This week I’ve been in Amsterdam for Sibos – the annual international banking conference sponsored by SWIFT. (For those of you who aren’t familiar with SWIFT it is a consortium of worldwide banks that runs a global secure network connecting banks in over 200 countries. Interbank messages to support payments and brokerage trades all travel via SWIFT.) This was my first Sibos and I’m impressed. There were over 9000 attendees from 150 countries, 170 sessions and 175 speakers, including yours truly. The exhibit hall was filled with the most extravagant booths I’ve ever seen – more over-the-top than BAI during the late 90s. It was all very well organized although I can’t believe they didn’t have wifi widely available (it made the Twitter coverage somewhat spotty, but we did our best).

This week I’ve been in Amsterdam for Sibos – the annual international banking conference sponsored by SWIFT. (For those of you who aren’t familiar with SWIFT it is a consortium of worldwide banks that runs a global secure network connecting banks in over 200 countries. Interbank messages to support payments and brokerage trades all travel via SWIFT.) This was my first Sibos and I’m impressed. There were over 9000 attendees from 150 countries, 170 sessions and 175 speakers, including yours truly. The exhibit hall was filled with the most extravagant booths I’ve ever seen – more over-the-top than BAI during the late 90s. It was all very well organized although I can’t believe they didn’t have wifi widely available (it made the Twitter coverage somewhat spotty, but we did our best).

It will take me a few days to digest and synthesize Sibos 2010 but here are some of the key themes and links to some must-see videos:

Cautiously Optimistic

The mood was generally positive. From what I gather the last two conferences were dreadfully gloomy: ’08 was right in the midst of the crisis with executives arriving only to turn around and board return flights to head straight back to the office, and last year in Hong Kong was subdued as a result of belt-tightening, with everyone unsure whether they’d still have a job, plus a Typhoon on the first day! So this year, with things feeling relatively normal the mood was one of relief, with a tinge of optimism.

Don’t get me wrong – there is acute uncertainty in the banking industry. But I was struck by how self-aware and open delegates and speakers were. Regulation, business models, trust in banks and bankers, profitability and even the relevance of the industry were openly questioned and debated.

Globalization (and Localization)

This event underscores the fact that payments are inherently local. Despite the reach of multinational banks, financial technology providers, and collaborative payment networks, most countries rely on domestic payment schemes for the vast majority of transactions. SWIFT was formed as a means to increase the efficiency of the correspondent banking relationships that all banks rely on to support their customers cross-border needs. Yes, SEPA will change things (at least in Europe) but it’s going to take awhile. The most often repeated (and often mispronounced!) word of the week was “interoperability” — recognizing that if we can’t all use the exact same standards, we can at least find ways to translate from one format to another in order to pass transactions and conduct business globally.

As large US and European banks seek continued growth, despite sluggish recovery at home, they turn to emerging markets such as India and China. (The Chinese bank pavilions on the exhibit floor were the largest of all as the Chinese banks demonstrated their importance.) There was a promising panel discussion on banking in India and China with really impressive participants, but sadly three quarters of the session was taken up by prepared introductory remarks and what little debate there was sounded very scripted. I was disappointed. An earlier session, featuring Om Prakash Bhatt, Chairman of the State Bank of india, highlighted the contrast between the developed and developing world, as he described that the biggest challenge facing Indian banks is how to manage rampant growth.

The recently published World Payments Report 2010 demonstrates the resilience of the payments industry, despite the economic crisis, but also underscores regional differences in payment preferences. Growth is strongest in emerging markets — such as China (up 29%), South Africa (up 25%) and Russia (up 66%) — although admittedly from a low base. I wasn’t surprised to hear Bertrand Lavayssiere of Capgemini observe that one of the primary drivers of increased adoption of electronic payment is eCommerce. At Glenbrook we’ve had a deluge of requests from clients wanting to understand payments in emerging markets. Often we advise those clients that they will have to rely on non-bank partners to deliver domestic payment assistance, particularly when it comes to e-commerce in markets where cards are much less popular and people rely on eWallets, local debit card schemes, and even cash.

