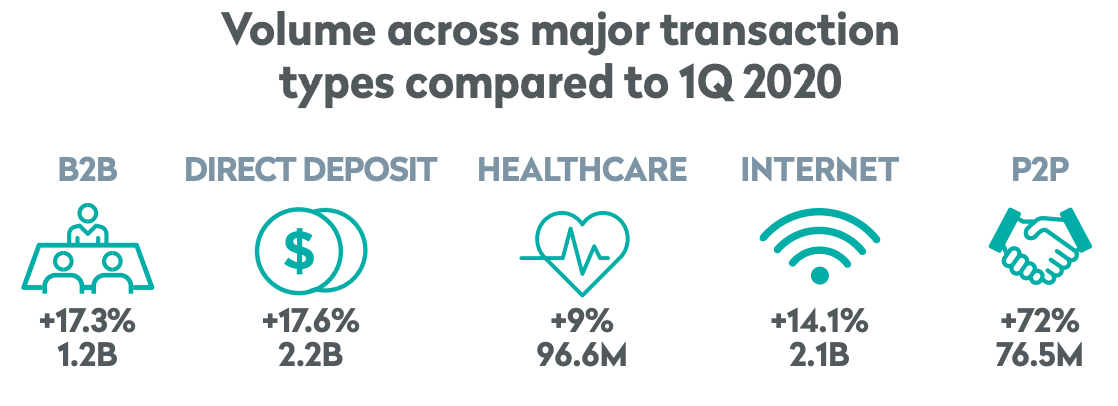

Data from Q1 2021 shows early indication of continued growth:

Source: Nacha

There is no doubt that ACH has its benefits: it’s low cost, it’s a “workhorse,” and it’s ubiquitous. But it is also not without its challenges. As such, Nacha is implementing a series of enhancements to address shortcomings. For example, new Account Validation and upcoming Data Security Rules will help originators reduce exceptions and better manage risk. An additional settlement window and increased transaction limits should increase Same Day ACH utility.

Furthermore, payment service providers (PSPs) that specialize in bank transfers want to make payment acceptance more cost-effective for merchants by offering an alternative to cards, and more consumer-friendly by providing easier ways to use a bank account to make a payment.

Let’s take a look at some of the trends and developments we’ve observed in the ACH payments ecosystem, first within ACH itself and then through enhancements from solution providers.

ACH Had a Banner 2020

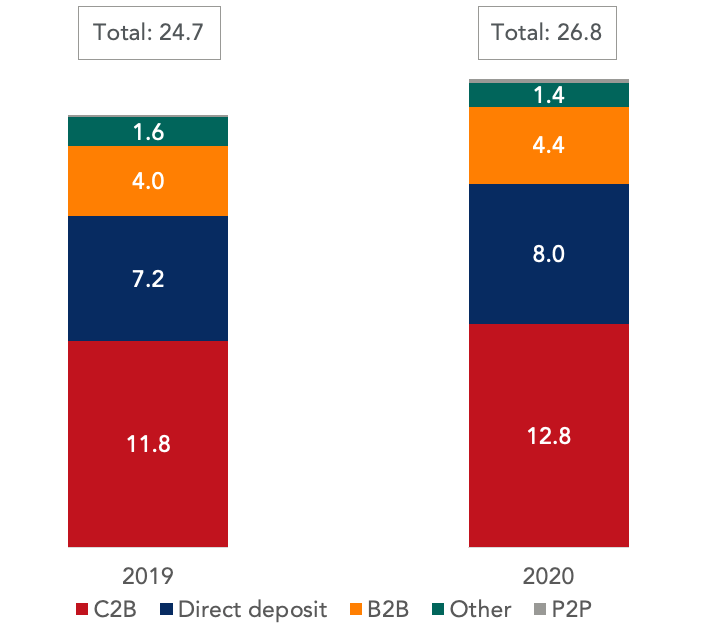

ACH Transaction Count (billions):

Source: Nacha, Glenbrook

ACH transactions saw an 8.2% increase in 2020, compared to debit card transactions, which grew about 6%, and credit card transactions, which remained relatively flat (Nilson Report, February 2021).

While one-time stimulus payments delivered via Direct Deposit contributed to some 10% of the total 2 billion in incremental transactions last year, overall network growth reflects a broader shift away from check payments.

