Last Thursday evening I attended a superb mobile payment panel organized by mPayConnect and co-hosted by the Wharton and Harvard MBA alumni associations at the Wharton West campus in San Francisco. The evening’s topic was From Afghanistan to Silicon Valley: Mobile Financial Services for the Next Billion Customers. Menekse Gencer of mPayConnect moderated and brought together the excellent panelists:

- Camille Busette, PhD – VP EARN, based in San Francisco, providing financial services to low income and underbanked. Formerly Deputy Director of Government Relations for PayPal, where she managed PayPal’s financial services legislative and regulatory advocacy efforts for the Americas and anti-money laundering regulatory efforts globally.

- Aiaze Mitha (on the phone from Dubai), Amarante Consulting is focused on mobile financial services in developing countries. Aiaze has experience in Afghanistan with m-Paisa, a Roshan project supported by Vodafone, following up on success with M-pesa in Kenya, plus 15 projects in Africa, Asia, Middle East, Central Asia.

- Monica Brand – Principal Director Frontier Investments, ACCION International. Before joining ACCION, Ms. Brand worked in Cape Town, South Africa, where she worked with Anthuri Ventures – an early stage equity fund – and founded Anthuri Catalysts to help prepare potential portfolio companies for investment. Ms. Brand began her career in financial services in California where she worked as a commercial loan officer and helped launch a $50 million statewide lending intermediary to finance “near bankable” small business and community facilities.

- Naeem Zafar, PhD, UC Berkeley Haas School of Business professor, on the board of Amaana mobile financial services in Pakistan.

This was the first in the Mobile Payments Series that Menekse is organizing on mobile financial services. The goal is to tap bright minds in the Bay Area – innovation in Silicon Valley – and spread it to rest of the world, enabling mobile payments, and fostering understanding about how to apply lessons from the developing world to other markets. The discussion on Thursday was fascinating. As I edited and cleaned up my notes (very sloppy touch-typing!) I realized that this would be very, very long blog post, but rather than edit it down, I’m including everything – the work that is being done to expand microfinance and foster development through mobile financial services worldwide is truly inspiring – but very challenging!

To start, Menekse shared an anecdote from when she was still at PayPal. She was in Tanzania, and was struck by the nobility and traditional nature of the Maasai people, but also by the fact that – although they had no electricity and no running water – many she encountered had a mobile phone. She realized at that moment that financial services – payments, loans, savings – and ultimately economic and social power could be delivered via the mobile phone.

A video featuring the Amaana payment system in Pakistan demonstrated the efficiency and ease of mobile financial services. The very satisfied shopkeepers, students, and an entrepreneur extolled they safety and convenience of both P2P and C2B transactions. (You can view the video here.)

The evening started with a primer on mobile financial services.

Mobile Financial Services 101

What is it?

The delivery of financial services via the mobile channel. The services fall into one of three categories: mobile payments (P2P, C2B, or B2B), mobile microfinance (loan disbursement and payments), or mobile banking (bill pay or account information, e.g. balances or alerts). The nature and breadth of the services varies depending on the consumer segment and needs, mobile technology infrastructure, maturity of financial services, and regulatory environment in a given market.

Today there are $300 billion in remittance P2P transactions delivered annually, and the value is expected to increase to $1 trillion by 2006 (Source: IFAD). Relatively few remittances are delivered via mobile so far, yet every major remittance provider and mobile payment company is focused on this opportunity. The global potential for C2B transactions is estimated at $24 trillion (Source: Ovum). Per Meneske, B2B cash replacement is estimated to be another few hundred $ USD billion. [See previous Payments Views posts on the global mobile banking & payments opportunity here.]

Banks and merchants benefit by reducing their transactional costs. In cash-driven economies, cost savings for banks can be significant as a result of reducing branch visits (estimates $4.00 for in-branch transactions down to $.08 for mobile transactions). And for utilities and other companies that accept in-person payments from unbanked customers there are also efficiencies.

How does a mobile wallet work?

The mobile wallet is a consumer account that can be accessed via your phone. It can be loaded with value from a bank account, a credit card, a debit card. Someone who is unbanked can use cash to top up their mobile wallet. In unbanked communities, mobile financial services are dependent upon agents or “human ATMs” that are typically little mom and pop shops. Once the mobile wallet is funded the consumer can transfer funds to someone else (P2P), pay at a store (C2B), or pay bills. Utilities worldwide are enabling payment via mobile phone rather than serving unbanked customers in local offices where lines can take hours and consumers wait in row upon row of chairs for their turn.