Regulation

The uncertainty regarding regulation was one of the most dominant themes at the conference. With Sibos in Amsterdam this year SEPA was on the forefront, although regulatory activity in the UK and the US was on the radar, too. The Europeans are acutely sensitive to local interpretations of EU-wide regulation. There was considerable talk of “geographic arbitrage” opportunities opening up as a result. As an American it was a eye-opening to witness the fissures in the supposedly united Europe. Recent economic woes have only underscored the tensions. SEPA – the ongoing effort to consolidate the domestic payment schemes in Europe – is moving ahead very, very slowly. The EU acknowledges that widespread adoption will require a mandated deadline; an open hearing is scheduled for mid-November. Meanwhile, the industry is waiting for pending announcement of mandatory SEPA deadlines and in the midst of the uncertainty not much is happening.

Innovation

Nearly every session mentioned innovation, and the need for banks to up the ante in order to remain relevant and continue to meet shareholder expectations for growth and profit. Throughout the week, it was clear that the banks all seem to know that they need to add value to payments in order to ensure margins, yet they can’t seem to execute. It’s a classic case of analysis paralysis.

Meanwhile, in sharp contrast to all the talk about innovation in the broader conference, there is a mini-conference within Sibos devoted to innovation called Innotribe. I applaud the efforts of Peter Vander Auwera, the leader of SWIFT’s Innotribe effort, who had the vision and put in significant effort to make this second annual Innotribe a reality. He brought together an impressive International group of technology thought leaders and VCs to stir things up. (It was amusing and actually rather nice to see the California/Silicon Valley Sibos attendees in their suits – we clean up well!) SWIFT also enlisted some of the most talented facilitators I’ve ever witnessed. It was really impressive.

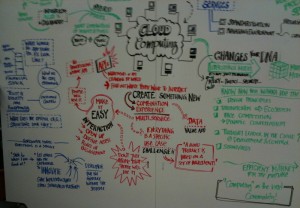

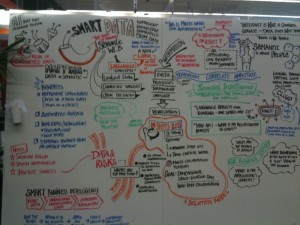

Here are a few pictures to give you a sense of the energy and content of the Innotribe sessions:

It was sad, however, when one of the SWIFT employees admitted that they’ve been talking about innovation for three years and haven’t started yet. That’s tough.

With coaching and support six teams worked in 2 hour sessions throughout the conference to develop innovative banking business concepts. They presented their efforts on the last day of the conference and were judged by a panel of bankers and SWIFT board members as well as a team of VCs. The winning concept received 50,000 Euro in start-up funding from SWIFT. I will do a follow-up post featuring more about Innotribe, the contest, and the winning idea.

Mobile

There was a star-studded panel to discuss mobile payments, featuring carriers, handset manufacturers, money transfer companies, and banks. Much of the debate centered on whether or not banks have a role to play in mobile payments – the consensus seems to be yes, but that the role will vary from market to market, depending on the varying degrees of cooperation and relative assets of carriers, banks, and regulators in each country.

Friend-of-Glenbrook Carol Realini, CEO of Obopay observed “If you want to know the potential of mobile go to Kenya. Kenya is the silicon valley of Africa.” Today there are 14 million mobile banking users in Kenya. The astounding success of m-Pesa is widely discussed – at Sibos and at other industry gatherings – but it is hard to emulate in other markets. There was only one (government controlled) carrier, so interoperability was not an issue.

At the conclusion of the debate, the moderator asked the audience whether banks would participate or lead in mobile payments. Nearly the whole room nodded in agreement that banks would participate, but only one person raised their hand to indicate that they believed banks would take a leading role in mobile payment.

Every bank technology firm seemed to have a brand new mobile app and there were even some slick iPad applications on display. At this point, I’d say that consumer mobile banking and payments are table stakes — every self-respecting bank should have a solution available and to be perfectly honest, the mobile banking discussions left me rather bored. However, I was really excited to see some business-oriented eInvoicing and payment mobile solutions. I’ll feature solutions I saw from LUUP, Fundtech, and Edge in more detail next week — the vendors are going to get me some screen prints to share. In the meantime, here’s the team at Fundtech showing off their iPad app:

Cloud Computing

It’s coming – perhaps not as soon as the financial technology vendors think – and is definitely relevant. The challenge for the banks is to evaluate their infrastructure and determine which capabilities are core and which are not and therefore candidates for SaaS. There was an intense debate about private vs public clouds – and whether a private cloud is an oxymoron. FinExtra has a nice video interview with Sean Kelley, Global CIO for Deutsche Asset Management talking about cloud computing and the bank’s use of Amazon and Google, among others.

