At Glenbrook, we believe that efficient and inclusive financial services are vital to economic growth. In support of this mission, we have worked on fast payments initiatives in 55 countries or regions to date. For example, we have developed principles for inclusive instant payments systems, contributed to the implementations of these systems, supported stakeholder convening efforts, assessed the business case and drafted complete scheme rulebooks. (Note: fast, instant, and real-time payments are often used interchangeably. We will use the term fast in this piece to refer to payments systems that make funds available to the payee in real time.)

While our implementation work has focused largely on emerging countries, our learnings and insights encompass global initiatives. Having developed the U.S. Fast Payments Barometer with the U.S. Faster Payments Council, we are keenly following industry developments and watching sentiments for how fast payments might change the U.S. payments landscape. And with the FedNowSM Service about to launch, it’s fair to say that the market is heating up!

Unknowns abound and we will have to wait and see if a fast payments revolution is coming to the U.S. Both RTP and Zelle have been active for several years but the fast payment market has not yet ignited beyond Zelle’s P2P use case. One thing we know is that change, as well as new entrants like the FedNow Service, bring new focus and opportunity. We hope payments service providers (PSP) of all kinds (we use that term loosely) are paying attention and developing strategies to take advantage of these opportunities. Here we share our thoughts on a few of those opportunities. First, let’s start by describing the U.S. fast payments landscape.

What is unique about fast payments in the U.S.?

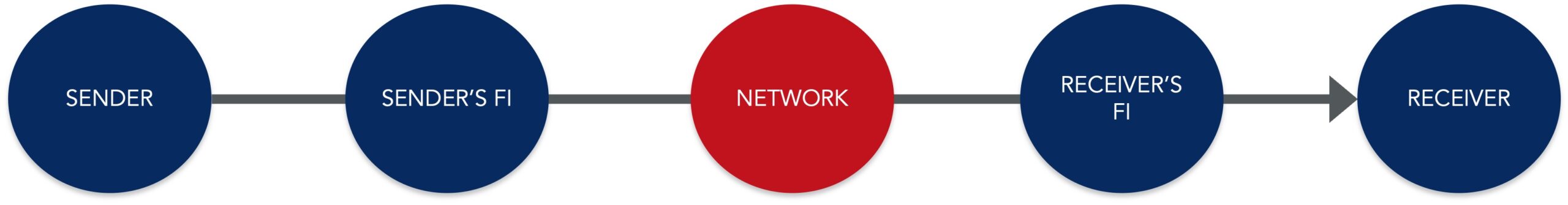

In its most basic form, the U.S. fast payments value chain mirrors other fast payments system value chains, with a sender and sender’s institution on one side of a network, and a receiver and receiver’s institution on the other side of the network (Diagram 1).

