Can we improve the payment experience for Patients and Providers? I think so.

Before I dive in, let me start with a confession – at one point I was pursuing a career in medicine – drawn, like many, by the opportunity to help people in need. My aversion to blood drew me away. Nevertheless, I’ve stayed connected to the industry (my first career was in market research where I focused on the healthcare industry and today, I’m surrounded by loved ones and friends working in the space). Inevitably, I’m attracted to thinking about opportunities to improve payments in healthcare, like many at Glenbrook.

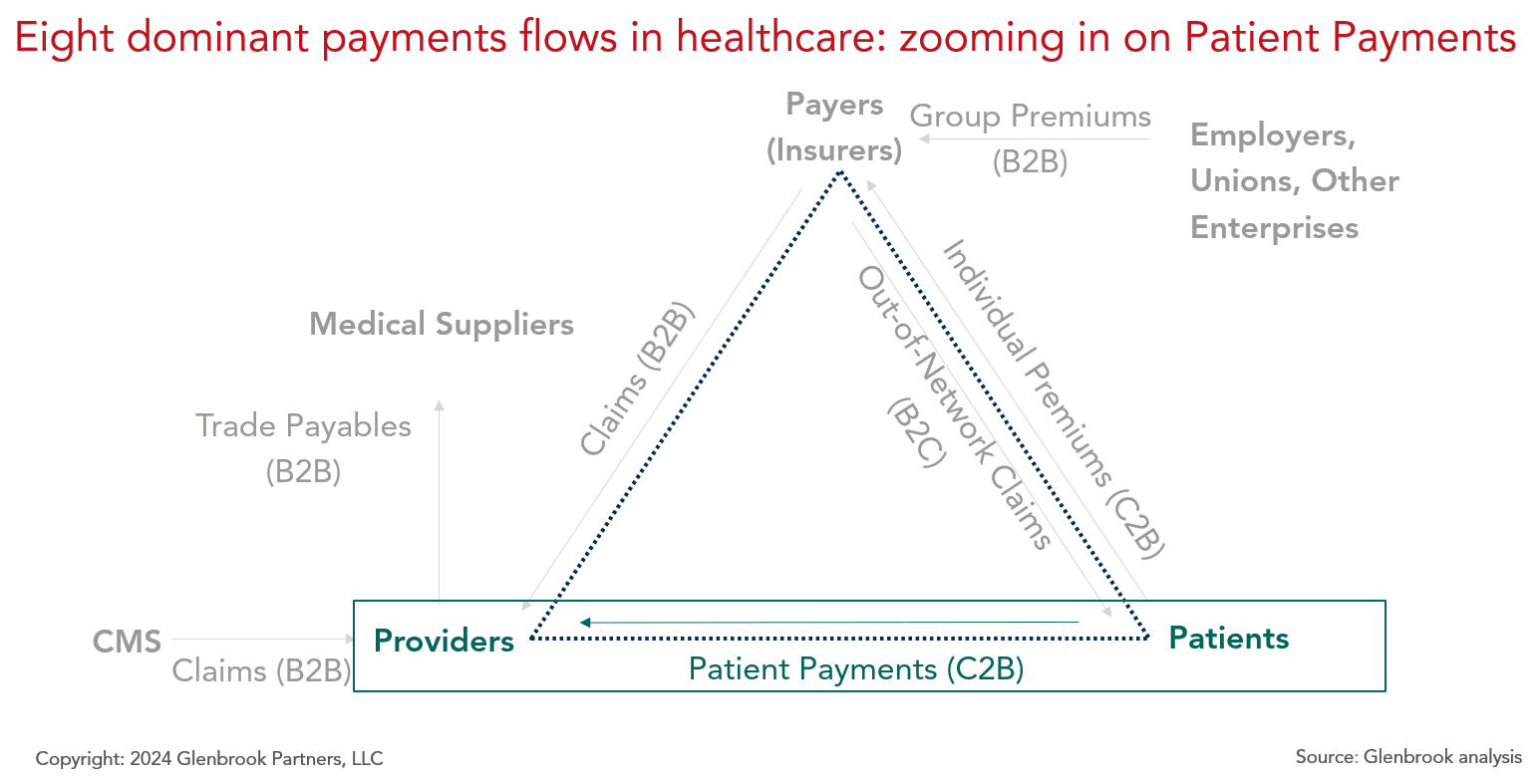

Today, I want to focus on one of the primary healthcare payment flows shared below in our healthcare payments map, the Consumer-to-Business (C2B) flow that, by Glenbrook 2023 estimates, represents a $400B payments value opportunity: Payments made from Patients to Providers to support co-pays, co-insurance, deductibles, elective procedures, and “direct pay” needs.