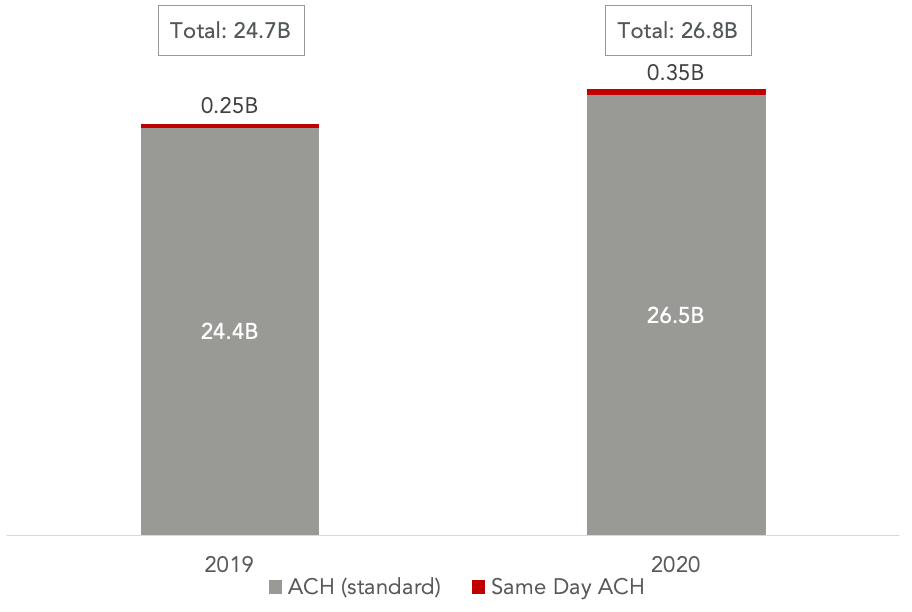

Same Day ACH, although representing less than 2 percent of total ACH transactions, grew 39% year over year. Some of last year’s growth can be attributed to the increased transaction limit, from $25,000 to $100,000, which went into effect in March 2020. As of March 2021, a third Same Day ACH settlement window went into effect to better accommodate West Coast originators. By March 2022, the transaction limit will be increased to $1 million. The new upper limit will be particularly beneficial for B2B transactions, but will increase ACH fraud concerns.

Same Day ACH Transactions relative to Standard ACH (billions):

Source: Nacha, Glenbrook

Enhanced Validation Necessary to Reduce ACH Exceptions

With increasing volumes and transaction limits, ACH shortcomings become more important to address. There is no authorization function, as in the card networks, to determine sufficient funds and guarantee payment. The lack of authorization, or even a simple way to verify account balance prior to debiting an account, often leads to revenue uncertainty for merchants, and costly NSF fees for consumers (in 2020 alone, banks reportedly made $30B in NSF fee income). Furthermore, the traditional methods to verify account ownership have been somewhat lackluster – both prenotes (zero dollar test to validate bank account information) and microdeposits are time-consuming.

As of March 19th, 2021, Nacha’s account validation rule for WEB debit entries went into effect to address the issue of excessive returns and exceptions. The rule specifies that originators implement a fraudulent transaction detection system that, at a minimum, verifies an account is open and valid. The rule does not specify that originators validate ownership of the account.

Nacha does not prescribe a specific way to meet its requirement. Nacha’s guidance indicates that standard prenotes and microdeposits can still be used. However, the rule making body also suggests a series of “preferred partners” and “certified vendors” that offer functionality above and beyond these traditional approaches.

