The POS Domain is Synonymous with the Retail Industry

The POS Commerce domain is the land of brick and mortar retail, representing the majority of retail activity. Despite the steady double digit annual growth of the Remote Commerce domain, the POS Commerce domain was responsible for some 84% of retail sales in 2019.

That said, the POS Commerce domain has taken a direct hit from the pandemic. This has major implications for the wider economy and the payments industry in particular because the POS Commerce domain continues to be synonymous with the Retail industry.

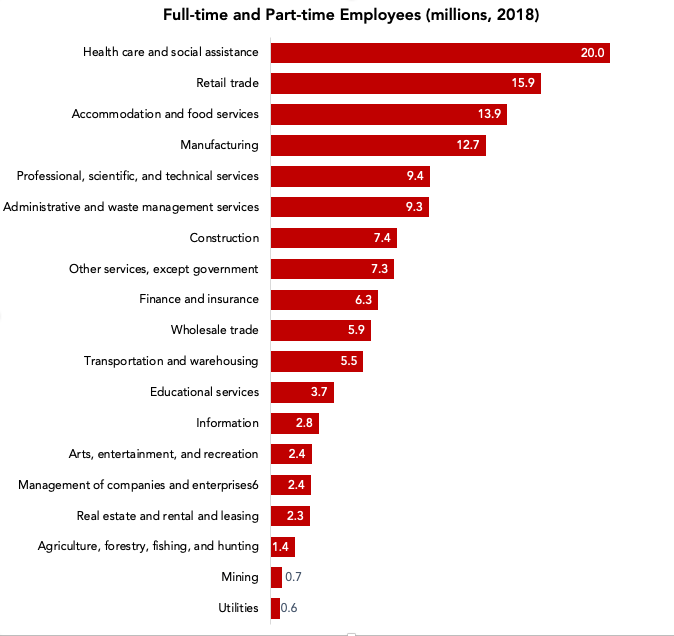

The size and importance of Retail to the economies of most countries is under appreciated. While hardly a provider of high paying jobs, it is a major source of employment. In 2018 the U.S. had some 15.9 million workers in Retail.

Only Healthcare and Social Assistance, at 20 million, exceeded Retail’s employment contribution. And just behind Retail is Food Services & Hospitality, another major employment contributor that lies in the POS Commerce domain. Taken together Retail and Food Services & Hospitality employ some 30 million.

US Census figures show that, combined, these two industry segments saw sales declines of $403.9 billion in April, down 16 percent from March, and 21 percent from 2019. The apparel and accessories subsegment declined in April a crushing 89.3 percent from the previous year.

That means the broad payments ecosystem that enables merchant payment acceptance – from issuers to providers of merchant services – lost some $8 billion in revenue in one month from just these two segments. This is a painful period.

Short-term Impact

Credit union processor PSCU’s Advisors Plus division has published weekly transaction reports through much of the lockdown period. In a May 12 podcast with Glenbrook, SVP Glynn Frechette reported on card and ATM volumes that demonstrate both the hit to the POS Commerce domain and the big shift to the Remote Commerce domain where online transactions take place.

A few statistics from PSCU are enough to demonstrate COVID-19’s impact on the POS Commerce domain.

- Restaurants are suffering. PSCU reports that credit transactions are down 52 percent and debit down 28 percent year over year.

- Fuel retailers, the ultimate POS Commerce segment (there’s no take-out option here), have seen volume drop by 59 percent for credit and 39 percent for debit. Commuting’s near cessation, exacerbated by oversupply and geopolitical tensions, has also dropped prices to a level not seen in a decade.

- The ultimate POS Commerce domain tender type is cash. People are both avoiding it and have reduced access or need for an analog method of payment. Others simply don’t have money in their accounts to withdraw as cash. PSCU reports its early May ATM transaction activity dropped 30 percent from its mid-April volume.

Not all POS Commerce segments, of course, have taken a beating. Supermarket and grocery volume, up 25 percent for credit and 23 percent for debit at the end of April, continues to stay up from its highs during the first weeks of the lockdown period.

