If Russ Jones was on a desert island, what would he bring? Four workshop slides. And this is one of them.

Russ often chats with professionals working for companies inside the payments industry who are providing payments and services to end users such as businesses, enterprises, governments, and individuals. Or they may be working at an enterprise, a merchant, or a biller. And they’re all trying to figure out how to save money in payments.

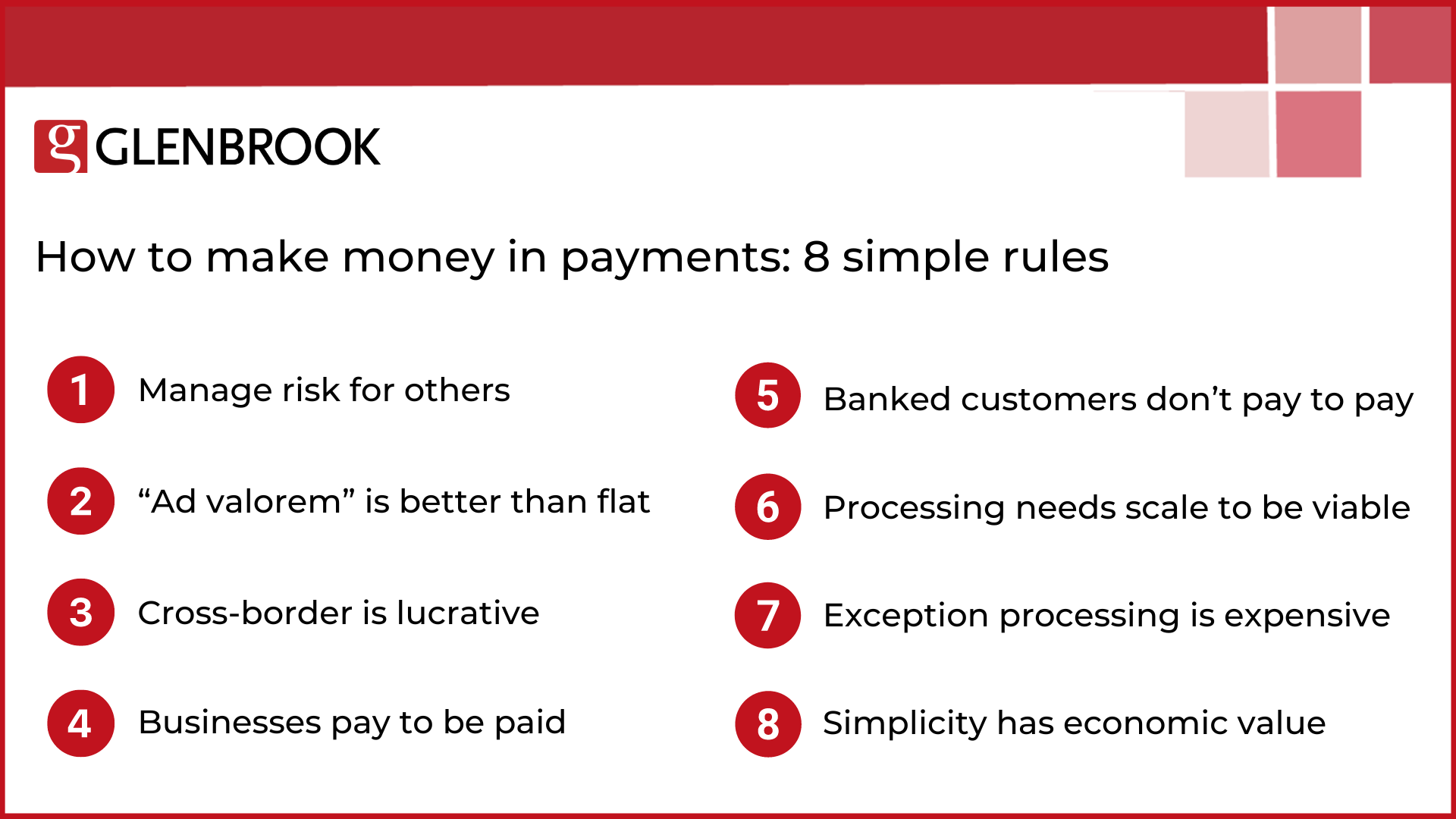

In this episode, Russ joins Yvette to talk through 8 simple ideas about how you make money in payments.