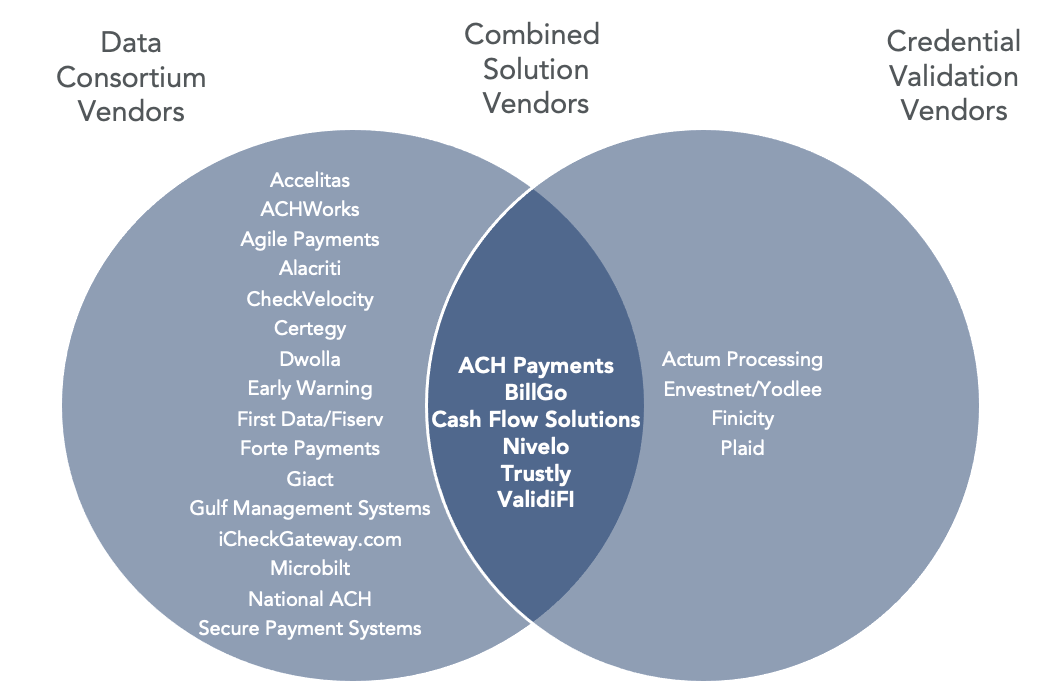

Nacha defines two categories of validation providers:

- Data Consortium Vendors rely on pools of data to validate account information

- Credential Validation Vendors rely on online banking credentials to access account data such as balance information and transaction history

- Some providers offer a combination of both

Source: Nacha Account Validation Resource Center

Solution Providers Build on ACH

Glenbrook has been watching various solution providers, noted for their differing approaches to making the ACH system more usable for broader use case adoption. Examples include:

- Nivelo

- Trustly

- GoCardless

- Square

- Plaid

Nivelo.io has introduced a real-time risk scoring mechanism that leverages various data partners to confirm validity of routing number, account number, and identity. When combined with historical cash flow analysis and machine learning, Nivelo’s approach helps determine the likelihood that a transaction is subject to security threat or failure (for more on Nivelo, check out our Payments on Fire® episode with CEO and Founder, Eli Polanco, here).

Other providers specializing in ACH processing include payment service providers (PSPs), such as Trustly and GoCardless (we recorded a podcast with Chief Product Officer, Duncan Barrigan), which make ACH more merchant-friendly. Their core value proposition includes lower payment acceptance cost and fewer exceptions. While both companies initially started in Europe, they have since expanded into the U.S. market. They charge an ad valorem fee, and are betting that businesses are willing to pay a premium over standard ACH fees, because the cost is still lower than that of credit or debit acceptance. In some instances, they will offer a payment guarantee. Trustly, in particular, offers account validation through direct connections with banks, in addition to its bank transfer money movement service.

Square has partnered with Plaid for bank account validation, and recently announced that it will support ACH acceptance for invoiced transactions, charging a 1% processing fee (for reference, other SMB providers such as Intuit and Bill.com charge about $0.50 and 1%, respectively, for ACH acceptance).

The Plaid Bank Transfers beta will combine Plaid’s account validation and data aggregation services, with money movement as well. (Plaid’s plans to actually move money on behalf of its customers is among the many reasons the Justice Department vetoed Visa’s acquisition of the company. Visa would own two dominant payment networks.) As many of us in the industry are familiar with the now infamous volcano diagram, it will be interesting to see the company’s messaging around a more public launch of the product.

What’s on the ACH Horizon?

ACH will likely see further growth as the industry continues to digitize payments, and as Nacha implements additional rules and enhancements. Some of the upcoming Nacha rule changes for the remainder of 2021 include:

- Data security requirements. Requires that Originators protect deposit account information, similar to tokenization standards set forth by PCI-DSS for card information

- Limitation on warranty claims. Limits the length of time in which an ACH payment can be charged back, providing Originators with greater payment certainty

- Meaningful modernization. Attempts to simplify the ACH user experience through guidance on authorization processes, technologies and channels, setting the stage for Request for Payment messaging

ACH is a ubiquitous and systemically important payment system. Even with faster payments slowly gaining traction, thanks to Nacha’s efforts to remedy various system pain points and the growing set of solution providers, use cases for overnight and Same Day ACH will continue to be plentiful.

Considerations for Implementers

- The economics of ACH transactions are compelling, while risk management is complicated. The right combination of management tools and processes requires in-depth examination of risks at each point in the transaction flow, from initiation to completion via interbank settlement.

- ACH is a ubiquitous payment system. Can added risk management functionality for ACH debit transactions render it “good enough”? Or is there a need in the market for instantaneous, push-only payments via real-time rails like RTP and FedNow? The trade-off is specific to use case and stakeholder.

- How important is the speed of payment when considering Same Day ACH vs. alternatives?

- Will consumers be more inclined to use bank transfers as a payment method if the provider combines superior UX design and experience with additional security measures in place to protect sensitive account information?

About the Author. Nicole Pinto is a self-proclaimed payments nerd and enjoys monitoring the competitive landscape across the payments value chain. She is particularly interested in non-card rails such as faster payments and ACH, and how fintech players are driving changes in payments and banking.