In this latest episode of Fanning the Flames, Yvette Bohanan catches up with Joanna Wisniecka and Cici Northup after their recent attendance at the 2023 Payments Summit and the Fintech: Innovation, Inclusion, and Risks Conference. Listen in to hear why “FOMO is not the answer” when implementing fast payments (or anything, really), and their other key takeaways on the digital currencies and fraud topics. Joanna is currently on the road again at the Women in Payments USA Symposium, moderating a panel on fast cross-border payments. If you attended any of these conferences, we’d love to hear your thoughts!

Yvette Bohanan: Welcome to Payments On Fire, a podcast from Glenbrook partners about the payments industry, how it works, and trends in its evolution. Hello, I’m Yvette Bohanan, a partner at Glenbrook and your host for Payments on Fire. In this Fanning the Flames episode, I’m catching up with Cici Northup and Joanna Wisniecka, members of our Glenbrook team who have recently returned from some conferences to share what they heard and get their key takeaways. Joanna, Cici, thanks so much for joining me to share the highlights of these recent gatherings.

Joanna Wisniecka: Thanks, Yvette. Great to join.

Cici Northup: Happy to be here.

Yvette Bohanan: All right, excellent. So let’s start, Joanna, where were you? What conference did you attend?

Joanna Wisniecka: So I was just recently at the 2023 Payment Summit in Salt Lake City. It’s a conference co-hosted by the Secure Technology Alliance and it’s payments forum. The event typically brings card and other professionals as well together to talk about really all things payments, so trends, FinTech, payment technology, NFC, contactless among others. This was the first time I was attending, but I understand the conference tends to have a card payments focus, which was largely true this time, although there were additional topics, and the interest in fast payments in particular came across. Fraud and payments more broadly came up. The recessions on digital currencies and cross-border, so pretty wide, wide range. The card focus kind of permeated throughout.

Yvette Bohanan: Wow, okay. And Cici, what about you? Where were you?

Cici Northup: I had the privilege of speaking as a panelist at the Innovation Inclusion and Risks Conference hosted by the Federal Reserve Bank of San Francisco, San Francisco State University and UC Santa Cruz. That took place in the Bay Area. And sort of the general goal was around building communication channels and information sharing across the diverse group of attendees that were present at the conference.

Yvette Bohanan: Cici, what were your key takeaways here from the conference? What did you hear about?

Cici Northup: As you can imagine with the title of conference such as the one, of that –

Yvette Bohanan: It’s kind of ambitious. That’s an ambitious title. You have risks, you have everything in there, right, inclusion?

Cici Northup: Yes, inclusion, risks, innovation, FinTech. I failed to mention FinTech was even in the name of the conference. So there were a number of fabulous speakers. A wide variety of topics were covered. Similar to sort of what Joanna mentioned, there’s typical themes that we see at most conferences and those were true here. But there were two topics that to me surfaced more frequently and received more engagement than others. And those were fast payments and digital currencies. And there’s a couple things within each of those that I just want to mention. So fast payments, I think just given the audience that was present, which was as I said, a mix of regulators, industry players and students, there was a really strong appetite to understand and share about what fast payment systems are and how they are different than other existing core systems. So there were a lot of questions around what are the unique design principles that make fast payment systems unique? Why are fast payment systems starting to come to market? And then there was an appetite to really understand how that fits within the context of the US, because most folks in the room and actually online, this was a hybrid event, were US based. So really trying to understand RTP and FedNow and how they will work together or in parallel to one another, those were definitely two key themes I’ve picked up on related to fast payments. The second trend that surfaced as most notable to me was around digital currencies. So to start, digital currencies are no longer a fringe topic. I think what was interesting to me was to hear just how frequently they are being explored in the context of our existing formal system, our formal ecosystem. So traditional players are actively exploring, how can I take the benefits of digital currencies and distributed ledger technologies and bring them to life while still staying compliant, while still keeping my licenses intact, while managing risks appropriately? And they are actively looking at this in a really true, really meaningful way. And I think to me, that speaks to something I love about the payment industry, which is we’re fully willing to say we’re doing really good things now. What can we do better? And that was definitely how I see institutions looking at digital currencies. A second thing, very related thing I noticed around digital currencies is just thinking about risk management. I think there were a lot of questions around risk management, likely the result of some things that have happened in the public domain recently. This was very top of mind. One of the most interesting sessions to me was a session led by Larry Wall, he’s the executive director of the Center for Financial Innovation and Stability at the Fed. And he shared some findings from a recent research effort that he and some colleagues conducted. I think it’s actually formalized in a white paper if folks are interested. And they looked at the risks and benefits of defi and one of the key takeaways that really struck a chord with me is that defi ultimately has not only the same inherent risks as many of our traditional financial services do, the same risks still hold. And then there are more, there are new risks that are also present. So if we are going to bring these tools to life for the benefit of the ecosystem, for the benefit of the everyday consumer, we really have to figure out this whole “risk management thing”. I know as a risk management practice lead, you must giggle at that.