Yvette Bohanan:

Welcome to Payments On Fire, a podcast from Glenbrook Partners about the payments industry, how it works, and trends in its evolution. Hello, I’m Yvette Bohanan, a partner at Glenbrook and your host for Payments On Fire. Today, I am fanning flames with Russ Jones, partner in charge of our education practice. Russ, I am always delighted to be recording an episode with you.

Russ Jones:

Always, always happy to be on with you, Yvette.

Yvette Bohanan:

We don’t get to talk enough, Russ.

Russ Jones:

Yeah. Right. Always ready to talk payments.

Yvette Bohanan:

Always ready to talk payments but we’re going to talk education before we talk payments because we have an intensive workshop coming up, right?

Russ Jones:

Yeah. That’s April 23rd. For listeners that are not familiar with that, we do and have done for a long time, payments boot camps which are, when done virtually, they’re three days long, 12 hours. One of the things we’ve heard from our customers is, “Boy, I wish I could get my boss to just sit through one afternoon of this type of stuff.” So we’ve created a payments boot camp intensive that is very focused on the forest and not the trees. It’s just helping people see the big picture of how the payments industry is structured, how it works, and what the major trends are.

Yvette Bohanan:

Yeah. It’s a good class. It’s a good course.

Russ Jones:

Yeah.

Yvette Bohanan:

So I’m super excited that we’re going to be doing that again. For those of you listening who are interested in the condensed overview, the forest instead of every tree species out there that we examine in the full workshop, we’ll give you the scenic overview of the landscape of payments. It’s not just for your boss or your manager. A lot of people just say, “I wish I could get away for just a half day and get some of this. I can’t commit to the three full days right now.” It’s a good way to just get re-oriented or get oriented into the industry. So we hope you can join us. But when we do these workshops, Russ, oftentimes you will say, “If I was on a desert island, there would be five slides out of the boot camp that I would want with me at all times.”

Russ Jones:

Don’t stretch it, Yvette. There’s four slides that matter.

Yvette Bohanan:

Oh, sorry. But there are-

Russ Jones:

Don’t exaggerate here.

Yvette Bohanan:

The slides, the reason you say that is because those slides are… We could talk for ten minutes about the information on the slide. We could talk for ten hours, we could talk for ten days, which you might need to do on a desert island.

Russ Jones:

Very foundational positioning of things in the payments industry.

Yvette Bohanan:

That you could riff on forever.

Russ Jones:

Yeah.

Yvette Bohanan:

Really. Literally.

Russ Jones:

Absolutely. Absolutely.

Yvette Bohanan:

Until the rescue boat shows up or whatever. So I would consider the slide we’re talking about in this episode, in this topic, one of those things that it’s perennial-

Russ Jones:

It is. It is a perennial topic.

Yvette Bohanan:

And it’s perennial because when you’re in the payments industry as a provider, you oftentimes are not in it as a charity. You are trying to make money somehow. That’s what we’re talking about today, is how to make money in payments which gets a lot of attention.

Russ Jones:

That’s exactly right. When I interact with our participants in our workshops, by and large, they’re either working for a company that’s inside the payments industry providing payments and services to end users. End users here are businesses, enterprise governments, individuals, if you will. They’re either doing that or they are working at an enterprise, working at a merchant, a biller, and they’re trying to figure out how to save money in payments, how to operate on a more efficient basis.

But that’s a different topic. There’s all sorts of techniques that could be used to reduce payments cost, increase efficiencies, and things like that. But what I wanted to do today is just talk about some very simple ideas about how you make money in payments. Just to set the context here, every year McKinsey publishes a report on the revenues in the global payments industry. Their 2024 claim is $2.2 trillion worth of revenues were generated-

Yvette Bohanan:

Globally?

Russ Jones:

In the global payments industry. So somebody’s figured out how to make money in payments.

Yvette Bohanan:

Someone out there is cleaning up-

Russ Jones:

Somebody. Yeah. Yeah. Right.

Yvette Bohanan:

We have a list. These are your eight simple rules, eight simple tenets, and your first one is near and dear to my heart.

Russ Jones:

So how do you make money in payments? One of the primary ways you do it as a provider is you manage risk for others. It’s a classic way in payments that you make money. You take the risk off somebody else’s plate and they pay you quite handsomely, actually, to take that risk off their plate.

Yvette Bohanan:

So let’s give a contemporary example of a company doing just that.