Diagram 1: Classic Open-Loop Fast Payments Value Chain

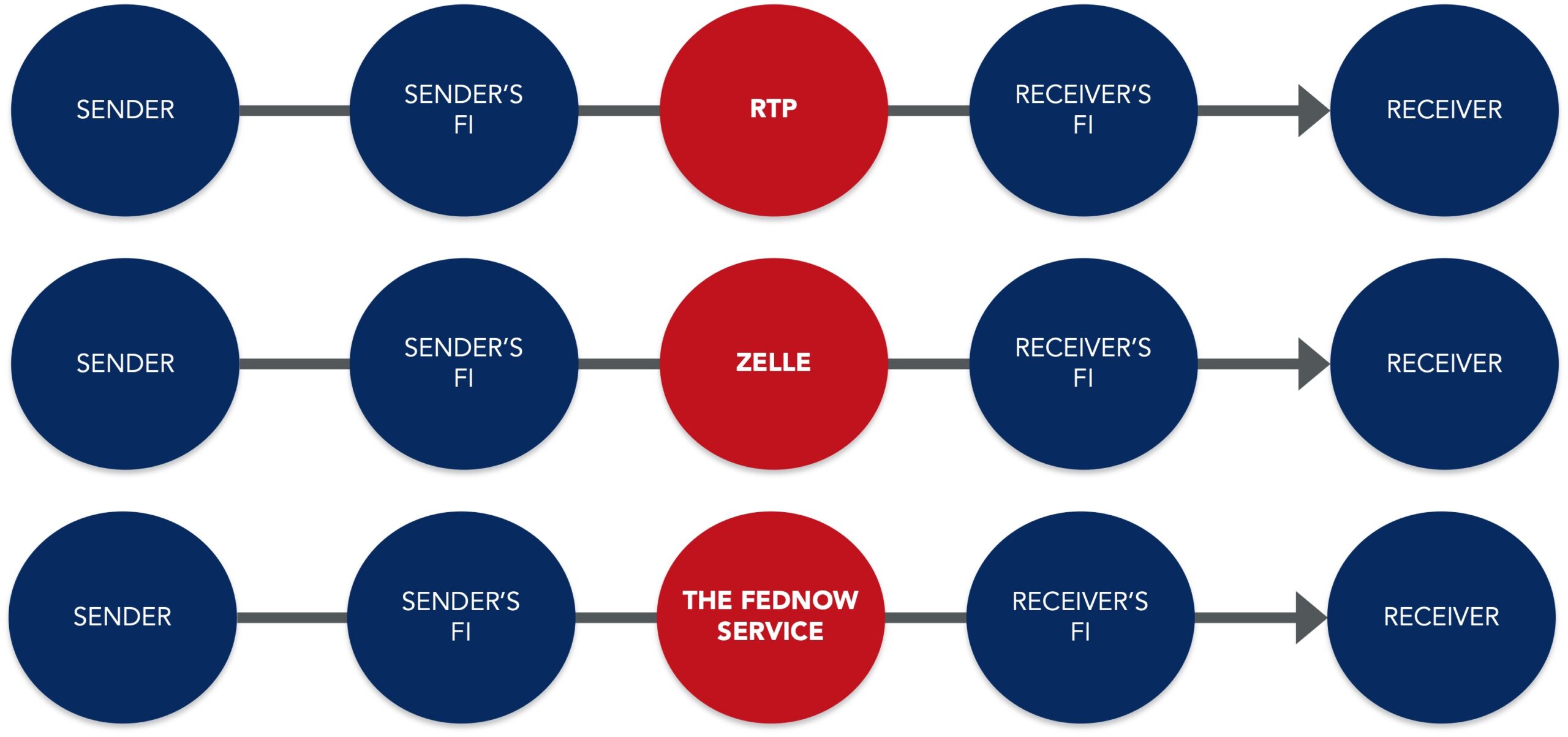

In most countries, there is a single open-loop fast payments network. In the U.S., we will soon have three: Zelle, RTP, and the FedNow Service (Diagram 2)! You may pause at our classification of Zelle as fast payments network in same category as RTP and the FedNow Service. See below to understand why we consider Zelle a fast payments system, while other P2P and P2M solutions like Venmo and PayPal we do not.

Why is Zelle a fast payments system?

We consider Zelle an fast payments system for two reasons

- It is open loop: an open loop payments system connects multiple financial institutions to one another to send and receive payments. End users have contractual relationships with their participating financial institutions and those financial institutions are bound to the system rules. Meanwhile, Venmo and PayPal are closed loop systems that connect to end users directly. Each end user has a direct contractual relationship with the system itself.

- It supports direct deposit account (DDA) to DDA payments: end users are not required to open another wallet or account to send a Zelle payment, they can use their DDA to send and receive payments. This contrasts with Venmo and PayPal where end users are required to fund their account or their transaction with another payment method (i.e. DDA, credit card).

And guess what, the three U.S. fast payments systems will not interoperate, at least not initially. Another by the way is that only deposit holding financial institutions (FI) will be able to participate in these networks directly. These factors raise complex questions. Two top of mind questions for us are:

- How will a financial institution connect with the multiple networks offering the same type of payment rails?

- How will the many small financial institutions in the U.S., which may be challenged by smaller IT budgets or other factors, provide relevant and engaging solutions and consistent fast payments experience to their senders and receivers regardless of the network those payments travel over?