The Future of Business Payments

On Monday I spoke to a respectably-sized crowd on The Future of Business Payments — the team at SWIFT asked me to be provocative and I did my best. It was a 90 min session and I spent half describing what makes B2B payments unique vs consumer transactions and outlining the challenges that prevent widespread adoption of e-Invoicing and electronic payments for businesses. And then I profiled twelve companies that are operating at the fringes of the B2B payment ecosystem and aren’t on the radar of banks, but should be. Reach out if you want to learn more.

As I listened to the speakers this week debate the relevance of banks and how they need to do a better job of wrapping value around increasingly commoditized payment services, it occurred to me that one of the most effective means to do so is to better support businesses by reliably delivering and synthesizing the data that accompanies payments between buyers and sellers. As large corporate increasingly connect directly to SWIFT, rather than rely on portals provided by banks to obtain payment data, there is an opportunity to focus on SMEs, a category that has been woefully neglected by banks and other business payment providers. As mature economies struggle to emerge from the economic downturn they increasingly look to smaller businesses to lead job creation. Banks can help by providing enhanced small business offerings, liquidly through early payment discount schemes, and perhaps the means to connect with some of the banks large enterprise customers that might be buyers.

[Meanwhile, in San Francisco at the PayPal Xinnovate conference for developers PayPal announced new business payment capabilities (and B2B pricing) — the irony of the bankers getting anxious about innovation in Amsterdam while simultaneously the PayPal crowd was gathering in SF was not lost on me.]

Best Quotes

- Charles Goodhart, London School of Economics: it’s a difficult time to be a banker, whether you were doing gods work, or just behaving naturally.

- Paul Saffo, in response to one of the Innotribe pitches: “I’m a consumer, I don’t care about banks”

- Judd Holroyde, SVP, Head of Global Product Management & Delivery, Wells Fargo: “Innovation is difficult, but necessary to ensure margins in payments”

- Michael Steinbach, Chairman, Equens: “Banks tend to discuss and discuss and discuss whereas others [Google, PayPal, Apple] tend to act”

- David Sear, Managing Director, Travelex Global Business Payments: “Banks need to concentrate on the consumer otherwise Apple eats your lunch”

- Lázaro Campos, CEO of SWIFT: “Asia Pacific is growing much faster than ever before, much of that intranet-Asia traffic.”

- Stephen Hester, RBS “We are all in this together. That requires humility and change”

- Carol Realini, CEO Obopay: “The mobile opportunity breaks down as follows: retail $10 Trillion, replacing checks & cash $5 Trillion, eCommerce and mCommerce: $500 Billion, cross-border P2P $400 Billion”

- John Hagel, referring to the Red Queen in Alice in Wonderland, who runs faster and faster to stay in the same place, Hagel commented that . “The financial industry is not even doing that well, it’s running faster and faster, but still sliding further and further behind.”

- Hans Van der Noordaa, CEO Banking Benelux, ING “The biggest mistake banks could make is to think we’ve fixed the trust issue”

Cool Stuff

The Finextra team recorded 33 videos throughout the conference. You can watch them here. I’m indebted to Liz Lumley and Finextra who graciously let me hang out in their booth and recharge my batteries (both literally and figuratively) throughout the conference. Liz also moderated a fantastic panel on social media usage by commercial bankers (as opposed to retail banking applications of social media). This session was simulcast on the web, so you can watch the whole thing here or read a brief recap here.

Official SWIFT conference converge (video, articles, photos) here. I recommend watching at least the Innovation Keynote and the Closing Plenary.

And here are some must-watch videos that made their debut in the Innotribe innovation sessions:

The Financial Reformation

The Future of Money

And now I’m off to explore Amsterdam by bicycle!