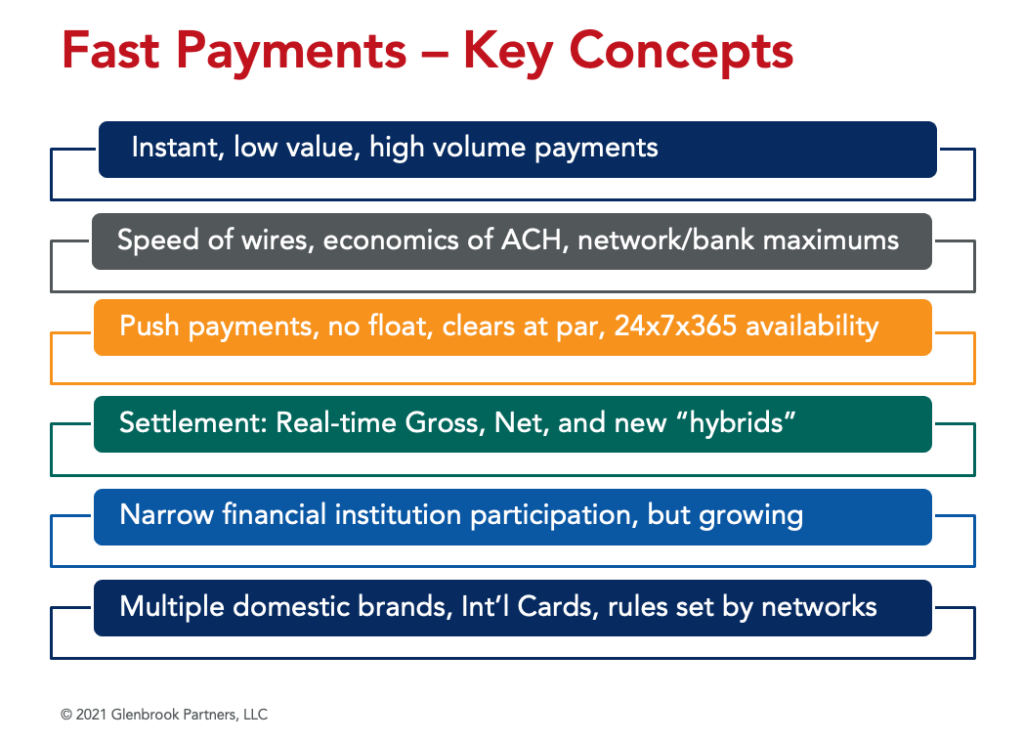

Fast payments are “must haves” in most economies. Their key attributes make them superior to other bank-led, open-loop systems. The speed of money has caught up with the speed of our communications. As Glenbrook’s Elizabeth McQuerry puts it, “this is a convergence of ideas around the world, a commonality, around this single approach in payments.”

Note: “Fast payments” is the term of art that the world’s standardized on. These new systems have gone by multiple names: real-time payments, faster payments, immediate funds transfers, and more. Very recently, the World Bank and the Bank for International Settlement (BIS) settled on “fast payments” as the moniker for these systems.

In this Payments on Fire® episode, Elizabeth and ACI Worldwide’s Craig Ramsey discuss the evolution of fast payments, its global spread, and the wide variability of use cases seen around the world.

ACI Worldwide is a $1.3B provider of payments technology to financial institutions, billers, merchants, and other ecosystem participants. Operating 24/7 in some 14 countries and 18 systems, ACI is a major participant in the global fast payment phenomenon. Among ACI’s roles are connectivity of core banking systems (the ledgers) to domestic fast payment systems. ACI also brings fraud management and back office services.

Elizabeth and Craig discuss the impact of rules on use cases, the slow rollout of services that take advantage of ISO 20022 messaging, and the nuances of deployment from country-to-country.

Craig notes that fast payments do not replace existing systems. They provide banks, and their customers, with a broader range of payments choices. Banks can make decisions about which rail to use for a given transaction.

