Are you a payments geek? You might be interested to hear what your peers think about immediate funds transfer (IFT).

The recent 2013 NACHA Payments Conference was full of interesting conversations and panels and the hottest topic was (IFT). I counted no fewer than four panels on the subject, including the one I organized with fascinating contributions from Bankgirot in Sweden, KIR in Poland, VocaLink in the U.K. and the Banco de México. We packed a lot into the panel – see the presentations here.

What We’re Talking About

Processing cycles for IFT in each of these countries all take place within a matter of seconds. Three of the four countries settle those payments in central bank money. Based on the number of puzzled looks among the audience, it seemed to me that there was some disbelief about this possibility. Is it possible that the failed vote to move the U.S. ACH to a same day processing and settlement (Expedited Processing and Settlement) option makes us doubt that other countries are already making immediate – and by this I mean almost instant – funds transfers? If so, we should keep in mind that the global card networks already run quasi-IFT systems: the authorizations are immediate, even if the settlement lags.

Glenbrook Survey on IFT

Glenbrook conducted an online quick survey about IFT prior to the conference, polling our audience of payments professionals. First, a big thank you to everyone who took the time to complete the survey and comment. There were 89 responses from payments industry practitioners around the world. Yes, that’s a relatively small sample and everyone who responded has a vested interested in some type of payment activity. At the same time, the responses were diverse and worthy of comment and reflection. Click here for the complete responses.

Survey Results: What do payments geeks think?

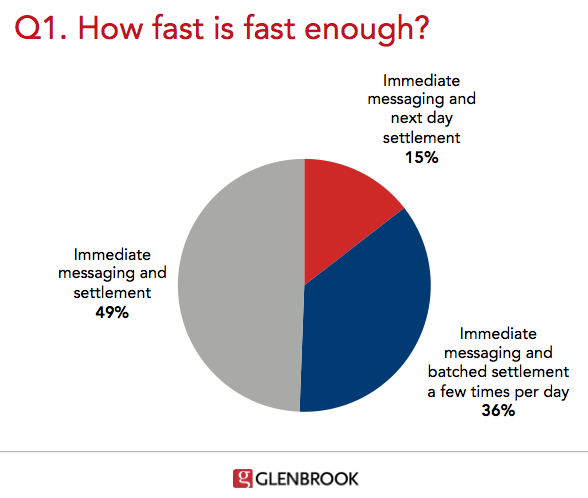

How fast is fast enough?

Nearly half (49%) responded that IFT should have immediate messaging and settlement, just over a third (36%) said immediate messaging and batched settlement several times a day was fast enough while 15% said immediate messaging with next day settlement would do just fine. Clearly faster is better.

If you’re wondering, respondents based in the U.S. and Canada were more or less in agreement with this result. So those may not have been puzzled looks in the NACHA audience but more a reflection of my need to get new glasses…but too bad we didn’t ask a specific question about the ideal migration path. Should countries take measured steps (a la EPS) toward IFT or move immediately to the end state? Let us know your thoughts in the comments.

As expected, there was general agreement that person-to-person payments (domestic) should have same day settlement (68%). However, it was notable to me that 58% thought business to consumer (payroll and reimbursements) and business-to-business payments (53%) should have same day settlement but only 40% thought consumer to business/government (bill or tax payment) should. To me, IFT will only be truly valuable to the consumer (and his or her payee) if a bill can be paid immediately and consumer perception of value may be one of – if not the most important – variable in a transition (more on that below).

My expectations were met in the responses to how important faster payments are for growth in the different payment domains. Person-to-person got the most responses (74%) but, notably, respondents felt that IFT was similarly important for growth in Point of Sale (70%) payments and Remote payments (69%) like e-commerce. On the other hand, only 41% of respondents felt that faster payments was important to bill payment.

Now the really thorny questions

What’s the most important obstacle to implementing faster payments? Only a handful (5%) said consumer or enterprise lack of interest. The lion’s share of respondents (67%) thought financial institution opposition due to operational issues/demands was the most important obstacle while others responded that financial institution opposition due to cannibalization of existing revenues (28%) was the key obstacle.