A mobile financial service is dependent on three key parties: the wireless carriers, or mobile network operators (MNOs), financial institutions (FIs), and platform provides that act as the “glue” between the MNOs and the FIs. Who is in the driver’s seat very much depends on the market dynamic of the local region based on regulations, market/brand power, nature of customer relationship, and local footprint.

What’s the opportunity?

The mobile financial services market is estimated to reach $15o billion by 2012, according to Ovum’s m-Payment Market Overview, mostly consisting of money transfers. A McKinsey CGAP study estimates that worldwide MNO revenue from mobile financial services will total $7.5 billion (Source: GCAP).

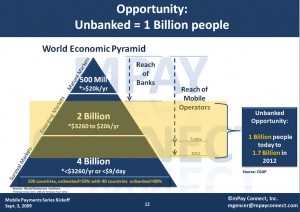

World economic pyramid:

Diagram: mPayConnect (click for larger image)

Today, 1 billion people worldwide are unbanked and have mobile phones. The number is expected to grow to 1.7 billion in 2012 (Source: CGAP).

Contributing enablers?

- Customer need: 3 billion need financial services, of which 1 billion have phones

- Payment technology: increasing electronic payment capabilities (Cash and check are decreasing while all electronically-enabled methods are increasing)

- Transaction types: large volume, of small value transactions (not ideal for traditional banking, but similar to current MNO model today)

- Mobile adoption: penetration of mobile phone usage among target communities (ubiquity of mobile phones)

- Mobile technology: increasing broadband coverage and NFC capabilities (for developed markets)

Finally, investment from various sectors – a lot of it – is a critical factor enabling mobile financial services today. Representative commercial investments:

- IBM recently announced a $100 million investment in mobile research and mobile payments,

- Nokia invested in Obopay: $35 million

- Qualcomm bought Firethorn: $210 million

- Sybase purchases PayBox: undisclosed amount

- Nokia invests in InsideContactless: $35 million

- FDC, Citi, Motorola, Nokia, NCR invest in Vivotech: $40 million

In addition, a number of grants/foundations have become involved. The Bill & Melinda Gates Foundation, CGAP, DFID, and the Clinton Foundation are investing in mobile financial services as a critical foundation for economic well being:

- Africa Enterprise Challenge Fund = $50 to 100 million

- Mobile Banking Call to Action = $100 million

- Mobile Money for the Unbanked (MMU) = $12.5 million

Complicating factors

Yet, mobile financial services solutions are not easily replicated from country to country. Customer needs vary, regulatory environments are vastly different, the value chain and partnership model is locally determined and not easily replicated, and many unique factors contribute to whether or not the necessary network effect of merchants and customers takes off. And if that weren’t enough, the business case and logistics of the operating environment are inherently country specific and not necessarily a logical fit for Mobile Network Operators. Each solution must be tailored.

Case study: mPesa

- 6.7 million users, so many that the service is having a hard time keeping up with demand (far exceeded the original 1 million goal)

- Today, some merchants only accept M-pesa

- M-pesa has moved $2 billion since launch – mostly very small value transactions [source: Safaricom]

[Mobile Financial Services 101 slides are available here.]

Question for the panel: if this is such a great opportunity, what is preventing further growth?

Naeem Zafar: In Pakistan mobile financial services enable people in rural areas to avoid a dangerous 2-3 day trip to bank in the closest large village or town. The ability to transfer funds via SMS is literally life changing and amazing.

Q. For Monica Brand, why are mobile financial services particularly appropriate for the unbanked?

A significant percentage of people who are unbanked or underbanked have a mobile phone. Thus, the mobile phone becomes a compelling solution to a big problem. By the end of this year our firm, Frontier Investments, intends to make big investments in this space. We’ve been studying a wide variety of solutions and potential solutions in the Southern Hemisphere. We have also looked at prepaid cards, etc.. But the Visa/MC platform is an expensive model, and in areas where there is no electricity, or internet, it is impossible.

Q. for Aiaze Mitha, you are setting up m-Paisa in Afghanistan – why is the service so important – based on your experiences in Afghanistan, as well as your history with M-Pesa in Kenya and other solutions?

There are a convergence of factors, including relevance and global need. Mobile penetration is far greater than bank penetration in the developing world. For instance, in Africa, banking penetration is not even 5-10% if you exclude the most developed nations (e.g. Egypt).