Russ Jones:

Yeah. Yeah. So there is a company that was on Payments On Fire-

Yvette Bohanan:

Not too long ago.

Russ Jones:

Not too long ago called Link Money. They had done something that hitting the bullseye on this managing risk for others. They would position themselves as a pay-by-bank company and they’re using the ACH system to do direct debits. So-

Yvette Bohanan:

Which are risky. They’re pull transactions, there’s no authorization.

Russ Jones:

Unvalidated, pull transactions out of someone who claims to be your customer’s bank account.

Yvette Bohanan:

They’re also wildly popular. People outside the industry look at this and say, “It’s amazing that this even works,” when you tell them exactly what it is.

Russ Jones:

Right. So what they have done is they have, in today’s market context, they have combined some open banking, fintech-like services. So they can validate that the bank account to be debited exists. They can periodically take a snapshot of the balance that’s in the account. They can do some AI-ish modeling of the balance as it goes up and down, anticipating paychecks coming into bank accounts, and things like that. They basically enable a business to debit their customer’s bank account over the ACH system. But the magic here, and the reason why this is a great example, is they make a binding payment guarantee to their customer that there will not be any returns for non-sufficient funds and there will not be any claims of unauthorized account access.

Yvette Bohanan:

So taking a little bit of a chapter and verse out of the authorization in credit cards that the issuer gives?

Russ Jones:

Yes, yes. Exactly.

Yvette Bohanan:

A little bit out of that playbook.

Russ Jones:

Of course, the ACH system is gigantically low cost. That’s an interesting thing. So when I saw that company and what they were doing, it made me smile because they were right on top of rule number one. They’re managing risk for others and they’re doing it very deliberately. They’re doing it with their eyes open. They’re doing it with internal tools. One of the downsides of this rule is you don’t want to manage risk for others and not know what you’re doing.

Yvette Bohanan:

Well, yeah. It’s not just about… The keyword in there is manage. Not take, all right? So managing risk for others is one rule. Second rule?

Russ Jones:

Second rule is when you think about fees that you charge to customers, ad valorem fees are better than flat fees.

Yvette Bohanan:

Okay? So you’re throwing down the Latin here. Ad valorem means?

Russ Jones:

It’s Latin for percent of value.

Yvette Bohanan:

Percent of value. So what we’re talking about is the principal value of the transaction. So if it’s 10% on a hundred bucks, it’s $10?

Russ Jones:

Right.

Yvette Bohanan:

1%, $1? Okay.

Russ Jones:

Right. As a provider of payment systems and services, you’re always better off charging ad valorem fees because this is a little bit tied to risk. One of the ways you justify ad valorem fees is you’re taking risk on behalf of your customer. You’re managing risk on behalf of your customer. The larger the transaction size, the larger the credit access, the more risk there is. So you charge a percent and it’s completely justifiable in the eyes of the customer. Of course, you’re charging a percent. And of course, the larger the transaction, the more risk there is so I understand why you’re charging a percent of value. So the thing that’s so intriguing about ad valorem fees is there because they’re a percent of the purchase amount, they’re immune to inflation. Something I don’t know if that… Did you know inflation has been in the news?

Yvette Bohanan:

I had no idea. Yes.

Russ Jones:

It’s been in the news, okay?

Yvette Bohanan:

You know, we have enjoyed a period in history where inflation was relatively low. I mean, there’s a whole generation of people out there, maybe two, that don’t even realize that this happens cyclically, right?

Russ Jones:

The flip side of ad valorem being immune to inflation is that flat fees are fully exposed to inflation and inflation eats away the inherent value. Most providers of services that charge flat fees don’t have the luxury of going back and increasing their fees and renegotiating their fees just because inflation has ticked up in the last quarter as an example. So you look out over the last two decades, someone who is charging 10 cents a transaction 20 years ago, effectively is making 5 cents a transaction today because of inflation.

Yvette Bohanan:

That’s the whittling away of the fee value. Mm-hmm.

Russ Jones:

Yeah.

So you’re better off as a provider charging ad valorem fees than flat fees. There’s no better way to justify ad valorem fees than managing risk associated with what your customer’s doing. Now, I will say that the reverse is true. If you’re charging valorem fees and you’re not managing risk, you’re going to have a hard time justifying that.

Yvette Bohanan:

Exactly.

Russ Jones:

A really hard time.

Yvette Bohanan:

We see that play out. We see that play out in regulation all the time, right?