An essential success factor is ubiquity. National mandates are enormously influential. The explosive success of Brazil’s new PIX system is an example. But even in a market-driven economy like the US, the benefits of fast payment systems are very apparent,

Push Payments and Risk

From a payments network and financial institution point of view, push payments are less risky than pull payments. The principal reasons include:

- They are “known good funds” transactions that are only entered into the network if the funds are in the sending account.

- Unless there is an account takeover, they can only be initiated by the accountholder.

- The rules of fast payment systems make these irrevocable transactions. There are no chargebacks.

That said, those accountholders themselves can be victimized by fraudsters through social engineering.

Authorized Push Payment (APP) fraud occurs when the rightful accountholder has been convinced to send funds to the criminal. This fraud is troubling because the payment is initiated properly. The accountholder has logged into their financial institution and provided the correct credentials. They’ve simply sent the funds to a fraudster. This form of fraud is a concern for wire systems—high value, low volume system ($4.5M per transaction) and, as the UK has reported, it is a serious concern for the fast payment systems that are built for high volume, lower value transactions. In the UK, no systemic solution has been found.

Fast Payments Now, CDBC Later?

The build-out of a new open loop payment system and technique is a once in a generation event. We’re five years into the US’s fast payments evolution. The next five will see Zelle, the RTP Network, and FedNow in operation and serving a whole range of use cases, many unanticipated by their designers. How these rails evolve and how they connect to the fast payment systems in other countries are unknowns. Rule changes are as inevitable as those new use cases.

Because tech accelerates change in payments too we may see yet another method of payment emerge in the US, a “digital dollar” issued by the Federal Reserve. Fast payments is a stepping stone to CDBC which requires realtime, 24/7 processing.

Aimed at very different use cases, these central bank digital currencies (CDBCs) are a newer phenomenon we will discuss in upcoming podcasts and blog posts.

Questions for Stakeholders

- How should fintechs use fast payment rails, how should they gain access to them, and who should they parter with?

- What makes more sense? Should you work with a financial institution or a gateway provider? Should you become a financial institution?

- What is the best way to prevent APP fraud? How should the industry make accountholders whole after they have been defrauded? Or are the victims of APP fraud on their own since they authorized the transaction?

- How does the card industry respond to a new payment system that operates with very different economics where fee revenue is only based on the number of transactions and not their size?

- We are here to work with you to make your fast payments initiatives successful. Reach out to talk.

Payments on Fire® Episode 152 – Fast Payments with Elizabeth McQuerry and ACI’s Craig Ramsey.mp4 from Glenbrook Partners on Vimeo.

Read the Transcript

George Peabody:

All right. Welcome to Payments on Fire, a podcast from Glenbrook Partners about the payments industry, how it works and trends in this evolution. I’m George Peabody, Partner at Glenbrook and Host of the podcast. Today, we’re going to take a deep look into the expanding world of real-time payments.

George Peabody:

I’m not talking about what you might be able to get from a person to person payment system, a closed loop system like a single company system like Venmo or WhatsApp, or rather Venmo, where both parties have to have an account with that provider. I’m talking about the modern push payment system that moves money directly between bank accounts.

George Peabody:

So in the US examples include Zelle and the Clearing House’s Real-Time Payments, RTP Network, in the UK you could think of Faster Payments. In Brazil think a Pix, and to take us deeply into the subject. We’re glad to welcome two experts. First, let me welcome my colleague Elizabeth McQuerry, Partner at Glenbrook and Head of Glenbrook’s Global Payments Work. Elizabeth, glad to have you here. Glad to have you back.

Elizabeth McQuerry:

Yeah. It’s fun to be back George.

George Peabody:

To bring us the perspective of a global provider of real-time payments, capabilities, and system connectivity. As my pleasure to welcome Craig Ramsey, who is the Head of Real-Time Payments at ACI worldwide. Craig, glad to have you here.

Craig Ramsey:

Thanks George. Great to be here.