Customer demand is great – 150 million people are being served by microfinance, vs. 4 billionstill with income less than $9 day. Savings services and credit services needed. Mobile provides low cost means to serve this population.

Afghanistan’s population of 31 million people is 70% illiterate. Income per capita is $300. The country is very, very poor (in 2003 it was ranked in the bottom five countries worldwide). Half of Afghanistan’s population is under 5 years old, and illiterate. It is an ideal target country for microfinance. Yet it is a huge challenge to reach this population through traditional microfinance means. Security is a huge concern. The typography (very mountains) is challenging. And of course there is the Taliban’s landmines, etc.

By using mobile technology to support microfinance – lenders can enhance their services for existing clients, increase outreach, and reach a larger segment of the population. In Afghanistan, we are using the same technology as M-pesa. But instead of P2P transactions, we’ve focused on loan disbursement and loan repayment. We conducted a pilot with 500 customers using mobile channel, mobile wallet funding. The reduction in cost, so tangible for microfinance bank, that they decided to rapidly deploy mobile to it’s entire customer base.

Through mobile financial services, the microfinance bank was able to reduce its costs, and therefore reduce their interest rate from 21% to 16% for loans serviced via the mobile channel. On a microfinance loan of roughly $1,000, by using the m-paisa mobile solution instead of a bank branch, the customer enjoys a lower cost of loan of 16%, saving approximately $50, and if you live on $2 a day, that’s a huge benefit.

The 2nd application of m-paisa is salary disbursement. We’re working with the Afghan government on a solution with which they can pay their 170K employees, many of which are in the army. The challenge in paying soldiers is that they disappear on payday to take money back to their family in their village and don’t return for a week. There is a pilot in place right now that allows the government employees to receive their salary and send money P2P to their families.

Q. for Naeem Zafar, in your opinion, how come the whole world isn’t tripping over itself to implement mobile financial services?

Before answering the question, Naeem shared a few slides he’d prepared in advance:

The biggest question when it comes to mobile financial services is telcos vs. banks – who leads the initiative? Banks don’t want to cede potential customers to the telcos, and telcos have existing customer relationships that they don’t want to lose. Meanwhile, PayPal is threatening both.

In my judgment, there have only been two true mobile financial services successes: Philippines, primarily remittances from California, and Pakistan. To be successful a mobile payment scheme needs density (market share). In the Philippines Globe has 60% market share and Vodaphone 80% in Kenya.

Each country is different. In Pakistan there are

- 170 million people

- 5% with bank accounts

- 50% with mobile phones

- 50 million have mobile phones, digitized national id cards, but no bank account

- There are dozens of banks

- 5 mobile operations – due to the intense competition the phone rates are cheap!

In Pakistan a small shopkeeper, selling cigarettes, is typically the agent. You pay him to top up your Amaana account. Transactions are primarily P2P and free. You are only charged when you remove money from the system. All powered by SMS, there is no application on the phone.

In 6 mo, the Amaana system has 200K users, and growth has been totally viral – there has been no advertising. Amaana is now introducing merchant payments, from consumers to businesses. Some favorable legislation – the initiative is bank rather than telco led – is paving the way. Branchless banking allows banks to extend reach to rural areas, and the cost of serving new territories is significantly lower. This new mobile economic model allows the FIs to offer financial services in areas they could not profitably service otherwise.

Q. from audience: In this case, Amaana is like a virtual bank? Are legislations / regulations in place to protect balances if something happens to Amaana?

Naeem: The State Bank of Pakistan (the central bank) is the regulatory body. It is difficult, “so influence had to be used.” Amaana is aligned with a bank.

Q. from audience: Payments within network are free, how do you make money?

Naeem: When people take money out.

Q. from audience: Is it enough?

Naeem: No. But if it’s good enough for PayPal its good enough for us. We are using P2P free transfers to spread virally and grow.

Q. for Monica Brand: can you share your investment perspective on business models?

Mobile financial services require a change in behavior. Until they are accustomed to making mobile financial purchases [and until there are enough merchants that accept mobile payment] consumers will want to take cash out. So how to encourage? You can charge them when they remove the funds.

Remember that Visa doesn’t work in these markets. There is no precedent for merchants paying for payment services. And the agent isn’t going to pay for transactions. Oftentimes the service operator is paying the agent (they need a win to participate). This poses a challenge that is specific to emerging markets.

