Entertainment

The entertainment industry is made up of multiple, distinct sub-markets. One way to break it down is to consider the content or activity type, for example:

Digital content, inclusive of video streaming and downloads, news access and subscriptions, audio content purchases (i.e., books, stories, music, podcasts), and video games (i.e., game purchases, in-game purchases)

Events , inclusive of events ticketing to sports games , concerts, etc .

Online gaming and betting, inclusive of sports betting, casino games, and other wager-based betting experiences

Another way to consider the market is by the key players, like Consumers, Content Creators, Distributors/Platforms, and Advertisers. In either instance, if you are an organization working within one of these markets, you offer end users access to fun and leisure, and end users have high expectations for related experiences – including payments. As a result, you must take a more systematic and intentional approach to your payments strategy.

Glenbrook supports entertainment companies to address the following common questions

How should our payments strategy support our growth strategy?

How should we support tokenization, if at all?

What fraud vectors should we be most concerned about and how do we best mitigate those?

What is the optimal team configuration to support our payments strategy?

What is the optimal architecture to support our objectives?

Are we using the right payments partners?

What orchestration approaches are most meaningful to us?

Are we exposed to churn risk? If so, how do we best manage it?

Our Clients

Gaming Companies

Event Ticket Marketplaces

Newspapers

Digital Music & Audiobook Services

Video Streaming Services

Other Entertainment Companies

Entertainment Case Studies

Resources

Articles

Glenbrook shares our perspectives on activities in the industry.

Podcasts

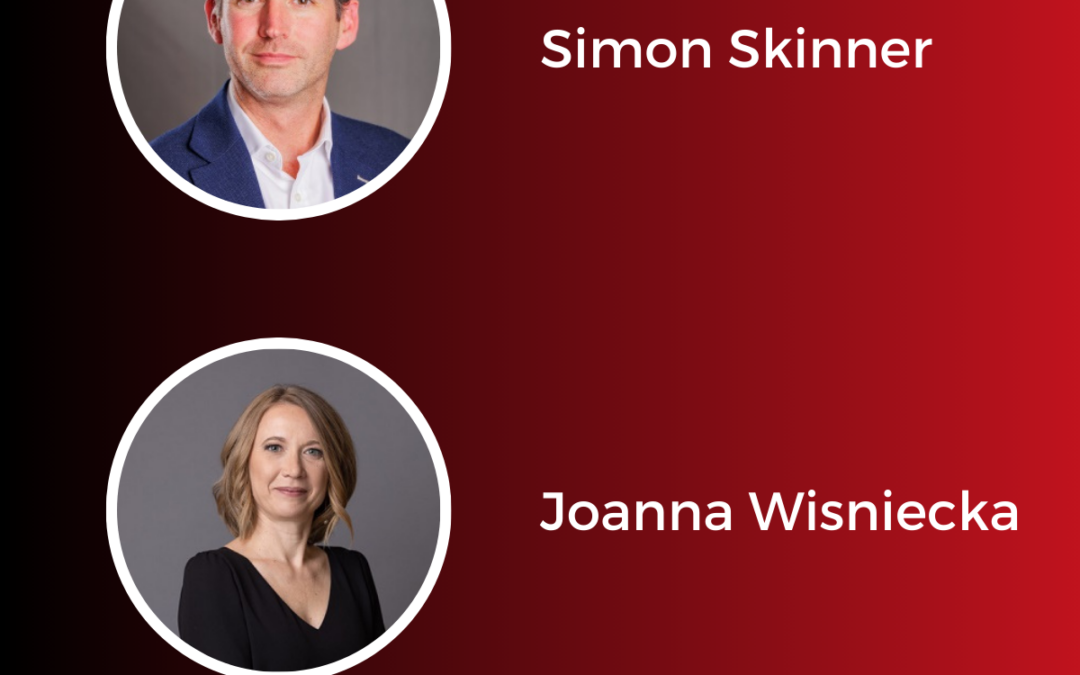

Glenbrook speaks with industry leaders to share a variety of perspectives on the latest payments trends and activities.

Episode 284 – Fanning the Flames – Advanced Payments Workshop Recap

If you missed our Advanced Payments workshop in San Francisco last month, tune in to this episode to hear Yvette Bohanan and Russ Jones discuss the key topics and conversations from the session, including card network updates, stablecoins, and agentic commerce.

Episode 283 – Banking on Stablecoins, with Scott Southall and Will Artingstall, Citi

In this episode, Yvette Bohanan and Ashley Lannquist welcome Scott Southall, Head of BaaS, and Will Artingstall, Head of Digital Assets Payments and e-Commerce at Citi, to dig into what recent stablecoin regulatory changes mean for the future of banking, how U.S. institutions are mobilizing behind digital dollars, why clients are asking about new forms of money, and what’s next as stablecoins potentially go mainstream in the American financial system.

Episode 282 – Why You Need a Stablecoin Strategy, with Ran Goldi, Fireblocks

In this episode, Yvette Bohanan welcomes back Ran ‘Goldi’ Goldshtein, Senior VP of Payments and Networks at Fireblocks to provide his perspective on the evolution of the digital currency space.

Tune in as they break down a stablecoin transaction, discuss the current state and adoption of blockchain technology, and review various use cases for stablecoins. They define terms like TradFi, Defi, and smart contracts, and explore the impact of tokenized deposits and AI on the digital currency landscape.

News

Glenbrook objectively curates the news to keep you abreast of important daily headlines in payments.

Apple Card Will Move From Goldman Sachs to JPMorgan Chase

"JPMorgan Chase has reached a deal to take over operation of the Apple Card reports The Wall Street Journal. Barring any "last minute hiccups," the deal should be announced shortly after over a year of negotiations. Alongside its new Apple Card partnership, JPMorgan...

Stripe Users Can Now Pay With Crypto Through New crypto.com Partnership

"Stripe, the software used by millions of businesses to process payments, has just announced a partnership with Crypto.com to facilitate the acceptance of cryptocurrency. The collaboration will also allow Stripe users to purchase crypto with credit or debit cards. The...

JPMorgan to Issue Its JPM Stablecoin Directly on Privacy-Focused Canton Network

"J.P. Morgan's Kinexys and Digital Asset plan to bring JPM Coin to the Canton Network, enhancing real-time, interoperable digital money. The initiative aims to bridge traditional finance and digital ledger technology while maintaining privacy and compliance. The...

Ready to see how Glenbrook can support your entertainment company to be as efficient and effective as possible?