George Peabody:

So let’s just level set on ACI worldwide. If you’re not familiar with ACI, ACI is a $1.3 billion provider of payments technology to financial institutions around the world, billers, merchants, and other ecosystem participants. This real-time payment phenomenon is occurring in over 50 countries. So it’s truly global in scope, which sort of maps to the footprint of ACI. So yeah, we’ve got just the right people here to talk about this topic.

George Peabody:

Elizabeth, you would to get us started. Could you give us a quick take on the status of these real-time payment systems? Beyond the fact that there are push payment account to account transfers here, there are other important commonalities or variances you’re seeing around the world because what would you say, they’re over 50 systems now, either in operation or in plan.

Elizabeth McQuerry:

Yeah. This is such a fascinating area, George, that we’ve gone from maybe having a number of key, variations of how real-time payments work, flavors or just different tendencies and moving very quickly to a real convergence of what this really means in the market.

Elizabeth McQuerry:

One of the fascinating things to me is that we’ve also gone from… This is a very quickly, from this is a nice to have, that we would love to move to real-time payments. We think that’s what we’re going to do and five years or what have you, if we don’t have one now, and to very quickly to… This is an essential that we have to have, keep our economy modern, to stay competitive, to keep our banks competitive, as well as just, this is what, the speed of money now.

Elizabeth McQuerry:

It needs to be fast, faster. And what’s, I think just great is it’s kind of become a real convergence of ideas here. We’re not talking about all different flavors anymore. We’re not exactly on a paradigm, but we’re moving in that direction. I do a lot of work in emerging market economies.

Elizabeth McQuerry:

One of the things that I think is most exciting here is that we’re not talking about simply, closed loop systems that have instant payments because there are a lot of those. They work just fine. We’re not simply talking about card rails that are now doing credit push. And of course they also have instant payments for their debit transactions as well.

Elizabeth McQuerry:

But we’re really talking about bringing together all providers into a single ecosystem of payments, whether it’s commercial banks, credit unions, E-money issuers, the closed loop providers, the payment institutions. This is where everyone’s coming together in the payment space and pretty darn exciting.

George Peabody:

It really is a clean sheet of paper based on design principles approach. We’re no longer automating existing paper systems. So something is brand new. So Craig, let me turn to you. I know at and to Elizabeth’s point, I know connectivity between the incumbents, the banks core systems, for example, and the news payment rails that we’re talking about, is a big part of where ACI has delivered a lot of value in the years, over the years. Could you tell us about ACI’s role here? Because I know it’s beyond that, but I’d love to hear the two sides of that.

Craig Ramsey:

Yeah, sure. So first day that’s blow everyone’s mind away. Real-time payments isn’t new. What’s new is how we use them, the first real-time payment system, 1973, which is clearly older than all of us put together. It’s magnificent [inaudible 00:06:11], but real-time payments isn’t new. The new thing is about the customer experience of real-time payments. That’s what’s changing the game in payments globally.

Craig Ramsey:

ACI is actually also coincidentally around about 50 years old. Throughout that time we’ve been providing banks with real-time access to various elements of the payment chain and that’s continued. Obviously if we fast forward to today, the big conversation that’s going on in the market is around what we are referring to as real-time payments, elsewhere in the world, they’re called faster payments, immediate payments or instant payments, but they’re actually all the same thing. They are an account to account real-time clearing of funds.

Craig Ramsey:

Now I deliberately didn’t mention settlement, because settlement doesn’t actually have to happen at the same time. The settlement between the banks can come later. It’s about the consumer experience of seeing real-time cleared funds. And if I’m sending huge money, George, for the dinner that we’re sharing or something where we’re splitting the bill, you want immediate access to those funds so that you’re not subbing me.

Craig Ramsey:

So a real-time payment needs real-time clearing the funds. It needs real-time beneficiary access to those funds. So then we come back to how they see I helped. Well, we’ve helped with the acquisition of the transaction terminals, online banking, mobile banking now, and obviously as the digital channel experience changes, then so have our answers to how you actually solve for acquiring a real-time transaction. Then you need to do fraud management on the transaction.