Russ Jones:

Yeah. We see that all the time. When we see a payment provider that is not taking any risk on behalf of their customers, yet they’ve somehow managed to establish an ad valorem pricing structure, that pricing structure will not stand the test of time.

Yvette Bohanan:

That’s true. It might work for a while, especially if they’re the only game in town.

Russ Jones:

Yeah. But people will figure out, “Wait a minute. Why am I paying you $40 on this transaction instead of $20 and there’s no difference to you from an economics point of view or a risk exposure point of view?”

Yvette Bohanan:

Right.

Russ Jones:

That’s a real tool. Ad valorem is better than flat. Get comfortable with the phrase add valorem.

Yvette Bohanan:

Yeah. Learn your Latin. Okay. It’s not just for doctors and lawyers. Okay. So rule number three, cross-border is lucrative.

Russ Jones:

Absolutely.

Yvette Bohanan:

And this is a fun one right now.

Russ Jones:

Yeah. There’s… Cross-border payments are the most lucrative corner of the payments industry. If you’re going to plant your flag, if you’re a fintech company and you’re going to revolutionize how Americans pay for automobile loans or you’re going to facilitate cross-border payments, cross-border payments is hands down the more lucrative of the two.

Yvette Bohanan:

Go cross-border. Yep.

Russ Jones:

Yeah. And so, what makes it lucrative first off is it’s hard and common sense says you get to charge more for things that are harder to do. If it was easy to do, companies would do it themselves, they wouldn’t need any help. But it’s hard to do so you can charge more because it’s hard to do. There’s also risk in cross-border payments because cross-border payments have a way of being cross-currency payments. So you have currency-

Yvette Bohanan:

Currency risk.

Russ Jones:

Currency risk. Once again, you’re making money by managing risk for others, you’re charging ad valorem fees. The thing that really justifies both here is because you’re facilitating cross-border transactions for your customers. So it’s not really surprising when you look around the fintech leaderboards and you see company after company after company that has established a new technique, a new corridor, new something that enables cross-border payments.

Yvette Bohanan:

Cross-border is not just confined to your grandparents set of fiat currencies anymore.

Russ Jones:

Yeah.

Yvette Bohanan:

The cross-border technique, this cross-currency conversion technique, is now being applied to stablecoins. Very similar models and it’s just considered yet another currency to a lot of providers out there. So you’re moving from… And in some cases even bitcoin, just a few of the cryptos. So bitcoin to fiat, fiat to USDC or Paxos or whatever. You’re seeing this model of cross-border currency conversion, different systems having to interact, be applied into this space, and it’s working. It’s very lucrative.

Russ Jones:

Yeah. So as an example of lucrative and not lucrative here, the international card networks have done a wonderful job creating a global card system that allows people like me and you to go have lunch in Singapore. There’s no confusion about how we will pay. There’s no confusion that the restaurant will be paid. That was not fall off a log easy, there’s a lot of heavy lifting that went into that. Today, when you look at the quarterly results and the annual results of these international card networks, cross-border payment processing has an outsized influence on their profitability.

In rough numbers, you would say it’s roughly somewhere in the 20… 5 to 10% of the transactions are cross-border in the card system and it represents maybe 20% of profitability for those card networks. So good example of that. The corollary that really proves the case is during the pandemic, when international travel round to a halt, man, did that hit those companies hard. They had negative growth on cross-border transactions that had an exaggerated impact on their P&L because of the role, the lucrativeness of those transactions in normal times.

Yvette Bohanan:

Exactly. Exactly. So cross-border is lucrative. Next one, businesses pay to be paid. If you’re not a business owner, you may not realize this.

Russ Jones:

Yeah. Businesses will pay fees to be paid. The thing that’s charming about that rule is that’s not a controversial idea. Maybe there’s some businesses that think payments should be free, but that’s few and far between. Most businesses think that if I’m the beneficiary of the payment, whether it’s my customer paying a bill, whether it’s my random person off the street buying something from me over the counter, it’s going to cost me some fees to collect those funds and get them into my bank account.