Yvette Bohanan: I’m giggling because I don’t know that we’ve figured out all the risk stuff, this risk management thing for all the existing systems, let alone all the stuff that we’re bringing online here. But okay, I digress, go ahead. It’s good. This is good that people are talking about it, right? This is important.

Cici Northup: It is. You always remind me of this story you told of you were working on risk management in one of your past jobs and you said you were working late doing some risk management stuff thinking that you were working yourself out of a job because you were really trying to do the best that you could to manage that risk. And I’m sure I’m butchering this story and you can tell it better.

Yvette Bohanan: We thought we would have e-commerce fraud problems and all of the associated risks around internet payments figured out in a year, back in. You’re right. And here we are.

Cici Northup: And here you are still working to mitigate risks. So this is going to be a long haul. So I think there’s an understanding of that, but people are saying how can we progress it further?

Yvette Bohanan: Okay, yeah. And there were a lot of heavy hitters here. So Larry Wall, Executive Director for the Center of Financial Innovation and Stability at the Fed, that’s a pretty serious speaker to have on this topic. So like you’re saying, no longer a fringe sort of thing. You were noting that Robert Morgan, the CEO of USDF was there talking about fast payments and I believe Mark Gould, so you had the Chief Payments Executive at the Fed who was doing a keynote, right? So Joanna, batter up here, try to top that line up. What did you hear? Who did you hear from and what did you hear at your conference?