Craig Ramsey:

It’s not long into a conversation on real-time payments. Do you then have the fraud management and fraud prevention conversation because you need to be scoring transactions in real-time, you need very high throughput of transactions, thousands of transactions, a second, you obviously need the approval of the payment, but the core banking, and those are all the things that ACI have been doing.

Craig Ramsey:

Only once you’ve done the acquisition and the fraud and the core banking management and the workflow processes, then you need to connect to what’s commonly called the scheme. And the Zelle is a scheme. The Clearing House real-time payments is as a scheme, the new FedNow system is a scheme. The US has got three, Europe has got one in each country at least plus some Pan-regional ones, there’s in Asia. And that’s where we talk about 50 of those around the world.

Craig Ramsey:

But the scheme changes, as with any new thing, it will evolve over years to come. That’s what’s so critical for a bank or a participant in this scheme, is it’s not just a connection point to a new way of clearing and settling transactions. You’ve got to have your back office processes in place. You’ve got to have your systems in place, and you’ve got to do that 24/7 as well, which, most payment systems don’t run 24/7.

Craig Ramsey:

That’s where I see I’ve been helping. Around the world we’ve now got customers in 14 countries in production with over 18 schemes or adding more this year. And that’s our mantra at the moment is to really build out those library of real-time connectivity scheme points that give our customers access to these real-time payments, so that they can turn that into modern digital experiences for their customers.

Elizabeth McQuerry:

Yeah, Craig, you mentioned scheme. That’s a word that we don’t commonly go much on this side of the Atlantic and it’s such an important variable here. These are where the real choices are made. The governance, what sort of use cases we’re going to have, what the rollout sequence is going to be. What differences are you seeing in schemes and around the world? I mean, what are the big commonalities and differences?

Craig Ramsey:

One of the happy places we see in real-time payments is there is a lot of commonality around the world now, every scheme, and yes, I know that’s not necessarily a word that’s used on the West of the Atlantic, but it is a reference point that most people can refer to. It’s the Clearing and Settlement Mechanism, what we might call the CSM.

Craig Ramsey:

There’s a lot of commonality between them, except for how the use cases are deployed. So everyone has a P2P scheme. Everyone has a P2P rule book effectively, after person to person payments. Then the next thing is to get the merchants of bolt. Once the merchants were involved in the billers and the utility companies get involved, and we see that as a pretty common rollout around the world. Now, every country will have a rule book, every scheme, sorry, we’ll have a rule book for their particular use case.

Craig Ramsey:

That’s where our solutions are actually configurable to suit those different rule books. So you might hear, okay, there’s a standard credit transfer in Europe under the separate in schemes. There’s a credit transfer, the clearing house. There’s a credit transfer in Malaysia. There’s another one in Australia. Guess what? They’re all different. They’re all sufficiently different that you need a rule book effectively for each one to be managed within the software.

Craig Ramsey:

And then you have to maintain it because as with any new thing, it changes over time and it will change very quickly. It will evolve very quickly. The Federal are already talking to us and saying, “Well, we’ve got these on phase one, phase two or phase three could look something different.”

Craig Ramsey:

So we know there’s evolution coming as well. It’s not a point in time. This is not an ISO 20022 point in time to get to, it’s about making your back office ready, preparing your systems, then connecting to these schemes and then having the maintain to keep up with the very rapid change that comes in the market.

Craig Ramsey:

I say 20022 is a common factor. People shouldn’t get worried about that. There are enough examples and experience now for rolling out ISO 20022 in real-time, that it is now a commodity, but that’s not the problem. The problem is about louring on the digital products that you offer to your customer.

Craig Ramsey:

It’s about, do you work with the FinTech community to give them access to real-time payments? Those are the… That’s where the variance happens. It’s not the technical standards that, sorry, the technical ecosystem. It’s not that that’s changing rapidly around the world. It’s all the nuances of how it’s deployed.