Yvette Bohanan:

This isn’t just credit cards-

Russ Jones:

No. No, it’s not-

Yvette Bohanan:

You collect cash, you have fees associated with accepting cash-

Russ Jones:

Yeah. Exactly right. Unless you’re a small business, you don’t really see the cost of cash in a fully exposed way. So when you think about someone who’s running a convenience store or running the dry cleaner and their customers are paying in cash, you and me, that seems like a cost-free way to make transactions and it’s not. There’s an inherent cost to accept cash, count cash, get cash to the bank to be deposited, and there’s fees to deposit cash in a bank. If you’re a business, if my grandmother sent me $100 bill in the mail. Grandmother’s like to do those types of things. I would just deposit it in the ATM machine and I’d have $100 more in my bank account. But it doesn’t work that way for businesses, they pay to deposit cash.

Yvette Bohanan:

Right. So you just hit on the corollary which is the next rule which is banked consumers don’t pay to pay or be paid.

Russ Jones:

One final point about businesses paying to be paid, what sort of fees do the banks charge? They charge ad valorem fees.

Yvette Bohanan:

Well, of course,

Russ Jones:

Of course, they do.

Yvette Bohanan:

The savvy banks do.

Russ Jones:

Why would they do that? It’s risky, right? The more potentially counterfeit funds are deposited in an ATM machine or in a bank commercial drop box, the more risk the bank is taking. So completely justified to charge ad valorem fees.

Yvette Bohanan:

That I jumped over, I leapfrogged into the consumer side of it, the other side.

Russ Jones:

Yeah.

Yvette Bohanan:

You’re very specific here, banked consumers don’t pay.

Russ Jones:

Yeah. Banked consumers will not pay to pay.

Yvette Bohanan:

Banked means, because we get this question a lot, people who have bank accounts, who are participating in the formal financial structure of a country.

Russ Jones:

Right. There was a point in time, and I can’t remember… Certainly in the last 20 years where Bank of America floated an idea… You might know about this, that Bank of America floated an idea that they were going to charge their customers, their good customers, a fee every time they used their debit card. The way that was reported in the news, it was like people were grabbing torches and lighting them and marching in the streets.

Yvette Bohanan:

That’s… Exactly. When they were coming into banking locations and ripping out phones and destroying the office.

Russ Jones:

Yeah. The psychology there is the bank customer thinks, “The bank already has my money and I’m pretty sure they’re making money off of my money somehow. I don’t know exactly how they do it, but they don’t need to be charging me additional fees to access my money after I’ve given them my money.” So they just basically won’t pay to use a debit card at the point of sale. They won’t pay an extra fee to pay a bill. They won’t pay their bank to send a real-time payment to one of their friends. They’re just not going to pay. Because in their heart of hearts, they believe that the deal they have with their bank is they have placed their funds in the bank, the bank is monetizing and making money off those funds, and they should be provided with free access to those funds.

So the point here is that it’s the banked customer who feels this way. The non-banked or the unbanked consumer doesn’t feel that way. They feel, “Of course, I’ll be charged a fee. If I don’t have a bank account and I have $100 in my pocket and I go into a convenience store to send some money somewhere, of course I’m going to be charged a fee. Because otherwise, how would the convenience store make money? Why would they do this for me? They have no relationship for me. They just wouldn’t do that unless I paid them to do it.” So the unbanked population, and I think this is true all over the world, the unbanked population stands ready to pay when they make payments. I’m not saying they like it, but they don’t object to it. They don’t light-

Yvette Bohanan:

If it’s reasonable, right?

Russ Jones:

Yeah. They don’t light the torches and march in the streets.

Yvette Bohanan:

Yeah. I think that that’s where the regulatory lens gets applied a lot here too is, “Okay. We get that there’s a fee associated with this, but it can’t be egregious.”

Russ Jones:

Right. It has to be reasonable.

Yvette Bohanan:

You can’t be taking advantage of someone. So a lot of times, you’ll see the regulations step in, in many countries, and temper that to keep it in line with what would be considered a reasonable fee or reasonable amount. They need to do that to protect people because folks do figure, “Well, I’m going to have to do this,” and you don’t want them getting taken advantage of in that process.

Russ Jones:

Rule number six.

Yvette Bohanan:

Rule number six, now we’re talking about the nuts and bolts of the stuff. So processing needs to scale to be viable. Scale is the synonym for volume in payments. We often say, “Payments is a volume game,” and it’s holding true for decades and decades here.

Russ Jones:

Right. So what is going on here, and this is a payment system phenomena, is you’ll sometimes hear people say, “When they build out the infrastructure for a new payment system…” New payment systems happen all the time, by the way. A lot of fintech companies are building new payment systems. All the buy now pay later companies have built new payment systems. When you build out the infrastructure and infrastructure here is data centers, bandwidth processing, software, operational staff, people will sometimes say that, “I spent $10 million to do the first transaction. And now, transactions 2 through 8 billion are effectively free.”