In segments where e-commerce is practical, some POS Commerce domain volume has shifted to the Remote Commerce domain where online transactions live. Only two examples are needed to underline the push the pandemic has given to digital e-commerce in the Remote domain:

- During Mastercard’s Q1 earnings call the company reported that, for the first time, over 50 percent of its volume was card not present versus 40 percent in the prior year. PSCU reported that CNP transactions represented 55 percent of overall transactions and 63 percent of total spend at the end of April.

- The big winner at the expense of online and its offline competitors has been Amazon, with PSCU reporting credit transactions up by 51 percent and debit up 135 percent year over year.

It’s a tough situation for those payments industry players with broad exposure to face-to-face merchant transactions.

The impact affects analog tender types as well. The expanded use of digital methods of payment will put even more pressure on old fashioned paper-based payments.

Cash in the Time of COVID-19

The role of cash in the POS domain is changing due to the pandemic. The medical community reports that infection risk through cash handling is very low but it is still non-zero. Consumers are responding to that non-zero risk with increased usage of card and card-on-file payments.

Many businesses, in an effort to protect both employees and their customers, have chosen to stop accepting cash. In some states, attorneys general have responded with reminders that their state has regulations mandating cash acceptance.

Based on public health recommendations and concerns regarding its safety, the secular trend away from cash is being accelerated by the pandemic. While cash is used for some 28 percent of transactions, the average size of those transactions is now below $10.

While there is debate about the risk cash handling presents, individuals and businesses are reducing their reliance on it for transactions as will be illustrated through our evaluation of the Remote Commerce and P2P domains. As we have seen in other countries further along in their digital payments transition, diminution of cash usage raises issues of financial inclusion. There are 14 million Americans without bank accounts who need the ability to get paid and to spend.

Providers of cash services have much to worry about if the pandemic decreases cash usage. Operators of ATM networks and ATM fleets have significant fixed costs. The sustainability of their current business model has been raised as a concern by UK operators who have seen cash usage drop in favor of contactless debit payments. PSCU’s ATM usage numbers suggest similar challenges here in the U.S.

Checks in the POS Commerce Domain

The role of checks and the check system in the POS domain has been declining for decades. While checks can represent over 10 percent of value at the few and diminishing number of grocers still accepting them, their decline in the POS domain will get a further push by the pandemic. The parents of Baby Boomers are the major demographic continuing to use checks at the POS. This especially vulnerable population has far fewer of its members out and about writing checks.

The pandemic will further push check payments out of the POS domain and leave it to operate in the Biller, B2B, and Income domains with a smattering of P2P gifts via check.

Longer-term Impact

Retail Industry

The pandemic will push Retail into the long-anticipated Retail Apocalypse, an industry reconfiguration driven by multiple trends that the coronavirus will accelerate.

Despite the robust pre-pandemic economy, many brick-and-mortar retailers were already in weakened financial condition due to high debt burdens, the continued growth of consumer preference for the e-commerce channel, and younger demographic disenchantment with the mall shopping experience. Now, multiple marquee store brands are either up for sale (Victoria’s Secret), in bankruptcy (Neiman Marcus, J. Crew, J.C. Penney, Pier 1 Imports), or nearing the brink (Macys, GNC).

Social distancing and stay-at-home orders produced an immediate 50 percent drop in sales for Apparel. Mall foot traffic was down by double digits by mid-March. Other mall- and superstore-centric retailers saw between 15 and 27 percent declines. Restaurants and bars were down 26 percent. Non-store retailers, on the other hand, were up 3.1 percent with food and beverage stores up 25 percent.

The pandemic has added pressure onto mall operators and commercial real estate. The U.S. is famously overstored compared to other countries. Using Cowen’s 2019 figures, every American has 23.5 square feet of retail space, a Canadian has 16.4, each UK resident has 4.6, and the French 3.8., a 600 percent difference. Mall real estate valuations declined 20 percent just from March to April.

Many retailers won’t survive the added pressure of COVID-19. Competitors with strong balance sheets and able crisis management will survive.