Elizabeth McQuerry:

Yeah. Fascinating stuff, the choices that are made. I would even slice the diagram a little bit thinner and say that the scheme makes all those choices. Does that structuring, it’s the platform like ACI that may be where the clearing and settlement itself, choices are concentrated and the scheme choices of moving things forward.

Elizabeth McQuerry:

That those are the real uniquenesses that we’re saying. And that, it’s great to look around the world and see that not every country is really just starting with PDP. They’re going for more, what we might call advanced use cases.

Elizabeth McQuerry:

I can’t tell you how many sort of government collections, opportunities that we’re looking at around the world where maybe tax collection hasn’t been as, shall I say, elaborated it as it is in some of our countries. But these are transformative opportunities through the payment system. It’s going to have long-term benefits, not just to banks or other financial services providers and their customers.

Craig Ramsey:

I think one of the… There’s a lot of conversation moment about central bank digital currency, real-time as a stepping stone to a central bank digital currency, if you expect to be where we are today and then leapfrog to central bank digital currency, got horrible shortcome because there are stepping stones along the way.

Craig Ramsey:

One of those is being ready for real-time services, real-time products, providing the right environment to support the FinTech community with overlay services. Those are all keen to what your effectively, your modern payment hub needs to look like. If we just bring it back to kind of more, now, there are multiple ways in the US they’re all going to be, three schemes and then several digital wallets as well. I know they probably are. They do or will have their own very specific target markets and use cases.

Craig Ramsey:

But there will come a time where there will be more than one way to clear and settle a real-time payment. That looks exactly the same. We know it’s coming. We can already see that there’s, certain similarities between what the Fed are offering with FedNow and what the Clearing House have already got out there with real-time payments. Then there’s going to become an extra layer of bank decisions, which scheme do I use for this payment and what might be the right answer at 10 o’clock in the morning might not be the same answer at two o’clock in the afternoon.

Elizabeth McQuerry:

Yeah. Glenbrook does some, I guess, thought leadership with the U.S. Faster Payments Council. We recently completed some qualitative interviews around, what are the end user perspectives on what interoperability should be with major systems in the US, there’s a real expectation that there will be some form of interoperability.

Elizabeth McQuerry:

Right now it’s not at least in public discourse on the table. They don’t really care how it happens. I think there’s a common belief that it’ll be something more of a technical integration rather than a scheme integration. As sort of coming together of the schemes. And of course, there’s a bounce sides and benefits to the technical perspective.

Elizabeth McQuerry:

It’s quicker. Doesn’t always cater to every possible thing that might happen to a payment. You get the long tail of little things gets bigger, even though it’s not going to happen very often, but the market is expecting this, and we’re not saying how it’s going to happen yet. So a lot of anticipation.

Craig Ramsey:

We’ve got an interesting use case in Europe. That’s already in production actually. And this all comes back again to the customer experience. In this instance, the customer is our banks, and I’ll explain why, but a customer expects the same experience.

Craig Ramsey:

They’re not going to go into their application and make the decision or which real-time system that they’re going to connect to. That’s what the bank adds value for. It has to be seamless. In all of this, the only successful real-time systems out there are the ones that have got the ubiquity.

Craig Ramsey:

If you look at countries where it’s being mandated, and there’s quite a few of them, we work in that, of course, there’s a hundred percent coverage, but also look at the growth rates that have happened in those markets. In Malaysia, it’s actually not mandated in India, but India is real-time on heat.

Craig Ramsey:

I’m sure we’ll come back to India. But in these countries where it has been mandated, fantastic growth rates and a shift in customer behavior away from legacy payment types, into the new modern real-time digital world. It’s not my language, I’m going to steal it from someone else I heard say it.

Craig Ramsey:

But one thing that we’re really good at in the payments industry is standing up new reel, is standing up new payment schemes. But the thing we’re really bad at is shutting down the old ones. So that use case in Europe. I should come back to that, sorry. I don’t know. It drifted.