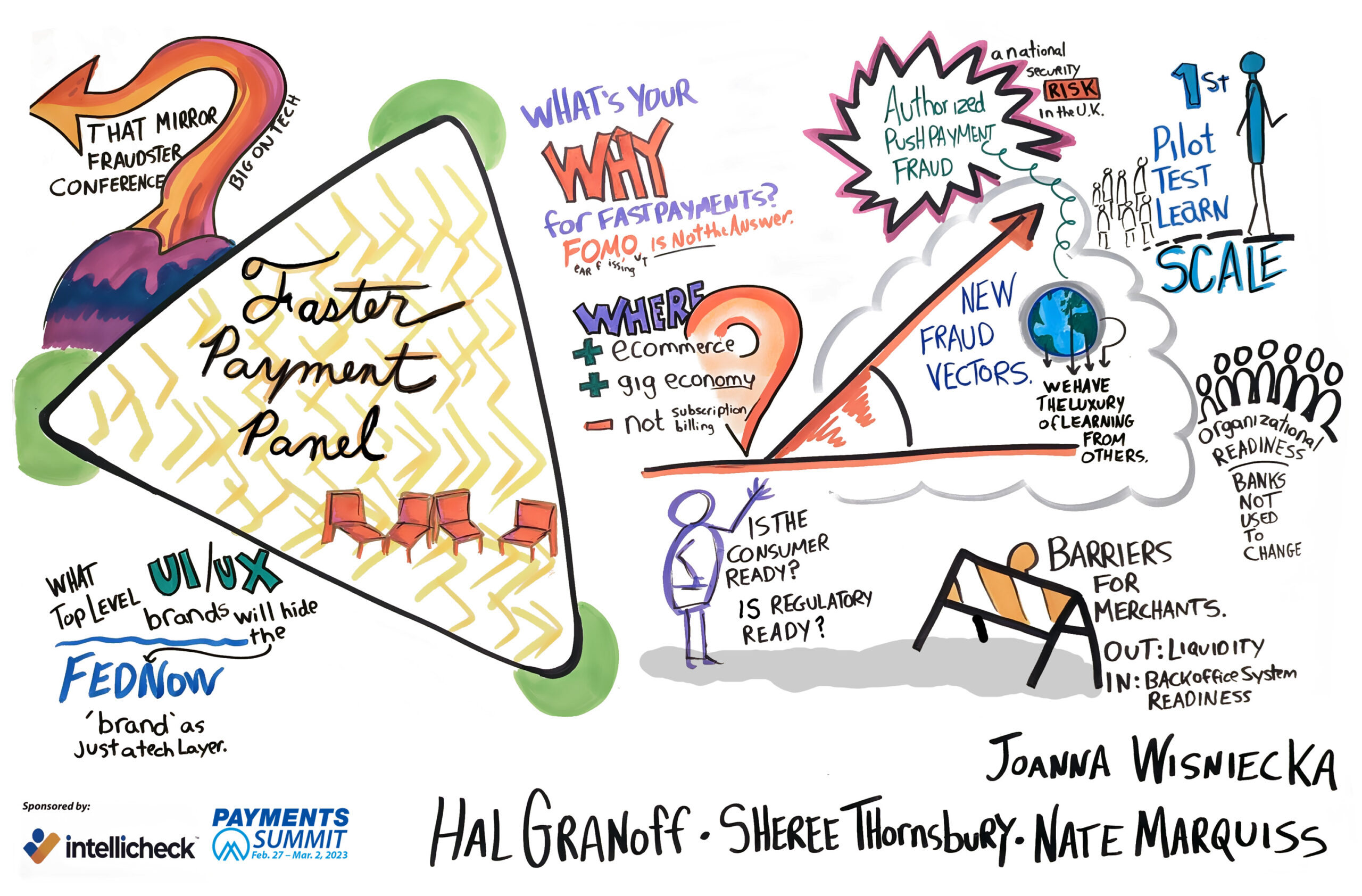

Joanna Wisniecka: I don’t know if I can top that, but I certainly will start by saying that fast payments is winning the popular topics contest at some of these conferences or the recent conferences. No surprise I think there. It’s a hugely important topic. In particular with FedNow recently announcing the July, 2023 long, so that’s exciting. I mentioned this is typically a card payments focus conference. Fast payments had dedicated time on the agenda and also popped up in discussions, certainly discussions that I had. The fast payments conversation in particular was in two parts. So there was a keynote and there was also a panel. The keynote was by Dan Baum who is the Head of Payments Product Management for FedNow. So certainly a very senior person in the space. The session was super well attended and there were a lot of questions afterwards, I think probably the session that had the longest Q and A. As a little side note, it brought me back to my days at the Fed, the days before FedNow was actually called FedNow. And the talk itself was mainly an overview of how FedNow will work and what it will offer and timing. They hadn’t announced the timing yet. But one of the points highlighted in the Q and A was that while of course the goal is for ubiquity and to get all US financial institutions to participate in the system eventually, there’s very much a recognition that this is going to take time. It will take years to get there. That seems like a good bet. It’s consistent with what we’re seeing in most fast payment systems path or evolution. Adoption typically starts out slowly. Brazil’s Pix system may be a bit of an exception. So after the keynote, we also had a panel on the topic, and so I participated in that panel. Lots of topics covered there. The key focus really was kind of the how and the why of fast payments, meaning what are the use cases that are likely to benefit most and whether for our FIs and merchants, whether they should prioritize this type of payment. One point that really stuck with me that one panelist said that I liked is that FOMO is not the answer, and specifically meaning that really it’s so important for financial institutions, but businesses industry participants generally to have a very clear business case for implementing and offering fast payments.

Yvette Bohanan: Going to your board and saying, “I don’t know if we really should do this or not, but I’m scared to death I’m missing out if we don’t, so let’s just go for it.”

Joanna Wisniecka: That’s right?

Yvette Bohanan: That is not a strategy for you.

Joanna Wisniecka: Great takeaway, right? FOMO is not the answer.

Yvette Bohanan: There you go.

Joanna Wisniecka: So don’t use that as a business strategy.

Yvette Bohanan: That’s great and broadly applicable to things in life, for sure, if anyone out there is trying to pursue this.

Joanna Wisniecka: Personal as well as professional.

Yvette Bohanan: Oh my gosh, all right.