Especially acute is the plight of small and medium business (SMB) retailers. Main Street merchants, those that have adapted to the pressure from Remote Domain actors (Amazon, Walmart, Target), are facing renewed existential pressure, especially for non-essential businesses. Without substantial government relief, many SMB retailers and service providers will not recover. Expect to see even more empty strip mall storefronts.

Restaurant Industry

There are some good news stories for restaurants. Some have recouped lost business by pivoting to online ordering and home delivery, added e-gift card programs, and other digital programs. But the restaurant industry has taken a massive hit. Restaurants operate on thin margins. With social distancing enforced or preferred by diners, how will a restaurant survive serving 50 percent of its normal capacity?

Many restaurants won’t survive.

Long term structural change will come to the Restaurant industry. Food halls and high density restaurants and bars, so popular with urban dwellers, will be forced to adjust their model to accommodate social distancing requirements and preferences. Famously operating on thin profit margins, many sit-down restaurants will not survive the COVID-19 pandemic.

Payment Industry Pain

Issuers, acquirers, processors, PSPs and ISVs are all seeing drops in volume. Some of those operating primarily in the POS domain, with a reliance on in-person services, are responding with layoffs and furloughs.

COVID-19 and the fragility of many brick-and-mortar merchants add up to a permanent reshaping of the POS domain. Its dominant role in payment acceptance will be reduced but not overturned. As economies re-start, the POS domain will begin its recovery. The extent of that recovery remains unclear.

That means payment services providers with significant focus on Main Street retailers will hurt. Merchant cost sensitivity will only increase and that suggests renewed interest in alternate payment methods (APMs). There will be an abundance of used terminals for sale.

Concentration of sales into larger physical retailers (once customers are comfortable enough to return to them) and e-commerce players will benefit acquirers and PSPs serving the largest retailers. Those serving SMBs, especially in the restaurant vertical, face truly challenging times.

Consumer Impacts

Consumer payment volume drops in every recession because unemployment rises. U.S. unemployment has increased by over 33 million in two months. Continuing financial uncertainty, exacerbated by oscillations between reopening of public activity and self-isolation orders, will further depress consumption. Managing current obligations and uncertainty will depress discretionary spending.

Cautious consumers will be the new normal. For a payments industry reliant on robust consumer consumption and accustomed to the robust growth of the last decade, serving the POS domain will be a defensive activity as it continues to lose share to the Remote Commerce domain.

Industry Implications

High Pressure on the Payments Ecosystem

It has been a decade since the last recession and merchant-facing providers have enjoyed a steady increase in payment volume since. Those gains are now in reverse. Operational course corrections – from budget cuts and freezes to staff furloughs and layoffs – are taking place. Independence for some providers, survival for others, will depend on:

- The extent of exposure to and reliance upon POS Commerce domain volume

- The sophistication of their card not present acceptance capabilities

- Fiscal condition entering the COVID-19 crisis

- Skilled crisis management

- The wherewithal to manage through a multi-year recovery process

Contactless Expansion

Contactless card and digital wallet adoption has been growing fast. COVID-19 is an accelerant. According to Mastercard, more than 50 percent of U.S. consumers have some form of contactless payment in use. Contactless acceptance should become nearly ubiquitous as merchants respond to the shift in customer preference. As important, merchants, ISVs, and PSPs should finally get on with removing the signature prompt, that unnecessary step obsoleted two years ago by the card networks. No one wants to touch a terminal used by dozens or hundreds of hands in a day.

Accelerating the Shift to the Remote Commerce Domain

Merchants must meet their customers “where they are” and today that means online, in the Remote domain where card not present and card on file payments take place. Under these circumstances, volume will continue to shift to the Remote domain. Proof is here. The pandemic has doubled global e-commerce retail sales (The next chapter in this series dives deeply into the Remote Commerce domain).

Diminishing the Role of Cash

While the death of cash has been predicted for decades and it remains an important method of payment for millions of Americans, the pandemic has increased competitive pressure on cash. While a resilient tender type, concerns over its safety, reasonable or not, will put further pressure on its use.