Diagram 2: U.S. Fast Payments Value Chain(s)

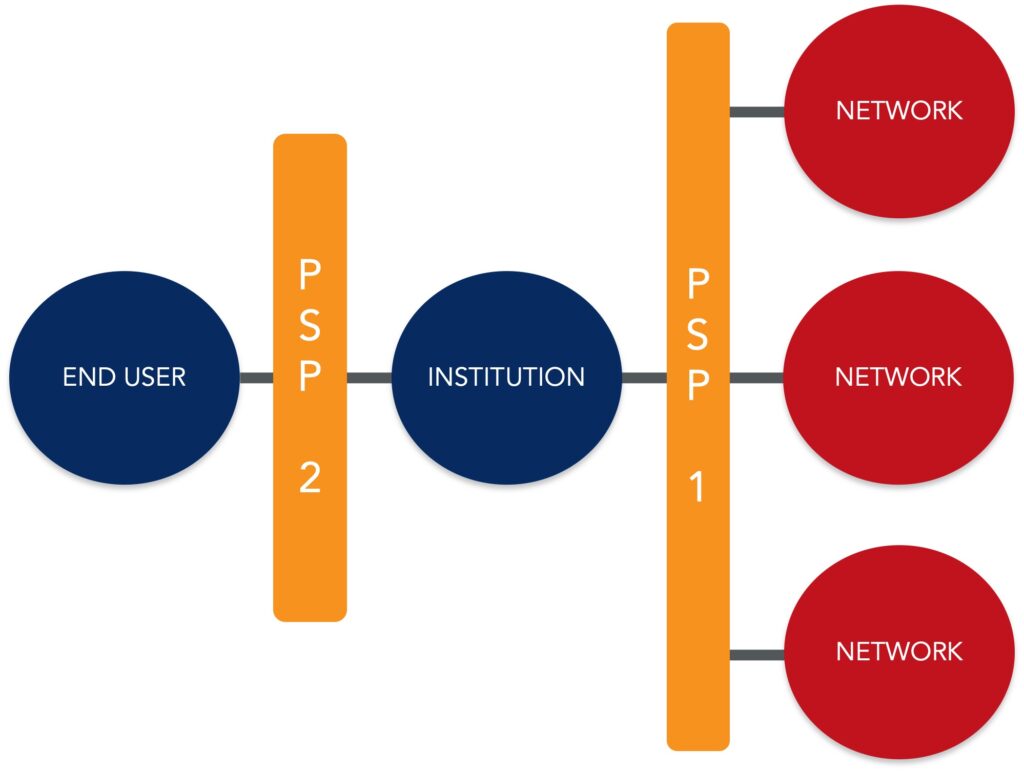

The payment value chain, in reality, is typically much more colorful than its basic form above and may involve more entities at all stages. In the context of the unique U.S. structure, this complexity spells opportunity for industry players. We use the term payments service provider to broadly refer to the companies that do not have direct access to the networks but can play a role in the value chain by supporting and partnering with financial institutions to provide solutions.

- Payments service provider that provides a bridge between a financial institution and the networks: financial institutions that may struggle with directly connecting into all networks, since each has specific requirements, can instead partner with a PSP that can do it on their behalf. Moreover, the PSP can support ‘smart’ routing, selecting the network that is best suited for each specific transaction and potentially other solutions that support FIs like mitigating fraud.

- Payments service provider that partner with financial institutions to provide end users (consumers and businesses) with solutions: many financial institutions in the U.S. may struggle to quickly provide engaging solutions and end user experience built to enable fast payments. PSPs can step in with solutions (white-labeled or branded) to help promote uptake and ubiquity. PSPs may provide various services, such as mobile and online banking platforms, bill presentment solutions, payment operations software, and others.

Diagram 3: U.S. Fast Payments Opportunities

We see companies in the U.S. playing many of these roles already in the U.S. and others working to step into the fast payments space with new and targeted products. Other countries’ experience with fast payments provide great learnings on companies successfully enabling fast payments for end users and network participants.

Specific approaches and products that have worked well elsewhere, may not translate as well to the U.S. market but global learnings provide inspiration for innovators to develop solutions targeted to our environment. The next Payments Views post by my colleague Cici Northup will speak to these global learnings in more detail.