Joanna Wisniecka: I will say just one more thing. So I focused on fast payments because obviously that’s a topic that’s near and dear to my heart. But the other broader topic was fraud. And that touched on fraud and cards, but also broader kind of trends and other payment types. A little joke that developed during the conference was that as we were sitting there talking about all the latest developments, innovations to combat fraud, that fraudsters are having a mirror conference talking about how to respond to all of these innovations. So really, really interesting stuff both in terms of the fraud vectors, the risk they pose, and then ways to mitigate them. I’d say just a couple things that I paid attention to is really the evolution of security standards. That really came across is a real collaboration in an industry to come up with standards that are designed to protect account data. PCI version four is just one example. The need for strong identity authentication, one point kind of picked up on as this trend of or maybe it’s an aspirational trend, the evolution or the end of passwords as a security mechanism, and generally just the importance of understanding customer behavior trends to be able to identify unusual patterns. And that certainly is already something that’s being applied in the card space. I know I get little notifications saying in a different country and maybe trying to make a payment with a card and that’s not my typical behavior. There are notifications that come up around that. That’s something that’s certainly a topic in the fast payment space as well.

Yvette Bohanan: Yeah, super important because well it’s fast, but that means funds availability, clearing all of that is super timely. And if something’s going wrong, you want to know about it right away as the true account holder. So yeah, big themes there. But fast payments, digital currency systems and risk, risk, risk, risk, risk management all over the place. So particular sessions that you went to that you found illuminating or interesting that if you could say to someone, “If there was one session I want to tell you about coming out of this conference…” Cici, what else did you hear any particular session that you went to that was just really, really good?

Cici Northup: That’s such a hard question. You mentioned a couple of the phenomenal speakers, Robert Morgan, I mentioned Larry Wall, Mark Gould. I think there’s another standout to me. Sean Higgins, who’s an Assistant Professor of Finance at Northwestern, talked about some research findings that he recently published around how debit cards are helping low-income household save money in Mexico. And financial inclusion is topic I’m quite passionate about. And so I was just really interested to hear about the findings from that effort, so that was another phenomenal one.

Yvette Bohanan: How did that work exactly, that a debit card is helping people save money?

Cici Northup: I think that he shared a number of hypotheses as to why, but I think what was most interesting to me is that their findings suggest that not only having the tool helped formalize savings. You can imagine having an account to save would be beneficial as opposed to saving under a mattress as an illustrative alternative, but it actually increased the proportionality of the amount that people were saving relative to their income, so it was a vector for saving. And I think there were some interesting insights and corollaries related to women and their ability to have access to these saving and payments vehicles. Particularly, if I understood him correctly, we should have him on so he can speak to them properly, particularly when they weren’t the head of the household. So there’s an additional benefit that’s being realized by women when they’re not spearheading the financial decision making in their household when they have access to these formal services. So I’ve spent many, many years looking at financial inclusion through the lens of fast payment systems, but of course there are other tools here that really, really help and promote financial inclusion. So I was very open and interested in learning about that effort in Mexico.

Yvette Bohanan: That’s cool, very cool. Joanna, what about you? Any sessions that really struck home or stood out or that you find yourself reflecting on as you get back?

Joanna Wisniecka: Well, so I really enjoyed the actual keynote to the whole conference because it really set the tone. And that was by Mike Lemberger, who was Visa’s Chief Risk Officer for North America. He was just really lively and brought the topic of emerging threat and payments. Again, fraud being one of them, and the role the networks can and are planning to implement. He really brought that topic to life. One point he highlighted is fraudsters tend to focus on the less mature systems. Fast payments are the new shiny toy. Card payments didn’t start out with the solutions that they currently have in place, and they’re continuing to evolve. And so just really highlighting that there’s going to be an evolution that fast payments as well go through with respect to managing the risk of fraud occurring. I know you said one, but there was another one that was just interesting because it’s not a topic that I think about as often from a payments perspective. Maybe I did when I lived in New York and took public transit often, but it was about how mass transit is actually leading or had been leading the charge in enabling contactless payments. And they talked a little bit about some examples. So the Oyster card in the UK, another card has a name I forget in Australia. So that was just interesting tidbits and insights I hadn’t reflected on before.