What is the Patient payments experience today?

In short, confusing. Prior to receiving medical care, Patients often don’t know a) what the cost of the service is; b) how much insurance will pay; and therefore, c) what they will ultimately owe. Then, upon receiving their bill(s) following the service, it is often unclear: a) what service(s) are tied to the bill; b) if that bill reflects all fees for that service(s); and c) what proportion insurance paid, if any and why. My friend, Dr. Dan Doan, a hospitalist in Oregon, describes it perfectly:

“Imagine you go to a restaurant, you’ve had dinner, but you don’t know the price of dinner and the chef gets to decide what you eat…and you have a gift certificate, but you don’t know for how much. Then instead of receiving and paying for a single bill at the end of dinner, you get multiple bills over the next six months for each person involved in your dinner – the server, the hostess, the chef, the landlord, etc.…and there is an extra dishwasher charge but you don’t actually know if that person washed your dishes…then you get charged for the salt, which you didn’t ask for. That’s how Patients interface with paying for healthcare today.”

What is driving this Patient payments experience?

It’s complex and multi-faceted. Let me share one piece of the puzzle – part of this experience is driven by the bespoke and complex contracting agreements between Providers and Payers, resulting in a Patient’s inability to compare prices. As my husband, Dr. Cody Gillenwater, who has worked in the healthcare field for nearly 20 years, explains:

“Despite regulatory efforts aiming to provide price transparency, it remains extremely difficult for patients to understand what a service will cost. Providers put forward the chargemaster, but each Payer has a negotiated contract rate that varies from the agreed to fees (chargemaster) by a proprietary amount. Payers do their best to provide members (Patients) with cost estimates, but there remains a risk that there could be ancillary charges for a service, if it isn’t paid on a bundled rate (DRG) – things like surgical supplies, medications, facility fees, and more may not be fully accounted for even by the best cost estimators”.

What is the result of this Patient payments experience?

Patients face rising medical costs, confusing financial responsibility, and an inability to compare prices. The collection of these circumstances, paired with mounting economic pressures, can lead to healthcare avoidance and/or an inability to pay. In fact, according to Patient Rights Advocates, 60% of U.S. consumers surveyed “have put off medical care because they didn’t know the cost and feared they couldn’t afford it.”

So how can we in the payments industry help improve this Patient user experience?

These are really difficult problems to solve. Let me share a few considerations:

1. Payments Organizations: can you help Patient cashflow issues by offering payments methods that break apart bills into sizeable payments at little or no cost to the Patient? In the near term, is there an opportunity to offer more 0% interest installments options to Patients? Patients could receive medical services today and pay tomorrow- a premise available to some for medical services (often elective) but increasingly familiar to many because of the growing interest and use of BNPL for other retail payments. Installments would also likely help Providers increase collections and improve reconciliations relative to, say, check-based payments which make up 10% of this particular market.

2. Healthcare Organizations: Have you taken the digitization of your business as far as it can go? While we have seen massive digitization in healthcare in the last decade (think of the widespread use of electronic health/medical record (EH/MR) solutions), digitization has not always reached the last mile. If you pause for a moment to quickly scan your personal experiences paying medical bills, I imagine you will find what I found – a disproportionally high number of physical invoices (and requests for physical payment) relative to other industries. End-to-end digitization sounds rudimentary, but we need to tackle it as it will promote integration and ultimately, the ability to link and share information about the service, the invoice, and the payment. Added bonus – improvements here may also help the longstanding and sizeable issue Providers face when trying to reconcile payments with invoices and related services.

3. Overall Ecosystem: Can you further simplify and automate back-end processes to help decrease your check volume? Check volume is notably high across all healthcare payment flows, partly a result of legacy systems and habituated preferences. There are more affordable payment methods that can help decrease overall costs and increase speed and convenience. These improvements will help the overall ecosystem thrive, ideally implicating Patients along the way.

These considerations are a starting point that can inch progress forward. What ideas do you have?

Leave a Reply