This one is really though provoking and makes me wish we could have taken more of everyone’s time and asked more probing questions. While those living in the US or Canada were more likely than respondents in other geographies to note cannibalization of existing revenues (33%), most respondents, by far, named the cost of an additional payment system as the principle obstacle. Some additional questions could have been to guesstimate the cost but also to guesstimate the cost of not implementing some sort of faster payments? By the way, does anyone remember the last time that financial institutions supported operational change?

Another thorny question was how important is faster payment processing and settlement for the payment system where respondents live? Nine percent said not so important – there are many more important issues. One quarter (25%) said extremely important – it’s the most important issue for keeping the payment system relevant and competitive. However, the majority response was more measured. Forty percent said faster payments are somewhat important – among the top demands.

If you’re wondering what US and Canadian respondents said: 31% said it was the most important issue and 46% said it was somewhat important. Another 11% said it was not so important and the remainder said they already have IFT. They’ve got to be referring to wires or a private exchange example… but we did suggest that faster payments be defined as what are typically thought of as retail payments with deferred settlement.

While nearly two-thirds (65%) said faster payment processing and settlement was either extremely or somewhat important, I think it is a fair and considered result that most said it was one among many needs facing their payment system. There are many needs and we have to determine where the real bang for the buck lies across cost, risk reduction, and user satisfaction.

Finally, another quarter (26%) said they already have immediate payments – which included respondents from all the geographic categories (not broken out by country).

Some final observations

Among those who provided additional comments, many noted that the survey did not include the cost of moving to IFT. Would the responses have been different if systemic costs were factored in? Certainly most IFT implementations have been in response to policy directives. Would respondents feel differently if they had to pay to pay? Maybe so. The most recent implementation among our four countries in the NACHA panel was Poland and an IFT payment there, depending on the bank, can cost between USD $1-$6!

While I can’t imagine a lot of people in the US opting to make a basic payment for a $5 fee, let’s consider the context. Poland’s IFT system does not yet have interoperability with all its banks and is still very new. If all banks were included, the price would likely decrease. Banks there do not charge for slower payments. In the UK example, banks don’t charge consumers for Faster Payments and the transfer limit is quite high. In the US, while many people routinely pay around $3 to a money transfer company to make a bill payment, banks on the other hand, have never really figured out how to charge consumers for payments. Wires are an exception but then again consumers don’t use wires in the normal course of business.

One thoughtful US-based respondent (you’ll soon see how I know this) provided a lengthy comment on the issue of pricing.

No ACH network inter-bank compensation mechanism exists today that would facilitate RDFIs recovering costs from the Originator/ODFIs, who will primarily benefit from this service. For that matter RDFIs have limited options to recover costs resulting from any new value-add service added to the network. Would propose FIs are not against payments innovation/IFT, but expecting FIs will be able to increase customer pricing to recover new RDFI costs in today’s commoditized ACH payments environment is not realistic. Current network pricing approach has not changed since inception…should be revisited as changes like IFT are considered.

Translation of this US-based ACH lingo isn’t really required as it’s clear what the comment is about. The current model in the US is broken when it comes to payments innovation – certainly for consumer payment innovation and quite possibly for business payments. (Okay, perhaps I added in some personal commentary there.)

Don’t get me wrong, I love the ACH (and many of you know I previously spent a decade working to expand it’s use to cross-border payments). The ACH is what most consumers really have in mind when they think about making payments or paying for payments (i.e., no fee). My sense is that the ACH itself could certainly process more and faster than it does today but faster settlement may be an entirely different issue. Even so, the fundamental issue in the US is not the technology but the business model of payments in the banking sector. Non-bank challengers charge customers a modest fee for a payment transaction but the banks chose to not charge or have not been able to gain customer acceptance for fees. This is a much larger and more complex issue that better or faster payments alone cannot overcome.

IFT around the world will be a continuing focus for Glenbrook and, based on the responses, for PaymentsViews readers as well. Let’s keep the dialogue going.