At Glenbrook we take pride in, and place great importance on, our historical focus on end users: consumers, enterprises and small businesses that make and receive payments.

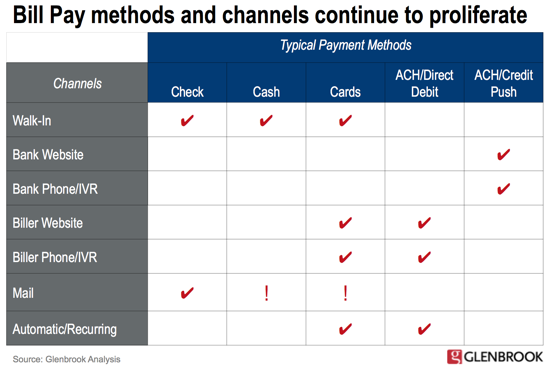

Recently, we’ve been working with and thinking about billers – the unsung masters of payments complexity. Consider the table below. What other players in the industry accept as many different forms of payment, across so many channels as billers?

We recently performed a Glenbrook biller benchmarking study that confirmed the acute challenges facing billers, ranging from persuading customers to pay electronically, the cost of payment acceptance, to timeliness of processing incoming payments (see chart below).

No surprise, cash is particularly expensive to accept. It adds delay in processing. Although large billers are well aware of cash’s handling cost, very few billers limit the number of payment methods they accept because most, of course, simply want to get paid. As a result, billers support a wide range of customer payment preferences that almost always includes in-person cash payments as well as checks, money orders and cards.

Larger billers typically accept payments directly at their own facilities with a dedicated payments counter in their offices or accept payments at customer service locations that also provide account management or sell goods and services.

Handling in-person payments requires well-trained staff, live access to billing systems to verify consumer account status, disciplined procedures to ensure accurate accounting and avoid shrinkage, and convenient means to securely deposit funds in a timely manner at the biller’s bank. Back office support is also necessary to ensure accurate application of in-person payments to the consumer’s account and make correct reconciliation of bank deposits.

As billers expand their payment acceptance offerings to include in-person transactions, mobile payments, as well as one time and recurring payments online, the back office effort to accurately apply payments to consumer accounts and reconcile incoming bank deposits will demand more time, IT resources, and payments expertise. Billers are increasingly seeking solutions that minimize this data-handling overhead.

In this white paper, we explore how PayNearMe addresses the cash headache for billers and extends bank treasury management solutions to support cash alongside the traditional payment methods of checks, cards and ACH. It contains two case studies illustrating the back office benefits and customer satisfaction results. Download a copy here or click on the thumbnail below.

This Payments Views post was written by Glenbrook’s Erin McCune.