Q. from audience: what does the agent do with the money?

The agent [who is being paid by consumers to top up the value in their mobile wallet] takes the cash to the bank every few days. Yet the agent needs to keep some money on hand for those that want to take money out of their wallet. This poses the question, how much cash on hand should the agent keep? No one really knows.

In some countries, agents can’t take deposits, due to regulatory restrictions, therefore the payment scheme needs to have a bank behind the scenes.

In many developing nations, where mobile financial services are promising, the cash in / cash out bottleneck needs to be resolved before the solutions are scalable. In many cases there are huge cash requirements in place from regulators – under pressure from banks.

Q for Camille Busette: I understand you have some slides prepared about regulations?

I have developed a conceptual framework to understand when regulation is likely to be more challenging, from country to country. I’ve also put together some thoughts on how to most effectively work with regulators. These observations and lessons learned are based on my work at PayPal up until earlier this year.

Mobile financial services regulations vary across jurisdictions. In my experience, there are six factors/situations that trigger regulatory action:

1) The degree of decentralization of regulatory oversight of financial services and telecom. In US regulations are decentralization, FCC for telecom, a wide variety of responsible regulatory bodies in financial services (and they are morphing). The challenge here is having to deal with lots of regulators, vs. one huge regulator. But you can exploit the situation to your advantage. In the EU it is the opposite – the PSD regulates banks, nonbank financial service providers, and telcos. Recent PSD updates are more favorable to telcos, than the regulations were before.

2) Political power of telco vs. financial services sectors. Where both are powerful (US, Mexico) you get progressive regulatory environments. Whereas, in India banks are more powerful than telcos. Remittances to India are mostly received by middle class families that are often banked rather than unbanked.

3) Presence of significant political or policy initiatives that are relevant to mobile movement of money. For example: SEPA in Europe, anti-money laundering efforts in Mexico, initiatives to increase financial liberalization, or protectionism.

4) Significance of remittances – e.g. Philippines, 20% of GDP vs. 4% of Mexico GDP. Yet in Mexico, remittances are important for rural economic development. Yet efforts to facilitate remittances must be balanced against simultaneous efforts to prevent drug cartels from laundering money.

5) Depth of financial services. Low penetration of financial services tends to favor mobile financial services

6) Penetration of land lines. Where mobile penetration is low, the situation is ripe for government support of mobile financial services.

How to navigate? It’s an art. Some questions to ask yourself as you are preparing to work with regulators in a given country:

- What is the profile of regulator? Are they political appointees? Are they free market or status quo oriented?

- How entrenched are wireless carriers? How supportive of the government are they?

- How powerful is FI sector with regulators?

- Does the regulator have policy goals? Such as decreasing rural poverty, expanding financial services, controlling International illicit flows of money?

- Some countries want to demonstrate their regulatory stature (and therefore impress the US and EU) in order to gain trust.

Q. for Aiaze Mitha, can you share examples based on your efforts in 15 countries (lessons learned)?

I concur with everything Camille has shared. I have two relevant examples:

1) Afghanistan – The context is very specific. There are issues of money laundering, drug dealing. The Taliban is financing terrorism. The banking sector was very limited, focused on high end customers and the commercial sector. There are national policies with development objectives, for instance bringing a certain percentage of country to financial services. There are specific money laundering efforts. We have worked to position mobile financial services to align with the regulators objectives. We have a very open discussion – we educate them – we also have discussed the controls, etc. that they would like us to have in place that will then allow them to grant a license (make them feel comfortable with what we can do to support their anti-money laundering efforts). Mobile financial services can provide a lot of transparency, oversight. It can aid know your customer efforts. It is possible to set max values, max transaction limits, number of transactions per day, etc. In addition to limitations configured in system, we asked the regulators to identified suspicious behaviors that they are on the look out for, and created flags, controls in the system, to identify suspicious patterns and report back to regulators. We defined reporting to meet their needs. And in addition, we allow them to audit whenever they want (utilizing 3rd party auditors). We have been flexible in order to support them in their supervisory responsibilities.

In some cases, depending on the regime, particularly where the banking sector is entrenched, it can be much more difficult to introduce novel mobile banking services. Joint-venture models with financial institutions, telcos can be useful in getting the ear of the regulators, helping everyone feel less threatened, less reluctant. It makes the telcos happier.

In developing markets regulatory challenges are paramount.

In the developed world customer need is paramount (do I need mobile payments?)

Q. for the panel: Why is mobile banking not taking off in the US?

There is a large immigrant population. Many are unbanked. Is mobile financial services a viable alternative?

