Zak Kazzaz co-authored this post.

Time to Read: 7 minutes

Highlights:

There is a set of high payoff steps necessary to increase financial inclusion of women in South Asia and other markets

Collaboration across the stakeholder ecosystem accelerates female participation in financial services

Glenbrook’s framework is an approach to evaluation and roadmapping

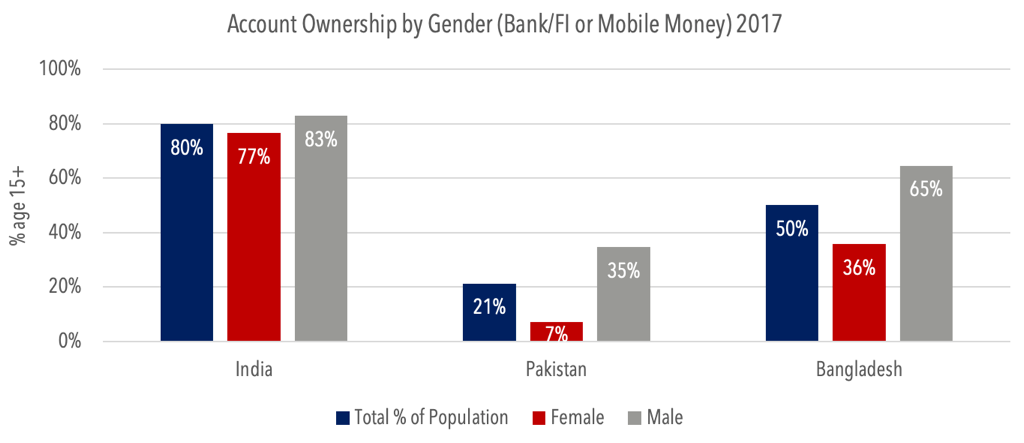

As financial inclusion efforts continue to scale across the globe, there has been a steady increase in women’s ownership of financial services accounts. However, the total growth can obscure the persistent gender gap in many regions. Despite that, digital financial services (DFS) promise to be an effective tool to help close the gender gap.

For example, a recent study on the uptake of M-PESA, a mobile money platform in Kenya, shows that 194,000 Kenyan households have been lifted out of poverty between 2008 and 2016. Women have shown the greatest benefits (MIT). Female-headed households saw far greater increases in consumption than male-headed households. This demonstrates the possibility of closing the gender gap and highlights the societal value of doing so. Closing the gender gap is essential to improving multiple aspects of a woman’s life including autonomy and empowerment, better outcomes for households and children, and overall poverty reduction.

Account Ownership by Gender

Characterizing the Situation

Recently, Glenbrook hosted a virtual workshop on International Women’s Day in South Asia to examine gender gap impact and determine potential mitigation strategies. Our global practice group has engaged in similar efforts to improve gender equity around the world through improved access to financial services by women.

Traditional and Digital Financial Products

Women utilize both traditional and digital financial products in the South Asia region. Providers have created products catering to women for different use cases. Given the multiple roles women fill and their limited access to financial products, female-centric offerings are prime for innovation.

For example, a local bank we spoke to has created niche credit and microfinance products for female entrepreneurs and small business owners. Oftentimes these products require no upfront collateral, helping to drive adoption by women. Additionally, USSD-based products have high adoption rates by women and are successful at driving access and usage of DFS.