Craig Ramsey:

In Europe, we’ve actually provided into connectivity between some of the schemes. In Europe, ACI provided that service. We work with our partner steps, who are the big clearing, the settlement mechanism in France and Belgium. What they do is they accept all real-time payments from their banks so that the banks have only got one connection point to pass the real-time payments or to receive them prom.

Craig Ramsey:

And then anything that’s not settled on stet. We, they work with us and we connect them out to the EBA and the CB tips to provide interconnectivity that way. That provides that holistic ubiquitous experience that the banks need to give to their customers for certainty.

Elizabeth McQuerry:

Are you able to bring that over here on this side of Atlantic?

Craig Ramsey:

We do have an operation. We shouldn’t find enough, and we could certainly offer that. So to the point where it shouldn’t be the bank’s problem as to which scheme they connect to. We already know if we look at the FedNow and the Clearing House, the expectation is that the larger banks will need to have connections to both. The smaller banks will likely just have a connection to FedNow. So for inter-operate, so for ubiquity happen, you’ve got to see interoperability as well.

Elizabeth McQuerry:

Yeah. There’s just too many financial institutions on this side as well, to think that we’re going to have everybody connected, everything. It’s just not workable.

Craig Ramsey:

We worked with Jack Henry and I know that certainly like, just love to connect the whole world.

Elizabeth McQuerry:

Yeah. But we’d like to do it in our lifetime. I want to ask you what sort of truly interesting end user use cases you’re seeing out there. I mentioned government collections, one of the countries that we’re just fascinated with is the phenomenal success of the new Pix in Brazil. I know they’ve had a lot of positive factors in their quiver, but they’re going out with multiple use cases.

Elizabeth McQuerry:

I think it’s actually the most successful, real-time implementation in history. If you look at the first five, six months of data, of course have read bank connected to it. It’s mandated, but we’re going straight to… We’re zooming right past P to P and taxes straight into the merchant world. We’ve never seen-

Craig Ramsey:

That’s right. The ramp-up in Brazil. So it went live just last November. So it’s six months effectively. It’s, let’s be generous and call it six months. Is this in production? Now, it wasn’t Brazil’s first real-time steam. They already had one, but it was quite limited in its reach. It was also limited in its timing that it was available in market.

Craig Ramsey:

It wasn’t available 24/7. So when Brazil started to go down the Pix journey and look at the use cases, then it was a big shift on how they do their digital payments in Brazil. We’ve actually got a sizable office in Brazil. So I spoke to our team down there. I wanted to get the hit.

Craig Ramsey:

I wanted to hear from the folks on the ground, how has it changed your lives? And sure enough, they’re all using it now. Okay. These are electronic payment geeks. So maybe you might claim that they would anyway, but they’ve said that they have changed their behavior on how they pay merchants, changed how they interact with each other.

Craig Ramsey:

It’s been a very positive experience for most people in Brazil, which I think is fantastic. I think if you were standing six months after the launch of your new real-time payment system, you’d be pretty chuffed with how it looks right now.

Elizabeth McQuerry:

Yeah. Of course, we should also mention that to the consumer who has a bank account, it’s free. So there’s no inhibition in trying it. You’re, everyone’s, in fact, people are even sending pictures and stuff to each other, where here they’re trying to stop that. It’s got to have a value. If you want to put something, put some data in there as well.

Craig Ramsey:

Which is value, pitchers data, data equals value.

Elizabeth McQuerry:

Art is in the eye of the beholder. But it’s pretty remarkable. The fact that they’re sort of, Brazil has had the Boleto for a couple of generations now, which is, was kind of the pay me a request for payment before even the barcode was popular. So this barcode would show up in your email and you can take it to a bank branch and they’d scan it and draw money out of your account. But now that’s going on the real-time system this year. I mean, just phenomenal transformation.