A Window for Non-card Payments?

Retailer margins will be tight for many months. Every business will focus on cost management.

For card-accepting merchants, it’s often the case that payment acceptance is their number three cost after supply chain and employee costs. These enterprises will look at alternatives with renewed interest. Preference for regulated debit will, of course, continue in many merchant segments. But interest in lower cost alternatives or those that do more to help the merchant sell will rise.

- RTP Network. In those markets not well served by Durbin-regulated banks, the Real Time Payments Network (RTP) of The Clearing House (TCH) and the eventual availability of the FedNow network, operated by the Federal Reserve, may offer a retailer-friendly method of payment. While little used today, the RTP Network’s Request for Payment message type pushes a data rich message to the message recipient, requesting that the payer initiate a push transaction to the merchant.

- Installment Loans at the POS. We see continued growth opportunities for installment credit providers such as Affirm and Klarna, and the processors who help sell them, to serve as sales accelerants.

- ACH at the POS. While merchant interest in ACH-based payments at the POS (think Target Debit RedCard) has languished somewhat since Durbin regulations went into effect, richer decisioning and assumption of risk by intermediaries like Trustly could revitalize interest in using ACH in the POS Commerce domain.

Given how nimble many of today’s PSPs are, implementations of these primarily software-based approaches could appear fairly soon.

Raising the Likelihood of a U.S. Central Bank Digital Currency?

Returning to cash use cases, COVID-19 is yet another stimulus for the Federal Reserve to examine and consider piloting the digital greenback. The digital dollar was referenced in an early version of the CARES Act as a means of easing benefit payment distribution, particularly for the 14 million who are unbanked.

Recommendations

Digital Enablement of Real World Interactions

The smartphone revolution, app store downloads, mobile broadband, and cloud computing are the building blocks of the digital enablement of real world interactions. They are also the tools of the burgeoning Remote Commerce domain. The blending of digital and analog experiences has to be the ongoing focus of merchants and the providers of commerce capabilities to those merchants.

POS Commerce domain stakeholders have to ask “how can I improve my in-store customer’s experience through the digital channel?”

- POS Commerce providers need to offer programmable platform services and user interface tools that enhance the customer experience.

- Providers who have been focused on terminal-based, card present transactions must provide merchants with tools that enhance the customer’s digital commerce journey that leads to a card-less transaction.

In other words, the skills specific to the POS Commerce domain experience are insufficient going forward. Successful POS Commerce providers must also excel in the Remote Commerce domain because those building blocks work so well in the POS Commerce domain, too.

Merchant Recommendations

- Turn on contactless and turn off signature capture at your terminals because many customers will not want to touch your POS equipment.

- Look to pay-at-table or order and pay ahead solutions. Restaurant customers will be increasingly reluctant to hand over their cards to a server, adding health and sanitation worries to security concerns. For sit-down restaurants, pay-at-table options abound but they are not inexpensive and require active management, tough asks for the gut-punched restaurant industry.

While retailers have been on the bumpy path of multi-channel sales, the need for buy online, pick up in store (BOPIS), curbside delivery, and home delivery capabilities will only increase. SMB merchants should turn to acquirers and PSPs who bring a higher level of commerce support, beyond simple payment acceptance, for this capability.

These merchants will be wise to review their current payment, order management, and inventory systems. Cloud-based alternatives to in-store systems are capable replacements and do not require upfront hardware and software licensing expenses. They also play well in the important Remote domain.

We recommend you evaluate alternative payment methods that either lower cost or help improve sales. Installment loans offered at the POS can be very helpful. ACH-based payment acceptance costs can be lower than debit cards.

Of course, digital enablement of the customer’s commerce journey is essential.

Acquirer and Processor Recommendations

Helping merchants streamline payments through contactless support and signature elimination are obvious, long overdue moves. Support for moving payments to the Remote domain for order and buy ahead, prepaid gift card programs, and other value-added services is another strategy that most acquirers have already employed.

Offering new APMs and installment loans at the POS will provide merchants with more options to offer their paying customers.

