Payments in Healthcare

Implementing a payments strategy that fits your organization’s needs while following strict industry requirements can be a challenge, but the right partner can help you answer key questions and make data-driven decisions.

Healthcare organizations must effectively navigate complex payments ecosystems.

Organizations must build long-term, scalable solutions.

On top of the complexities of payments, organizations must also thoroughly understand and manage their strategy within an ever-changing industry — dealing with external factors like:

- Regulatory Mandates

- Escalating Costs

- Data-Privacy Rules (HIPAA, etc.)

- Economic Changes

- An Aging Population

- Evolving & Modernizing Patient Preferences

- Increasing Numbers of Uninsured Patients

How We Can Help

Glenbrook can help answer questions like:

How do we optimize our payments acceptance strategy?

What should we outsource vs. take on in-house?

What organizational structure and capabilities best support our goals?

What are industry trends that may impact our payments strategy?

What is the role of B2B networks in healthcare?

What payment methods should we accept? Where can we leverage virtual cards?

How do we manage such a large roster of suppliers?

What vendors could we work with, and which ones should we work with?

How do we optimize payments sending strategy?

Our Clients

Large Practices

Large Hospitals

Claims Clearing Houses

Insurance Associations

Insurance Providers and Other Payers

Related Services

Research

Product Strategy

Market Analysis

Training / Education

Healthcare Case Studies

Resources

Articles

Glenbrook shares our perspectives on activities in the industry.

Podcasts

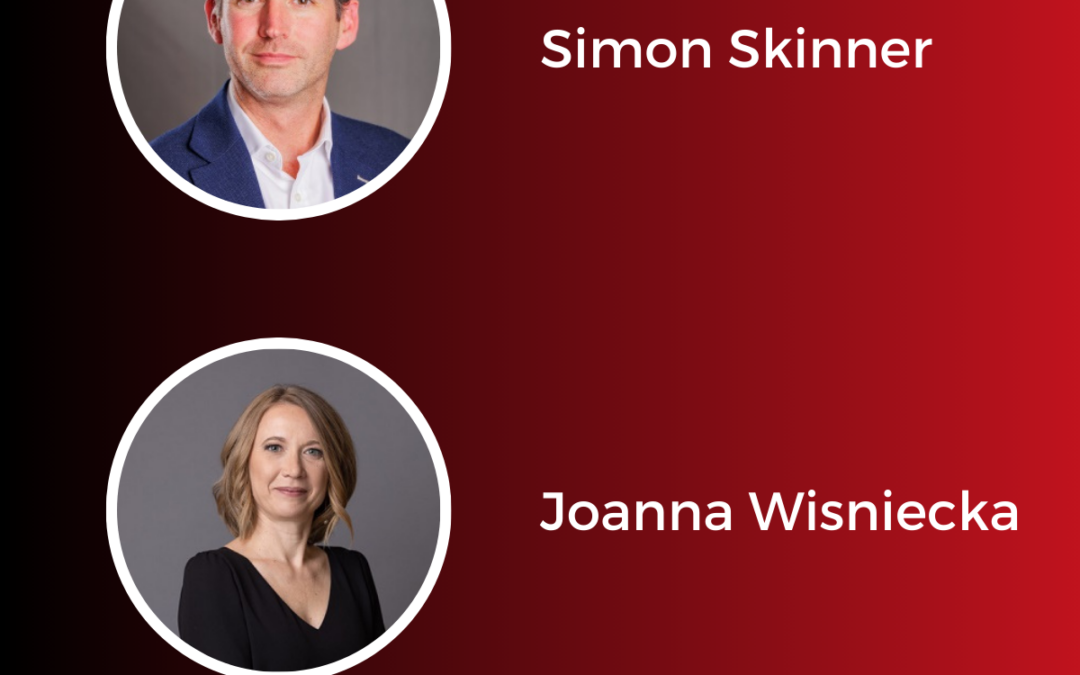

Glenbrook speaks with industry leaders to share a variety of perspectives on the latest payments trends and activities.

Episode 287 – Fanning the Flames – State of Stablecoins 2026

Join Glenbrook’s Russ Jones and Ashley Lannquist for a detailed discussion on the state of stablecoins, focusing on market developments, regulatory and policy impacts, usage patterns, and competition from other improved payments systems.

Episode 286 – Understanding Trust in the Modern Agentic and Digital Economy, with Jenny Hadlow and Rory O’Neill, Checkout.com

In this episode, Chris Uriarte welcomes Jenny Hadlow, COO, and Rory O’Neill, CMO, from Checkout.com to discuss the findings from their recent report “Trust in the Digital Economy 2025” and explore the interesting dimensions of trust that merchants, consumers, and service providers need to be aware of in today’s ever changing digital (and agentic) economy.

Episode 285 – Fanning the Flames – What We’re Watching in Payments in 2026

2026 is set to be another dynamic year in payments. Join our Glenbrook partners as they discuss their perspectives on industry trends and what they’ll be keeping an eye on this year.

News

Glenbrook objectively curates the news to keep you abreast of important daily headlines in payments.

TNS Launches TNSPay SmartRoute to Put Merchants and Acquirers in Control of Payment Routing

"Transaction Network Services (TNS) announced the launch of TNSPay SmartRoute, an intelligent transaction routing solution that lets merchants, acquirers, processors and FinTechs balance performance, cost and uptime on their terms – across data centers, hosts and even...

New BofA Rewards™ Program to Reach Millions More Clients with Expanded Benefits

"Bank of America announced plans to launch BofA Rewards, a no fee loyalty program designed to reward and recognize clients for their full relationship across their Bank of America banking and Merrill investing accounts. Starting May 27, millions of clients can enroll...

Sumsub Debuts AI Copilot to Transform Compliance Workflows and Fraud Investigations

"Sumsub announced the launch of its new Summy AI Copilot (“Summy”), the first platform-native AI agent for compliance and fraud teams. Operating within thresholds and controls set by compliance teams, Summy keeps AI-driven actions aligned with established policies,...

Ready to see how Glenbrook can support your healthcare organization to be as efficient and effective as possible?