Yesterday Wells Fargo announced a new online invoicing solution for its small business customers that positions the bank to compete against entry level accounting packages. I’ve tried it out and I am impressed: it’s quick, easy, and intuitive. This afternoon I spoke with Richard Weeks, Sr Vice President at Wells Fargo’s Internet Service Group, to learn a bit more.

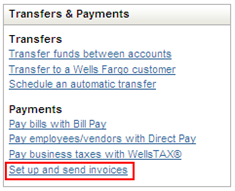

Wells Fargo is not promoting the new invoicing solution heavily (at least not yet). Other than a press release, you’d never know it existed. The links to the new product on their website are subtle. It is mentioned at the bottom of the second page of small biz online banking services – four links from the home page! Let me help you find it: here. But, as a customer, I was able to easily enroll once I logged into small business online banking and scanned the left hand navigation (see picture).

How it Works

Once the business owner/account holder signs up – review and accept terms, enter email associated with invoice delivery and confirm receipt of authorization code at that email – he or she can quickly and easily enter contact information and payment terms for each customer.

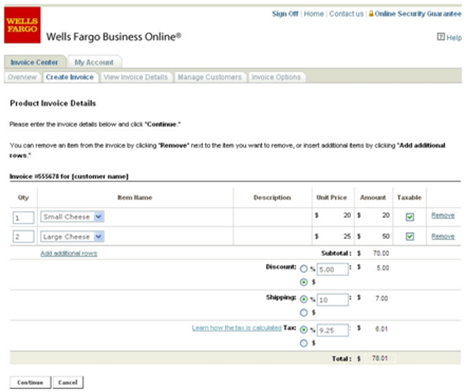

Creating invoices is a two step process, first you select the customer (or add a new one), assign an invoice number, PO number (if appropriate), payment terms (including early payment discount terms or custom terms), and late payment penalty (none or up to 2%). You can elect to have the service automatically send email payment reminders when the discount expiration date is approaching, when the payment due date is approaching, or when payment is past due. Then you can select from one of three invoice templates: product, service, or freeform. Customers can add their own logo to the invoice template.

The second step involves adding line items to the invoice. It is easy to add new items, either products or service types, as you are creating the invoice, without having to stop, save, go to the item master, and then return. (I wish QuickBooks was as easy!) The service calculates the subtotal for each item based on the quantity and there is check box to indicate whether each line item is taxable or not. Discounts, shipping, and tax can be applied as a percentage or a fixed amount (see picture).

Wells Fargo’s customers’ customers (the payors) receive invoices via email as a PDF and can click on a secure link to pay by ACH or debit/credit card, if the business has a Wells Fargo merchant services account. The payor is directed to the new Wells Fargo Payment Hub. The Payment Hub was developed specifically for this product. Unfortunately, I did not actually see it (I suppose I could have invoiced myself). From what I gather, the payor can make a one time payment via debit/credit card without registering, or register and enter payment information, either ACH or credit/debit card, that can be re-used on a recurring basis for future invoices. I was very pleased to learn that it is possible to pay an amount other than the original invoice and supply an explanation for the short pay or over pay, a critical feature for business to business payments.

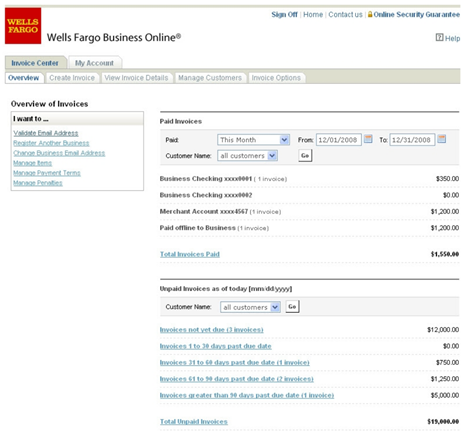

Upon receipt, payment is applied to the open invoice. The overview page of the Wells Fargo Online Invoicing solution manages the business’ accounts receivables, showing a summary of current and past due invoices as well as the total amount paid thus far (see picture). It is easy to limit the view by date or by customer. Payments received outside of the Payment Hub – checks received via mail and deposited, wires – can be applied to open invoices manually.

Pricing

Wells Fargo is offering a free trial for the first two months; thereafter Online Invoicing is $9.95 per month for up to 25 invoices. Additional invoices are 50 cents each. Merchant services for credit card acceptance are priced separately but fully integrated into the payment hub.

Assessment

These are the things that impress me about this service:

- It literally takes 5 minutes to sign up if you are already a Wells Fargo customer. You can create your first invoice in a matter of minutes.

- Makes it easy to offer early payment discounts, a key means of accelerating cash flow in this challenging economy.

- Automates email reminders, to encourage early payment, or follow up on late payments.

- Payors can pay via credit card without registering with Wells Fargo, enabling frictionless one time payments. (The BofA service requires payors to register and create a username and password).

- The Wells Fargo Online Security Guarantee covers payment transactions.

BofA has had a similar service for almost a year. The pricing is similar, as is the look and feel. Yet neither of these bank invoicing solutions has the Web 2.0 polish of Freshbooks (which is free for up to 3 clients).

The new invoicing offering, in conjunction with Wells Fargo’s small business bill pay, Direct Pay (ACH payment for employees and vendors), and WellsTAX offering, are a viable alternative to QuickBooks and other small business accounting packages for businesses that bank exclusively at Wells Fargo. The only thing missing is G/L and more robust financial reporting capabilities – if I were Wells Fargo, that’s what I’d be working on next.

Wells Fargo relied on a “variety of internal and external partners” to develop this solution, but would not disclose specific vendors.