Yvette Bohanan:

That doozy, that first transaction was a doozy.

Russ Jones:

Right. If you could just skip that first transaction and jump right into transaction number two, it’d be very sweet. So there’s this never ending competition between the cost to support the infrastructure, the processing infrastructure, and the amount of transactions that go over that processing infrastructure. In general, the more transactions you have over the infrastructure, the lower your per unit cost is. So it doesn’t cost me $10 million to do a transaction, it costs me a fraction of a penny to actually execute one transaction.

Yvette Bohanan:

Right. I think this is also why you see payments when it becomes at the right price point and right level of maturity grabbing on to the next technology. Whether it’s mainframes to get out of manual, internet to get out of leased lines, you see this over and over again play up. Because that scale is so important to the overall business and you want the most economical way to scale because that improves your margin on every single transaction.

Russ Jones:

Right. And so, you see, on the business side of payments providers, you see a lot of consolidation, a lot of companies coming together all in search of what they call scale. But actually, it’s to competitively lower their per unit cost of processing a transaction to be as low as possible.

Yvette Bohanan:

Exactly. Exception processing. So we should probably define what we mean by an exception item.

Russ Jones:

Yeah. There’s a lot of things in payments that are lights out. Sometimes, it’s referred to as straight through processing. Where I go into the store, I use my debit card, and the charge purchase shows up on my bank account and it didn’t require humans to actually do anything. It was all done by computers and software and it’s straight through.

So the opposite of that is when there’s an exception, when something goes wrong, when there’s a problem, and it requires manual intervention, manual inspection, forensic work, special access to a special screen that the customer doesn’t have but the provider has. Anytime you’re doing something that’s not straight through processing, it’s considered an exception and it’s expensive to do. You don’t want to have people involved in digital payments. That’s the bottomline. The same thing… We say this is one of the simple rules to how to make money in payments, is to reduce the amount of exceptions you handle.

But I would say this goes outside the payments industry and there’s a lot of companies that have figured this out. I think about, “I can’t get this search engine to work. I think I’ll call Google,” right? No one is going to call Google because Google won’t let them call them, right? They refuse to handle exceptions. You see that when companies work, when really, really, really, really big companies work at scale, always a corollary there is they are taking super deliberate steps to reduce exception handling and the payments industry here is no different at all.

Yvette Bohanan:

Well, it’s extremely expensive and it goes against that last rule of being able to scale.

Russ Jones:

Right.

Yvette Bohanan:

It’s a separate rule but it goes hand in glove.

Russ Jones:

Okay.

Yvette Bohanan:

Simplicity.

Russ Jones:

Rule number eight.

Yvette Bohanan:

I feel very zen as we approach rule number eight. The simplicity of a payment transaction has economic value.

Russ Jones:

We’re going from risk management on one end all the way to zen simplicity on the other end.

Yvette Bohanan:

Our moment of zen here with simple transaction.

Russ Jones:

Yeah. The final simple rule and payments is that simplicity itself has economic value. Meaning, people will pay more for products and services that are simpler to use. You see that plenty of examples in the real world. People flood Apple stores. They love MacBooks. They could get a PC cheaper but they like the simplicity. They value the simplicity. The same thing is true in payments. Anytime you can do something that’s very easy, very intuitive, very self-serve oriented, usually have pricing elasticity, then you have the ability to charge very attractive fees for that.

So the two bright shiny stars on the hill are Square and PayPal. Square especially which has made payments acceptance in a store just drop dead easy, drop dead simple. Granted, it was a complicated market to start with so it was easy to simplify it in that sense. But they have had the ability to get a lot of economic value out of the simplicity. The fact that it costs more is just immaterial to the customers because it’s so, so, so easy to use.

Yvette Bohanan:

I don’t know if it always costs more actually. It’s the real interesting thing about it. A lot of businesses that were able to pay or to accept cards in that were paying quite a bit more than what Square’s charging these days. So there’s a history there that’s interesting too in how they’ve brought down. They still make money, obviously, but they’ve brought it down to a whole different level. And probably because they were doing a lot of these other things with ad valorem, with exception, removing exception processing. In fact, I remember actually going into a small pharmacist in Portland at one point and this pharmacist was using Square. And so, I said, “How do you like Square?” Because I always have to ask, I can’t just pay and walk out like a normal person.

