As we dive into the new year, we at Glenbrook reflect on the key themes and learnings within payments from 2022 and assess what we believe will emerge as key trends in 2023. My colleague Chris Uriarte recently shared his 8 Payments and Fintech trends for 2023 on LinkedIn, where he discussed fraud and embedded finance, among other things. In this Payments Views post, I build on his post, sharing three regulatory trends that I believe will be significant in 2023.

Buy Now, Pay Later (BNPL) Regulation is Coming Soon

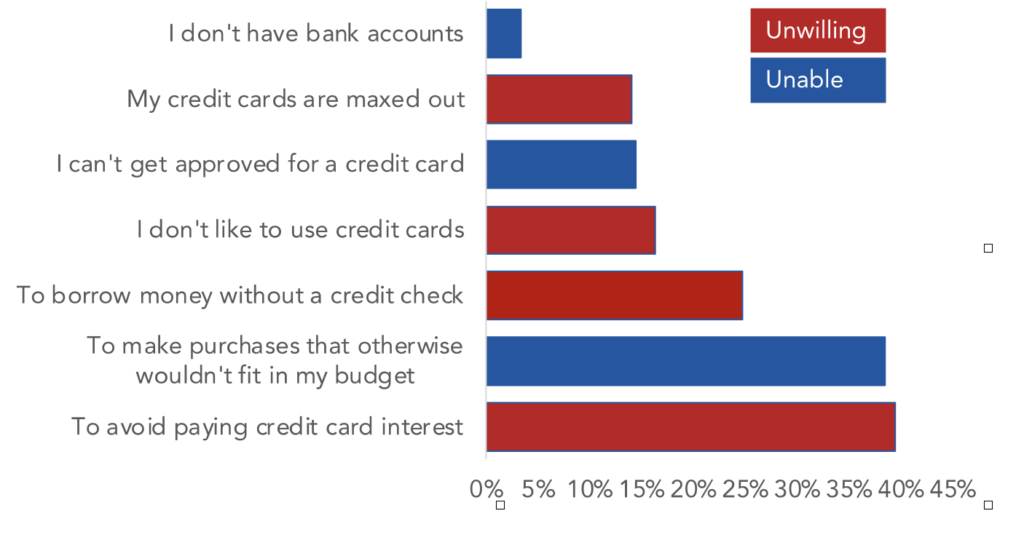

BNPL became a dominant trend in 2019 with a continuous flow of partnerships and launches. While the market has softened, BNPL is still a popular lending product, particularly among consumers who want a) to avoid paying interest on traditional credit products, or b) to pay for things that would not otherwise fit in their budget (see Diagram 1).

Source: Study: Buy Now, Pay Later Services Growing Quickly Among U.S. Consumers, The Ascent

But BNPL products, like all products, are imperfect:

- Consumers are at risk: affordability (i.e., more late fees, too much debt) and data sharing (i.e., consumers and the Consumer Financial Protection Bureau [CFPB] lack knowledge about how BNPL lenders collect, maintain, and use consumer data)

- Providers are at risk: BNPL providers are facing potentially higher credit losses and shrinking profit margins

BNPL lenders have access to customers’ payment histories. Some have used this data to create shopping apps with businesses, pushing products that are often targeted at younger audiences.

As we continue in this period of economic uncertainty, these imperfections are concerning to regulators and the CFPB is taking action: the CFPB, among other things, instructed leading BNPL providers in the country to submit information to the Bureau on their business practices, as the Bureau seeks to explore issues such as the accumulation of debt and data harvesting. More recently, the CFPB released a report stating its intent to issue additional interpretive guidance to ensure BNPL lenders comply with the same or similar regulations already established for credit cards, such as supervisory examinations.

We will likely see the CFPB issue regulation that aligns with its Buy Now, Pay Later: Market trends and consumer impacts report, which may focus on addressing debt accumulation, data harvesting, and a lack of consumer protections.

Regulation can benefit this market by protecting consumers and positioning BNPL as a sustainable product with more transparency and greater checks for credit risk and affordability.

Open Banking-Related Rulemaking Will Advance

Formal open banking has grown swiftly in LATAM, EMEA, and APAC over the last five years, while American consumers have an unregulated and less developed form of open banking.

Open banking can promote greater competition, as players in the broader financial services ecosystem utilize APIs to offer innovative and personalized solutions made possible by greater data sharing. Open banking often features stronger consumer authentication and data rights (e.g., PSD2 and SCA in EU), streamlined data management for fintechs, and collaboration between banks and fintechs. Open banking can benefit companies that provide the best products and rates, lowering costs for consumers.

In the US, industry associations have formed standards that allow third parties to access consumers’ banking data. Notably, The Financial Data Exchange (FDX) has grown significantly and reported last October that 42 million consumer accounts are now using its FDX API for open data sharing. Formal rulemaking may add requirements to the existing data sharing standards and improve open banking adoption by companies who seek to compete in a more standardized and regulated market.

Will open banking regulation advance in 2023? Sort of – a formal open banking framework is unlikely though progress is coming, as

- Open banking has the attention of the President: President Biden recently urged the CFPB to make it easier for consumers to share financial data with third parties.

- Open banking has the attention of the CFPB:

- It is working with the industry, including banks, fintechs, and other data users to determine what and how information should be shared.

- It is in the process of writing regulations to implement section 1033 of the Dodd-Frank Act. Though it is not an explicit open banking rule, it will require financial institutions to share consumer data upon consumer request and allow consumers to cut ties with banks that provide poor service.

A formal proposal of these regulations in progress by the CFPB should come in 2023 and could be finalized by 2024, establishing the framework needed for open banking to thrive.

Crypto Regulation is Coming

The cryptocurrency market faltered in 2022, and we are experiencing a “crypto winter” with digital asset prices well below their recent highs and consumer confidence much lower due to scams and crashes, such as the FTX collapse. Through it all, regulators and (some) investors have been advocating for crypto regulation to help stabilize this market.

The Commodity Futures Trading Commission (CFTC) has emerged as one of the main U.S. crypto regulators:

- The CFTC recently sued FTX, Sam Bankman-Fried, and Alameda Research, and hit Bankman-Fried with fraud charges.

- The CFTC chair, Rostin Behnam, recently emphasized the dangers of an unregulated crypto market and the need for legislation.

Will Mr. Behnam be successful in his campaign in 2023? I think so.

While the idea of crypto regulation is exciting to many and could introduce more confidence in the market once fully rolled out, the impending regulation will further challenge crypto companies in the short-term as they will have to address topics like tax policy, requirements to combat money laundering, consumer protection rules, and licensing and disclosure obligations.