Perhaps more important is the need for acquirers and their processing partners to innovate. Their decades-long focus on payment transaction processing has allowed PSPs to emerge that bring commerce-focused high-value services to merchants.

This lack of innovation has allowed new competitors to take share. Today, for many merchants, the provider of first resort for payment services is no longer the acquirer recommended by their bank or the ISO-based seller of card acceptance. Now, it is the ISV that’s the first point of contact for merchants. The ISV sells software that automates much of the client’s business while bundling payment processing. COVID-19 or not, acquirers need to innovate to compete.

This means that the tools of digital enablement have to be a core part of the acquirer offering.

Payment Service Provider (PSPs) Recommendations

This category sells services to merchants, many times offering services well beyond simple card acceptance. Through the PSP’s crisp visibility into the merchant’s operations they can build and offer a broad palette of offerings to generate new revenue sources. But PSPs are still subject to the diminished transaction volumes caused by COVID-19.

Many PSPs, using the technology building blocks, have started and prospered in the Remote Commerce domain. Few have embraced the POS Commerce domain with a similar level of success. Expect more of these Remote Commerce experts look with growing interest, using better tools, at the POS Commerce opportunity. Incumbents will feel even more pressure from the PSP and fintech vectors.

Independent Software Vendors (ISVs) Recommendations

Until the “new normal is found” ISVs will thrive or suffer based on the verticals they serve. If you write software for sit-down restaurants or day care centers, you have to hunker down, especially if your revenues are based on payment volume. Because the volume of face-to-face transactions has dropped across all segments, ISVs must rely on resilience and patience, all the while serving existing customers.

Digital enhancements such as order ahead are obvious enhancements for some restaurants. Buy online pickup in store (BOPIS) is another for retailers but is no short term panacea. Once order management and inventory systems are involved, the task becomes much more difficult.

ATM Networks and ISOs

The slow secular trend away from cash has caused ATM industry consolidation and, with a few cash-loving exceptions, reduced opportunities for ATM placement. As we have seen, the virus has worsened this situation. Increasing fees may be necessary to maintain economic viability.

Issuers

“Top-of-wallet” position is the primary mission for every card program. No issuer wants its cardholder to think their card is the least sanitary one in her wallet. Commit to issuing dual interface contactless cards. Examine the benefits of accelerated replacement, ahead of the expiration date of currently deployed cards. Issuers should make sure all of their cards are enrolled in EMVCo issuer tokenization for compatibility with Apple Pay, Google Pay, Samsung Pay and other wallets that support contactless payments.

At the same time, issuers should examine every available method to improve convenience and/or financial reward in the Remote Commerce domain to ensure your card is “top-of-wallet”.

Conclusion

The payments industry’s overall volume is at the mercy of the larger economy; there is little ability to stimulate payment activity when a large percentage of the economy is on hold. The best industry stakeholders can do is to optimize their offerings to support changing consumer preferences which means fast-paced innovation will continue to be the differentiator.

The POS Domain has few levers to pull to slow the secular trend away from in-store purchases. The pandemic has only accelerated the pace. Industry stakeholders can only play defense to hold onto volume.

That said, the changes ahead are a matter of degrees. Humans are an intensely social species. We crave experiences and the company of friends, family, and even strangers (concerts, sporting events, crowded restaurants). Those venues and the journey to reach them are all in the POS Commerce domain. As the coronavirus threat recedes, we will return there, cautiously at first, choosing to return to a reconfigured workplace and to skip the crowded restaurant in favor of a takeout meal. With a vaccine, we’ll return in droves to what we’ve known.

Until then, payment industry players serving the POS Commerce domain have a challenge ahead: to operate a profitable business while strengthening it using the Remote Commerce playbook.

This series examines these impacts, and others, in more detail through Glenbrook’s Domains of Payments framework. In the next chapter, we examine the Remote Commerce Domain and what the pandemic means for the future of online commerce.

[Domains]

Please return to the series landing page, to the Payments Views website, or sign up here to be alerted when the next installment is published.