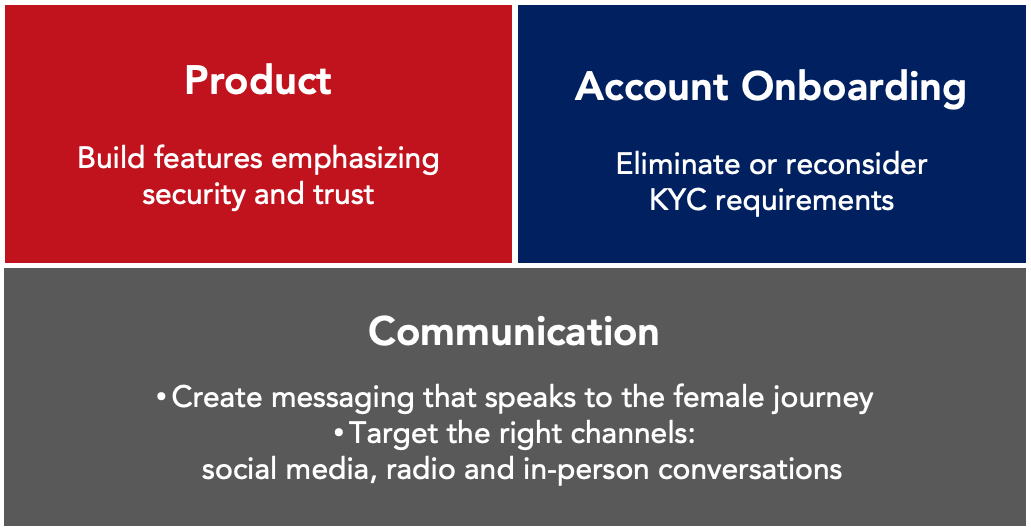

Through our work, Glenbrook developed a framework to apply a gender-conscious lens to financial inclusion across three dimensions: product, communication, and account onboarding. When applied, this framework can help lower gender-specific barriers to digital financial services.

A framework to guide organizational change aimed at eliminating the gender gap

Product Characteristics

Our user research focused on women in South Asia. Their views on DFS were assessed using focus groups and in-person interviews.

The principal findings revealed that women are most concerned with security and convenience when it comes to accessing financial services.

Security and Privacy are Essential

Women tend to distrust digital access of financial services. Female users voiced concerns over the use of a personal phone number to sign up for an account as well as over a lack of data protection methods to prevent fraudulent use of their phone numbers. Similar concerns were found over account balance notifications that lack privacy controls. Women expressed their need for autonomy and confidentiality in their use of DFS.

To address these concerns, trust building product features and services are necessary. Examples include dispute mechanisms for mobile PIN issues (PIN reset procedures, linkage to personal information) and digital receipting to reinforce payment confirmation.

Targeted Messaging for Women

Several communication tactics proved to be most effective across multiple channels. This is a departure from the typical provider’s approach to ignore women and the impact of the gender gap on financial inclusion.

The Right Channels

Social media marketing and advertising campaigns are very effective because smartphone penetration is starting to increase among women in this region. Radio works to reach women without smartphones. Additionally, door-to-door is very effective when banks and organizations dedicate brand ambassadors. This person-to-person contact is especially important in rural areas and where financial literacy is low.

Opportunity exists to harness the power of agent banking to improve outreach to women. There is particular value in hiring and training female agents, as they are both trusted and adept at teaching women how to use mobile money products through such personal interactions.

Messaging Matters

Messages focusing on the female journey are effective. Meena is an example of a nationally recognized personality able to deliver an effective message to women. Meena’s messages address gender, child rights, education, protection, and development. Her story promotes social issues in an appealing and provocative way. Messages tied to women’s lifecycle events (marriage, childbirth) are also effective ways at gaining women’s attention.

Simplifying Account Onboarding

Beyond the development and communication of female-centered DFS products, women are often excluded at the point of access, facing logistical and legal barriers when trying to open a new account. Some jurisdictions require the presence of a male guardian (i.e., husband, father) for women to receive or renew an identity card. Competing needs, lack of reliable transportation, and exclusion from legal residency documents (e.g., property deeds, leases) raise further barriers. These impacts combine to drive down the issuance rate of government identity among women to a mere 55% in lower-income countries compared to 70% for men.

To be inclusive, providers should consider alternative or no-KYC requirements for products catered to women. Glenbrook previously analyzed how this can be done safely and securely, with more information found here.

Surging Interest in Serving Women

The good news is that NGOs, nonprofits, ICT (Information and Communication Technology) providers, and governmental organizations are working on these issues. Coordination among these players will increase the effectiveness of their efforts.

Glenbrook looks forward to supporting and strengthening this ecosystem of supporters as it works to improve women’s access and usage of digital financial services. The benefits to women, their children, families, and national well being are indisputable.

We welcome the opportunity to discuss this, and related, issues with you. Please contact the authors or simply connect here.

About the Authors

Heather Cerney focuses on the topic of financial inclusion in the U.S and around the globe. She’s particularly interested in the emergence of digital financial technology as an enabler to facilitate access and usage of banking products in underserved communities. She comes to Glenbrook with previous experience in the digital banking space.

Zachary Kazzaz is passionate about financial inclusion, having worked on programs in more than 15 emerging countries. He focuses on the strategy underlying new financial infrastructure and the associated products and services that encourage usage among vulnerable populations.