You are a bona fide payments professional if that headline makes senses to you. For everyone else, here’s an explanation.

Kombini Payments

Before we take a look at PayNearMe, let’s first explore how Kombini payments work. Kombini (variously spelled Konbini, Kombini, or Combini) or convenience store payments are an important element of the Japanese payment system. Since the late 1980s many Japanese consumers have paid their monthly bills at convenience stores, rather than online or at a bank. This practice has expanded to support eCommerce payments.

Survey data indicates that one-third of Japanese consumers visit convenience stores 2-3 times a week, and 17% visit daily. The Japanese Franchise Association reported in early 2009, sales increased 7.6% over 2008. Services – primarily Kombini payment fees – represent 4.3% of convenience store revenue. Service revenue was up 9.6% versus the previous year, indicating strong growth of Kombini payments. Anecdotal evidence suggests that, in Japan, Kombini payments may account for more transactions than credit cards. A number of convenience stores support Kombini, but 7-Eleven dominates. The company has over 12,000 locations in Japan (the company is headquartered in Japan) and also has a banking license. It has its own eMoney platform, nanaco, to facilitate payments.

2009, sales increased 7.6% over 2008. Services – primarily Kombini payment fees – represent 4.3% of convenience store revenue. Service revenue was up 9.6% versus the previous year, indicating strong growth of Kombini payments. Anecdotal evidence suggests that, in Japan, Kombini payments may account for more transactions than credit cards. A number of convenience stores support Kombini, but 7-Eleven dominates. The company has over 12,000 locations in Japan (the company is headquartered in Japan) and also has a banking license. It has its own eMoney platform, nanaco, to facilitate payments.

In Japan, the Kombini eCommerce payment process is as follows:

- Consumer makes online purchase and selects Kombini as the payment method

- Consumer obtains a “receipt” number from the merchant website

- Consumer goes to Kombini store location (or in some situations an ATM) and effects payment, referencing the receipt number or showing the clerk the barcode on the receipt

- The Kombini network collects information for all payments made in stores and ATMs

- Kombini network notifies merchant that payment has been received, referencing receipt number and/or barcode

- Merchant ships product or allows download of digital goods.

Seems like a niche solution doesn’t it? Not so fast. Kombini payments made in advance (COO) or at the time of delivery (COD) represent approximately 25% of Japanese eCommerce transactions. [If you want to learn more about eCommerce payments in Japan let us know. We have a series of global eCommerce country profiles.]

Enter PayNearMe (nee Kwedit Direct)

Meanwhile, back in the U.S., the payments start-up formerly known as Kwedit has garnered a lot of attention for its Kwedit Promise payment method that was designed for teens as a way to pay for online games and virtual goods. But quietly, behind the scenes, the company has been working to test and refine the Kombini payment method here in the United States. The resulting service, called PayNearMe, was recently announced in partnership with 7-Eleven.

Meanwhile, back in the U.S., the payments start-up formerly known as Kwedit has garnered a lot of attention for its Kwedit Promise payment method that was designed for teens as a way to pay for online games and virtual goods. But quietly, behind the scenes, the company has been working to test and refine the Kombini payment method here in the United States. The resulting service, called PayNearMe, was recently announced in partnership with 7-Eleven.

Unlike Kwedit Promise, PayNearMe has broad applicability and the right economic model to handle purchases of physical goods, travel and tickets, online services, digital goods, and even loan payments.

Here’s how PayNearMe works:

- The merchant stages or initiates the transaction, defining rules for what will happen when the buyer visits the 7-Eleven location to make payment.

- The rules for each transaction are associated with a unique token. The token may take the form of a printed barcode, a mobile-displayed barcode, or a magstripe associated with an optional PayNearMe card (for those without printer or phone).

- The buyer is directed to nearest 7-Eleven (buyer enters their zip code as part of checkout process; there are more than 6,000 7-Eleven locations that accept PayNearMe payments in the U.S.)

- The buyer presents the token (in whatever format) to the clerk at the 7-Eleven location.

- 7-Eleven sales associate accepts the exact cash amount for the individual transaction associated with the token.

- Payment credit is posted to merchant in realtime before the buyer even leaves the store.

- Merchant releases the goods for shipment or download.

- Optionally, the receipt printed at the 7-Eleven may include a download code, a game activation code, event ticket, or specific instructions to redeem the product.

At the point of payment, the steps takens by the 7-Eleven clerk are the same, regardless of whether the transaction is for an eCommerce purchase, a telephone order, an event ticket, loading an eWallet, purchasing virtual currency, or repaying a loan.

PayNearMe Under The Hood

In terms of money handling, PayNearMe handles both ends of the payment process, providing a walk-in network to collect cash (via 7-Eleven) and a settlement system to distribute the funds collected to merchants.

Merchants utilize APIs to connect their eCommerce site, customer service rep platform, or other sales systems to PayNearMe to create unique payment instructions for each transaction and be informed real-time when the cash payment is received at the POS (effectively, the authorization to ship or release the goods).

The service also allows merchants to send context-specific confirmation information back to buyer in real-time via the 7-Eleven receipt. For example, merchants are working with PayNearMe to provide insurance products, sell transportation tickets, and initiate money transfers. When payment is made, customers leave 7-Eleven with proof of insurance, a valid ticket, or appropriate legal disclosures, respectively.

Notable Early Adoptors

The company has announced that Amazon.com, Facebook, Progreso Financiero, MOL AccessPortal (MOL), m-Via, Lexicon Marketing, LLC, Adknowledge’s Super Rewards, Money to Go and SteelSeries will be among the first merchants to use PayNearMe to provide their customers with the option to pay with cash at 7-Eleven stores. Here’s a description of how some of the merchants are utilizing PayNearMe (excerpted from the press release):

- Amazon.com : Amazon.com customers can conveniently buy Gift Cards online in any amount they choose (in $0.01 increments up to $1,000), and pay for them with cash. These Gift Cards can be used to buy millions of items on Amazon.com starting the end of this month. Here’s a sample for what the Amazon.com purchase token will look like (click to see full size image):

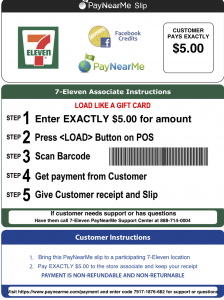

- Facebook: Facebook users can safely and easily buy Facebook Credits with cash using PayNearMe at a 7-Eleven store, and those Credits will be deposited into users’ accounts before they reach the parking lot. Facebook Credits are used to buy gifts and virtual goods in many games and applications on the Facebook platform. Here’s sample of a Facebook Credit purchase token that I created.

- Progreso Financiero: Progreso Financiero helps underbanked Hispanic families build credit and gain access to mainstream financial services. The company extends small dollar loans to customers that are often repaid in person at Progreso Financiero storefronts located in neighborhood retail outlets. PayNearMe increases the number of locations at which Progreso Financiero customers can make their loans payments from approximately 30 throughout California and Texas to more than 1,000. Progreso customers who make payments at a PayNearMe location will receive an up-to-date receipt reflecting their payment and outstanding loan balance.

It’s interesting to see how the original Kwedit model has morphed to reflect what the market wants. In addition to understanding the need, PayNearMe has refreshed the model to reflect todays hyper-connected, real-time consumer.

We will be curious to see how merchant’s take advantage of the cash-in network and start to interact with their customers through the oldest of transaction mediums – the sales clerk and the receipt.