Craig Ramsey:

Yes. Yeah. Some of the use cases that they’ve been drawing out, just come back to that question of where we’ve seen use cases. As I said before, the first use cases that most countries roll out are those P2P credit transfers. Nice and simple. I want to pay someone. Then you typically get sending, CTB payments, maybe I’m paying my credit card. Maybe I’m paying off a utility bill. That kind of thing.

Craig Ramsey:

It takes a while before merchants get engaged. The way to a merchant’s heart is to reduce their interchange fees, to give them better reconciliation, to give them more data, to give them instant access to their liquidity on the payment. All of which funny enough real-time Gibbs and the request to pay mechanism is the answer to merchant streams in terms of how to do that.

Craig Ramsey:

Some of the legislation around strong customer authentication on cards means that a request to pay transaction is no harder as a customer experience than some of the strong customer authentication on cards is now around the world.

Craig Ramsey:

And certainly in an E-commerce environment, it’s very simple because you probably already registered at the merchant. So they’ve already got your mobile phone number or your email address. That’s often enough to refer to a directory to get to your account and be able to do request to pay.

Craig Ramsey:

It’s a natural evolution of delighted to see FedNow, we’ll include request to pay, call out to our friends at the Clearing House. They’ve already got request to pay. We’ve deployed that in a few markets around the world, actually, a request to pay services. Then you get the billers and you get insurance company disbursements.

Craig Ramsey:

What could possibly be better that you’ve got an insurance claim, you need money instantly. And it’s sent to your account for you to re-use instantly. Sending a check is really not very helpful when there’s a tree sticking through your house. So you need to out to solve these things and insurance payments, disbursements, salaries.

Craig Ramsey:

I’ve seen use cases in places like California who have got the legislation that you must have paid the worker if they’re leaving and a real-time payment enables you to do that. So it’s, all these times where you need to move money quickly and instantly, real-time payments are typically the answer. We see that evolution around the world.

George Peabody:

So Craig, go ahead, Elizabeth.

Elizabeth McQuerry:

No, George. Please.

George Peabody:

So Craig, you’ve used a few of the characteristics of these payments systems and of course, recency in market and moving money in real-time are kind of attractive attributes for fraudsters and in developed markets where we’re used to charge back privileges and consumer protections around some of those existing systems.

George Peabody:

The rhythm here that the Faster Payments Systems represent say at, are pretty attractive to fraudsters. We’re seeing in markets, well, of course, UK, because it’s wonderfully reports on its fraud activity and know has been able to…

George Peabody:

Has really shown that this problem of authorized push payment has really been a growing problem and authorized push payment is actually when the account holder correctly authenticates themselves to their bank. It’s not an account takeover. It’s, they have initiated the authentication process. They’ve done it themselves.

George Peabody:

And still the money is being sent to the wrong place. It’s being sent to a fraudster, it’s being sent to a fraudulent merchant and this losses have been pretty significant. As we work at Glenbrook, we’re working not only in developed markets, but in developing markets where we’re seeing fraud take place in these E-money systems. It’s a real concern where social engineering is so prevalent.

George Peabody:

What are you seeing to mitigate it, or is ACI have a role here to mitigate this thing? Because the operators can educate, sometimes that education is just Window dressing, and it’s certainly, we have a whole, we have generations of people who have particular expectations around protections, and now we’re saying use this real-time system. If you send it to the wrong person, the rules of different. What do you see to mitigate this risk?

Craig Ramsey:

Yeah, well, rather wonderfully the UK, not only reports on its fraud data, it provided rather conveniently the report update two days ago. So we’ve got some very fresh data on what the market looks like in the UK. Can you hear that from… Do I need to redo that? There was a phone ringing in the background.

George Peabody:

No. Its fine. Carry on.

Craig Ramsey:

Okay. I’m sure you can take that out. Just a couple of days ago, the UK provided the latest update on the fraud statistics in, according to the last 12 months or so. So we’ve got a good look of how fraud has changed during COVID as well, rather worryingly, 38% of all fraud losses are now down to authorized push payments, but there’s a couple of extra double click moments in there. Firstly, the value has only gone up about 5%, but the volume of authorized push payments has gone up much more.