Menekse Gencer: In the United States there are 70 million or unbanked or underbanked. Many are immigrants. Many are Hispanic and remit back to Mexico. They opt out of banking system – either because they do not trust banks, or because they think they will only be here briefly (but then they wind up staying ten years).

It seems like there is customer need – for savings, loans, etc. The wireless carriers are paying attention. Yet we have very high PC penetration, and therefore less demand for alternative channels. Africa is way ahead of us when it comes to mobile financial services, because there is no fixed line phone, no PC/internet, and no financial infrastructure. Just as Africa has leapfrogged fixed line with mobile, so too will they leapfrog traditional banking infrastructure with mobile financial services.

Monica Brand: In the US stored value has big penetration, Visa/MC have addressed the needs of the unbanked effectively. There may not be a market for mobile payments in the US.

Audience comment: In other markets 85% of mobile users are prepaid, and consumers are accustomed to stored value on phone (vs. in the United States).

Menekse Gencer: Even pre-paid is different in the US. Among the Tier 2 carriers, where many of the customers are unbanked, 75-90% of users are paying in cash, sitting in row after row of chairs at the mobile carrier’s local office waiting to prepay their account in cash.

Camille Busette: We often talk about underbanked and unbanked as if their needs are the same. With the unbanked – those that are waiting for hours at a time to pay cash for their phone, their utilities, prepaid is a godsend. But for the underbanked, they understand that prepaid has higher fees associated and will prefer to use other, less costly, methods.

Audience question: Solutions are limited to one country or another. Each mobile financial service is required to use national currency, I presume, what are drawbacks to using national currency?

Camille Busette: Controls vary re: currency movement, e.g. in Brazil, financial services providers cannot provide foreign exchange. If you are not transferring fund across borders, it’s not an issue. There are some multi-country mobile operators.

Audience question: How significant are security concerns? What is the remedy if my phone is taken?

Aiaze Mitha: There are different approaches, whether bank or mobile operators. Mobile operators have more flexibility. They can protect at the user interface level. Each transaction must be controlled by a PIN, whether secure or encrypted SMS. Control mechanisms at the bank end can reverse specific transactions as necessary.

Other way is to secure transactions (as opposed to the user interface). For P2P transfers, the user can be required to pre-register a list of numbers that they will be sending money to. Once they’ve done so, that phone can only be used to send funds to the mobile numbers that have been pre-registered. This limits the potential for fraud.

Other solutions rely on a voice service that prompts the user to dial in a PIN code. It all depends on regulatory requirements and your system capabilities.

Reversals are handled differently. No one is going to guarantee that if you send money to the wrong person you will get it back. There are no legal / contractual agreements to refund mistakenly sent funds.

In Kenya, if a customer makes a mistake in entering numbers, the provider has no contractual obligation to refund. But, in fact, for brand reasons, to build trust, the mobile operator often re-credits when there is a genuine mistake. They have been very accommodating with customers. But the average transaction is very small – approximately $10.

Q. for Monica Brand: On the investment side, what do you think predicts success when investing in the base of the pyramid?

When it comes to the business model, obviously, cash in/out has to be handled well, agent incentives and other value chain participants, telcos, banks, etc. need to be aligned, and have appropriate incentives.

And when we are evaluating investments, we want to see a demonstrated understanding of the customer – there are a lot of fancy technologies in search of a problem. User interface is critical when the user base is illiterate – so you have to use more numeric prompts rather than alphabetic (numeric literacy tends to be higher).

Inspiration is critical – the management team – are they prepared to recalibrate their plans when things go awry? Emerging markets are unpredictable.

Who else is involved? We tend to be high contact investors – how can we support the entrepreneurs? Do they have the appropriate technology partners to support their business model, their execution? We are not technologists, security experts, etc ourselves but we rely on our network to support the companies we invest in.

More information:

- Menekse Gencer’s bio is here

- Full bios of each of the panelists are here

- Slides that were presented by Menekse and the panelists are here

Next event in the Mobile Payments Series:

The next session in the series will take place October 5th @ 6:00 PM at Google, hosted by the HBS Tech Club (register here). To learn more reach out to Menekse on Twitter @mpayconnect or join the Linked In group “Mobile Payment Series – mPay Connect” where Menekse will post event notices.

Related posts:

- My colleague Carol Coye Benson’s series of posts on mobile banking and payments

- Western Union’s mobile strategy

- M-Paisa on our sister blog Payments News