Yvette Bohanan: Yeah, yeah. Oyster’s been pointed to a lot in terms of transit and this notion of transit cards. Because if you can speed something up at transit and get people used to doing that turnstile activity and it’s working all the time, they get confident in other things they can do that way. So that’s interesting that they’re still seeing that happening right now. The risk thing is interesting, too, because some of the things we’ve heard anecdotally, I would say, we’re talking about new, new, new, new , new, new defi, digital currency systems, fast payment systems. The other systems, cards, checks, hello? Paper checks, wires, ACH, all those are still around. And one of the big things you were saying, FOMO’s not a strategy and all that, and people are figuring out how to adopt this, particularly with Fed Now coming online soon, those other systems have to be controlled. And the fraudsters aren’t necessarily going to go to where weak controls are in the new systems exclusively. They’re going to realize other things. And I don’t think I’m giving any secrets away to the fraud community by saying this, because we’re seeing this happen actually where companies can’t make investments in the older systems to keep them up to date. The fraud’s going back there. So we’re seeing a increase in check fraud because people aren’t investing in that as much, putting in the controls, putting in the updates or whatever. They’re focused on the new stuff and getting that launched. So a word to the why’s out there, you have to keep looking across everything. So I think that’s interesting that both of these conferences had such a large element here focused on payments risk management and what people are doing about it across the board. Really interesting takeaways to me, so I’m glad you shared those.

Joanna Wisniecka: Yeah, no, I agree. And I think as a former regulator with the Federal Reserve, I guess I also just naturally kind of pick up on the risk management topic and maybe gravitate towards it, so interesting stuff.

Yvette Bohanan: What was the attitude of people? You had some pretty broad groups at each of these. Cici, you’re talking about students as well as folks from the Fed in the regulatory area. Joanna, any leaders in cards and payments and risk? They’re talking about topics that maybe weren’t on the agenda five to 10 years ago, like fast payment systems. Are people thinking, are they overwhelmed? Are they excited? Is there a lot of debate going on in the room or over lunch and dinner and so forth? Or are people fairly aligned on certain things but debating others? What’s the attitude of the groups that are coming together?

Cici Northup: I’m happy to start. For me, I think the term that resonates most is humbled. I think there were regulators and industry players and academics and students in the room and I think everyone was looking to learn. I think the goals of the conference to create a communication channel were successful. I think people wanted to understand where the payments ecosystem is headed, what needs to be improved, how to leverage new technologies to do so, and how to do so in a way that appropriately manages risk. So I think humbled is the term that fits.

Joanna Wisniecka: I would say excitement, the developments in fast payments just generate the excitement. But the same is happening in the card space. It’s just focus on innovation. So new payment types developing in one space means others are going to react to it to keep up as well, and they already are. So I kind of sense a lot of excitement, actually, about everything that’s happening in payments and urgency and urgency to, again from the risk perspective, to really pay attention and to innovate. So innovation I guess being the really key keyword.

Yvette Bohanan: Yeah. So where are you off next, Joanna?

Joanna Wisniecka: So I am heading to the Women in Payments USA symposium in DC. I’m going a few days early to check out the cherry blossoms, happens to be really at the peak of it. The conference itself has been on my radar really for some time, so I’m super excited to meet inspiring women in the space, in the payment space. I’ll be moderating a panel there and you guessed it, fast payments, but specifically this time focused on fast cross border payments. So I’ll be joined by, very exciting, I’ll be joined by panelists from Swift, from Wyze, the Clearing House and JP Morgan. And the main foundational question for the conversation is, can innovation keep up with the growing demand to eliminate borders and payments, making them instant and free? Maybe a bit controversial there. So lot’s happening in this space and super excited about the topic. Recently, Asia has been quite active in the space with Singapore linking their domestic fast payment system with Thailand’s prompt pay, more recently with India’s UPI. And in the US, the Clearing House in the US has completed a pilot with Europe’s CBA clearing supported by Swift or collaborating with Swift. And they completed the IXB pilot to test the ability to do simultaneous settlement between US and Europe, so instant cross-border payments. Technically it works, the pilot proved it. Lots of other work though obviously to take it to the next level. So I’m looking forward to the panelists shedding light, both these specific examples and other innovations that they’re focused on.