Craig Ramsey:

It’s about 22% up on last year. That tells us that the fraudsters are simply doing this more for less value. If you look at some of the examples that are out there, purchase scans, investment scans got a list here, Holiday Scouts, romance scams, advanced fee scams, there’s whole avenues of what’s out there.

Craig Ramsey:

That’s really the issue, is that people aren’t stopping and taking stock of what’s being asked of them to do. We’ve all heard the radio interviews of the person that was phoned and was told that by their bank, there’s some unusual activity on their account and they suddenly need to move everything into this new account that they don’t know anything about.

Craig Ramsey:

You listen to it and you can’t believe what’s happened, but it is happening. It’s happening to people who are very much on the ball of what’s going on across the business.

Craig Ramsey:

So it’s very important that we educate. And that’s the first thing that industry must do is to educate the customer base. It has to be in many different ways. In the UK they’ve actually got a new education campaign going on called Take Five. As it suggests, just stop, think about what you’re being asked to do.

Craig Ramsey:

And then if you’re not sure, don’t do it, it’s as simple as that, but I was rather worried that they were promoting how they’re going to do this on social media, forgive me. But a lot of the people that need education and support may not be on social media.

Craig Ramsey:

If I think about my parents, they’re not doing social media, so that’s no good. So how about some door drops? How about some adverts and the education, even in a market where we’ve had real-time payments for 13 years is not enough.

Craig Ramsey:

We have to educate more. Education is only one thing you’ve then got to have the systems. Obviously ACI can help the systems. It’s about the scoring. Does this look right? Is the mute, is this going to a mule account? Are the, is there suddenly a lot of credits going into one account that’s never happened before? Is the KYC good enough?

Craig Ramsey:

That’s where the banks need to continue to invest. I’m not suggesting for one moment. They’re not investing already. They are, but this isn’t a problem. That’s going to go away. We’ve mentioned some other markets. One of the other scary things that’s going on at the moment in some markets is the authorized push payments are attached to what can only be described as a kidnapping.

Craig Ramsey:

They are taking the person off the street and forcing them to make the payment. Now, obviously you’ve got to protect the customer. The last thing we need to do is to give them a reject in their face that says, “Sorry, it looks like you’ve been kidnapped, good luck.” That’s not going to work, but you do need the systems back there to make sure that the payment and the accounts KYC are all adequately working or support, working well. And the industry collaborates to share that information. That’s a successful fraud prevention.

Elizabeth McQuerry:

That’s one of the missing elements I think is that industry collaborating on this right information sharing because fraudsters move from easy target to easy target. I think we could somehow do a better job there without getting into sharing private information. But we’re hesitant to do that as a general rule.

Craig Ramsey:

We do work with ACR also, a provider of central infrastructure itself to the central banks, the standup real-time payment schemes. And one of the things, the conversations we have is around fraud.

Craig Ramsey:

We encourage that collaborative, almost a committee of the senior fraud teams in the banks and the central bank to meet from before day one, but from day one onwards to share what’s going on, what kind of fraud attempts they’re seeing, and to then be able to change the rules in flight, across the industry to improve the prevention, because with a brand new scheme launching, that’s where the fraudsters are targeting first, you may have seen they’ll phone someone up, you may have seen this on the news today.

Craig Ramsey:

Good news. I can get you on it. Just give me all your money and passwords. That’s where you’ve got to have the right systems in place to protect your customer and give them a positive digital experience. Because if they get a negative digital experience, they’re never coming back.

George Peabody:

So Craig and Elizabeth, I have, we could go on for a really long time with this topic. This is fascinating. I have to thank you both, but we got to, we have to cut it off there. Thank you both for joining us. The Payment’s on Fire.

Craig Ramsey:

Thank you.

Elizabeth McQuerry:

Always fun, George, and great to talk with you, Craig.

George Peabody:

All right. Well done everyone. Hang on. Just a titch. I’m going to.