Russ Jones:

No, you’re compelled. Professionally compelled.

Yvette Bohanan:

So I knew being in the payments industry, this person was not a pharmacist, they were a merchant, they were accepting cards with Square. So I said, “How do you like it?” The pharmacist said, “This is great. It’s absolutely great. Except if I have a problem, I can’t get ahold of these people. There’s no phone number. I don’t know how to reach them for customer support.” So they were definitely applying this very early on.

Russ Jones:

Yeah. What he told you was, “I love this but this rule number seven is killing me.”

Yvette Bohanan:

The rule number seven is killing me. But everything else, I like about it, so I’m going to keep doing it, right?

Russ Jones:

Yeah. There’s no exception processing.

Yvette Bohanan:

Yeah. “So well, what do you do when you have a problem?” “Well, I unplug it and I wait.” Yeah.

Russ Jones:

That’s exactly right. That’s exactly how real life works. When something’s broken, you reboot it. You unplug it and plug it back in. Let’s see if that fixed it. Oh, it’s fixed.

Yvette Bohanan:

Ta-da, let’s go. Yeah. Off to the races.

Russ Jones:

I’m pretty smart about doing the maintenance on this stuff.

Yvette Bohanan:

Yeah. So… That’s a far cry from 30 years ago, right?

Russ Jones:

Yeah.

Yvette Bohanan:

So Russ, the last thought I think we should leave people with as they contemplate the eight simple rules of how to make money in payments is… We’ve said this word a lot in this podcast which is system. These are systems. There’s always that push me, pull you, yin yang in a system, right? We like to say that one person’s revenue stream is another person’s egregious fees in the stakeholder value chain. So the system is always working to figure out how to balance itself across these principles and-

Russ Jones:

Yeah. For sure.

Yvette Bohanan:

That’s what makes watching disruption, watching new innovation around these rules, watching fintechs come in and try stuff. Sometimes they’re super spectacularly successful and sometimes they’re breaking the rules too much and you watch an epic failure. But that’s the important thing to keep in mind through all of this, right?

Russ Jones:

Yeah. And that’s… Circling back to our education workshops and the intensive, it’s all about getting clear in your head how the industry works, what the key ideas are, the core principles, the terminology. So you feel confident talking to your peers, you feel confident talking to customers and vendors about what’s going on.

Yvette Bohanan:

Well, and you think about it a little bit harder. You think about these things more deeply because you understand that there’s always something that could happen that’s an unintended consequence out of all of it, right? You lean a little bit too heavily on one of the rules versus another or you ignore the other rules and that system is out of whack. Your solution that you’re providing, how you’re providing it, how you’re going to market, isn’t quite humming the way you thought it would. I think it’s important to remember that you have to consider everything. You can’t just pick up one bullet and go in this stuff. It doesn’t work that way.

Russ Jones:

Bullet point, Yvette-

Yvette Bohanan:

One bullet point. I am not advocating violence in payments. Bullet point-

Russ Jones:

Violence in payments… That’ll be a different Payments On Fire.

Yvette Bohanan:

For the record, I was one of two executives in the room that said, “Don’t impose those fees on those accounts.”

Russ Jones:

At Bank of America?

Yvette Bohanan:

They did… Yeah. Yeah. I don’t go on the record very often about my past but I will go on the record for that one. I took a very principled position on that. I was unfortunately outvoted but I had my day and said my piece. Okay. Well, Russ, it’s always a pleasure. Thank you so very much for this discussion. I hope our listeners find it as fun and useful as so many of the folks that have gone through our workshops. So thanks.

Russ Jones:

Thank you, Yvette.

Yvette Bohanan:

To all of you listening, thanks so much. Until next time, do good work. Bye for now.

If you enjoy Payments On Fire, someone else might too. So please feel free to share this podcast on your favorite social media outlet. Payments On Fire is a production of Glenbrook Partners. Glenbrook is a leading global consulting and education firm to the payments industry. Learn more and connect with us by visiting our website at glenbrook.com. All opinions expressed on our podcast are those of our hosts and guests. While companies featured or mentioned on our show may be clients of Glenbrook, Glenbrook receives no compensation for podcasts. No mention of any company or specific offering should be construed as an endorsement of that company’s products or services.