Last week’s news that MasterCard was exploring an investment or outright acquisition of VocaLink really lit up the “News” channel on our Slack system at Glenbrook.

For those unfamiliar, VocaLink is a company currently owned by 17 large U.K. financial institutions, which operates the U.K.’s main ATM network (Link), its ACH-equivalent system (Bacs), and most interestingly, its Faster Payments system, an “immediate” payment service for account-to-account transfers. Of course, immediate payments are a very hot topic in global banking and VocaLink’s leadership in this area (U.K. Faster Payments has existed since 2008) is what has raised the company’s profile and captured the attention of the likes of MasterCard.

These kinds of immediate payment systems are making their way around the globe as developed market banking associations and central banks modernize their systems. VocaLink has already developed the FAST system in Singapore, and was recently hired by The Clearing House (TCH) in the U.S. to build its forthcoming offering. There is even growing discussion and effort around the idea of making these systems compatible across borders, with consensus on a credit push model with associated remittance information carried by the ISO 20022 data standard. At the same time, mobile money and other closed loop wallet programs in emerging markets are starting to create similar capabilities and interoperability. With this growing momentum, MasterCard’s interest in VocaLink is easy to understand.

One of the unknowns, at least in the U.S., is the economic arrangement that will accompany these new immediate payments (as my colleague, Carol Coye Benson, recently discussed). While we assume that participating financial institutions (FIs) will set the price of the new service to its own customers (likely as part of a checking account package of services), the internal network pricing is still to be worked out. How much will FIs be charged for their use of the service? What value limits, if any, will apply to these payments? Perhaps most important, will use of the service involve any mandatory fee payments between the banks involved? Card networks have a long required an interchange payment between the banks involved in a transaction, and recently the U.S. ACH announced that its new same-day payment service would include an interbank fee of 5.2 cents from the originating FI to the receiving one for each transaction.

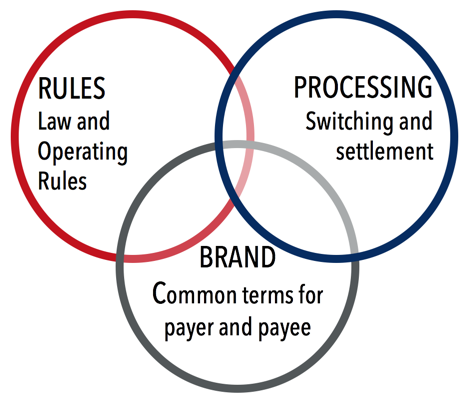

These musings led us to review just who gets to make these kinds of decisions in payment systems. In our Payments Boot Camps, we use the following simple chart to explain the three critical functions in any payment system:

The assignment of these functions can vary from one payment system to the next. Card-based payments are typically highly centralized, with a large entity like Visa, for example, simultaneously overseeing the rule making, processing and branding functions, with rule making obviously strongly influenced by law and regulation. Other systems allocate these roles to different entities. In the U.S. ACH system, for example:

- Rule making is handled by NACHA, an organization consisting largely of the FI users of the ACH system

- Processing is spread across two “operators” – the Federal Reserve and EPN, a unit of The Clearing House

- Branding is not a major focus of the ACH system; those decisions are generally left to the participating FIs and other users of the system, who employ a variety of names for different ACH use cases such as “direct deposit”, “auto debit” and “e-check”.

In recent years, European regulators have sharpened this distinction, calling for a separation in each payment system of the Processor, the company mechanically operating the system infrastructure, from the Scheme, essentially the rule making body governing the system. The word “scheme” sounds nefarious to the American ear (as in Ponzi Scheme), but in this case it simply describes a specific payment system, particularly its commercial rules and pricing structures. In fact, one of the reasons that VocaLink may be for sale surrounds concerns by U.K. regulators that the company is not sufficiently separated in ownership from the schemes that it serves.

So, while VocaLink plays a critical role in the operation of the U.K. Faster Payments system, it does so as the processor for the system, which is managed by the U.K. Faster Payments scheme, a non-profit membership organization whose Board of Directors consists of representatives from most of the U.K.’s major FIs and a few independent directors. In effect, the Faster Payments Scheme has hired VocaLink to provide central infrastructure for the operation of its payment system.

So, how would all of this be affected if MasterCard, or another commercial entity, acquired VocaLink? The potential impact of immediate payments on card payments is already the subject of some debate, but it seems presumptuous, and probably simply wrong, to assume that a new owner of VocaLink (a Processor) would exert any special influence over the commercial attributes of the payment systems (Schemes) it supports.

The centralized and privatized governance model of the card networks seems unlikely to prevail in the immediate payments arena, even here in the U.S. As noted above, TCH has decided to create an immediate payments scheme — even as the Federal Reserve continues its process to define the requirements for immediate payments — and it has hired VocaLink to help build and operate its system on an outsourced basis. TCH is owned by a consortium of large banks that would be the largest users of the system; I believe TCH will want to retain the rule making responsibilities for their system.

In fact, the U.S. is headed for multiple immediate payment schemes as Early Warning Systems (another company owned by a group of large banks) recently acquired clearXchange, a bank-owned company that had built infrastructure designed mainly to support very low value immediate payments geared to the person-to-person use case. That system is expected to become operational later this year, with no apparent involvement by VocaLink, even though there is a substantial overlap of ownership between TCH and Early Warning.

So, while MasterCard (or another owner of VocaLink) would likely not be able to dictate the rules of a new immediate payments scheme, I still believe VocaLink represents an increasingly important asset in the processing space. Immediate payment systems seem likely to proliferate across both the developed and developing worlds. Given that VocaLink enjoys a leadership position, and is already demonstrating an ability to scale technology on a global basis, its growth prospects would be appear to be strong. Other processors are also active in immediate payments and could also become acquisition targets for the large, global payment processors.

The interesting question that we will be monitoring as these systems develop is how they find their place among other payment methods and compete for the volume available in a range of payment domains, from P2P to consumer bill payment, to business payments and even onto POS and remote commerce transactions.

It should be fascinating to watch this evolution. How do you see it playing out?