Yvette Bohanan: Excellent, excellent. So we’ll have to have you back on to hear what they say and what happens with the panel. I’m sure you’ve probably got five or six more good questions up your sleeve for that one, so cool. Sounds like a lot of fun. Cici, what about you? Where you headed?

Cici Northup: I don’t have a public conference that I’m going to for quite some time. I think the next one on my docket is the Nacha Payments Alliance event in October here in the US. They have one between now and then that’s taking place in Portugal. Glenbrook is a member, I failed to mention, of the Nacha Payments Alliance. And the Portugal event will be attended by Elizabeth McQueary. So you should have her on as I believe she will be speaking about, surprise, fast payments.

Yvette Bohanan: Fast payments. Oh, if only payment systems had a popularity contest. So it’s a long time coming, though. So Joanna, you mentioned you were working on Fed Now before it was called FedNow. I don’t even know what it was called before. Did you have a name before FedNow or was it just that new thing?

Joanna Wisniecka: Well honestly, when I was there my last year at the Fed, it was still an idea and a question mark whether the Federal Reserve should play any role in building and then potentially operating a fast payment system. So it was really the initial conceptual idea. The decision had not yet been made if the Fed should play a role and here we are.

Yvette Bohanan: Here we are months away from a launch. This is super exciting. And then Cici, you’ve been working with fast payment systems in countries all over the world for years. This must be interesting when you go to a conference in the US, and here we are talking about the block and tackle of trying to get things going here in the US. What’s the same and what’s different in the conversations that you’ve had in the past with agencies, governments all over the world and what you’re hearing when you go to a conference like this right now?

Cici Northup: What a great question, Yvette. I probably shouldn’t say this, but for many years I didn’t really pay attention to what was happening related to faster payments here in the US. There was just so much traction being gained in other markets and we were actively involved in helping spin those systems up and designing in them in a way that aligned with the goals of the Central Bank or the operator who is putting it in place. I would say a couple things to respond to your question. To start, there is clear alignment in the conversations that I’ve had in other markets and the conversation here around how do we use fast payments systems to improve payments for the benefit of all? There’s this really close knit conversation between fast payments and financial inclusion, and that’s because we’ve seen dramatic, dramatic changes in the payments behaviors in certain countries, very much correlated to the rise of fast payment systems. So Brazil is a great example, 40 million new accounts opened in the past couple years with the G to P social transfer payments being sent through Pics. They’re the Brazilian faster payment system. India has seen rapid growth in financial inclusion paired with a number of initiatives, the JAM initiative, demonetization, and of course the launch of UPI. So there’s this really close knit relationship there. And I hear in the US the same conversations being had around how can we make this ubiquitous? How can we bring this in a life so that it’s accessible by all and being used in multiple ways to both recognize all financial institutions that exist in the US? The long, long tail of financial institutions that we have here, as well as the end users that we serve. I think the second key thing is the design principles that exist in fast payment systems. Really there’s core principles that just perpetuate in practically all of them. So they are push payment systems that are available 24/7, 365. They are digital. These are core trends in payments more broadly, and fast payment systems are really bringing them to life. I would say the key distinction or one key distinction between the conversation in the US relative to conversations in other markets is the number of fast payment systems we have. So in most countries we see one core fast payment system. Not always, but in many instances participation is mandated by the regulator in some way. In the US, we’re very market driven, so we’re seeing a much different manifestation of fast payment systems here, and it will be very interesting to see how we bring it to life. And I think Joanna mentioned success will be looked at in years, not months. It will be really interesting to see progress five years from now.

Yvette Bohanan: I agree. And I’m going to go out on a limb and say this is probably not the last time we’re going to be talking about fast payment systems in the foreseeable future. So I’m glad you were both able to join us. Thanks so much for taking the time to share these highlights, and I’m looking forward to hearing about the upcoming adventures. Joanna, we’ll have you back on soon, I think, to get the redux on your panel, so this’ll be fun. Thanks so much for joining me. It was great to talk with you both and catch up.

Joanna Wisniecka: Thanks, Yvette. Thanks. Cici. Bye.

Yvette Bohanan: If you enjoy listening to Payments on Fire, someone else might, too. Please feel free to share this podcast on your favorite social media outlet. Thanks for listening and until next time, take care and do good work.